Digital banking, cross-border fintech, RegTech, and embedded finance are now shaping how billions transact, borrow, insure, and invest. Over 1.8 billion people are expected to join digital payment ecosystems by 2030, pushing financial institutions to scale internationally faster than ever.

But global expansion is about navigating licensing, trust, compliance, and customer behavior. Each geography introduces its own regulatory frameworks, digital maturity levels, partnership ecosystems, and risk expectations. For BFSI institutions, the winners will be the ones who treat market entry not as a process, but as a strategic leadership opportunity.

Why Market Expansion in BFSI Is Complex

Expanding into new financial markets unlocks transformative growth, but also exposes organizations to risk, compliance hurdles, and operational unpredictability.

- Regulatory Fragmentation Across Jurisdictions: Insurance approval processes in GCC often require local partnerships and minimum capital thresholds above USD 10 million.

- Data Localization & Cyber Compliance Pressure: Over 70 countries now enforce data localization, impacting cloud architecture, CX platforms, and fraud analytics.

- Interoperability & Technology Integration Gaps: Integrating core banking, API gateways, and credit risk systems often requires 6–12 months of custom engineering.

- Low Trust for New Entrants: World Bank research shows 72% of customers in emerging markets prefer locally licensed financial institutions.

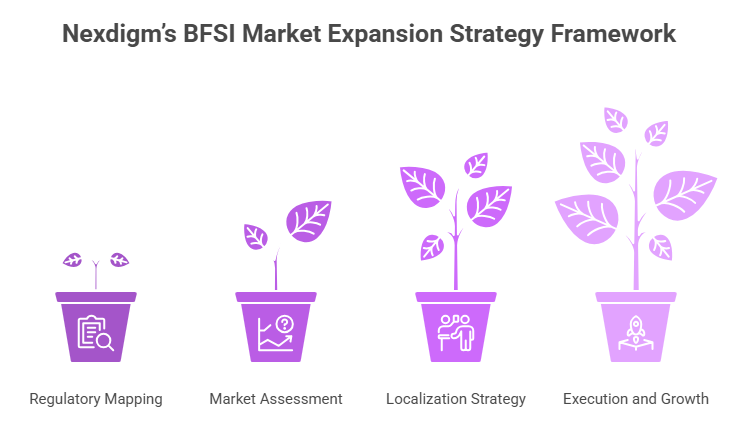

Nexdigm’s Market Expansion Strategy Framework

Nexdigm’s BFSI Market Expansion Strategy Framework helps BFSI institutions move from ambition to execution with a structured, data-driven, compliance-ready market expansion framework.

Our methodology integrates regulatory intelligence, market analytics, and operational execution across four interconnected pillars.

Regulatory & Policy Mapping

Understanding the regulatory environment is the foundation of BFSI expansion. Nexdigm analyzes:

- Banking & fintech licensing rules

- AML/KYC requirements

- Foreign ownership guidelines

- Data governance and cross-border data rules

- Open banking / open finance policies

- Capital adequacy expectations

- Digital lending & insurance compliance

Outcome: Clients reduce licensing delays, avoid compliance rework, and enter markets with regulatory clarity.

Market Feasibility & Competitive Assessment

We examine financial inclusion indicators, transaction volumes, digital adoption, credit penetration, and customer behavior. Our assessments include:

- Digital maturity mapping

- Transaction ecosystem analysis

- Competitor & product benchmarking

- Consumer trust and demographic profiling

- Opportunities in underserved or high-growth niches

Outcome: Institutions know where to enter, which model to adopt (digital, hybrid, JV), and which segments will deliver the fastest traction.

Localization & Partnership Strategy

Local credibility drives BFSI adoption. Nexdigm helps institutions:

- Identify regional banks, fintechs, PSPs, and ecosystem collaborators

- Localize credit models, insurance products, or payment flows

- Build culturally relevant customer engagement strategies

- Adapt pricing, onboarding, and communication models

- Navigate co-lending or revenue-sharing partnerships

Outcome: Clients gain faster acceptance, regulatory goodwill, and customer trust in new geographies.

Execution & Growth Enablement

Beyond strategy, Nexdigm enables full-scale operational rollout:

- License application & documentation

- Entity setup & governance frameworks

- Technology integration support

- Compliance monitoring & reporting

- Post-entry growth dashboards

- Risk, fraud, and audit readiness architecture

Outcome: A seamless, compliant, agile market launch, followed by sustainable scaling.

Nexdigm Case

A global payments company entering East Africa faced challenges with fragmented KYC rules, inconsistent merchant-onboarding standards, and unclear e-money licensing pathways. Nexdigm conducted a regulatory deep-dive across three countries, standardized compliance workflows, and identified two licensed PSP partners. This enabled the client to cut onboarding time by 45%, reduce compliance escalation cases by 32%, and achieve market launch four months ahead of schedule.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704