Market Overview

The Asia Pacific airport ground handling systems market is driven by increased air traffic and demand for more efficient and cost-effective ground operations. Based on a recent historical assessment, the market size is valued at approximately USD ~ billion, supported by the growing demand for automated and IoT-integrated systems. Key drivers of this growth include the need for faster turnarounds, improved operational efficiency, and increased safety standards in aviation. Moreover, airports are investing heavily in upgrading ground support infrastructure, which is further boosting market expansion.

Countries such as China, India, and Japan dominate the market due to their significant investments in airport infrastructure and rapid economic development. China, with its vast airport expansion projects, has emerged as a leader in the market. India follows with its increasing number of airports and rapid growth in both domestic and international air travel. Japan, known for its technological advancements, continues to lead in the adoption of automation in ground handling operations. These countries have been implementing advanced technologies to streamline ground operations, positioning them as key players in the Asia Pacific market.

Market Segmentation

By Product Type

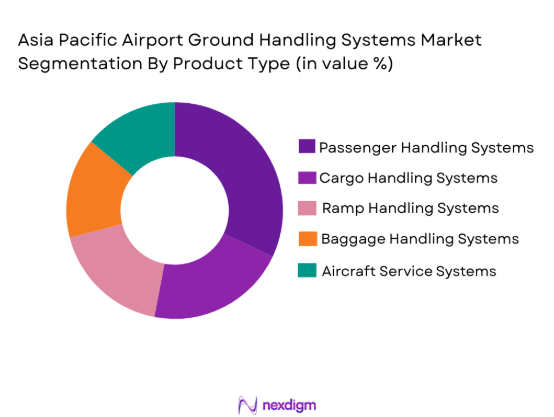

The Asia Pacific airport ground handling systems market is segmented by product type into passenger handling systems, cargo handling systems, ramp handling systems, baggage handling systems, and aircraft service systems. Recently, passenger handling systems have dominated the market due to growing air traffic and the increasing need for improved passenger experience at airports. The demand for efficient check-in, boarding, and baggage handling systems has surged as more airports focus on automation to reduce wait times and increase throughput. Passenger handling systems are expected to continue leading due to advancements in self-service kiosks, automated check-in counters, and smart baggage handling technologies.

By Platform Type

The market is segmented by platform type into automated systems, manual systems, hybrid systems, electric systems, and conventional systems. Automated systems have a dominant market share due to their ability to enhance operational efficiency, reduce human error, and streamline ground handling tasks. These systems are increasingly favored by airports seeking to improve safety standards, reduce operational costs, and accommodate rising air traffic volumes. Automated systems are especially popular in large airports, where handling large volumes of passengers and cargo requires highly efficient processes.

Competitive Landscape

The Asia Pacific airport ground handling systems market is highly competitive, with major players consolidating through acquisitions and technological advancements. Companies are focusing on product innovation and partnerships to enhance their market presence. The dominance of established players in the market is supported by their significant investments in R&D and product diversification. These companies leverage their strong distribution networks and technological expertise to expand their reach across the region.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Swissport International Ltd | 1996 | Switzerland | ~ | ~ | ~ | ~ |

| Menzies Aviation | 1833 | UK | ~ | ~ | ~ | ~ |

| dnata | 1959 | UAE | ~ | ~ | ~ | ~ |

| LAGARDÈRE GROUP | 1996 | France | ~ | ~ | ~ | ~ |

| TCR Group | 1990 | USA | ~ | ~ | ~ | ~ |

Asia Pacific Airport Ground Handling Systems Market Analysis

Growth Drivers

Increased Air Traffic and Global Connectivity

Increased air traffic has significantly contributed to the growth of the airport ground handling systems market. Airports in the Asia Pacific region, driven by rapid economic development and globalization, are witnessing unprecedented growth in passenger numbers and freight volume. This surge in air travel creates pressure on ground handling operations, which in turn increases demand for advanced systems that can streamline operations and ensure safety and efficiency. Efficient ground handling operations are key to managing the flow of passengers and cargo in airports, and the rise in air traffic has driven the need for automated solutions to handle the increasing workload. Moreover, this trend is supported by growing international and domestic air travel in the region, especially in China, India, and Southeast Asia.

Technological Advancements in Ground Handling Systems

Advancements in automation and IoT integration have been pivotal in the growth of the airport ground handling systems market. Automation is now integral to operations such as check-ins, baggage handling, and cargo tracking. The adoption of AI, robotics, and machine learning helps improve efficiency, reduce operational costs, and enhance security measures. Additionally, the use of electric-powered systems is increasing as airports strive to reduce their environmental footprint. These technological advancements are crucial for addressing the challenges faced by the region’s busiest airports, including managing high passenger traffic and improving turnaround times. Airports are investing heavily in upgrading their infrastructure to incorporate these advanced technologies, making them essential drivers of the market’s growth.

Market Challenges

High Initial Investment Costs

One of the key challenges in the airport ground handling systems market is the high initial investment required to implement advanced systems. The purchase and installation of automated systems, baggage handling equipment, and other ground support technologies demand significant capital expenditure. Many airports, particularly in emerging economies, are finding it difficult to allocate the necessary funds for such investments. While these systems promise long-term operational savings, the high upfront costs can be a barrier for smaller or less-developed airports. Additionally, the maintenance and upgrade costs associated with these systems add another layer of financial burden. Despite the potential for efficiency gains, the financial constraints prevent many airports from fully embracing automation and other advanced technologies.

