Market Overview

The ASIA pacific ammunition market size is expected to reach USD ~ billion, driven by increasing defense spending in the region. A growing focus on modernizing military forces, bolstered by rising geopolitical tensions, is contributing to the demand for various ammunition types. Additionally, defense contractors’ expanding production capacities and evolving security needs are expected to push the market forward. Government-backed initiatives across nations are also a crucial factor fueling the market’s growth, particularly in countries with large armed forces.

Key countries such as China, India, and Japan dominate the asia pacific ammunition market. These nations’ strong defense budgets, combined with their strategic military needs, are key drivers for the market. China, in particular, has bolstered its production of advanced ammunition, contributing significantly to the region’s output. India’s growing defense procurement and the demand for modernization within the region further support this dominance. Japan’s security policies also play a substantial role in shaping the demand for ammunition in the Asia Pacific.

Market Segmentation

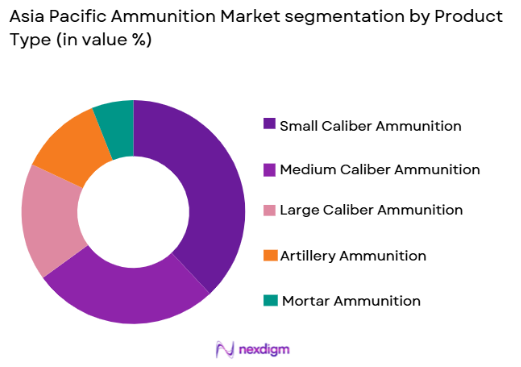

By Product Type

The asia pacific ammunition market is segmented by product type into small caliber, medium caliber, large caliber, artillery, and mortar ammunition. Recently, small caliber ammunition has a dominant market share due to factors such as high demand from military forces for firearms and their widespread use across law enforcement agencies. Additionally, small caliber ammunition’s production volume is comparatively higher, and it benefits from established manufacturing technologies. Increased demand for handguns, rifles, and other small arms drives this dominance, with significant procurement by security forces across the region.

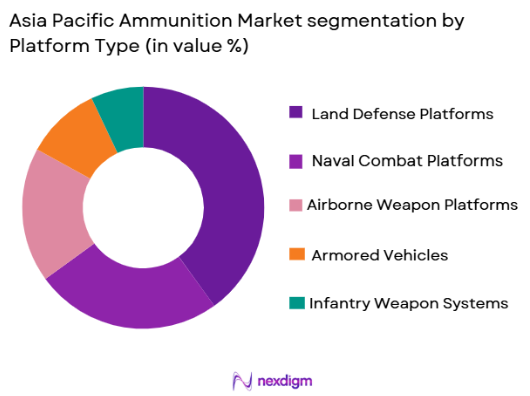

By Platform Type

The asia pacific ammunition market is segmented by platform type into land defense, naval combat, airborne weapon, armored vehicles, and infantry weapon systems. Recently, land defense platforms have a dominant market share due to the ongoing modernization of ground forces in major Asia Pacific countries. The increasing procurement of light and heavy weapons systems by armed forces in the region, including artillery and infantry weapons, is a key factor behind this dominance. These platforms are critical for national defense, which explains their significant share in the market.

Competitive Landscape

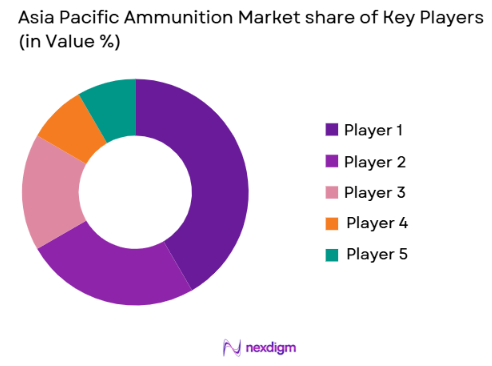

The competitive landscape of the asia pacific ammunition market is characterized by a mix of domestic manufacturers and multinational defense companies. The market sees substantial consolidation, with major players consolidating their resources to enhance manufacturing capabilities and technological advancements. Major players significantly influence the market due to their large-scale operations, robust defense contracts, and constant innovation. These players focus on maintaining a competitive edge through strategic collaborations and technology upgrades, ensuring continued growth in a highly competitive environment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) |

