Market Overview

The Asia Pacific attack helicopter market reached approximately USD ~billion based on a recent historical assessment, driven primarily by increasing defense expenditures and modernization initiatives across regional armed forces. Governments are prioritizing advanced rotary-wing platforms to strengthen combat readiness, border surveillance, and rapid deployment capabilities. Procurement programs, indigenous manufacturing efforts, and technology upgrades are supporting demand, while rising geopolitical tensions further accelerate investments in next-generation attack helicopters across major military economies.

China, India, South Korea, Japan, and Southeast Asian nations dominate regional demand due to sustained military modernization programs and the need to address territorial disputes and asymmetric threats. Strong industrial bases, expanding defense budgets, and government-backed procurement pipelines reinforce their leadership positions. Additionally, several countries are focusing on domestic production to reduce import dependency, encouraging partnerships with global manufacturers and strengthening long-term aerospace capabilities within the region.

Market Segmentation

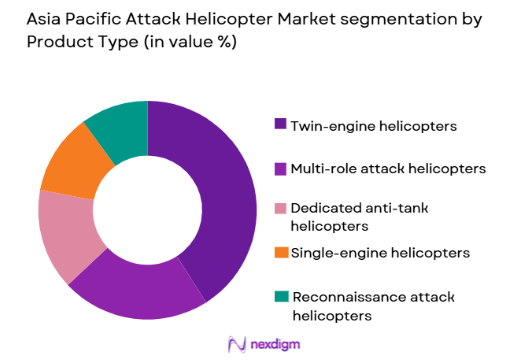

By Product Type

Asia Pacific Attack Helicopter market is segmented by product type into single-engine helicopters, twin-engine helicopters, multi-role attack helicopters, dedicated anti-tank helicopters, and reconnaissance attack helicopters. Recently, twin-engine helicopters have a dominant market share due to factors such as enhanced survivability, superior payload capacity, longer operational range, and improved redundancy during combat missions. Armed forces across Asia Pacific increasingly favor twin-engine configurations for high-intensity operations and maritime environments where reliability is critical. These helicopters also support advanced avionics, network-centric warfare capabilities, and heavier weapons integration, making them suitable for modern battlefield requirements. Procurement agencies prefer platforms capable of operating in diverse terrains including mountainous borders and island territories, further strengthening adoption. Additionally, defense ministries emphasize lifecycle efficiency and mission flexibility, both of which twin-engine platforms deliver more effectively than lighter alternatives. Strategic collaborations between domestic manufacturers and global aerospace firms are also enabling localized production, improving supply resilience and accelerating deployment timelines throughout the region.

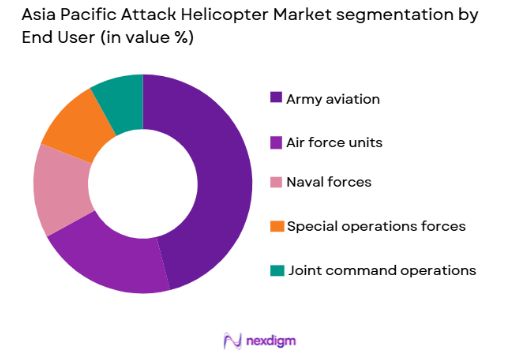

By End User

Asia Pacific Attack Helicopter market is segmented by end user into army aviation, air force units, naval forces, joint command operations, and special operations forces. Recently, army aviation has a dominant market share due to factors such as expanding land security requirements, persistent border tensions, and the growing need for close air support in ground combat scenarios. Attack helicopters remain integral to tactical battlefield coordination, enabling armored support, reconnaissance, and precision strike capabilities. Many regional governments are restructuring land warfare doctrines to emphasize mobility and rapid response, which directly increases reliance on army aviation fleets. Furthermore, modernization programs are replacing aging helicopters with advanced platforms capable of operating in extreme climates and high-altitude environments. Training infrastructure, maintenance ecosystems, and established procurement frameworks further reinforce army aviation leadership. Governments are also investing in indigenous helicopter development for land forces, improving operational sovereignty while stimulating domestic aerospace industries.

Competitive Landscape

The Asia Pacific attack helicopter market demonstrates moderate consolidation, with a limited number of global defense manufacturers competing alongside emerging domestic aerospace firms. Large contractors benefit from long procurement cycles, technological expertise, and established defense relationships, while regional players gain traction through localization strategies and government support. Strategic partnerships, technology transfers, and licensed production agreements are shaping competitive positioning as countries prioritize self-reliance and supply chain security.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Indigenous Manufacturing Capability |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Netherlands/France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | India | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Attack Helicopter Market Analysis

