Market Overview

The Asia Pacific Aircraft Avionics market is experiencing significant growth due to increasing air traffic and rising demand for advanced aircraft technologies. The market size has seen substantial investment, with figures in billions ~ USD based on recent assessments. Aircraft avionics systems are in high demand for both commercial and military applications, driving expansion. The market’s growth is fueled by technological advancements in digital cockpit systems, navigation, communication, and surveillance. Additionally, the rising need for upgraded safety and operational efficiency contributes to growth.

Key countries in the Asia Pacific region, such as China, Japan, and India, play a crucial role in shaping the market landscape. These nations are dominating the aircraft avionics market due to factors such as their robust aerospace industries, government support, and technological advancements. China, for instance, is investing heavily in the modernization of its aviation infrastructure and domestic aircraft manufacturing, while Japan leads in technological development. India is also emerging as a significant player due to growing air travel demand, contributing to the regional market dominance.

Market Segmentation

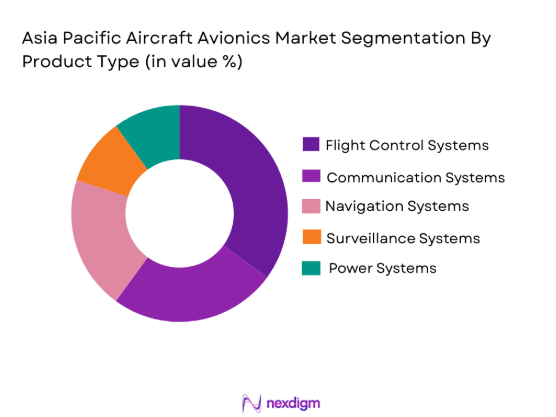

By Product Type

The Asia Pacific Aircraft Avionics market is segmented by product type into flight control systems, communication systems, navigation systems, surveillance systems, and power systems. Recently, flight control systems had a dominant market share due to their essential role in ensuring the safety and performance of aircraft. Flight control systems are increasingly sophisticated, incorporating digital technologies such as fly-by-wire systems, which enhance aircraft stability, reduce pilot workload, and improve fuel efficiency. This sub-segment benefits from the constant evolution of automation in aviation and growing demand for high-performance aircraft. As aviation safety standards continue to tighten and operational demands increase, flight control systems remain integral to the future of aviation technology.

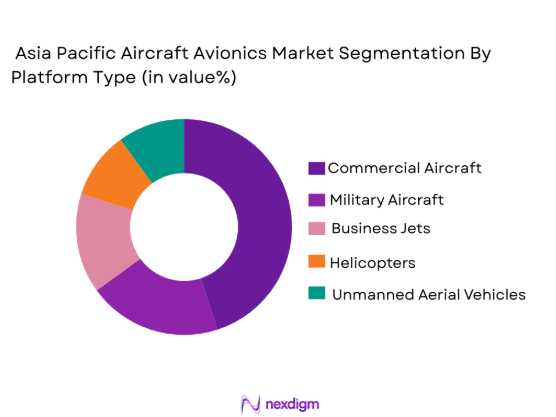

By Platform Type

The Asia Pacific Aircraft Avionics market is segmented by platform type into commercial aircraft, military aircraft, business jets, helicopters, and unmanned aerial vehicles (UAVs). Among these, commercial aircraft are dominating the market share due to the continuous rise in air travel demand across the Asia Pacific region. As commercial aviation grows, the need for advanced avionics systems that can improve navigation, communication, and safety is increasing. The expansion of low-cost carriers and the growth of international travel within the region are further driving demand for modern avionics in commercial aircraft. Additionally, increasing regulations and advancements in aircraft design contribute to the growing reliance on sophisticated avionics systems for commercial aircraft.

