Entering a new market can unlock exponential growth, but it also exposes businesses to layers of uncertainty. From shifting consumer behavior and evolving regulations to hidden competitive dynamics, even established players can misjudge the terrain. Many organizations rush into expansion with limited visibility, only to face unforeseen barriers such as regulatory delays, misaligned pricing structures, or inaccurate demand projections.

A New Market Opportunity Assessment acts as a strategic compass in this complex landscape. It helps decision-makers move beyond assumptions by grounding every expansion decision in evidence-based insights. By quantifying market potential, understanding customer segments, mapping competition, and identifying entry barriers early, businesses can minimize financial exposure while maximizing success potential.

Why Opportunity Assessment Is the Foundation of Low-Risk Market Entry

Expanding into a new geography or segment demands more than ambition; it requires clarity. Without a structured understanding of the market, even well-capitalized businesses risk misaligning their offerings with local realities. A New Market Opportunity Assessment reduces this uncertainty by converting fragmented data into actionable intelligence.

At its core, opportunity assessment is designed to quantify potential and qualify feasibility before investment decisions are made. It evaluates both macro and micro factors, from economic outlook, regulatory climate, and infrastructure readiness to consumer behavior, pricing sensitivity, and distribution networks. This layered approach ensures that businesses are not only targeting the right markets but are also entering them with the right strategies.

By integrating demand forecasting, competitive benchmarking, and regulatory landscape analysis, companies can:

- Identify markets with sustainable demand rather than short-term spikes.

- Avoid overestimating revenue potential or underestimating barriers.

- Align internal capabilities with external opportunities.

- Define the most viable market entry models (greenfield, joint venture, acquisition, or partnership).

Opportunity assessment functions as a risk mitigation framework, empowering leadership teams to allocate resources more intelligently, prioritize expansion efforts, and establish early-mover advantages in high-potential markets.

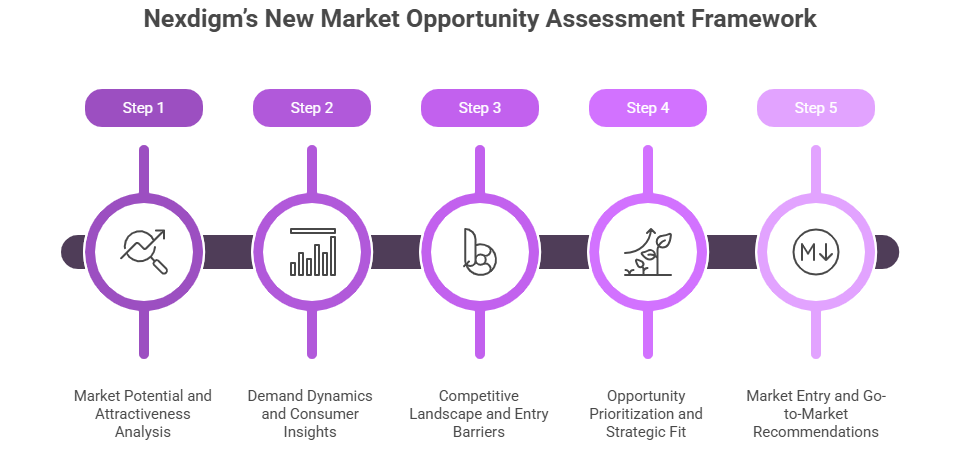

Nexdigm’s New Market Opportunity Assessment Framework

At Nexdigm, we believe that every market expansion decision must be grounded in evidence, not estimation. Our New Market Opportunity Assessment Framework is designed to provide organizations with a 360° understanding of the market landscape, balancing opportunity sizing with risk diagnostics to guide confident entry decisions.

Our structured approach integrates quantitative data modeling with qualitative market intelligence, ensuring that strategy formulation is backed by both numbers and nuanced insights.

Step 1: Market Potential and Attractiveness Analysis

We begin by evaluating the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) to quantify the true scale of opportunity. This includes assessing macroeconomic conditions, sector growth, and investment sentiment to determine market attractiveness and growth viability.

Step 2: Demand Dynamics and Consumer Insights

Our team conducts in-depth primary and secondary research to analyze demand drivers, purchase behavior, and evolving consumer preferences. This insight helps businesses align their products, pricing, and marketing strategies with the most profitable customer segments.

Step 3: Competitive Landscape and Entry Barriers

Through comprehensive benchmarking and competitor profiling, we assess the intensity of competition, market share distribution, and white-space opportunities. Parallelly, we evaluate regulatory, infrastructural, and operational challenges to minimize risks associated with entry and scale-up.

Step 4: Opportunity Prioritization and Strategic Fit

Each opportunity is evaluated against client capabilities, financial feasibility, and long-term goals. By combining opportunity scoring with risk-weighted analysis, we help businesses prioritize markets that offer sustainable growth and strategic alignment.

Step 5: Market Entry and Go-to-Market Recommendations

Finally, we translate insights into action by recommending entry modes (such as JV, M&A, or Greenfield investment) and developing detailed go-to-market strategies. This includes guidance on positioning, channel strategy, and pricing to ensure a successful and scalable market launch.

Through this end-to-end methodology, Nexdigm transforms data into direction, helping global enterprises move from opportunity identification to execution with confidence.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704