The mining industry stands at the crossroads of opportunity and uncertainty. Global demand for critical minerals is accelerating, driven by the energy transition and industrial innovation, yet the sector continues to face challenges related to volatile commodity prices, high capital intensity, and cyclical returns. In such a landscape, achieving predictable profitability requires more than operational excellence; it requires financial clarity and capital discipline.

Mining enterprises operate across vast geographies, with varying ore grades, extraction costs, and capital cycles. This complexity often obscures visibility into asset productivity and investment efficiency. Leadership teams struggle to identify which mines deliver consistent returns, where capital is over-extended, and how reinvestment decisions align with long-term value creation.

This is where Mining Financial Benchmarking Studies become indispensable. By comparing financial performance across peers, mines, and markets, companies can assess EBITDA resilience, CapEx intensity, and return volatility with precision. Nexdigm’s benchmarking insights reveal how effectively capital is deployed, where inefficiencies lie, and how to design more predictable investment cycles.

Nexdigm’s Mining Financial Benchmarking Framework

At Nexdigm, we help mining enterprises bring financial precision and comparability to some of the most capital-intensive operations in the world. Our Mining Financial Benchmarking Framework enables organizations to evaluate the performance of assets, projects, and portfolios through a financial lens, connecting operational metrics with profitability, capital efficiency, and investment predictability.

Stage 1: Peer and Asset Mapping

We begin by mapping relevant peer sets based on resource type (iron ore, copper, coal, gold, or rare earths), production scale, and geographic exposure. This ensures every benchmark reflects a fair and relevant financial comparison.

Stage 2: Financial and Operational KPI Benchmarking

Nexdigm benchmarks key performance indicators such as EBITDA per ton, CapEx-to-revenue ratio, ROCE, cost per unit of extraction, and depreciation patterns. This data reveals margin differentials, capital efficiency, and structural financial gaps across mines or companies.

Stage 3: Investment Cycle and CapEx Efficiency Analysis

Our framework evaluates mine lifecycle investments, from exploration and development to sustaining and expansion CapEx. We identify which investments have the shortest payback periods, where overcapitalization exists, and how capital intensity compares with global benchmarks.

Stage 4: Return Volatility and Cash Flow Resilience Assessment

Nexdigm analyzes cash flow variability, cost sensitivity to commodity prices, and EBITDA stability to measure return volatility across assets. These insights help companies strengthen financial planning, debt management, and dividend strategies under cyclical market pressures.

Stage 5: Strategic Dashboard and Capital Allocation Insights

All findings are consolidated into a Mining Financial Benchmarking Dashboard, offering a real-time view of asset performance, capital productivity, and financial resilience. Nexdigm supplements this with strategic recommendations to enhance portfolio efficiency, CapEx prioritization, and investment discipline.

Nexdigm’s benchmarking framework empowers mining companies to align their capital strategy with operational performance, turning financial insight into long-term competitive advantage.

Strategic Benefits for Mining Enterprises and Investors

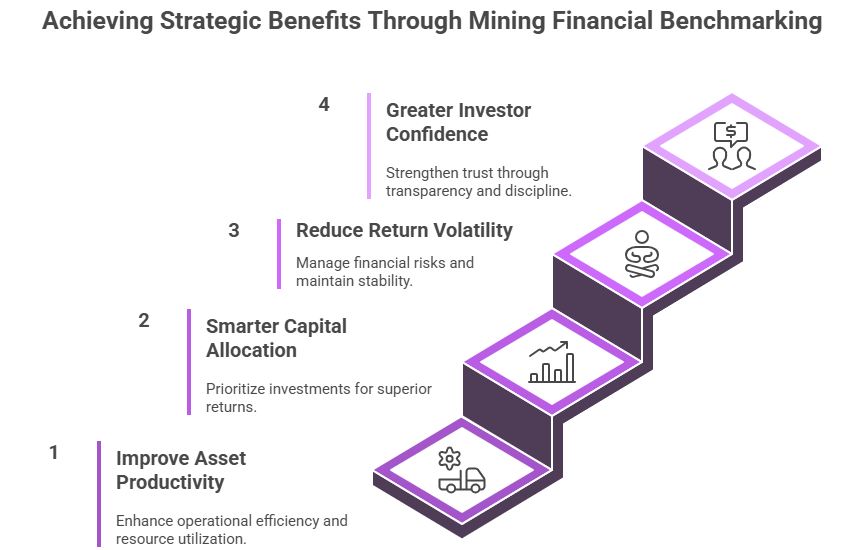

Financial benchmarking is a strategic enabler that helps mining enterprises and investors make confident, data-backed decisions across their global portfolios. By transforming complex operational data into actionable financial intelligence, Nexdigm’s benchmarking services help organizations maximize asset productivity, reduce volatility, and enhance capital efficiency.

- Improved Asset Productivity and Transparency: Benchmarking enables mining companies to identify high-performing mines versus underutilized assets by comparing output per unit of investment, operational efficiency, and maintenance intensity. This clarity helps management optimize existing resources and plan targeted interventions for low-yield operations.

- Smarter Capital Allocation Across Mines: By benchmarking CapEx-to-output ratios, ROI timelines, and payback periods, enterprises can prioritize investments toward mines and projects that offer superior returns. This fosters disciplined capital allocation, ensuring that each investment contributes to long-term value creation.

- Reduced Return Volatility and Financial Risk: Mining cycles are inherently unpredictable, but benchmarking provides insight into EBITDA sensitivity, cash flow stability, and cost flexibility across assets. This helps companies manage risk exposure and maintain steady financial performance despite commodity price swings.

- Greater Investor Confidence and Portfolio Governance: Standardized financial benchmarks strengthen investor trust by showcasing transparency and capital discipline. Whether preparing for M&A, refinancing, or public reporting, benchmarking demonstrates that management decisions are data-driven and strategically aligned with shareholder expectations.

Nexdigm’s Mining Financial Benchmarking Consulting Services empower mining enterprises, investors, and holding companies to make data-driven decisions across their asset portfolios.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704