Growth Drivers

Rising Defense Modernization Programs Across Asia Pacific

Governments throughout the region are significantly expanding military modernization initiatives to strengthen deterrence capabilities and maintain operational readiness in an increasingly complex security environment. Attack helicopters are considered essential assets because they combine mobility, firepower, and surveillance within a single platform capable of supporting joint force operations. Countries such as China, India, Japan, and Australia are investing heavily in advanced helicopters to enhance battlefield effectiveness and protect territorial interests. Procurement strategies increasingly emphasize network-centric warfare capabilities, requiring platforms that can seamlessly integrate with drones, satellites, and ground command systems. Defense planners are also prioritizing helicopters capable of operating in high-altitude and maritime environments, reflecting geographic realities across Asia Pacific. Indigenous manufacturing programs are gaining traction as governments attempt to reduce reliance on imports and develop sovereign aerospace ecosystems. Technology transfers from Western manufacturers further accelerate capability development while fostering domestic supply chains. Additionally, long-term procurement pipelines provide predictable revenue streams for industry participants, encouraging research investments in avionics, survivability systems, and precision weapons. As regional tensions persist, sustained capital allocation toward rotary-wing combat platforms is expected to remain a foundational growth catalyst.

Escalating Geopolitical Tensions and Border Security Requirements

Persistent territorial disputes and strategic rivalries are compelling Asia Pacific nations to enhance aerial combat readiness through expanded attack helicopter fleets. Security challenges ranging from border confrontations to maritime disputes demand rapid response platforms capable of delivering precision strikes and close air support under dynamic conditions. Military planners increasingly view attack helicopters as force multipliers that can quickly deploy troops, neutralize armored threats, and provide reconnaissance during high-risk operations. Rising threat perceptions from neighboring states are encouraging governments to accelerate procurement cycles and upgrade legacy fleets with technologically superior aircraft. Investments are also being directed toward helicopters equipped with advanced sensors, electronic warfare suites, and guided weapon systems to counter emerging battlefield threats. The need for interoperability with allied forces further drives adoption of standardized platforms compatible with multinational operations. Moreover, expanding defense budgets across major regional economies are creating favorable conditions for sustained acquisitions. Industrial collaborations are simultaneously strengthening maintenance infrastructure, ensuring higher availability rates during operational deployments. Collectively, these factors reinforce attack helicopters as indispensable components of modern military doctrine, supporting steady market expansion.

Market Challenges

High Acquisition and Lifecycle Costs Limiting Procurement Scale

Attack helicopters require substantial capital investment not only for acquisition but also for maintenance, training, and lifecycle support, creating financial pressure on defense budgets. Many Asia Pacific countries must balance helicopter procurement against competing priorities such as naval expansion, missile defense, and cyber capabilities. Advanced helicopters incorporate sophisticated avionics, weapons integration, and survivability technologies that significantly elevate production costs. Additionally, spare parts logistics, specialized repair facilities, and pilot training programs further increase long-term expenditures. Budget-constrained nations often delay purchases or opt for smaller fleet sizes, slowing overall market growth despite strong operational demand. Currency volatility and inflation can also raise procurement costs for import-dependent countries, complicating contract negotiations. Governments attempting domestic production frequently encounter high upfront investment requirements for manufacturing infrastructure and skilled labor. Furthermore, extended procurement timelines can expose projects to technological obsolescence before deployment. These financial constraints collectively limit rapid fleet expansion and require careful strategic planning to ensure cost-effective capability development.

Emergence of Alternative Combat Technologies Reducing Platform Dependence

The growing adoption of unmanned aerial vehicles and other advanced defense technologies presents a structural challenge to attack helicopter demand. Armed drones offer persistent surveillance, lower operational risk, and comparatively reduced operating costs, making them attractive alternatives for certain mission profiles. Defense strategists increasingly deploy unmanned systems for reconnaissance and targeted strikes, potentially reducing reliance on manned rotary-wing platforms. Tiltrotor aircraft and next-generation vertical lift programs are also reshaping future battlefield mobility concepts. Budget allocations may gradually shift toward these technologies as militaries seek scalable and cost-efficient solutions. Additionally, rapid technological evolution creates uncertainty for procurement agencies concerned about long-term platform relevance. Some defense planners are prioritizing hybrid force structures that integrate drones with fewer manned helicopters, altering traditional acquisition models. Industrial players must therefore invest heavily in innovation to maintain competitive differentiation. Without continuous technological upgrades, legacy helicopter platforms risk diminished strategic importance within future combat architectures.

Opportunities

Expansion of Indigenous Aerospace Manufacturing Capabilities

Asia Pacific governments are increasingly promoting domestic helicopter production to strengthen defense autonomy and stimulate industrial growth. Indigenous programs enable countries to control supply chains, reduce dependence on foreign suppliers, and customize platforms according to operational requirements. Collaborative ventures between global manufacturers and regional firms facilitate knowledge transfer, enhancing engineering capabilities and workforce expertise. Local production also improves maintenance responsiveness and lowers long-term operating costs for military operators. Several governments are offering policy incentives, research funding, and infrastructure support to accelerate aerospace development. As domestic programs mature, export opportunities may emerge, positioning regional manufacturers within the global defense marketplace. The creation of integrated aerospace ecosystems further attracts component suppliers and technology partners, amplifying economic benefits. Moreover, sovereign manufacturing aligns with national security priorities by ensuring equipment availability during geopolitical disruptions. This structural shift toward localized production represents a major opportunity for sustained market expansion.

