Market Overview

The Asia Pacific aircraft engine MRO market is expected to witness substantial growth, driven by the increasing demand for air travel and a growing fleet of commercial, military, and cargo aircraft. The market size is projected to reach USD ~ billion, driven by significant investments in MRO facilities and technological advancements in engine repair and overhaul.

The region’s expanding airline industry and rising aircraft fleet utilization contribute to the increasing demand for maintenance, repair, and overhaul services.

Key countries such as China, India, Japan, and Australia dominate the market due to their large aircraft fleets and strong aviation infrastructure. China, with its rapidly growing commercial airline sector, is expected to lead the demand for engine MRO services. Similarly, India’s burgeoning airline industry, bolstered by strong government initiatives and growing air traffic, also plays a significant role. Japan and Australia contribute to the demand due to their established aerospace industries and ongoing investment in aircraft maintenance capabilities.

Market Segmentation

By Product Type

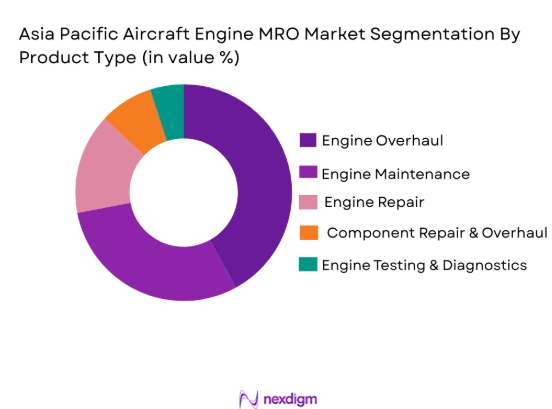

Asia Pacific aircraft engine MRO market is segmented by product type into engine overhaul, engine maintenance, engine repair, component repair & overhaul, and engine testing & diagnostics. Recently, engine overhaul has had a dominant market share due to increasing demand for extending the lifespan of older engines, especially in commercial aviation. The need to maintain operational efficiency and reduce operational costs pushes airlines and fleet operators to focus on overhauling their engines to avoid costly replacements. Additionally, regulatory compliance requirements for maintenance and safety also contribute to the growing preference for engine overhauls. These factors, combined with the high cost of new engine installations, make engine overhaul a dominant sub-segment in the market.

By Platform Type

Asia Pacific aircraft engine MRO market is segmented by platform type into commercial aircraft, business jets, military aircraft, general aviation aircraft, and cargo aircraft. The commercial aircraft segment has the largest market share due to the increasing number of air travelers in the region, particularly in China and India. As airlines expand their fleets to accommodate rising demand, the need for regular engine maintenance and overhaul becomes essential. This, in turn, drives the demand for MRO services in the commercial aircraft segment. Furthermore, international and domestic travel growth in the Asia Pacific region is contributing significantly to the increase in commercial aircraft fleets and the overall demand for maintenance services.

Competitive Landscape

The competitive landscape of the Asia Pacific aircraft engine MRO market is shaped by several key players, with a focus on consolidation and strategic partnerships. Major MRO providers such as GE Aviation and Rolls-Royce have established a strong presence in the region, leveraging their technological capabilities and extensive service networks to maintain their dominance. These companies are continuously expanding their global reach, through both acquisitions and joint ventures, to tap into the growing demand for engine MRO services. The market is also characterized by the rising influence of regional players and collaborations between airlines and independent MRO providers.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Service Capabilities |

| GE Aviation | 1917 | Cincinnati, USA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | Derby, UK | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | East Hartford, USA | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1951 | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ |

| SIA Engineering | 1982 | Singapore | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Aircraft Engine MRO Market Analysis

Growth Drivers

Rising Air Traffic Demand:

The aviation sector in the Asia Pacific region is experiencing unprecedented growth due to an increasing number of air travelers, especially in emerging markets like India and China. This surge in air traffic is resulting in a larger fleet size for both commercial and cargo aircraft, which directly influences the demand for MRO services. The rise of low-cost carriers, along with the growing middle class in these regions, further accelerates this trend. As airlines expand their fleets to accommodate increasing demand, the need for efficient, timely engine maintenance and repair becomes essential. Airlines are also under increasing pressure to ensure the highest safety standards, making regular MRO activities vital for keeping their fleets operational. Additionally, airlines are seeking cost-effective maintenance solutions to extend the lifespan of their engines, which further drives the MRO demand. This growing demand for air travel and increased fleet size is one of the primary factors propelling the Asia Pacific aircraft engine MRO market forward.

