Market Overview

The Asia Pacific Aircraft Tires market, valued at approximately USD ~ billion, is driven by the rapid growth in the aviation industry, with increasing passenger traffic and air cargo movement. Demand is further bolstered by the expansion of both commercial and military aircraft fleets in the region. The growing need for high-quality tires, combined with technological advancements and rising investments in airport infrastructure, has fueled market growth. Based on a recent historical assessment, the market is witnessing increased adoption of innovative tire technologies and maintenance solutions.

Countries like China, Japan, and India are the dominant players in the market due to their established aircraft manufacturing hubs, expanding air travel, and large military fleets. These nations are investing heavily in the aviation sector, supported by government policies and initiatives aimed at boosting regional infrastructure. Furthermore, major metropolitan areas like Beijing, Tokyo, and New Delhi continue to serve as key aviation and logistics hubs, driving regional demand for aircraft tires. The focus on fleet modernization and sustainable tire solutions in these regions also contributes to their dominance in the market.

Market Segmentation

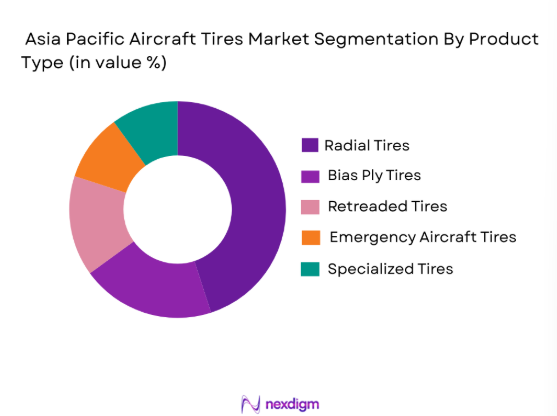

By Product Type

Asia Pacific Aircraft Tires market is segmented by product type into radial tires, bias ply tires, retreaded tires, emergency aircraft tires, and specialized tires. Recently, radial tires had a dominant market share due to their superior performance characteristics such as higher durability, fuel efficiency, and enhanced safety. Their widespread adoption is driven by the increased demand for commercial and military aircraft, where reliability and longevity are critical. The efficiency improvements offered by radial tires, along with growing investments in fleet modernization, continue to drive their dominance.

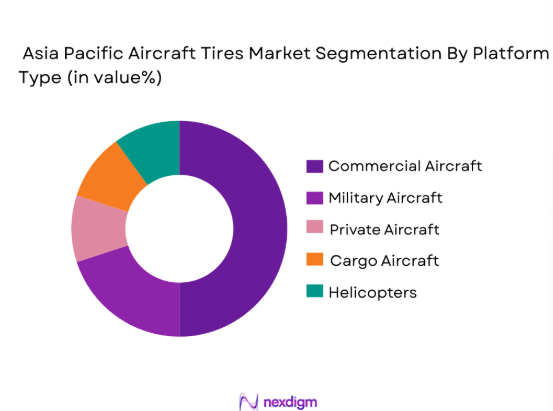

By Platform Type

Asia Pacific Aircraft Tires market is segmented by platform type into commercial aircraft, military aircraft, private aircraft, cargo aircraft, and helicopters. The commercial aircraft sub-segment has a dominant market share due to the increasing number of air travelers and airlines expanding their fleets. The commercial aviation sector in Asia Pacific is rapidly growing, fueled by rising disposable incomes, tourism, and business travel. This sector’s dominance is supported by the availability of a large number of airports and the increasing frequency of air traffic in the region.

Competitive Landscape

The Asia Pacific Aircraft Tires market is highly competitive, with major players focusing on strategic partnerships, mergers, and acquisitions to expand their market presence. These players are also emphasizing technological advancements and expanding their service networks to cater to the growing demand. The industry is marked by a blend of established global brands and regional companies offering specialized solutions, making the competition intense. As a result, players are continuously innovating and optimizing their operations to gain a competitive edge.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Michelin | 1889 | Clermont-Ferrand, France | ~ | ~ | ~ | ~ | ~ |

| Bridgestone | 1931 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Goodyear | 1898 | Akron, Ohio, USA | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Hanover, Germany | ~ | ~ | ~ | ~ | ~ |

| Toyo Tire | 1945 | Osaka, Japan | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Aircraft Tires Market Analysis

