Market Overview

The Asia Pacific border security market generated revenue of USD ~billion based on a recent historical assessment, supported by accelerating investments in surveillance technologies, biometric authentication systems, and integrated command platforms. Governments across the region are prioritizing advanced radar, unmanned systems, and sensor networks to address cross-border threats and illegal migration. Increasing territorial disputes and defense modernization programs are further strengthening procurement activity, while adoption of artificial intelligence-enabled monitoring continues to expand operational capabilities across land, maritime, and aerial borders.

China, India, Japan, South Korea, and Australia remain dominant due to extensive land and maritime boundaries, large defense allocations, and ongoing infrastructure upgrades. Major metropolitan defense hubs such as Beijing, New Delhi, Tokyo, Seoul, and Canberra lead procurement and deployment initiatives because of strong governmental oversight and technological ecosystems. Strategic investments in satellite surveillance, coastal monitoring networks, and smart fencing solutions reinforce regional leadership, while domestic manufacturing capabilities enhance supply resilience and accelerate system integration across national security frameworks.

Market Segmentation

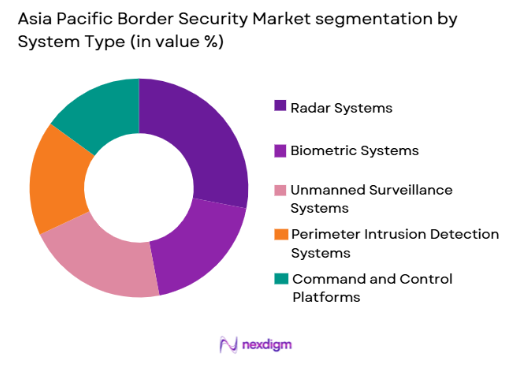

By System Type

Asia Pacific Border Security market is segmented by system type into radar systems, biometric systems, unmanned surveillance systems, perimeter intrusion detection systems, and command and control platforms. Recently, radar systems has a dominant market share due to factors such as continuous perimeter monitoring requirements, long-range detection capabilities, and suitability across diverse terrains including deserts and mountainous borders. Governments favor radar because it integrates efficiently with sensor arrays and centralized command centers, improving threat response times. Rising procurement for coastal defense and airspace monitoring further reinforces demand, while technological advancements have improved accuracy and reduced false alarms. Additionally, radar infrastructure supports multi-layered security strategies, making it a foundational component in modernization programs throughout the region.

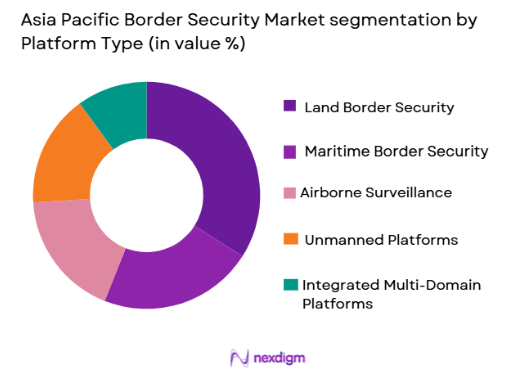

By Platform

Asia Pacific Border Security market is segmented by platform into land border security, maritime border security, airborne surveillance, unmanned platforms, and integrated multi-domain platforms. Recently, land border security has a dominant market share due to extensive terrestrial boundaries and persistent geopolitical tensions requiring permanent monitoring infrastructure. Countries with complex border terrains invest heavily in smart fencing, motion sensors, and vehicle-mounted surveillance to maintain situational awareness. Migration control, anti-smuggling operations, and counter-terrorism priorities further elevate deployment rates. Land-based systems also provide scalability and cost efficiency compared to aerial alternatives, enabling continuous surveillance coverage while supporting rapid response logistics for defense agencies across the region.

Competitive Landscape

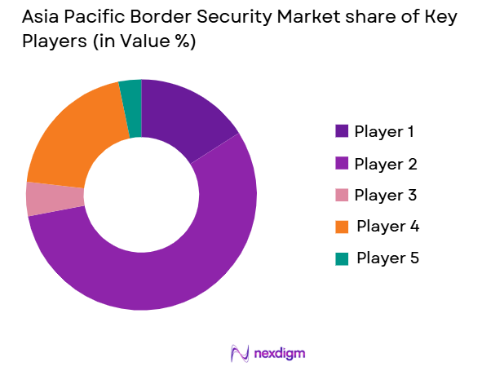

The Asia Pacific border security market demonstrates moderate consolidation, with multinational defense contractors and regional technology providers competing through integrated surveillance architectures and long-term government contracts. Major players maintain influence by offering interoperable systems combining sensors, analytics, and communication networks, while domestic firms strengthen competitiveness through localized manufacturing and regulatory alignment. Strategic partnerships, technology transfers, and joint ventures remain common, enabling companies to expand geographic reach and address evolving national security requirements.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Border Security Capability |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2014 | Leiden, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Hanwha Systems | 2018 | Seoul, South Korea | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Border Security Market Analysis

