Grocery retail is becoming one of the world’s fastest-moving battlegrounds. But high-volume, low-margin grocery operations leave no room for error.

A single gap in cold-chain logistics, inventory planning, or compliance can shrink margins by 3–7%, derail availability, and impact customer trust.

This is exactly where Nexdigm’s Grocery Retail Distribution Entry Strategy transforms expansion from a risk-heavy decision into a scalable, data-led growth roadmap.

Challenges in Grocery Distribution Market Entry

Expanding into grocery retail without feasibility-driven planning exposes retailers to operational, financial, and compliance risks. Below are the most common challenges brands encounter:

- Regulatory & Compliance Complexity: Non-compliance penalties can exceed USD 50,000 per facility and cause operational shutdowns.

- Vendor & Partner Reliability Issues: In underdeveloped ecosystems, vendor fill rates can drop to 60–70%, causing stockouts and demand–supply gaps.

- Infrastructure Gaps & Supply Chain Fragmentation: Many growth markets have limited temperature-controlled warehousing, driving wastage rates of 12–20% in perishables.

- Financial Planning Challenges: Working capital cycles in grocery distribution stretch to 45–70 days, and brands often underestimate operational cash requirements.

A structured distribution feasibility study eliminates these risks and ensures expansion decisions are backed by operational reality.

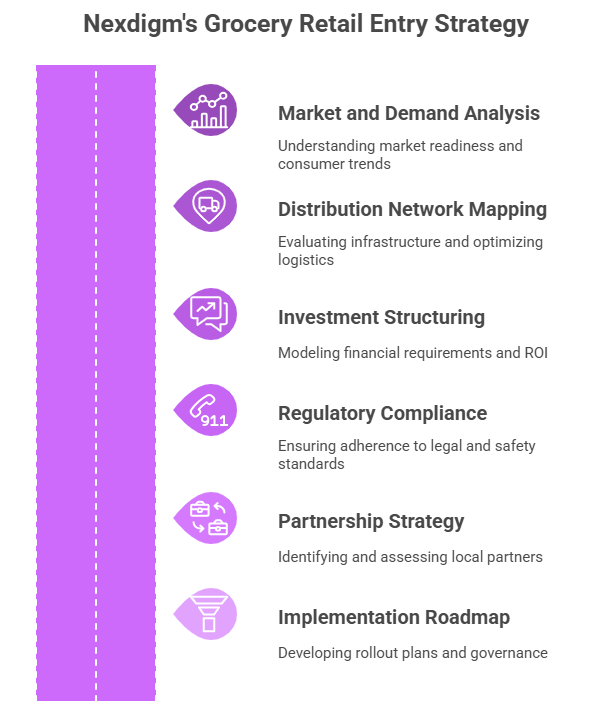

Nexdigm’s Grocery Retail Distribution Entry Strategy Consulting

Market & Demand Feasibility Analysis

We assess:

- Household food expenditure

- Category demand trends

- Urban density (3,000–8,000 people per sq km)

- Competitive intensity

Outcome: Identification of high-potential cities, clusters, and formats.

Distribution Network & Infrastructure Mapping

We analyze:

- Cold-chain integrity

- Warehousing capacity

- Transport corridors

- 3PL/4PL ecosystem maturity

Outcome: Lower cost-to-serve, better availability, and optimized replenishment.

Investment Structuring & Financial Viability

Nexdigm models:

- Capex & opex

- Working capital (45–70 day cycles)

- Operating cost breakdown

- ROI & payback

- Sensitivity scenarios

Outcome: A clear, investment-ready financial blueprint.

Regulatory & Compliance Advisory

We map:

- Licensing

- Food handling & hygiene compliance

- Labeling norms

- Cold-chain safety regulations

- Warehouse certifications

Outcome: A compliance-first, audit-ready setup.

Partnership & Vendor Strategy

We assist in:

- Distributor/warehouse operator selection

- Tech partner mapping

- Vendor due diligence

- Contracting frameworks

Outcome: Reliable partners that ensure consistent supply and quality.

Implementation Roadmap & Performance Governance

Includes:

- Phase-wise rollout

- Logistics partner onboarding

- Inventory digitization

- KPI dashboards

Outcome: Predictable execution and continuous improvement..

Nexdigm Case

A regional grocery distributor entering the Middle East struggled with rising stockouts and inconsistent warehouse performance. Nexdigm conducted a data-led supply chain diagnostic across five cities, identifying gaps in vendor fill rates, cold-chain temperature integrity, and route optimization. Through targeted process redesign and partner restructuring, the client achieved a 28% improvement in replenishment accuracy and a 17% reduction in logistics cost within four months, enabling a stable launch across new markets.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704