Growth Drivers

Increasing Air Travel Demand

The increasing demand for air travel across the Asia Pacific region has significantly contributed to the growth of the aircraft tires market. With an expanding middle class, rising disposable incomes, and an increase in business and leisure travel, airlines are investing in larger fleets to cater to the growing number of passengers. Aircraft tire manufacturers are benefiting from this trend, as airlines require high-quality, durable tires to ensure safe and efficient operations. Additionally, as airlines adopt modern, more fuel-efficient aircraft, the demand for advanced tire solutions that improve performance and fuel economy continues to grow. The rapid expansion of air cargo services also plays a critical role in driving the demand for aircraft tires. This sector, primarily driven by e-commerce, requires reliable and durable tires to ensure timely deliveries across vast distances. Thus, the growing air travel demand acts as a key growth driver for the aircraft tires market, with manufacturers focusing on innovations to meet the requirements of modern fleets.

Technological Advancements in Aircraft Tires

Another significant growth driver for the Asia Pacific aircraft tires market is the continuous technological advancements in tire manufacturing. Tire manufacturers are investing heavily in research and development to produce more advanced and sustainable products. Innovations such as improved rubber compounds, enhanced tread designs, and the development of airless tire technologies are reshaping the market. These advancements not only improve the safety and performance of aircraft tires but also increase their lifespan and reduce operating costs for airlines. As technological solutions continue to evolve, aircraft tire manufacturers are focusing on reducing the environmental impact of tire production and disposal. The use of eco-friendly materials and sustainable manufacturing processes is becoming increasingly important to meet regulatory requirements and align with global sustainability trends. As the aviation industry moves toward greener practices, technological advancements in aircraft tires play a pivotal role in addressing these challenges and supporting the sector’s long-term growth.

Market Challenges

High Cost of Aircraft Tires

One of the primary challenges facing the Asia Pacific aircraft tires market is the high cost of tires, which can be a significant barrier for smaller airlines and private aircraft owners. Aircraft tires are a crucial component of aviation safety, and their high-quality standards come at a premium price. The cost of manufacturing aircraft tires, especially those with specialized features like improved durability, fuel efficiency, and safety performance, is high. Furthermore, maintenance costs, including tire replacement and retreading, add to the overall expenses for airline operators. While large airlines with extensive fleets may be better equipped to absorb these costs, smaller players in the market, especially in emerging economies, find it difficult to afford premium tires. This has led to a reliance on cheaper, less durable tire options, which may affect the overall safety and performance of the aircraft. The high cost of aircraft tires remains a major challenge in the region, and finding cost-effective solutions without compromising safety standards will be crucial for the continued growth of the market.

Regulatory Pressure and Environmental Concerns

Regulatory pressure and environmental concerns pose another challenge for the Asia Pacific aircraft tires market. Governments across the region are tightening environmental regulations, particularly regarding tire disposal and the carbon footprint of manufacturing processes. Aircraft tire manufacturers are under increasing pressure to comply with these regulations while maintaining the high safety and performance standards required for aviation. The disposal of used tires is a particularly critical issue, as they contribute to landfills and environmental pollution. Manufacturers are being urged to explore recycling solutions and reduce the environmental impact of their operations. Additionally, the need for sustainable raw materials in tire production further complicates the manufacturing process, requiring significant investment in research and development. These regulatory and environmental challenges require manufacturers to adapt to new standards and adopt sustainable practices, which can be costly and time-consuming.

Opportunities

Adoption of Retreaded Tires

The adoption of retreaded tires presents a significant opportunity in the Asia Pacific aircraft tires market. Retreading involves the process of reusing and refurbishing old tires by replacing their worn-out treads, making them as good as new. This process offers a cost-effective solution for airlines looking to extend the lifespan of their tires while maintaining performance and safety standards. In regions where cost constraints are more pronounced, such as emerging economies, retreaded tires are a practical solution to reduce operational expenses. Additionally, the growing awareness of the environmental benefits of retreading, including reduced waste and lower carbon emissions, has led to an increased demand for this service. With airlines increasingly looking for ways to reduce operating costs without compromising safety, the adoption of retreaded tires is expected to rise, presenting a valuable opportunity for manufacturers and service providers in the market.