Regulatory and Compliance Challenges

Airports must adhere to various local and international regulations regarding safety, security, and environmental standards, making compliance a significant challenge. The regulatory environment in the Asia Pacific region can vary widely across countries, with some regions having stringent requirements for ground handling operations. Navigating these regulations can be time-consuming and costly for airports, particularly those adopting new technologies. Moreover, airports must ensure that their operations meet environmental standards, which can limit the types of systems they can adopt. Adapting to these regulatory changes while ensuring operational efficiency remains a constant challenge for many airports in the region.

Opportunities

Growth of Low-Cost Carriers

The rise of low-cost carriers (LCCs) in the Asia Pacific region presents significant opportunities for the airport ground handling systems market. As more passengers opt for affordable air travel, airports are witnessing an increase in passenger volume, which in turn increases the demand for ground handling services. LCCs typically focus on operational efficiency and quick turnaround times, creating a need for advanced ground handling systems that can streamline operations and reduce costs. This shift towards LCCs is expected to drive the adoption of automated systems and other technological solutions designed to handle higher volumes of passengers and cargo within shorter turnaround times. Moreover, as LCCs expand their network, the demand for more ground handling services will increase, benefiting players in the market.

Integration of AI and Automation in Ground Handling Operations

The integration of AI and automation in ground handling operations is another promising opportunity for the market. AI-powered solutions can optimize baggage handling, improve fleet management, and enhance operational efficiency by analyzing vast amounts of data in real-time. Automated baggage systems and smart check-in counters are becoming increasingly prevalent in airports, reducing human error and improving speed. Moreover, automated solutions help streamline cargo handling processes, allowing airports to better manage the growing volume of freight. The increasing focus on AI-driven systems will likely continue as airports seek to improve both operational performance and passenger experience.

Future Outlook

The future of the Asia Pacific airport ground handling systems market looks promising, with continued growth expected due to technological advancements and increasing air traffic. Airports are projected to continue adopting automation and smart technologies, driven by the need for operational efficiency, sustainability, and safety. With growing investments in infrastructure, particularly in emerging markets, the demand for ground handling systems will rise. Additionally, regulatory support aimed at enhancing airport operations and improving environmental standards will further drive market growth, making this an exciting period of transformation for the industry.

Major Players

- Swissport International Ltd

- Menzies Aviation

- dnata

- LAGARDÈRE GROUP

- TCR Group

- Airport Handling

- Celebi Ground Handling

- Qantas Ground Services

- Korean Air Ground Handling

- Air India SATS Airport Services

- SATS Ltd

- Ground Support Worldwide

- Renaissance Aviation Services

- WFS (Worldwide Flight Services)

- Avia Solutions Group

- ICTS Europe

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airports and airport operators

- Airlines

- Ground handling service providers

- Cargo and freight companies

- Aviation equipment manufacturers

- Technology providers for aviation systems

Research Methodology

Step 1: Identification of Key Variables

This step involves determining the critical variables influencing the airport ground handling systems market, such as air traffic growth, technological adoption, and regulatory changes.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted using primary and secondary research, including interviews with industry experts and reviewing historical market data.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses based on initial research are validated through consultation with industry experts, ensuring that key assumptions and market drivers are accurate.

Step 4: Research Synthesis and Final Output

Data is synthesized into a coherent market report, incorporating insights from primary research, expert consultations, and market analysis to provide actionable recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Air Traffic & Passenger Demand

Technological Advancements in Ground Operations

Expansion of Airport Infrastructure

Increased Focus on Sustainability & Green Technologies

Government Investments in Airport Modernization - Market Challenges

High Initial Investment Costs

Maintenance & Operational Costs

Lack of Skilled Workforce

Regulatory & Compliance Challenges

Security & Privacy Concerns - Market Opportunities

Integration of AI for Operational Efficiency

Growth of Low-cost Carriers Expanding Ground Handling Needs

Rising Demand for Autonomous Ground Handling Solutions - Trends

Increase in Use of Automation & Robotics

Growing Demand for Sustainable Solutions

Technological Integration of IoT in Ground Handling Systems

Focus on Operational Efficiency & Turnaround Time Reduction

Rising Adoption of Electric Ground Support Equipment - Government Regulations & Defense Policy

Regulations on Safety & Security in Ground Handling Operations

Airport Development & Expansion Funding Policies

Sustainability Regulations and Green Airport Initiatives

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger Handling Systems

Cargo Handling Systems

Ramp Handling Systems

Baggage Handling Systems

Aircraft Service Systems - By Platform Type (In Value%)

Automated Systems

Manual Systems

Hybrid Systems

Electric Systems

Conventional Systems - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Airports

Ground Handling Service Providers

Airlines

Cargo Companies

Government & Regulatory Authorities - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Automated Guided Vehicles (AGVs)

Robotics & Drones

IoT-enabled Systems

Electric-powered Systems

AI & Machine Learning Technologies

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Swissport International Ltd

Menzies Aviation

dnata

LAGARDÈRE GROUP

TCR Group

Airport Handling

Celebi Ground Handling

Qantas Ground Services

Korean Air Ground Handling

Air India SATS Airport Services

SATS Ltd

Ground Support Worldwide

Renaissance Aviation Services

WFS (Worldwide Flight Services)

Avia Solutions Group

ICTS Europe

- Growing Demand for Efficiency from Airlines

- Airports Seeking to Enhance Operational Efficiency

- Ground Handling Providers Increasing Technology Adoption

- Governments Driving Infrastructure Development and Standardization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035