Product survey is a structured method of collecting feedback from potential users to evaluate a product idea, feature set, design, or pricing before its launch. It plays an important role in ensuring product-market alignment. Thus, reducing risk and increasing the likelihood of commercial success.

Despite the availability of data and tools, many companies still rely on gut instinct over market validation. Over 42% of startups fail because their offerings lack market demand. In addition, 29% run out of cash, 23% suffer from team issues, and 18% face pricing/cost problems. This reflects a deeper issue that skipping product validation can lead to misaligned offerings, wasted resources, and failed launches.

Product surveys bridge this gap. By gathering real-world input from target users, they allow businesses to assess demand, validate assumptions, and refine product strategy.

Challenges Companies Face

Companies often face several critical challenges during product development and launch that can affect adoption, revenue, and overall market success. Identifying these challenges early is essential for making informed, data-driven decisions. The most common issues include:

- Misaligned Product Features: 38% of products fail because they don’t meet customer needs or expectations.

- Incorrect Pricing: 18% of startups struggle due to pricing or cost-related miscalculations.

- Weak Messaging or Packaging: 25% of product launches underperform because messaging fails to connect with the target audience.

- Inefficient Rollouts: 22% of launches are affected by poor execution or distribution challenges.

- Limited Understanding of User Needs: 42% of new products fail because the market demand was never properly validated.

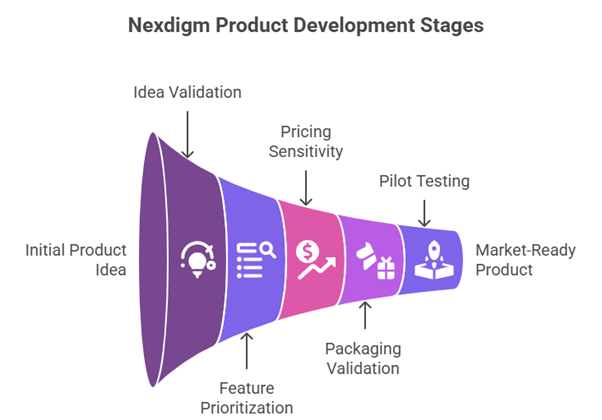

Insights Across Product Development Stages

Product market survey offers value across the entire product development lifecycle. Well-designed surveys provide critical insights that guide informed decisions at every stage from ideation to post-launch optimization.

- Concept Validation: “Does the concept solve a real problem?”, “Is it unique enough to capture attention?”

- Feature Prioritization: “What matters most to users?”

- Pricing Sensitivity: “What’s the right price?”

- Packaging and Messaging Validation: “Do users interpret your product the way you intend?”, “Does the packaging convey the right quality, function, and positioning?”

- Pilot Testing and Feedback Loops: “Is the product delivering as intended?”

Nexdigm Product Survey Solutions

At Nexdigm, our Product Survey solutions are designed to equip businesses with the data-driven clarity needed to make informed, market-aligned product decisions.

What sets our product survey offering apart is its end-to-end research architecture, from defining the hypothesis to delivering actionable insights. We partner with product teams to discover:

- Real customer needs and pain points

- Product-market fit before launch investments

- User expectations around features, usability, and experience

- Price acceptance, value perception, and purchase triggers

Each survey is tailored to ensure statistical validity, target audience accuracy, and insight relevance, so that every response translates into a clear product decision or pivot.

Nexdigm Case

A healthcare client planning to launch beauty supplements lacked clarity on consumer preferences, competitive positioning, and pricing risks. Nexdigm conducted market assessment, segmentation, pricing analysis, and concept testing to validate demand and identify preferred formats. This data-led approach reduced the risk of product failure, delivered ~25% savings in R&D and marketing, and enabled a confident, insights-backed launch

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704