| NORINCO | 1980 | China | ~ | ~ | ~ | ~ |

| Poongsan Corporation | 1968 | South Korea | ~ | ~ | ~ | ~ |

| Hanwha Aerospace | 1977 | South Korea | ~ | ~ | ~ | ~ |

| Ordnance Factory Board India | 1942 | India | ~ | ~ | ~ | ~ |

| Bharat Dynamics Limited | 1970 | India | ~ | ~ | ~ | ~ |

ASIA Pacific Ammunition Market Analysis

Growth Drivers

Increased Defense Expenditure

As countries in the Asia Pacific region continue to bolster their defense capabilities, a significant increase in defense expenditure has been observed. This growth is primarily driven by regional security concerns, including territorial disputes and the desire to modernize military forces. Nations like India and China are ramping up their defense budgets to enhance military infrastructure and stockpile ammunition. The demand for advanced weaponry and the upgrading of existing systems to meet evolving threats have contributed to a heightened need for various types of ammunition. This trend has led to a sustained demand for ammunition products across small, medium, and large caliber ranges, which are integral components in modern defense systems. Countries are also enhancing their indigenous manufacturing capabilities to reduce dependency on foreign suppliers and secure their defense requirements. This increased investment in defense expenditure across the region is a vital growth driver for the ammunition market.

Technological Advancements in Ammunition Systems

Another key growth driver is the continuous innovation and development of advanced ammunition technologies. Over recent years, there has been a significant focus on developing precision-guided munitions (PGMs) and smart ammunition systems capable of improving targeting accuracy and reducing collateral damage. This has resulted in the creation of highly sophisticated ammunition for different platforms, including land, naval, and airborne systems. The introduction of smart and programmable ammunition, which can be tailored to meet the specific needs of modern warfare, has been a game-changer. Additionally, advancements in materials used for ammunition production, such as polymer casings, have led to lighter and more cost-effective products. As military forces modernize their arsenals, the demand for these innovative products is expected to continue to drive market growth. These technological advancements are shaping the future of the ammunition market, contributing to a more efficient and precise combat environment.

Market Challenges

Stringent Regulatory Compliance

One of the major challenges facing the ASIA pacific ammunition market is the complex and stringent regulatory compliance required for ammunition production, distribution, and sale. Different countries have varying standards and certifications for manufacturing, transporting, and storing ammunition, which complicates the supply chain. Stringent export control regulations, such as the International Traffic in Arms Regulations (ITAR) in the United States, impact cross-border sales of ammunition, restricting access to global markets. Companies operating in the region must navigate these regulatory barriers to ensure their products meet the necessary standards, which often involves significant investment in compliance systems. These regulatory constraints can delay production timelines and increase operational costs, which may limit the ability of ammunition manufacturers to meet growing demand efficiently.

Rising Raw Material Costs

The increasing cost of raw materials, particularly metals like copper, steel, and brass, is another challenge that manufacturers in the ASIA pacific ammunition market face. Fluctuations in the global market for these materials have directly impacted ammunition production costs. These raw materials are essential for the production of both small and large caliber ammunition, and any increases in their prices often lead to a rise in overall production costs. As ammunition manufacturers struggle to maintain competitive pricing while absorbing these increased costs, they may face margin pressures. Additionally, supply chain disruptions due to global trade tensions or natural disasters can further exacerbate these challenges, making it difficult for companies to maintain stable production rates and pricing.

Opportunities

Shift Toward Smart Ammunition Technologies

As modern warfare evolves, there is a growing need for smart and precision-guided ammunition that can enhance targeting accuracy and reduce collateral damage. The shift toward smart ammunition presents a significant opportunity for the asia pacific ammunition market. Military forces across the region are increasingly focused on integrating advanced technology into their weapons systems, including the development of ammunition that can be programmed for specific targets or adjusted in-flight for greater accuracy. These innovations offer the potential for better performance and cost savings in the long term. Companies that invest in smart ammunition technologies will have a competitive advantage in capturing the increasing demand from both government and private defense contractors. This opportunity is further supported by government initiatives focused on defense modernization and the integration of artificial intelligence into military operations, which bodes well for the future growth of smart ammunition in the region.

Expansion of Domestic Ammunition Manufacturing Capabilities

Another opportunity lies in the expansion of domestic ammunition manufacturing capabilities within the Asia Pacific region. With growing geopolitical tensions and a desire for self-reliance, countries such as India, Japan, and South Korea are increasingly investing in their own ammunition production facilities. This move is intended to reduce dependency on foreign suppliers, particularly in the face of export restrictions and trade imbalances. Domestic production allows countries to meet their defense needs more efficiently and securely while fostering local industries and creating jobs. As governments prioritize defense self-sufficiency, the demand for local ammunition manufacturers is expected to rise. This presents a growth opportunity for companies that can scale their operations to meet the increasing demand for domestically produced ammunition across various segments.

