Global retail trade has surpassed USD 30 trillion, while e-commerce alone now contributes over USD 6 trillion to global retail value.

The retail shift is equally driven by digital adoption. Urbanization is reshaping consumption too, over 4.4 billion people now live in cities, driving exponential demand for omnichannel, experiential, and convenience-first retail formats.

Yet with expansion comes complexity. Retailers must navigate regulatory hurdles across 150+ retail markets, fluctuating import duties, fast-evolving consumer behavior, and operational risks that can erode profitability if not addressed early.

This is where Nexdigm’s Global Retail Expansion Strategy Consulting Services empower brands to expand smarter, faster, and more sustainably.

Challenges in Global Retail Expansion

Entering new markets without structured planning exposes retailers to financial, operational, and compliance risks.

- Demand Overestimation & Market Misjudgment: Brands often assume global appeal equals universal demand.

- Regulatory & Licensing Complexity: Regulatory confusion can delay store openings by 6–12 months.

- Supply Chain & Distribution Gaps: In Africa and parts of South Asia, logistics inefficiencies raise operating costs by 20–40%.

- Cultural Disconnect & Localization Failures: Over 60% of customers in new markets prefer brands that adapt their assortment, pricing, and store experience to local norms.

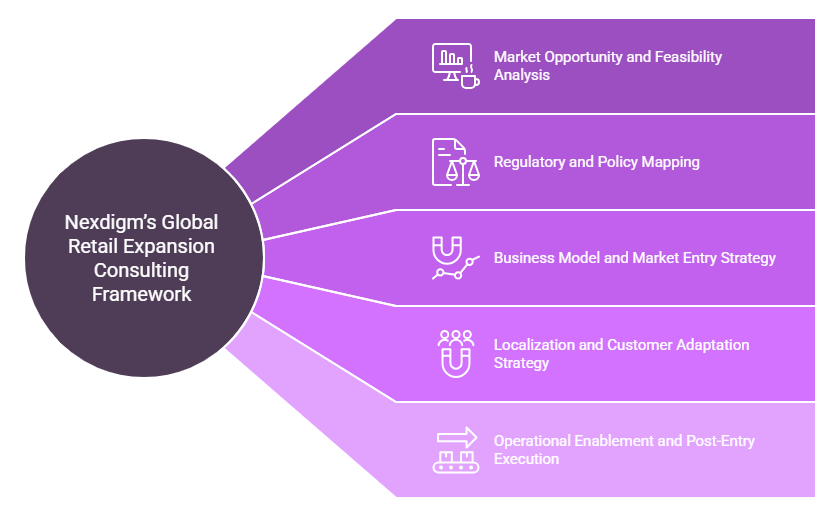

Nexdigm’s Global Retail Expansion Consulting Framework

Nexdigm’s structured, research-driven framework helps global retailers enter markets with clarity, compliance, and commercial viability.

Market Opportunity & Feasibility Analysis

We assess market attractiveness using:

- GDP growth trends

- Per-capita retail spending (e.g., GCC > USD 6,000, SEA < USD 1,500)

- Retail density, mall penetration, and urbanization levels

- Category demand & competition mapping

- Consumer purchasing power and inflation-adjusted spending

Outcome: Brands know exactly where to enter, why to enter, and which formats will scale profitably.

Regulatory & Policy Mapping

Nexdigm provides complete clarity on:

- FDI rules & foreign ownership restrictions

- Import duties & customs clearance steps

- Retail licensing requirements

- E-commerce & digital advertising regulations

- Consumer protection laws

- GST/VAT implications

Outcome: Reduced delays, fewer compliance risks, and fully aligned expansion plans.

Business Model & Market Entry Strategy

We evaluate:

- Franchise, master franchise, JV, or direct ownership structures

- Real estate availability (high-street, malls, community centers)

- E-commerce + offline hybrid models

- Distribution, warehousing, and cross-border operations

- Category-specific pricing and assortment models

Outcome: A scalable business model aligned with market economics and brand control.

Localization & Customer Adaptation Strategy

Retail success = global identity + local relevance. Nexdigm adapts:

- Pricing architecture to match regional income bands

- Product assortment based on local tastes, seasonality, and climate

- Store layouts and VM aligned to cultural expectations

- Brand messaging and communication strategy

- Digital interfaces, payment methods, and language localization

Outcome: Stronger consumer connection and faster market adoption.

Operational Enablement & Post-Entry Execution

Nexdigm supports execution through:

- Licensing documentation & entity setup

- Logistic partner onboarding & warehouse planning

- SOP creation for stores & workforce enablement

- Inventory flow planning and supply chain modeling

- Post-entry dashboards for performance tracking

- Ongoing compliance and cost optimization

Outcome: A smooth, compliant, and scalable entry, backed by continuous performance insights.

Nexdigm Case

Nexdigm supported a European apparel brand evaluating expansion into the GCC by mapping FDI rules, mall readiness, and city-tier demand. Through a structured feasibility study and optimized entry-route planning, Nexdigm accelerated the client’s launch by 7 months, reduced setup costs by 18%, and identified mall clusters contributing over 65% of target-category footfall — enabling a faster, more profitable international expansion.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704