Competitive Landscape

The Asia Pacific Aircraft Avionics market is highly competitive, with several major players shaping the industry. Key players dominate through technological innovations, strategic collaborations, and geographic expansion. The market is seeing consolidation as companies invest in research and development, particularly in AI, machine learning, and safety systems. This landscape is influenced by both regional leaders and global aviation giants, making it a dynamic and rapidly evolving market.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Honeywell Aerospace | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | La Défense, France | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | Olathe, Kansas, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Aircraft Avionics Market Analysis

Growth Drivers

Technological Advancements in Aircraft Safety Systems

The demand for advanced aircraft safety systems is one of the key growth drivers in the Asia Pacific Aircraft Avionics market. With the increasing focus on passenger safety and the introduction of more stringent safety regulations, airlines and manufacturers are investing heavily in avionics technologies that enhance aircraft safety. The rise in the adoption of enhanced vision systems (EVS), weather radar systems, and collision avoidance systems has significantly contributed to market growth. These systems improve situational awareness and allow pilots to make better decisions in real-time, particularly under adverse weather conditions or in complex air traffic environments. The integration of AI and machine learning technologies in avionics systems further contributes to improving safety by enabling predictive maintenance, reducing human error, and enhancing flight performance. As a result, safety systems have become a fundamental component of new aircraft designs, driving substantial demand in the market.

Government Support for Aerospace Infrastructure Development

Governments across the Asia Pacific region have been providing strong support for the growth of their aerospace sectors. China, India, and other countries in the region are investing heavily in upgrading their aviation infrastructure, which is expected to create significant opportunities for the avionics market. Governments are supporting domestic aircraft manufacturers and avionics suppliers through favorable policies, subsidies, and research funding. This investment is also focused on expanding airports and upgrading air traffic control systems, which creates demand for more advanced avionics technologies. As countries seek to boost their aviation industries, particularly in light of increasing air travel demand, the demand for avionics systems that improve safety, operational efficiency, and communication has seen a significant rise. The increased regulatory focus on aviation safety and modernization initiatives within the region further strengthens the demand for avionics systems.

Market Challenges

High Initial Costs of Avionics Systems

One of the significant challenges in the Asia Pacific Aircraft Avionics market is the high initial cost associated with avionics systems. Advanced avionics solutions are expensive, and their installation requires specialized skills and infrastructure, which increases the overall cost of aircraft manufacturing and maintenance. These costs can be a barrier, particularly for smaller airlines or regional carriers that may have limited budgets for upgrading their fleets. The financial burden of retrofitting older aircraft with modern avionics systems is another challenge that adds to the high cost of ownership. This issue is particularly prominent in emerging markets where aviation players are more cost-sensitive. Although the long-term benefits of enhanced operational efficiency, safety, and fuel savings are clear, the upfront capital investment remains a significant hurdle for many airlines and aircraft operators in the region.

Cybersecurity Risks in Avionics Systems

As aircraft avionics systems become increasingly connected and reliant on digital technologies, the threat of cyberattacks has emerged as a critical challenge. The integration of cloud computing, AI, and big data into avionics systems has expanded the potential for cyber vulnerabilities. These systems are increasingly linked to ground-based operations and air traffic control networks, making them susceptible to hacking, data breaches, and system disruptions. A successful cyberattack could compromise the safety of the aircraft, disrupt operations, and damage the reputation of manufacturers and operators. To mitigate these risks, there is a growing need for advanced cybersecurity measures to secure avionics systems. However, implementing and maintaining robust cybersecurity protocols adds additional costs and complexity to avionics systems, which can strain the resources of smaller aviation companies, further exacerbating this challenge.

Market Opportunities

Emerging Demand for Autonomous Aircraft

The rise of autonomous aircraft represents a significant growth opportunity for the Asia Pacific Aircraft Avionics market. As autonomous technology advances, the demand for specialized avionics systems that support the operation of unmanned aircraft is increasing. This includes systems for navigation, communication, collision avoidance, and flight control. Autonomous aircraft, particularly in the commercial and military sectors, require sophisticated avionics solutions to ensure safe and efficient operation without human intervention. The growing interest in unmanned aerial vehicles (UAVs) for cargo delivery, surveillance, and transportation services is fueling the demand for these systems. Additionally, several governments in the Asia Pacific region are investing in the development and testing of autonomous flight technologies, which will further propel the growth of avionics systems tailored to autonomous aircraft. As technology matures and regulatory frameworks evolve, the market for avionics in autonomous aircraft is expected to grow rapidly.

