Market Overview

The Asia Pacific Aircraft MRO market is valued at USD ~ billion, driven primarily by the growing demand for air travel, particularly in emerging economies such as China and India. The expansion of the commercial airline fleet, coupled with the increasing need for periodic maintenance and repairs, has fueled market growth. Additionally, advancements in aircraft technology, rising defense budgets, and an aging aircraft fleet have further contributed to the market’s strong momentum. Global and regional factors, such as regulatory compliance and the rising need for sophisticated MRO services, are pushing the demand in this sector.

The dominance of countries such as China, Japan, and India in the Asia Pacific region is a key factor behind the robust growth of the aircraft MRO market. China’s vast fleet and rapid growth in domestic air traffic are significant drivers, while India is increasingly becoming a hub for low-cost carriers. Japan remains a leader in MRO services for both commercial and military aircraft due to its advanced technological capabilities. These countries also benefit from established infrastructure, government support, and the presence of major MRO providers, which strengthen their positions in the market.

Market Segmentation

By Product Type

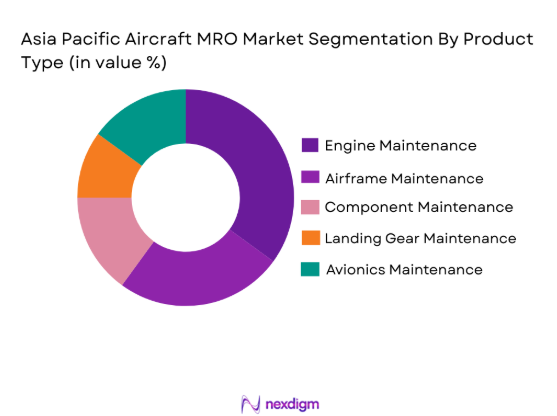

The Asia Pacific Aircraft MRO market is segmented by product type into engine maintenance, airframe maintenance, component maintenance, landing gear maintenance, and avionics maintenance. Engine maintenance holds the dominant market share due to the critical need for periodic servicing, replacement, and overhaul of engines to maintain aircraft safety and performance. The growing demand for long-haul flights and the expansion of regional fleets have made engine maintenance a focal point, with major MRO providers investing in specialized services to cater to both commercial and military aircraft sectors.

By Platform Type

The Asia Pacific Aircraft MRO market is segmented by platform type into commercial aircraft, military aircraft, helicopters, business jets, and general aviation. Commercial aircraft hold the dominant market share due to the growing air travel demand in the region. As more airlines expand their fleets to meet the increasing passenger traffic, the need for MRO services for commercial aircraft is rapidly increasing. The extensive fleet size and frequent maintenance requirements of commercial aircraft make this segment a primary driver of the market. In addition, the expanding military budgets in countries such as India and China are increasing the demand for military aircraft MRO services. Similarly, the growing use of helicopters in sectors such as tourism, oil and gas, and emergency services, along with the rise in business jet ownership, also contribute to the market’s growth in their respective sub-segments.

Competitive Landscape

The competitive landscape of the Asia Pacific Aircraft MRO market is characterized by a mix of global and regional players who dominate the sector. Consolidation is evident as large OEMs (Original Equipment Manufacturers) and third-party MRO providers expand their service offerings. Major players such as Lufthansa Technik and Singapore Technologies Aerospace have a significant influence on the market. Their strong market presence, advanced technology, and broad geographic coverage allow them to cater to the growing demand for MRO services, especially in emerging economies.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | One additional market-specific parameter |

| Lufthansa Technik | 1951 | Germany | ~ | ~ | ~ | ~ | ~ |

| Singapore Technologies Aerospace | 1975 | Singapore | ~ | ~ | ~ | ~ | ~ |

| AAR Corp | 1955 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell International Inc. | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Delta TechOps | 2007 | USA | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Aircraft MRO Market Analysis

Growth Drivers

Rising Demand for Air Travel

Rising demand for air travel in the Asia Pacific region is one of the major growth drivers for the Aircraft MRO market. The increasing middle-class population in countries like India and China has contributed significantly to the demand for domestic and international air travel. As airlines continue to expand their fleets to meet the growing passenger traffic, the need for regular aircraft maintenance services has risen correspondingly. This trend is further supported by the expansion of low-cost carriers, which increases the frequency of flights, thus requiring more frequent MRO activities. The demand for both commercial and private aircraft maintenance services is expected to remain strong due to the increase in air traffic and the rising number of aircraft in the region. Additionally, the trend towards more sustainable and efficient aviation practices requires regular updates to maintenance protocols, including the adoption of eco-friendly maintenance solutions. Airlines are also focusing on upgrading their fleets to improve fuel efficiency, further boosting the demand for engine and airframe maintenance services.

