Market Overview

The ASEAN Satellite Communications market, valued at approximately USD ~ billion, is experiencing rapid growth due to the increasing demand for high-speed internet and satellite-based services. This surge is largely driven by technological advancements in satellite communication technologies, infrastructure expansion, and rising regional telecommunications needs. The market’s expansion is further fueled by government initiatives focused on digital connectivity and the development of satellite systems for various applications, including broadband, defense, and broadcasting. As countries in ASEAN embrace digital transformation, the market is set to maintain a strong growth trajectory, with increased investments in satellite infrastructure.

The dominant players in the ASEAN region include countries such as Singapore, Indonesia, and Thailand. These nations are leading due to their advanced infrastructure, strategic geographic locations, and robust government support for satellite communications. Singapore, in particular, has emerged as a hub for satellite operations in Southeast Asia, benefiting from its strategic position for regional connectivity. Indonesia’s vast archipelago demands reliable satellite services, thus contributing to the expansion of the satellite communications sector. Thailand, with its growing telecommunications sector, is also playing a key role in driving the market forward.

Market Segmentation

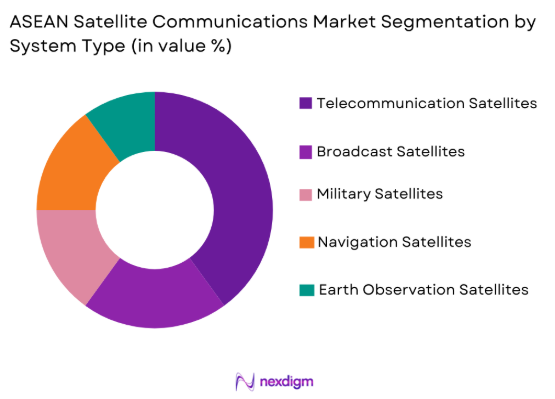

By System Type

The ASEAN Satellite Communications market is segmented by system type into telecommunication satellites, broadcast satellites, military satellites, navigation satellites, and earth observation satellites. Among these, telecommunication satellites dominate the market due to the high demand for satellite-based broadband services and digital television. Their widespread use in providing internet and mobile connectivity in remote areas, as well as their essential role in telecommunications infrastructure, has positioned them as the market leader. The rapid growth in internet penetration in rural ASEAN regions is a key driver for this dominance. Telecommunication satellites continue to benefit from increasing data usage and the need for robust communication networks across ASEAN nations.

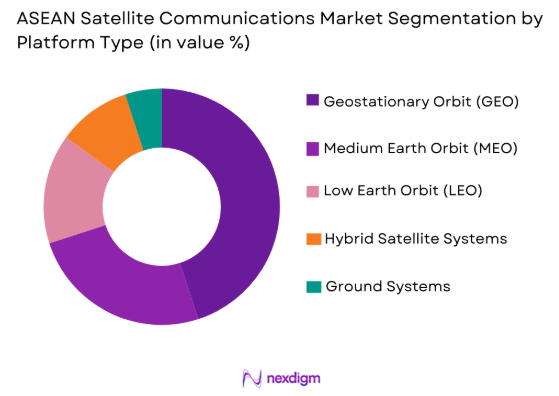

By Platform Type

The ASEAN Satellite Communications market is segmented by platform type into geostationary orbit (GEO), medium earth orbit (MEO), low earth orbit (LEO), hybrid satellite systems, and ground systems. Currently, the GEO satellites dominate the market due to their capability to cover large geographical areas, making them ideal for delivering services across the ASEAN region. These satellites remain popular for their ability to provide stable, long-term communication solutions for broadcasting, broadband, and military services. The recent advances in LEO satellite deployments, while promising, have yet to surpass the dominance of GEO satellites, though their potential for low-latency communications is an emerging factor.

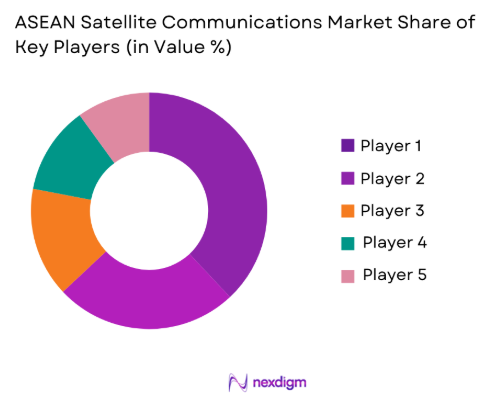

Competitive Landscape

The ASEAN Satellite Communications market is highly competitive, with major players consolidating to leverage technological advancements and broaden their market reach. As key companies continue to innovate and expand their satellite networks, they are positioned to capture larger shares of the market. This consolidation has resulted in improved service offerings and access to new markets within ASEAN. Leading players such as SES, Intelsat, and Singtel dominate the market with their advanced satellite communications technologies and global reach. These companies are heavily investing in next-generation satellite systems, which contribute to the market’s competitive intensity.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| SES S.A. | 1985 | Luxembourg | ~ | ~ | ~ | ~ | ~ |

