In the rapidly evolving retail ecosystem, profitability depends on how efficiently every channel contributes to the bottom line. As brands expand into e-commerce, marketplaces, and physical stores, the complexity of managing inventory costs, logistics, and digital marketing spend multiplies. Traditional accounting or ratio analysis often fails to capture this cross-channel interplay.

This is where Financial Benchmarking Intelligence becomes transformative. It enables omnichannel retailers to measure their financial health against peers, uncover margin leaks across digital and offline touchpoints, and evaluate the return on investments in technology, fulfillment, and customer acquisition.

Leading retailers are now turning benchmarking into a strategic compass, aligning it with profitability dashboards, sustainability initiatives, and data-driven decision-making. Whether it’s optimizing SKU-level contribution, comparing last-mile delivery costs, or balancing in-store vs. online margins, financial benchmarking provides an empirical foundation for sustainable growth.

Why Financial Benchmarking Matters in Omnichannel Retail

The retail sector has entered a phase where channel convergence demands sharper financial visibility than ever before. Consumers expect seamless experiences, yet each channel carries its own cost dynamics and profitability curve. Without benchmarking these financial levers against peers and industry standards, retailers risk misjudging true performance efficiency.

- Channel Profitability Analysis: E-commerce and brick-and-mortar channels rarely operate at similar cost structures. Financial benchmarking enables retailers to evaluate contribution margins per channel, identify underperforming SKUs, and assess fulfillment and return costs that directly impact profitability. It highlights which channels enhance revenue and which silently erode margins.

- Working Capital and Cost Efficiency: Omnichannel strategies require higher inventory buffers, diversified logistics networks, and flexible supplier contracts. Benchmarking helps map inventory turnover, vendor payment cycles, and cost-to-serve metrics against best-in-class peers. The insights often reveal opportunities for freeing tied-up capital or improving cash flow discipline.

- Digital Spend Rationalization: With marketing costs rising and conversion rates flattening, comparing digital acquisition costs, customer lifetime value (CLV), and marketing ROI across competitors is essential. Benchmarking provides the clarity needed to prioritize campaigns, evaluate channel payback, and rebalance spending between performance and brand-building efforts.

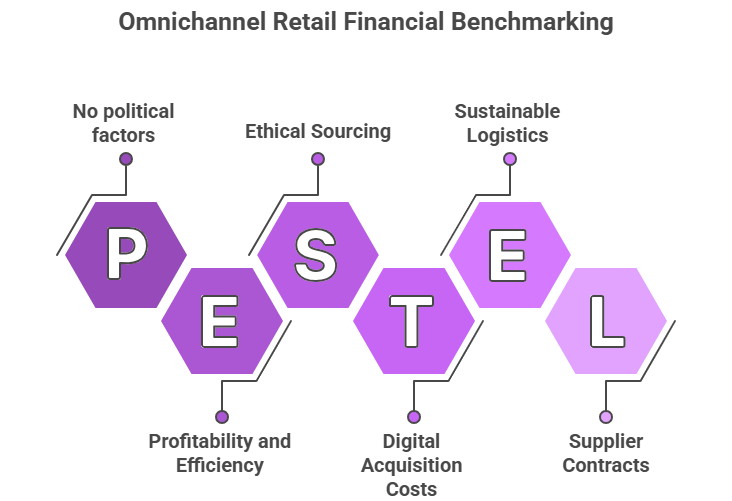

- Sustainability and Operational Alignment: Modern retail success also depends on how financial efficiency aligns with ESG objectives. Benchmarking the cost impact of sustainable logistics, energy-efficient stores, and ethical sourcing practices helps enterprises pursue responsible growth while protecting margins.

Nexdigm’s Financial Benchmarking Framework for Retailers

At Nexdigm, we view financial benchmarking as a diagnostic and transformation tool designed to help omnichannel retailers uncover cost efficiencies, strengthen profitability levers, and align capital deployment with long-term growth. Our Retail Financial Benchmarking Framework integrates competitive intelligence, granular ratio analytics, and operational data to create a 360° view of business performance.

Stage 1: Peer Group Identification and Data Normalization

The process begins by identifying relevant peer groups across retail formats while normalizing data for business scale, channel mix, and regional variations. This ensures that each benchmark is comparable, credible, and aligned with real-world dynamics.

Stage 2: Financial Ratio and KPI Mapping

We deep-dive into channel-level financial KPIs such as gross margins, EBITDA ratios, fulfillment costs per order, marketing cost per acquisition, and working capital turnover. These are benchmarked against industry averages and top-quartile performers to reveal efficiency gaps and performance deviations.

Stage 3: Value Chain Cost Benchmarking

Our framework dissects the retail value chain. By analyzing each cost component, retailers gain a transparent view of which activities drain profitability and which drive value creation.

Stage 4: Gap Analysis and Scenario Simulation

Through diagnostic gap analysis, Nexdigm quantifies potential savings and profit enhancement opportunities. Using financial modeling tools, retailers can simulate what-if scenarios to forecast margin outcomes.

Stage 5: Strategic Insights and Action Roadmap

Finally, insights are consolidated into a Strategic Financial Intelligence Dashboard, which highlights performance outliers, investment priorities, and actionable recommendations. This enables CFOs and business leaders to make evidence-based decisions that drive financial resilience and sustainable growth.

Nexdigm’s Financial Benchmarking Framework empowers omnichannel retailers to transform fragmented data into strategic foresight, helping them shift from reactive cost control to proactive margin design.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704