Growth Drivers

Escalating Geopolitical Tensions and Territorial Disputes

Persistent regional conflicts and maritime disagreements are prompting governments to strengthen border infrastructure with technologically advanced surveillance systems. Countries facing contested boundaries are investing in multi-layered monitoring frameworks to improve early threat detection and response efficiency. Rising defense allocations enable procurement of high-performance radar, electro-optical sensors, and autonomous patrol platforms capable of operating in remote environments. Security planners increasingly prioritize real-time intelligence sharing, which encourages adoption of network-centric command architectures. Expanding infrastructure projects also necessitate secure borders to protect trade corridors and logistics routes. Enhanced collaboration between defense agencies and technology vendors accelerates deployment cycles. Additionally, growing concerns over transnational crime, including trafficking and unauthorized crossings, reinforce the urgency of modernization initiatives. Governments are integrating artificial intelligence tools to analyze vast data streams and reduce operational blind spots. Strategic deterrence objectives further justify long-term capital commitments toward resilient border ecosystems.

Rapid Adoption of Intelligent Surveillance Technologies

Advances in artificial intelligence, machine learning, and predictive analytics are transforming how border agencies monitor vast territories. Automated detection platforms now process behavioral patterns and anomaly indicators with higher accuracy, reducing dependence on manual patrol operations. Governments are deploying drones and satellite-enabled imaging to maintain continuous situational awareness across difficult terrain. These solutions enhance operational efficiency while lowering lifecycle costs through predictive maintenance and optimized resource allocation. The growing interoperability of sensors and communication systems enables centralized command centers to coordinate responses effectively. Increasing availability of high-resolution imaging improves identification processes at checkpoints and remote border zones. Defense authorities are also prioritizing cyber-secure architectures to protect sensitive intelligence networks. Technology standardization across agencies promotes smoother integration and scalability. As innovation cycles shorten, procurement strategies increasingly emphasize modular platforms that can evolve with emerging threat landscapes.

Market Challenges

High Capital Expenditure and Budget Allocation Constraints

Establishing comprehensive border security infrastructure requires substantial financial commitments, often stretching defense budgets and delaying procurement timelines. Advanced systems such as satellite surveillance, long-range radar, and integrated analytics demand high upfront investment alongside recurring maintenance expenses. Governments must balance modernization priorities with competing fiscal obligations including social programs and infrastructure development. Smaller economies frequently encounter procurement barriers due to limited funding capacity. Cost overruns associated with complex deployments further complicate project execution. Additionally, currency fluctuations can elevate acquisition expenses for imported technologies. Decision-makers increasingly scrutinize return on investment before approving large-scale programs. Financing structures sometimes rely on phased implementation, extending project durations. These financial pressures encourage agencies to prioritize upgrades over full replacements, potentially slowing technological transformation across certain border segments.

Integration Complexities Across Legacy and Modern Systems

Many border agencies operate heterogeneous technology stacks accumulated over decades, creating compatibility challenges when introducing next-generation platforms. Legacy hardware often lacks standardized interfaces, requiring costly customization to achieve interoperability. Transitioning toward unified command frameworks demands extensive testing to prevent operational disruptions. Training personnel on sophisticated analytics tools adds further complexity. Cybersecurity considerations also intensify during integration because interconnected networks expand potential attack surfaces. Procurement teams must evaluate vendor ecosystems carefully to ensure long-term support and scalability. Data synchronization across multiple agencies can introduce latency issues if infrastructure is not upgraded simultaneously. Regulatory compliance and certification processes may extend deployment schedules. Without effective integration strategies, agencies risk fragmented situational awareness, undermining the intended benefits of modernization investments.

Opportunities

Expansion of AI-Enabled Predictive Border Management

Artificial intelligence presents significant opportunities for transforming border operations from reactive monitoring to proactive threat prevention. Predictive analytics platforms can assess movement patterns, environmental conditions, and historical incident data to anticipate vulnerabilities before breaches occur. Governments are increasingly exploring decision-support systems that recommend optimal patrol routes and resource deployment. Integration of AI with biometric verification accelerates traveler processing while maintaining strict security standards. Cloud-enabled architectures facilitate real-time data exchange across jurisdictions, enhancing coordination. Vendors capable of delivering scalable analytics solutions are positioned to capture long-term contracts. Additionally, AI reduces operational fatigue by automating repetitive surveillance tasks. Continuous algorithm refinement improves detection accuracy over time. As agencies pursue smarter security models, investment in intelligent border ecosystems is expected to accelerate across technologically progressive economies.