| Intelsat | 1964 | USA | ~ | ~ | ~ | ~ | ~

|

| Singtel | 1879 | Singapore | ~ | ~ | ~ | ~ | ~

|

| Arianespace | 1980 | France | ~ | ~ | ~ | ~ | ~

|

| Telesat | 1969 | Canada | ~ | ~ | ~ | ~ | ~

|

ASEAN Satellite Communications Market Analysis

Growth Drivers

Rising Demand for Broadband Connectivity

The increasing demand for high-speed internet, especially in remote and rural areas across ASEAN, is a major growth driver for the satellite communications market. This need for enhanced connectivity is fueled by the rise in internet-based services such as streaming, e-commerce, and digital education. Governments and private companies in ASEAN are investing in satellite systems to bridge the connectivity gap, ensuring that underserved areas benefit from reliable, fast internet access. With the vast archipelagos of countries like Indonesia and the Philippines, satellite-based communication has become crucial in meeting the growing demand for broadband services. Additionally, the expansion of mobile networks and the rise in mobile data consumption further contribute to this growth. Satellite communication, with its ability to provide internet services to hard-to-reach areas, has become a key enabler for the digital transformation of the region.

Government Support and Investments

Another key growth driver for the ASEAN Satellite Communications market is the substantial government support for digital infrastructure development. Governments across ASEAN countries are investing heavily in satellite systems to support national security, broadcasting, and digital services. This includes subsidies and initiatives to improve broadband access, which in turn fuels demand for satellite communication services. Countries like Singapore, Thailand, and Malaysia have developed extensive satellite programs aimed at enhancing national security and supporting telecommunications infrastructure. Furthermore, government partnerships with private satellite providers are enabling these countries to deploy more advanced systems to meet regional demands. With more governments recognizing the importance of satellite technology in achieving national digital objectives, their investments and policy frameworks will continue to drive the growth of the satellite communications market in ASEAN.

Market Challenges

High Initial Investment Costs

One of the biggest challenges facing the ASEAN Satellite Communications market is the high initial capital required for satellite deployments. Establishing satellite networks involves significant investments in infrastructure, technology, and operational maintenance. For many ASEAN countries, securing funding for large-scale satellite projects remains a challenge, especially given the economic conditions in certain regions. Despite the long-term benefits of satellite communications, including increased connectivity and economic development, the upfront costs can be prohibitive for some nations. This has slowed the pace of satellite adoption in certain ASEAN regions, particularly in less developed areas where governments and businesses may be reluctant to invest in costly infrastructure. While international partnerships and collaborations help alleviate some financial burdens, the overall cost structure remains a major barrier to wider adoption.

Regulatory Challenges and Bureaucratic Hurdles

Regulatory complexities also pose a significant challenge to the growth of the ASEAN Satellite Communications market. Each ASEAN country has its own set of regulations governing satellite communications, which can create barriers to entry for new players and complicate the coordination of regional satellite networks. The licensing process for satellite spectrum rights and orbital slots is often time-consuming and bureaucratic, with many countries requiring extensive documentation and approvals. Additionally, differing regulatory standards across ASEAN countries can hinder the standardization of services and delay the deployment of new satellite-based technologies. Governments must work together to streamline regulations and ensure that the satellite communications sector is able to grow in a cohesive and coordinated manner, fostering greater regional integration.

Opportunities

Expansion of Satellite Services in Remote Areas

One significant opportunity in the ASEAN Satellite Communications market is the expansion of satellite services in remote and underserved areas. Satellite communications offer a unique advantage over traditional terrestrial networks in regions where infrastructure is limited or non-existent. With many ASEAN nations consisting of islands and remote rural areas, satellite systems are ideal for providing broadband internet, mobile connectivity, and emergency communications. The growing need for digital services in these regions, especially in countries like Indonesia and the Philippines, presents a significant opportunity for satellite providers to expand their offerings. Moreover, satellite internet services are increasingly being used to support digital education, telemedicine, and e-government initiatives, which will further drive demand for satellite communications.

Emerging Demand for Low Earth Orbit (LEO) Satellites

Another opportunity for growth in the ASEAN Satellite Communications market lies in the growing demand for Low Earth Orbit (LEO) satellite constellations. LEO satellites, with their low latency and high-speed connectivity, offer a competitive advantage over traditional geostationary satellites, making them highly attractive for both commercial and governmental applications. The rise of global satellite network providers like OneWeb and Starlink, which are focused on LEO systems, is creating new opportunities for ASEAN countries to improve their broadband and telecommunications infrastructure. As more LEO satellites are launched, ASEAN nations will benefit from faster, more reliable satellite services. The opportunity to integrate LEO satellite technology into existing systems and improve coverage, particularly in underserved regions, presents a unique growth avenue for the market.