Advancements in Aircraft Technology

Technological advancements in aircraft systems and components have significantly impacted the growth of the Asia Pacific Aircraft MRO market. The introduction of new materials, such as lightweight composites and advanced alloys, has increased the complexity of maintenance services required to ensure the longevity and safety of modern aircraft. Furthermore, the integration of automation, artificial intelligence (AI), and predictive maintenance technologies has revolutionized the maintenance processes, making them more efficient and cost-effective. Predictive analytics and condition-based monitoring allow for proactive maintenance, reducing downtime and improving the overall reliability of aircraft. These advancements in technology not only enhance the capabilities of MRO service providers but also align with the growing emphasis on improving operational efficiency within the aviation industry. The use of AI in diagnostic tools and maintenance planning also helps MRO providers streamline their services and reduce operational costs, ensuring that maintenance procedures are completed on time and at a lower cost.

Market Challenges

High Cost of Aircraft Maintenance

The high cost of aircraft maintenance presents a significant challenge to the growth of the Aircraft MRO market in Asia Pacific. Aircraft owners and operators are facing rising costs due to the increasing complexity of modern aircraft systems, the need for specialized parts, and labor costs associated with highly skilled technicians. The growing demand for maintenance services has led to greater competition among MRO providers, pushing them to invest in advanced technologies, but this also leads to higher operating costs. The financial burden associated with aircraft maintenance is particularly challenging for smaller airlines and private operators who struggle to afford regular upkeep. Moreover, fluctuating fuel prices and economic volatility can further affect airlines’ ability to allocate resources for routine maintenance, potentially leading to delays or deferred maintenance activities.

Regulatory Compliance and Certification

Regulatory compliance and certification requirements are a constant challenge for MRO providers in the Asia Pacific market. Stringent regulations set by aviation authorities, such as the International Civil Aviation Organization (ICAO) and national regulatory bodies, ensure the safety and quality of maintenance services. However, these regulations can also increase operational complexity and the cost of maintaining compliance. MRO providers must adhere to evolving standards and certifications, which require constant investment in training, technology, and equipment. The time-consuming process of obtaining necessary certifications for new aircraft types, materials, and maintenance procedures can delay the rollout of new services, restricting market growth. Compliance challenges are further exacerbated by regional differences in regulations and the need to meet both local and international standards, which can complicate operations for global MRO providers.

Opportunities

Unmanned Aerial Vehicles (UAVs) in MRO Services

The increasing adoption of unmanned aerial vehicles (UAVs) presents a unique opportunity for growth in the Aircraft MRO market. UAVs are becoming more common in both commercial and military applications, creating new demand for specialized maintenance services. UAVs require less intensive maintenance than traditional manned aircraft, but as their use increases in industries such as agriculture, defense, and logistics, the need for UAV-specific MRO services will grow. The opportunity for MRO providers lies in expanding their offerings to cater to the UAV segment, focusing on battery maintenance, sensor calibration, and airframe repairs. The growth of UAVs also opens the door to the development of new technologies, such as automated repair processes and enhanced diagnostic systems, which could further streamline maintenance operations and lower costs.

Expansion of Maintenance Contracts for Emerging Aircraft Models

The Asia Pacific region is seeing a rise in new aircraft models, particularly from manufacturers such as Boeing and Airbus, which presents a significant opportunity for MRO providers. As airlines continue to modernize their fleets with the latest aircraft models, the demand for maintenance services specific to these new platforms will increase. MRO providers that can offer specialized services tailored to the needs of emerging aircraft models stand to benefit from long-term maintenance contracts and partnerships. Furthermore, emerging aircraft models often come with more advanced technologies, creating opportunities for MRO providers to adopt cutting-edge equipment and repair techniques. With the growing number of airlines in the region, especially in fast-developing economies, MRO providers that can offer comprehensive, cost-effective solutions for new aircraft models will be well-positioned for success in the competitive market.