Sustainability in Tire Manufacturing

As the aviation industry faces mounting pressure to reduce its environmental impact, the push for sustainable tire manufacturing presents a major opportunity for the Asia Pacific aircraft tires market. Manufacturers are exploring eco-friendly materials, such as biodegradable rubber and recyclable components, to create tires with a smaller environmental footprint. In addition, new tire technologies that reduce fuel consumption and improve aircraft efficiency are gaining traction. The aviation industry is moving towards more sustainable practices, and the demand for environmentally friendly products is increasing. As a result, manufacturers who prioritize sustainability in their operations are likely to benefit from this growing trend. This shift towards sustainable tire manufacturing not only meets regulatory requirements but also caters to the evolving preferences of consumers and businesses seeking greener solutions.

Future Outlook

The future outlook for the Asia Pacific aircraft tires market is positive, with steady growth anticipated over the next several years. Increasing air travel demand, fleet modernization, and technological advancements in tire manufacturing are expected to drive the market forward. Sustainability efforts, coupled with regulatory support for eco-friendly products, will shape the industry, while innovations in tire materials and designs will continue to enhance performance and safety standards. Additionally, the growth of air cargo services and increasing defense sector investments will contribute to the market’s expansion.

Major Players

- Michelin

- Bridgestone

- Goodyear

- Continental

- Toyo Tire

- Hankook

- ZC Rubber

- Aerospace Technologies

- NewTaiwanTires

- Yokohama Rubber

- Sailun Tire

- Boeing

- Airbus

- Cheng Shin Rubber Industry

- ApolloTyres

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Aircraftmanufacturers

- Military and defense agencies

- Airport operators

- Tire manufacturers and suppliers

- Commercial aviation maintenance companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the critical variables influencing the aircraft tires market, such as product types, regional demand, and technological trends.

Step 2: Market Analysis and Construction

In this phase, an in-depth analysis of market dynamics, including drivers, challenges, and opportunities, is conducted, followed by market construction based on verified data.

Step 3: Hypothesis Validation and Expert Consultation

Experts from the aviation and tire manufacturing sectors are consulted to validate market hypotheses and refine the research focus based on real-world inputs.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data into a cohesive and comprehensive market report, presenting insights and forecasts based on rigorous analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Travel Demand

Military Aircraft Expansion

Technological Advancements in Tire Materials

Rising Aircraft Fleet Size in Asia Pacific

Growing Aviation Infrastructure Investments - Market Challenges

Stringent Regulatory Standards

High Cost of Aircraft Tires

Environmental Impact of Tire Disposal

Uncertainty in Fuel Prices

Fluctuating Raw Material Prices - Market Opportunities

Development of Eco-Friendly Tires

Growth in Commercial Aircraft Production

Rising Demand for Retreaded Tires - Trends

Shift Toward Sustainable Tire Solutions

Increase in Aircraft Fleet Modernization

Technological Integration in Tire Maintenance

Advancements in Tire Durability and Safety

Focus on Cost-Effective Tire Solutions - Government Regulations & Defense Policy

Aviation Safety Standards Enforcement

Environmental Compliance in Tire Manufacturing

Defense Budget Allocations for Military Aircraft - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radial Tires

Bias Ply Tires

Retreaded Tires

Emergency Aircraft Tires

Specialized Tires - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

New Fitment

Retreaded Fitment

Replacement Fitment

OEM Fitment

Aftermarket Fitment - By EndUser Segment (In Value%)

Airlines

Military Organizations

Private Jet Owners

Cargo Transporters

Aircraft Manufacturers - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Sales

OEM Procurement

Third-party Vendors - By Material / Technology (In Value%)

Rubber Materials

Metallic Materials

Composite Materials

Non-Metallic Materials

Airless Technologies

- Market share snapshot of major players

- Cross Comparison Parameters (Price, Quality, Durability, Safety Features, Customer Service, Availability, Brand Recognition, Technological Innovation, Aftermarket Services)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Michelin

Bridgestone

Goodyear

Continental

Toyo Tire

Hankook

ZC Rubber

Aerospace Technologies

NewTaiwan Tires

Yokohama Rubber

Sailun Tire

Boeing

Airbus

Cheng Shin Rubber Industry

Apollo Tyres

- Airlines increasingly prioritizing tire longevity and cost efficiency

- Military and government sectors adopting advanced tire technologies

- Private aircraft owners seeking specialized, high-performance tires

- Cargo transport companies focusing on durability and safety

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035