Future Outlook

The ASEAN Satellite Communications market is expected to continue its strong growth trajectory in the next five years. Technological advancements, particularly in satellite manufacturing and LEO satellite systems, will drive innovation, enhancing service offerings across the region. As governments across ASEAN countries place greater emphasis on digital connectivity, especially in remote areas, satellite-based communication systems will become an essential component of national infrastructure. Additionally, the increasing demand for data services, coupled with regulatory support and private sector investments, will further propel market growth. The integration of satellite systems with 5G networks and IoT technologies will create new opportunities, ensuring that the ASEAN Satellite Communications market remains at the forefront of the global satellite communications industry.

Major Players

- SES S.A.

- Intelsat

- Singtel

- Arianespace

- Telesat

- AsiaSat

- OneWeb

- Viasat

- Eutelsat

- Iridium Communications

- Speedcast

- Inmarsat

- Hughes Network Systems

- Thaicom

- Telesat

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite service providers

- Telecommunications operators

- Broadcast companies

- Aerospace and defense contractors

- Infrastructure developers

- Satellite technology developers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key variables that influence the ASEAN Satellite Communications market. These include technological advancements, demand patterns, regulatory policies, satellite infrastructure, market trends, and the role of government and private investments. This step helps in setting the foundational framework for the analysis.

Step 2: Market Analysis and Construction

Market analysis is conducted using a combination of primary and secondary research. This involves collecting data from industry reports, market surveys, government publications, and interviews with key stakeholders. The information is then processed and used to construct market models and assess the market’s current status and future potential.

Step 3: Hypothesis Validation and Expert Consultation

The next phase involves validating the hypotheses and models developed during the market analysis by consulting with industry experts, satellite technology developers, and key market players. Expert insights help refine the analysis and ensure that the projections align with real-world conditions.

Step 4: Research Synthesis and Final Output

After validation, the research findings are synthesized into a comprehensive report. This final output combines the insights gained from primary and secondary data, expert consultations, and market analysis. The result is a complete overview of the ASEAN Satellite Communications market, including growth forecasts, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing Demand for Broadband Connectivity

Government Initiatives for Digital Infrastructure Development

Rising Demand for Satellite-based Navigation Services

Increased Adoption of Remote Sensing Technologies

Advancements in Satellite Manufacturing Technology - Market Challenges

High Cost of Satellite Deployment

Regulatory Hurdles and Licensing Issues

Limited Availability of Spectrum

Data Security and Privacy Concerns

Environmental Impact and Sustainability Issues - Market Opportunities

Expansion of Satellite Services in Remote Areas

Integration of Satellite Networks with 5G Technology

Partnerships for Global Satellite Communication Networks - Trends

Rise in Low Earth Orbit (LEO) Satellite Deployments

Adoption of Advanced Satellite Communication Technologies

Increasing Focus on Satellite IoT Connectivity

Increased Collaboration between Telecom and Satellite Operators

Development of Multinational Satellite Networks - Government Regulations & Defense Policy

Regulatory Support for Satellite Spectrum Management

National Security Regulations for Satellite Communications

Incentives for Domestic Satellite Development

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Telecommunication Satellites

Broadcast Satellites

Military Satellites

Navigation Satellites

Earth Observation Satellites - By Platform Type (In Value%)

Geostationary Orbit (GEO)

Medium Earth Orbit (MEO)

Low Earth Orbit (LEO)

Hybrid Satellite Systems

Ground Systems - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Integrated Solutions

Managed Services - By EndUser Segment (In Value%)

Telecommunications Providers

Broadcasting Companies

Government & Defense Agencies

Aerospace & Aviation

Energy and Utilities - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Communication Technologies

Satellite Components

Satellite Antennas

Signal Processing Technologies

Ground Equipment

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, EndUser Segment, Procurement Channel, Technology, Regulatory Compliance, Service Models, System Complexity Tier, Regional Expansion)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

SES S.A.

Intelsat

Eutelsat Communications

AsiaSat

Thaicom Public Company Limited

Arianespace

Telesat

Hughes Network Systems

Loral Space & Communications

Inmarsat

OneWeb

Sky Perfect JSAT Corporation

Kacific Broadband Satellites

Iridium Communications

Viasat

- Rising Demand for Satellite Internet in Remote Areas

- Government Agencies’ Role in Expanding Satellite Communications

- Telecom Operators’ Investment in Satellite Connectivity

- Increased Use of Satellites for Disaster Management and Response

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035