Technological Advancements in MRO Processes

As technology continues to evolve, the aircraft engine MRO market is seeing a shift towards more advanced, digitalized solutions. Modern diagnostic tools and predictive maintenance technologies are helping MRO providers anticipate issues before they arise, reducing downtime and improving engine reliability. The implementation of artificial intelligence (AI) and big data analytics for engine diagnostics is becoming increasingly common, enabling more precise and faster repairs. Additive manufacturing (3D printing) is also being employed to create critical engine components, reducing both production time and costs. These technological advancements are allowing MRO providers to offer more efficient, cost-effective solutions to their customers, thus driving the overall growth of the market. In addition to improving operational efficiency, these advancements are also contributing to the reduction of maintenance-related costs, making MRO services more attractive to airlines and operators in the Asia Pacific region.

Market Challenges

High Operational Costs for MRO Providers

One of the major challenges faced by aircraft engine MRO providers in the Asia Pacific market is the high operational costs associated with maintaining and repairing engines. The complex nature of modern aircraft engines requires specialized labor, tools, and technology, all of which come with significant costs. These expenses are often passed on to airlines and fleet operators, who are already under financial pressure to minimize operating costs. In addition, the need for frequent maintenance and the rapid pace of technological advancements in engines contribute to the continuous increase in MRO costs. Many smaller MRO providers struggle to keep up with the high costs of acquiring state-of-the-art equipment and skilled technicians, which can limit their ability to compete with larger players in the market. This challenge not only affects the profitability of MRO providers but also has a direct impact on the cost structures of airlines and other end users of MRO services, potentially raising the overall costs of air travel in the region.

Regulatory Compliance and Safety Standards

Stringent safety and regulatory requirements in the aviation industry are another significant challenge facing the Asia Pacific aircraft engine MRO market. The need for MRO providers to comply with a variety of national and international regulations often results in delays and increased costs. Compliance with these regulations requires MRO providers to constantly update their equipment, processes, and certifications, which can be a significant financial burden. The increasing complexity of engine technologies also means that MRO providers need to stay ahead of the curve in terms of training and certification to meet evolving regulatory standards. This regulatory pressure often requires heavy investment in infrastructure and training programs to maintain certifications, which can limit the operational flexibility of smaller MRO companies and increase costs for larger players. Furthermore, ensuring that all MRO activities comply with both local and international aviation regulations is an ongoing challenge that adds layers of complexity to the overall MRO process.

Opportunities

Growing Demand for Sustainable Aviation

The growing emphasis on environmental sustainability in the aviation industry presents a significant opportunity for the Asia Pacific aircraft engine MRO market. Airlines and operators are increasingly seeking solutions that can reduce their environmental footprint, which includes adopting more fuel-efficient engines and utilizing sustainable aviation fuel (SAF). As a result, the demand for MRO services focused on improving engine efficiency and reducing emissions is set to increase. MRO providers have an opportunity to capitalize on this trend by offering specialized services that enhance the environmental performance of aircraft engines. Additionally, engine manufacturers and MRO providers are working together to develop more sustainable technologies, such as engines that are compatible with SAF or engines that use advanced materials to reduce fuel consumption. This shift toward sustainability presents a long-term growth opportunity for the MRO market, as airlines and other aviation stakeholders look for ways to meet their environmental targets while maintaining operational efficiency.

Advancements in Engine Design and Performance

Technological advancements in aircraft engine design present significant opportunities for MRO providers to offer specialized services tailored to next-generation engines. The introduction of more efficient and powerful engines in the Asia Pacific region provides MRO providers with a chance to differentiate themselves by offering maintenance, repair, and overhaul services for these advanced systems. Engine manufacturers are focusing on reducing weight, improving fuel efficiency, and increasing performance, which in turn leads to more complex and specialized MRO needs. As airlines and fleet operators adopt these new technologies, the demand for MRO services will evolve, creating opportunities for companies that are able to keep pace with these technological developments. Furthermore, innovations in engine diagnostics, predictive maintenance, and modular component systems offer opportunities for MRO providers to offer more efficient services, thus reducing turnaround times and enhancing operational reliability for airlines and fleet operators. The continued evolution of engine technology in the Asia Pacific region ensures that the MRO market will remain dynamic and growth-oriented over the coming years.