Future Outlook

The ASIA pacific ammunition market is expected to experience significant growth in the coming years. With increasing defense budgets and a growing focus on military modernization, particularly in key players like China and India, demand for ammunition is projected to rise steadily. Technological advancements in ammunition, such as smart and precision-guided munitions, are expected to drive the development of more sophisticated systems. Additionally, regulatory support from regional governments will likely encourage the growth of domestic manufacturing capabilities. As geopolitical tensions persist, the demand for ammunition to equip modern military forces will continue to rise, ensuring a positive outlook for the market over the next five years.

Major Players

- NORINCO

- Poongsan Corporation

- Hanwha Aerospace

- Ordnance Factory Board India

- Bharat Dynamics Limited

- ST Engineering

- Australian Munitions

- PT Pindad

- Denel PMP

- CBC Global Ammunition

- Nammo AS

- Rheinmetall AG

- Elbit Systems

- General Dynamics Ordnance and Tactical Systems

- BAE Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and manufacturers

- Armed forces procurement agencies

- Homeland security agencies

- Military technology integrators

- Strategic defense partners

- Armed forces’ R&D units

Research Methodology

Step 1: Identification of Key Variables

Understanding the essential drivers of market growth, key segments, and technological advancements within the asia pacific ammunition market.

Step 2: Market Analysis and Construction

Analyzing market trends, historical data, and competitive forces to construct a comprehensive model of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Consulting with defense industry experts and stakeholders to validate assumptions and ensure the accuracy of market projections.

Step 4: Research Synthesis and Final Output

Synthesizing findings into a final report with actionable insights and accurate market sizing information.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense expenditure across major Asia Pacific economies

Expansion of indigenous ammunition manufacturing capabilities

Increasing cross-border security concerns and military readiness programs

Modernization of armed forces and replacement of aging stockpiles

Growth in joint military exercises driving ammunition consumption - Market Challenges

Stringent export control regulations affecting supply chains

Volatility in raw material prices such as copper and steel

Storage and safety risks associated with large ammunition inventories

Dependence on technology transfers for advanced munitions

Environmental concerns related to ammunition disposal - Market Opportunities

Development of next-generation precision-guided munitions

Expansion of domestic production under defense self-reliance policies

Integration of smart ammunition with digital battlefield systems - Trends

Shift toward environmentally safer insensitive munitions

Adoption of lightweight polymer cartridge technologies

Growing investment in automated ammunition production lines

Increased collaboration between regional defense manufacturers

Rising demand for multi-role and programmable ammunition - Government Regulations & Defense Policy

Strengthening of domestic defense manufacturing mandates

Implementation of stricter ammunition safety and transport standards

Expansion of long-term military procurement frameworks

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Small Caliber Ammunition

Medium Caliber Ammunition

Large Caliber Ammunition

Artillery Ammunition

Mortar Ammunition - By Platform Type (In Value%)

Land Defense Platforms

Naval Combat Platforms

Airborne Weapon Platforms

Armored Vehicles

Infantry Weapon Systems - By Fitment Type (In Value%)

Factory-loaded Ammunition

Modular Ammunition Systems

Linked Ammunition Belts

Caseless Ammunition

Programmable Ammunition - By End User Segment (In Value%)

National Armed Forces

Paramilitary Forces

Homeland Security Agencies

Law Enforcement Units

Special Operations Forces - By Procurement Channel (In Value%)

Direct Government Contracts

Defense Procurement Agencies

Licensed Domestic Manufacturers

Foreign Military Sales

Strategic Defense Partnerships

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product Portfolio Breadth, Caliber Range, Manufacturing Capacity, Technology Integration, Geographic Presence, Government Contract Strength, R&D Investment, Supply Chain Resilience, Pricing Strategy, Strategic Partnerships)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

NORINCO

Poongsan Corporation

Hanwha Aerospace

Ordnance Factory Board India

Bharat Dynamics Limited

ST Engineering

Australian Munitions

PT Pindad

Denel PMP

CBC Global Ammunition

Nammo AS

Rheinmetall AG

Elbit Systems

General Dynamics Ordnance and Tactical Systems

BAE Systems

- Military modernization programs increasing bulk procurement cycles

- Special operations units demanding high-performance precision rounds

- Law enforcement agencies transitioning toward advanced tactical ammunition

- Paramilitary forces expanding ammunition reserves for border security

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035