The global shipping industry, responsible for moving over 80% of the world’s trade volume, stands at the intersection of economic opportunity and financial pressure. Volatile freight rates, rising port charges, fuel cost fluctuations, and decarbonization mandates are forcing maritime enterprises to rethink how they measure performance and deploy capital.

While shipping companies continue to invest heavily in fleet expansion, route optimization, and digitalization, many lack clear visibility into vessel-level profitability and capital efficiency. Operational data alone doesn’t reveal how effectively each voyage contributes to shareholder value. What’s missing is a structured, comparative financial lens that can translate complex operations into measurable business intelligence.

This is where Global Shipping Financial Benchmarking Services by Nexdigm play a pivotal role. By benchmarking key financial metrics, Nexdigm helps shipping companies evaluate how well they perform against global peers and uncover actionable opportunities to improve margin control, fleet utilization, and capital discipline.

Nexdigm’s Global Shipping Financial Benchmarking Framework

At Nexdigm, we recognize that profitability in the shipping industry hinges on financial precision and operational efficiency working in tandem. Our Global Shipping Financial Benchmarking Framework is designed to help maritime enterprises evaluate vessel performance, optimize cost structures, and enhance capital utilization, all through data-driven financial intelligence.

Stage 1: Peer and Fleet Mapping

We start by mapping peer groups across fleet composition (container, bulk, tanker, LNG, Ro-Ro), ownership model (charter, owned, or leased), and regional operations. This ensures benchmarking reflects realistic industry comparatives rather than generic averages.

Stage 2: Financial KPI Benchmarking

Nexdigm benchmarks key financial indicators such as EBITDA per vessel, cost per nautical mile, port fee-to-revenue ratio, CapEx-to-sales ratio, and asset turnover. These metrics reveal hidden inefficiencies, identify best-performing assets, and measure overall capital productivity.

Stage 3: Port and Voyage Cost Analytics

We conduct a granular analysis of port fees, demurrage, bunker costs, berthing charges, and voyage turnaround times to pinpoint avoidable expenses and suggest efficiency improvements. The insights guide contract renegotiations and routing optimization to achieve tangible cost savings.

Stage 4: Fleet Capital and ROI Assessment

Nexdigm evaluates fleet-level CapEx, depreciation, and maintenance expenditure to determine capital recovery timelines and investment readiness. This helps management prioritize modernization or divestment decisions with measurable ROI visibility.

Stage 5: Strategic Dashboard and Insights Delivery

All results are consolidated in a Global Shipping Financial Benchmarking Dashboard, offering leadership a 360° view of vessel economics, cost structures, and capital deployment efficiency. Nexdigm complements this with strategic recommendations on route-level profitability, fuel efficiency, and financing structure optimization.

Nexdigm’s framework empowers shipping enterprises to navigate beyond cost control, enabling data-backed capital planning, informed decision-making, and global competitiveness in an increasingly complex maritime economy.

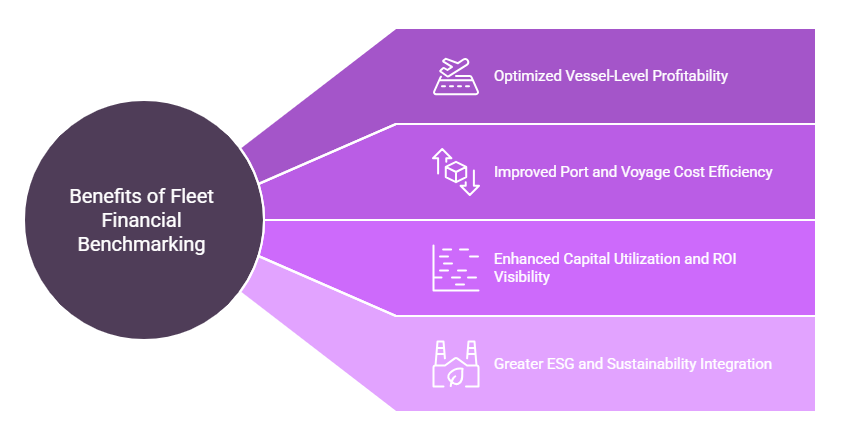

Strategic Benefits for Shipping Enterprises and Fleet Operators

Nexdigm’s Global Shipping Financial Benchmarking Services help organizations transform benchmarking insights into strategic levers for profitability, efficiency, and investor confidence. By aligning vessel operations with financial outcomes, we enable maritime companies to make sharper, faster, and smarter decisions across their fleets.

- Optimized Vessel-Level Profitability: Benchmarking provides clarity on EBITDA contribution and cost per nautical mile across vessel types, routes, and voyages. This enables shipping companies to identify underperforming assets, rebalance their fleet mix, and redeploy capacity toward higher-yield operations.

- Improved Port and Voyage Cost Efficiency: Comparative analysis of port handling, demurrage, and harbor fees across regions highlights cost outliers and operational inefficiencies. These insights empower companies to renegotiate port contracts, reduce laytime costs, and improve voyage turnaround.

- Enhanced Capital Utilization and ROI Visibility: By benchmarking CapEx intensity, asset turnover, and depreciation recovery, shipping enterprises gain control over capital cycles. This facilitates data-backed decisions on fleet expansion, vessel modernization, and financing models, ensuring optimal return on investment.

- Greater ESG and Sustainability Integration: Nexdigm’s benchmarking also evaluates the financial impact of decarbonization and fuel efficiency initiatives, helping enterprises balance sustainability investments with long-term profitability and compliance.

Nexdigm’s Global Shipping Financial Benchmarking Consulting Services empower maritime enterprises, fleet operators, and logistics conglomerates to gain financial clarity across vessel operations, port economics, and capital deployment.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704