Adoption of Electric Aircraft and Hybrid Technologies

As the aviation industry moves towards greater sustainability, there is an emerging opportunity in the Asia Pacific Aircraft Avionics market for systems that support electric and hybrid aircraft technologies. Electric aircraft are gaining attention for their potential to reduce carbon emissions, lower operating costs, and improve fuel efficiency. The development of lightweight avionics systems that can support electric and hybrid propulsion systems, as well as energy management technologies, is crucial for the success of these aircraft. With the increasing focus on reducing the environmental impact of aviation, particularly in light of government regulations and global sustainability goals, the demand for electric aircraft is expected to rise. As a result, avionics companies have the opportunity to innovate and provide solutions for these next-generation aircraft. The Asia Pacific region, with its rapidly growing aviation market and government initiatives to promote green technologies, presents a fertile ground for the adoption of electric and hybrid aircraft technologies, driving demand for advanced avionics systems.

Future Outlook

Over the next five years, the Asia Pacific Aircraft Avionics market is expected to experience robust growth driven by technological advancements, increasing investments in autonomous aircraft, and a focus on sustainability. The adoption of AI, machine learning, and 5G connectivity will further enhance avionics systems, improving safety and operational efficiency. Additionally, government support for the aerospace sector and the increasing demand for green technologies will contribute to the growth of the market. The rise of electric and hybrid aircraft will also drive the demand for new avionics solutions. With these trends, the market is poised for expansion, and major players are likely to continue innovating to meet the evolving needs of the industry.

Major Players

- Honeywell Aerospace

- Thales Group

- Rockwell Collins

- Garmin Ltd.

- BAE Systems

- Lockheed Martin

- Airbus

- Boeing

- Northrop Grumman

- Raytheon Technologies

- Leonardo

- Safran Electronics & Defense

- Collins Aerospace

- L3 Technologies

- Saab Group

Key Target Audience

- Airlines and aircraft operators

- Government and regulatory bodies

- Aerospace manufacturers

- Defense contractors

- UAV manufacturers

- Avionics system suppliers

- Aviation technology developers

- Investment and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the critical variables that influence the market, such as product types, regional factors, and customer preferences.

Step 2: Market Analysis and Construction

In this phase, we analyze the current market scenario, focusing on growth patterns, key trends, and major players.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions and feedback are gathered to validate assumptions, ensuring the market model reflects reality.

Step 4: Research Synthesis and Final Output

The research findings are consolidated, producing actionable insights and detailed market reports.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Traffic Demand

Rising Investments in Military Avionics

Advancements in Aircraft Safety Systems

Government Initiatives for Aerospace Development

Demand for More Efficient and Lightweight Avionics - Market Challenges

High Initial Costs of Avionics Systems

Technological Integration and Compatibility Issues

Regulatory Compliance and Certification Challenges

Cybersecurity Risks in Avionics Systems

Limited Availability of Skilled Workforce - Market Opportunities

Growth of UAVs and Autonomous Aircraft

Emerging Demand for AI-powered Avionics

Collaboration with Tech Startups for Innovation - Trends

Advancements in Artificial Intelligence for Avionics

Growth in Electric and Hybrid Aircraft

Increased Adoption of 5G Connectivity in Aircraft Systems

Development of Smart Airports with Advanced Avionics

Sustainability in Aircraft Systems

- Government Regulations & Defense Policy

Aviation Safety Regulations

Export Control and Compliance Policies

Defense Procurement Policies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Control Systems

Communication Systems

Navigation Systems

Surveillance Systems

Power Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit Solutions

Integrated Systems

Modular Systems - By End User Segment (In Value%)

Commercial Airlines

Defense Contractors

Private Operators

Government Agencies

OEM Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Avionics Electronics

Advanced Materials

Integrated Circuits

Sensors and Actuators

Software Systems

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Thales Group

Garmin Ltd.

Rockwell Collins

L3 Technologies

BAE Systems

General Electric

Northrop Grumman

Harris Corporation

SAAB AB

Rheinmetall AG

Sikorsky Aircraft

Indra Sistemas S.A.

Safran Electronics & Defense

Esterline Technologies

- Commercial Airlines Expanding Fleet and Service Offerings

- Government Agencies Focusing on National Security and Aircraft Modernization

- Private Operators Seeking More Efficient and Cost-effective Systems

- OEM Manufacturers Increasing R&D in Avionics Technology

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035