Future Outlook

The Asia Pacific aircraft engine MRO market is poised for significant growth over the next five years, driven by increasing demand for air travel, expanding fleets, and technological advancements. The growing focus on sustainability and operational efficiency will likely drive demand for eco-friendly engine services and the adoption of next-generation technologies. Additionally, strong government support for aviation infrastructure development and investment in MRO capabilities will contribute to the overall growth of the market.

Major Players

- GE Aviation

- Rolls-Royce

- Pratt & Whitney

- Honeywell Aerospace

- Air France Industries KLM Engineering & Maintenance

- Lufthansa Technik

- SIA Engineering Company

- MTU Aero Engines

- AAR Corp

- Turkish Technic

- Airbus

- Boeing

- Delta TechOps

- Safran Aircraft Engines

- ST Engineering

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial airlines

- Private aircraft operators

- MRO service providers

- Aircraft manufacturers

- Aerospace technology developers

- Fleet operators

Research Methodology

Step 1: Identification of Key Variables

Identify the core market drivers, restraints, and trends impacting the aircraft engine MRO industry in Asia Pacific.

Step 2: Market Analysis and Construction

Analyze historical data and create models for forecasting market size, growth potential, and segment contributions.

Step 3: Hypothesis Validation and Expert Consultation

Validate assumptions with industry experts and consult primary research sources, such as MRO providers, OEMs, and fleet operators.

Step 4: Research Synthesis and Final Output

Compile insights from secondary and primary research to finalize the market report and provide actionable recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Travel Demand

Technological Advancements in Engine Efficiency

Growing Fleet Size in the Region

Rising Aircraft Fleet Utilization

Government Investments in Aviation Infrastructure - Market Challenges

High Cost of Engine Overhaul

Technological Obsolescence of Older Engines

Strain on Supply Chains & Global Logistics

Regulatory Compliance & Standards

Skilled Workforce Shortage - Market Opportunities

Emerging Aircraft Engine Technologies

Partnerships Between MROs and OEMs

Growth of Low-Cost Carriers - Trends

Shift Towards Predictive Maintenance

Increased Use of AI for Diagnostics

Growth in Engine Leasing & Asset Management

Focus on Sustainable Aviation Fuel (SAF)

Advances in Engine Design & Performance - Government Regulations & Defense Policy

Stringent Environmental Regulations

Government Investment in Military Aircraft MRO

Defense Budget Allocations for Aircraft Maintenance - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Engine Overhaul

Engine Maintenance

Engine Repair

Component Repair & Overhaul

Engine Testing & Diagnostics - By Platform Type (In Value%)

Commercial Aircraft

Business Jets

Military Aircraft

General Aviation Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

Line Maintenance

Base Maintenance

Heavy Maintenance

Engine Shops

Field Maintenance - By End User Segment (In Value%)

Commercial Airlines

Private Aircraft Operators

MRO Service Providers

Government & Defense Contractors

Aircraft Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

Online Bidding

MRO Service Contracts

OEMs and OEMs Service Networks - By Material / Technology (in Value%)

Advanced Composites

Lightweight Alloys

Smart Materials

Additive Manufacturing Components

Electronics & Sensors

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Fitment Type, Procurement Channel, End User Segment, Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

GE Aviation

Rolls-Royce

Pratt & Whitney

Honeywell Aerospace

Air France Industries KLM Engineering & Maintenance

Lufthansa Technik

SIA Engineering Company

MTU Aero Engines

AAR Corp

Turkish Technic

Airbus

Boeing

Delta TechOps

Safran Aircraft Engines

ST Engineering

- Increasing Demand for Engine Maintenance from Commercial Airlines

- Growth of Private Aircraft Operators

- Focus on Cost Efficiency in Military Aircraft Maintenance

- Rising Demand for MRO Services in Emerging Markets

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035