In today’s tech economy, one wrong market-entry decision can set a company back by millions.

As data localization laws, cybersecurity mandates, and AI regulations evolve across 70+ countries, choosing the right mode of entry has become the biggest determinant of global success.

At the same time, digital economies are surging. This makes global expansion tempting, but far from straightforward. Companies must navigate data sovereignty mandates, IP risks, localization requirements, and fragmented digital trade policies.

The Hidden Landmines Tech Companies Overlook in Global Expansion

- Policy, Compliance & Data Localization Barriers: More than 60+ countries have implemented or strengthened data sovereignty laws since 2020.

- Misaligned Entry Models & Capital Inefficiencies: Misaligned ownership structures lead to 8–15% higher operating costs.

- Underestimating Competitive Intensity & Price Pressure: Over 52% of tech investors misjudge competitive saturation, entering ecosystems where incumbents already control pricing, distribution, and enterprise relationships.

- IP, Cybersecurity & Talent Risks: Over 40% of emerging markets face digital talent shortages, hindering post-entry scalability.

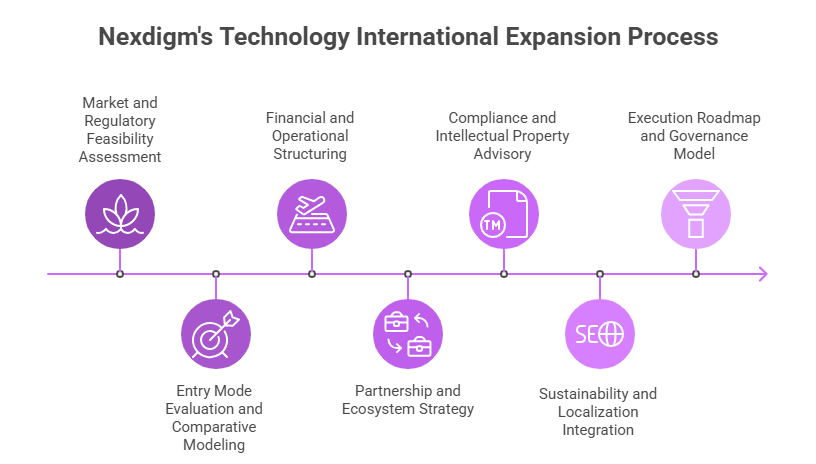

Nexdigm’s Technology International Expansion Mode of Entry Advisory Framework

Nexdigm’s Technology International Expansion Mode of Entry Advisory Framework ensures each market decision is backed by data, compliance intelligence, and financial precision.

Market & Regulatory Feasibility Assessment

We begin by analyzing digital ecosystem maturity, FDI openness, cybersecurity laws, and IP protection strength. Our evaluation includes:

- Data localization mandates across 60+ jurisdictions

- Digital taxation and cross-border data flow rules

- IP ownership and tech transfer restrictions

- Country-specific incentives for cloud, AI, semiconductor, and digital manufacturing investments

Outcome: Clients gain clear visibility into markets where regulatory stability aligns with their innovation roadmap.

Entry Mode Evaluation & Comparative Modeling

Using a structured decision matrix, Nexdigm compares:

- Greenfield setups

- Joint ventures

- Strategic alliances

- Acquisitions

- Franchising / Licensing models

- Each mode is assessed against:

- Speed to market

- Ownership and control

- CAPEX/OPEX intensity

- Data governance requirements

- Operational flexibility

Outcome: Businesses select an entry structure optimized for cost, control, and scalability.

Financial & Operational Structuring

Our financial models simulate:

- CAPEX/OPEX breakdowns

- Breakeven timelines

- Tax incentive mapping

- Profit repatriation models

- FX exposure and pricing sensitivities

- ROI scenarios based on different policy environments

Outcome: Expansion strategies are financially secure, predictable, and aligned with long-term growth.

Partnership & Ecosystem Strategy

Success in new tech markets often depends on:

- System integrators

- Cloud & infra partners

- R&D clusters

- Local distributors

- Digital government ecosystem players

Nexdigm evaluates governance, compliance, and operational maturity to identify high-capability partners.

Outcome: Clients build strong alliances that accelerate compliance and time-to-market.

Compliance & IP Advisory

Expansion into tech markets requires clarity on:

- Data protection frameworks (GDPR, PDPA, NCA, DPA, etc.)

- Cybersecurity regulations

- IP registration and enforcement

- Export controls and tech transfer norms

Outcome: Companies safeguard proprietary innovations and avoid compliance roadblocks.

Sustainability & Localization Integration

We embed ESG and localization into every market entry plan:

- Carbon accounting and digital sustainability metrics

- Local workforce integration

- Regional data storage strategies

- Green tech incentives and digital inclusion goals

Outcome: Brands enter global markets as responsible, future-aligned technology players.

Execution Roadmap & Governance

Nexdigm provides step-wise operationalization support:

- Entity setup

- Capital structuring

- Compliance documentation

- Product localization

- Pilot execution and rollout

- Governance dashboards for KPIs & risk

Outcome: Seamless transition from strategy to execution with measurable accountability.

Nexdigm Case

A SaaS automation firm expanding into Southeast Asia struggled with data localization laws and unclear fiscal incentives. Nexdigm mapped regulations across three markets, built a 5-scenario entry model, and shortlisted compliant digital partners. The client reduced projected market-entry time by 30% and unlocked an additional 11% cost advantage through optimized tax and incentive planning.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704