Supply chains are no longer stable; they are stress-tested every day. With global trade disruptions crossing USD 1.9 trillion in economic impact since 2020 and over 70+ countries revising ESG or import regulations, procurement leaders can no longer rely on intuition-driven sourcing.

As geopolitical shifts increase lead times, climate disruptions impact raw material availability, and policy changes reshape global trade corridors, supplier decisions must now be backed by deep market intelligence.

This is where Nexdigm’s Procurement Research helps organizations stay resilient and competitive.

Why Procurement Needs Data-Backed Intelligence in 2025

Global supply chains are more volatile than ever:

- Over 30% of global suppliers experienced delivery disruptions due to geopolitical events in the past two years.

- Container shipping costs have fluctuated by USD 4,000–7,000 per FEU on key routes.

- More than 60% of companies report supplier concentration risk, especially in electronics, APIs, and industrial components.

Nexdigm’s Procurement Research Framework

Custom Supplier Intelligence Reports

We assess suppliers across:

- Capability

- ESG adherence

- Workforce stability

- Quality systems

- Delivery performance

With supplier screening across 12–25 parameters, leaders gain clear visibility into hidden risks.

Diversification & Nearshoring Strategy Development

Supply concentration is a growing threat. Nexdigm helps organizations build multi-country sourcing models aligned to resilience and cost efficiency.

ESG & Regulatory Compliance Mapping

With 90+ countries tightening ESG norms since 2022, procurement must stay ahead of:

- Carbon reporting rules

- Ethical sourcing standards

- Waste & emissions regulation

- Labor compliance thresholds

Nexdigm maps these frameworks to ensure audit-ready supply chains.

Category-Specific Deep Dives

Our experts deliver intelligence across categories such as:

- Pharma APIs

- Auto components

- Semiconductors

- Electronics

- Rare earths

- Chemicals

- Metals & industrials

We analyze availability, raw material cycles, pricing drivers, innovation trends, and long-term category risks.

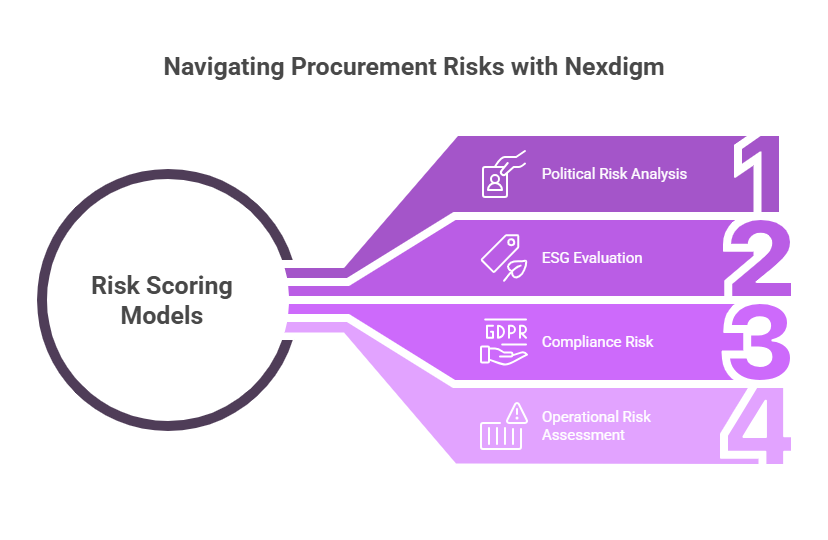

Risk Scoring Models: Political, ESG, Compliance, and Operational

Nexdigm uses a multi-dimensional risk scoring model integrating:

- Political Risk Analysis: 27+ trade restrictions were introduced globally in the last year alone.

- Environmental, Social, and Governance (ESG) Evaluation: Over 50% of global buyers now evaluate ESG during vendor onboarding.

- Compliance Risk: Companies lost USD 4.2 billion in fines last year due to compliance failures.

- Operational Risk Assessment: Logistics resilience, quality systems, scalability, digital maturity.

Nexdigm Case

A global electronics manufacturer faced recurring supply disruptions due to over-reliance on a single Asian vendor. Nexdigm conducted a multi-country sourcing attractiveness study across five regions, assessed 14 alternative suppliers, and built a risk-adjusted diversification roadmap. Within four months, the client onboarded three new suppliers, reduced lead-time volatility by 27%, and lowered category-level dependency risk by 40%, strengthening long-term supply resilience.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704