Integration of Advanced Digital and Combat Technologies into Rotorcraft Platforms

Rapid technological innovation is transforming attack helicopters into highly networked combat systems capable of operating within multi-domain warfare environments. Modern platforms increasingly incorporate artificial intelligence-enabled targeting, advanced sensor fusion, and secure communication links that enhance situational awareness. These capabilities allow helicopters to function as command nodes while coordinating with drones and ground forces in real time. Defense agencies are prioritizing upgrades that extend mission flexibility and improve survivability against evolving threats. The adoption of lightweight composite materials is simultaneously improving range and payload efficiency. Digital maintenance systems are also reducing downtime by enabling predictive diagnostics, thereby increasing fleet readiness. Manufacturers that successfully integrate these technologies can differentiate their offerings and secure long-term defense contracts. Continuous innovation supports higher replacement demand as militaries retire aging aircraft in favor of digitally enhanced platforms. Consequently, technological convergence is expected to unlock significant procurement opportunities across the region.

Future Outlook

The Asia Pacific attack helicopter market is expected to maintain steady expansion as defense modernization remains a strategic priority for regional governments. Technological advancements in avionics, weapons integration, and digital battlefield connectivity will shape next-generation procurement strategies. Regulatory support for indigenous manufacturing is likely to strengthen supply chains while encouraging international partnerships. Rising geopolitical uncertainty and border security requirements should sustain demand for advanced rotary-wing platforms. Over the next five years, innovation and localized production are projected to define competitive advantage.

Major Players

- Boeing

- Airbus Helicopters

- Lockheed Martin

- Hindustan Aeronautics Limited

- Leonardo

- Rostec

- Korea Aerospace Industries

- Bell Textron

- MD Helicopters

- Denel Aeronautics

- Turkish Aerospace Industries

- NHIndustries

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

- Safran

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Aerospace manufacturers

- Military helicopter operators

- Defense technology providers

- System integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Critical variables including procurement trends, defense spending, fleet modernization programs, and technological adoption were identified through secondary research. These indicators helped define the structure and scope of the Asia Pacific attack helicopter market.

Step 2: Market Analysis and Construction

Validated datasets from industry reports, defense publications, and financial disclosures were synthesized to construct market estimates. Regional dynamics, supplier positioning, and demand drivers were incorporated to ensure analytical consistency.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were cross-verified using expert opinions from aerospace analysts and defense specialists. Assumptions were refined to align with procurement realities, geopolitical developments, and industrial capabilities.

Step 4: Research Synthesis and Final Output

All validated insights were consolidated into a structured framework, ensuring accuracy and coherence. Quantitative and qualitative factors were integrated to present a comprehensive view of the market landscape.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets in Key APAC Countries

Rising Demand for Advanced Military Technologies

Geopolitical Tensions in the Asia Pacific Region

Growth in Border Protection and Surveillance Initiatives

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Maintenance Costs for Advanced Systems

Political and Social Resistance to Military Expansion

Regulatory Barriers for New Aircraft Deployment

Technology Integration Issues

High Capital Investment Requirements - Market Opportunities

Partnerships for Technological Advancements in Weaponry

Emerging Demand for Autonomous Military Aircraft

Increased Government Focus on Military Modernization - Trends

Development of Autonomous and Unmanned Helicopter Systems

Rise in Hybrid Electric Aircraft Technologies

Integration of AI in Tactical Operations

Increased Use of Lightweight and Durable Materials

Advances in Cybersecurity for Attack Helicopter Systems - Government Regulations & Defense Policy

Export Control and Compliance Policies

National Defense Spending Policies

Regulations for Advanced Aircraft Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-202

- By System Type (In Value%)

Multirole Attack Helicopters

Heavy-Lift Attack Helicopters

Light Attack Helicopters

Close Support Helicopters

Night Attack Helicopters - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Integrated Platforms

Command and Control Platforms - By Fitment Type (In Value%)

Modular Fitment

Integrated Fitment

Custom Fitment

On-board Systems

Hybrid Fitment - By EndUser Segment (In Value%)

Military Forces

Government Agencies

Private Sector / Technology Firms

Security Services

Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Composite Materials

Steel & Aluminum

Helicopter Engine Technologies

Avionics Systems

Flight Control Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Platform Type, System Type, Procurement Channel, Fitment Type, Material / Technology, End User Segment, System Complexity Tier, Average System Price, Installed Units, Government Regulations)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Boeing

Airbus Helicopters

Korea Aerospace Industries

TATA Advanced Systems

Bell Helicopter

Leonardo

Russian Helicopters

Sikorsky Aircraft

Northrop Grumman

MD Helicopters

Hindustan Aeronautics

Thales Group

Dassault Aviation

Safran

- Military Forces’ Growing Demand for Advanced Helicopters

- Government Agencies Increasing Control over Defense Systems

- Private Sector’s Role in Aircraft Technology Advancements

- Defense Contractors’ Innovation in System Design

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035