The global financial services landscape is witnessing an unprecedented convergence of WealthTech and InsurTech, where digital investment platforms, robo-advisors, and embedded protection models are redefining how financial value is delivered to end users. As customers increasingly expect hyper-personalized, seamless, and experience-driven financial journeys, product differentiation is now hinges on how intelligently those offerings are designed, experienced, and adapted to regional nuances.

While many BFSI players invest heavily in technology upgrades or customer-facing innovation, few possess the visibility to understand how regional leaders translate behavioral insights, UX sophistication, and regulatory adaptability into sustained competitive advantage. This is where product benchmarking becomes a strategic imperative, a dynamic intelligence framework that uncovers how leading players across Asia, the Middle East, and Europe design experiences, personalize value, and operationalize compliance into their WealthTech and insurance ecosystems.

By decoding the behavioral, experiential, and regulatory foundations of regional market leaders, BFSI organizations can chart a path toward feature-intelligent, design-conscious, and policy-aligned innovation, ensuring their products evolve in lockstep with customer behavior and market expectations.

Benchmarking WealthTech and Insurance Ecosystems Through Behavioral and Design Intelligence

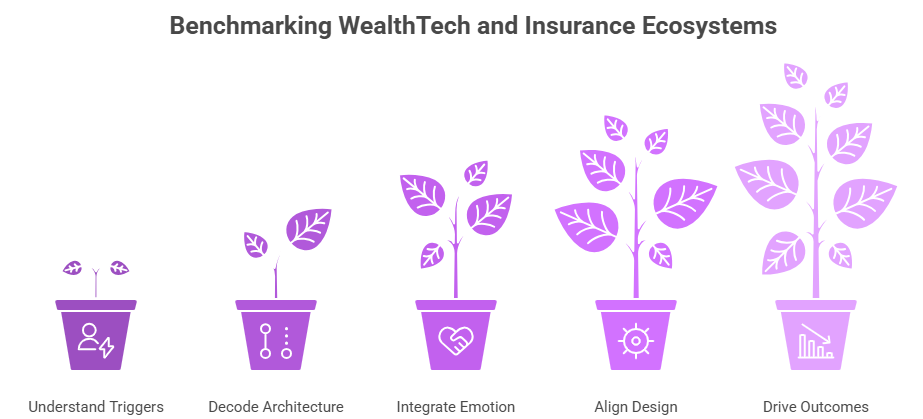

The next frontier of competitiveness in WealthTech and InsurTech lies in how intuitively products are designed and how effectively they align with user behavior. Benchmarking through a behavioral and design intelligence lens enables BFSI organizations to uncover what truly drives user engagement, decision confidence, and loyalty. Nexdigm’s approach moves beyond conventional feature analysis to study the emotional, psychological, and experiential dimensions of financial product interaction.

- Understanding Behavioral Triggers: Leading WealthTech and InsurTech platforms use behavioral cues to shape customer actions. Benchmarking these design triggers helps BFSI firms understand how subtle experience elements influence savings discipline, policy renewal rates, and cross-product adoption.

- Decoding Experience Architecture: Through benchmarking, Nexdigm identifies best practices in onboarding flow, dashboard navigation, and content hierarchy that minimize decision fatigue and enhance user confidence during complex financial tasks.

- Integrating Emotion into Design: Insurance and wealth management products often rely on emotional trust. Benchmarking design strategies across regional leaders reveals how empathy-driven interfaces, conversational support, and transparent visuals foster a sense of reassurance, turning routine transactions into meaningful experiences.

- Aligning Design with Financial Intent: Benchmarking also examines how UX logic supports the underlying financial goal. Nexdigm helps institutions map these design principles to product performance metrics.

- Driving Measurable Engagement Outcomes: By blending behavioral data and design benchmarking, BFSI organizations can quantify experience maturity.

Through this lens, benchmarking becomes not just a comparison exercise but a strategic tool to re-engineer customer journeys, enabling WealthTech and InsurTech providers to design digital ecosystems that are behaviorally intelligent, emotionally resonant, and financially empowering.

Benchmarking as a Strategic Lens for Regulatory Agility and Market-Specific Personalization

As WealthTech and InsurTech ecosystems expand across regions, success increasingly depends on how well products adapt to local regulations and customer realities. Product benchmarking serves as a strategic lens that helps BFSI organizations decode how regional leaders embed regulatory compliance, data ethics, and cultural personalization into their offerings, turning what were once operational challenges into powerful differentiators.

- Regulatory Adaptability as a Design Principle: Leading regional players have begun to treat compliance not as an afterthought, but as an integral part of product architecture. Benchmarking these models allows BFSI institutions to understand how regulatory intent is operationalized through product workflows. Nexdigm helps institutions translate such practices into frameworks that align compliance with customer convenience.

- Localized Personalization Frameworks: Regional benchmarking also reveals how financial products are tailored to reflect cultural, linguistic, and economic preferences. Nexdigm’s product benchmarking evaluates how such regional nuances influence engagement and trust, guiding BFSI players in developing personalization archetypes that scale globally but resonate locally.

- Data Governance and Ethical Benchmarking: Benchmarking across these ecosystems highlights how transparent consent flows, data-sharing protocols, and algorithmic fairness standards improve user confidence. Nexdigm integrates these insights into strategic roadmaps that help BFSI clients meet evolving regulatory expectations while reinforcing their brand’s ethical credibility.

- Anticipating Policy Evolution: Beyond compliance, product benchmarking offers foresight. By studying how market leaders adapt to policy shifts. Nexdigm helps financial firms anticipate changes and future-proof their product designs against upcoming regulatory transitions.

Nexdigm’s BFSI Product Benchmarking and Competitive Intelligence Services empower BFSI organizations to translate market learnings into actionable design, compliance, and innovation strategies. By benchmarking across regional leaders, we help financial institutions reimagine products that are human-centric, regulation-ready, and future-adaptive.

To take the next step, simply visit our Request a Consultation page and share your requirements with us.

Harsh Mittal

+91-8422857704