Future Outlook

The Asia Pacific Aircraft MRO market is expected to experience robust growth over the next five years, driven by an increase in air travel demand, fleet expansion, and advancements in aircraft technology. Technological developments such as predictive maintenance, automation, and AI integration will enhance operational efficiency and reduce maintenance costs. Regulatory support from governments across the region will further streamline processes, making it easier for airlines and MRO providers to meet compliance standards. Demand-side factors, such as the growing number of aircraft in operation and the need for sustainable aviation solutions, will continue to drive the market forward, creating new opportunities for MRO service providers.

Major Players

- Lufthansa Technik

- Singapore Technologies Aerospace

- AAR Corp

- Honeywell International Inc.

- Delta TechOps

- Rolls-Royce plc

- MTU Aero Engines AG

- General Electric Aviation

- IAG MRO Services

- Air France Industries KLM Engineering & Maintenance

- United Technologies Corporation

- Mitsubishi Heavy Industries

- Boeing Global Services

- Safran Aircraft Engines

- China National Aviation Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airline companies

- Aircraft fleet operators

- Aircraft manufacturers

- Maintenance service providers

- Military defense agencies

- Private jet owners

Research Methodology

Step 1: Identification of Key Variables

Market variables are identified through extensive industry research and expert consultations, including market demand, growth trends, and technological innovations.

Step 2: Market Analysis and Construction

A comprehensive market analysis is conducted, combining primary data sources such as interviews with industry experts and secondary data from published reports to construct the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and projections are validated by consulting with industry specialists, OEMs, and MRO providers to ensure accuracy and reliability.

Step 4: Research Synthesis and Final Output

Data is synthesized into actionable insights, creating a detailed and accurate market report that provides clear recommendations and strategies for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Air Travel in the Asia Pacific Region

Increased Investment in Military Aircraft Maintenance

Technological Advancements in Aircraft Components and Systems

Expansion of Aircraft Fleets in Emerging Markets

Aging Aircraft Fleet Requiring Maintenance and Overhaul - Market Challenges

Regulatory Compliance and Certification Requirements

High Cost of Aircraft Maintenance Services

Shortage of Skilled Technicians in the MRO Sector

Competition from Low-Cost MRO Providers

Operational Disruptions from Global Supply Chain Issues - Market Opportunities

Growth of Unmanned Aerial Vehicles (UAVs) in MRO Services

Expanding Maintenance Contracts for Emerging Aircraft Models

Technological Innovations in Predictive Maintenance - Trends

Increased Adoption of Predictive Maintenance Techniques

Shift Towards Digitalization in MRO Operations

Growth in Aircraft Fleet Modernization Programs

Rising Focus on Environmental Sustainability in MRO Services

Integration of Artificial Intelligence for Aircraft Diagnostics - Government Regulations & Defense Policy

Strict Air Safety Regulations for Aircraft Maintenance

Government Funding for Military Aircraft Overhaul Projects

Export Control and Compliance Policies for Aircraft Components - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Engine Overhaul

Airframe Maintenance

Component Maintenance

Landing Gear Maintenance

Avionics Maintenance - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

Business Jets

General Aviation - By Fitment Type (In Value%)

On-site MRO Services

Off-site MRO Services

Hybrid MRO Services

OEM Support Services

Third-Party MRO - By End User Segment (In Value%)

Commercial Airlines

Defense Forces

Cargo Operators

Private Jet Owners

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

OEM Procurement

Third-Party Distributors - By Material / Technology (In Value%)

Composite Materials

Lightweight Materials

Advanced Metal Alloys

3D Printing Technology

Automation & Robotics

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Singapore Technologies Aerospace

AAR Corp

Honeywell International Inc.

Lufthansa Technik AG

SIA Engineering Company

Delta TechOps

United Technologies Corporation

Airbus S.A.S.

Rolls-Royce plc

General Electric Aviation

MTU Aero Engines AG

IAG MRO Services

Hawker Pacific

Air France Industries KLM Engineering & Maintenance

China Aircraft Services Limited

- Increased Maintenance Demand from Expanding Airline Fleets

- Government Procurement for Military Aircraft Maintenance

- Rising Demand for Helicopter MRO in Remote Areas

- Emerging Markets Showing Growing Demand for MRO Services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035