Growth in Maritime and Coastal Surveillance Modernization

Expanding trade routes and rising maritime activity are encouraging governments to upgrade coastal monitoring capabilities with advanced detection technologies. Integrated radar chains, underwater sensors, and unmanned surface vehicles strengthen domain awareness across busy shipping corridors. Nations with extensive coastlines are prioritizing layered defense strategies to protect critical infrastructure such as ports and energy terminals. Enhanced maritime intelligence supports counter-smuggling and anti-piracy initiatives while safeguarding economic assets. Collaboration with regional security alliances fosters shared surveillance frameworks and information exchange. Advances in sensor miniaturization enable cost-effective deployments across remote islands and chokepoints. Governments are also investing in resilient communication networks to maintain operational continuity during extreme weather conditions. These modernization efforts create substantial procurement opportunities for technology providers specializing in maritime security ecosystems.

Future Outlook

The Asia Pacific border security market is expected to advance steadily as governments intensify investments in smart surveillance and integrated defense networks. Emerging technologies such as autonomous monitoring, biometric automation, and AI-driven analytics are likely to redefine operational efficiency. Regulatory backing for national security modernization will further encourage procurement activity. Rising cross-border risks and infrastructure expansion are projected to sustain demand, while domestic manufacturing initiatives may strengthen regional supply chains and reduce dependency on imports.

Major Players

- Thales Group

- Airbus Defence and Space

- Elbit Systems

- NEC Corporation

- Hanwha Systems

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- RTX Corporation

- Leonardo S.p.A.

- Israel Aerospace Industries

- Teledyne FLIR

- Bharat Electronics Limited

- Indra Sistemas

- Hensoldt AG

Key Target Audience

- Defense procurement agencies

- Homeland security departments

- Border protection forces

- Military modernization units

- Airport and seaport authorities

- National surveillance program offices

- Defense technology integrators

- Intelligence and security agencies

Research Methodology

Step 1: Identification of Key Variables

Critical variables including defense spending patterns, surveillance deployment rates, procurement cycles, and technology adoption trends were identified. These indicators formed the foundation for evaluating demand across land, maritime, and aerial security domains.

Step 2: Market Analysis and Construction

Market size was constructed using verified industry databases, financial disclosures, and defense expenditure records. Regional revenue estimates were synthesized through triangulation to ensure alignment with technology penetration and procurement intensity.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultations with defense analysts, system integrators, and security specialists. Expert insights refined assumptions regarding modernization timelines, technology integration, and operational requirements.

Step 4: Research Synthesis and Final Output

All data points were consolidated into a structured framework, ensuring consistency across qualitative and quantitative insights. Final outputs were reviewed for methodological accuracy, enabling a reliable representation of the market landscape.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising cross border security threats and geopolitical tensions

Expansion of smart border initiatives across developing economies

Increasing defense budgets allocated to surveillance modernization

Growth in illegal trafficking and migration monitoring requirements

Adoption of integrated digital border management systems - Market Challenges

High capital investment requirements for advanced systems

Interoperability issues among legacy and modern platforms

Complex regulatory approvals across multiple jurisdictions

Cybersecurity vulnerabilities in networked border infrastructure

Difficult terrain impacting deployment and maintenance - Market Opportunities

Deployment of AI driven predictive surveillance solutions

Expansion of maritime border monitoring in island nations

Cross country collaboration for integrated regional security networks - Trends

Shift toward autonomous surveillance drones

Integration of biometric verification at checkpoints

Adoption of cloud based command centers

Growing use of satellite imagery for border intelligence

Convergence of cyber and physical border security - Government Regulations & Defense Policy

Strengthening of national security legislation

Expansion of electronic identification mandates

Increased funding for smart fencing initiatives

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance and Monitoring Systems

Access Control Systems

Perimeter Intrusion Detection Systems

Biometric Identification Systems

Command and Control Platforms - By Platform Type (In Value%)

Land Border Security Platforms

Maritime Border Security Platforms

Airborne Surveillance Platforms

Unmanned Systems Platforms

Integrated Multi Domain Platforms - By Fitment Type (In Value%)

Fixed Installations

Mobile Border Units

Portable Surveillance Kits

Vehicle Mounted Systems

Rapid Deployment Modules - By End User Segment (In Value%)

National Border Protection Agencies

Military and Paramilitary Forces

Coast Guard Authorities

Homeland Security Departments

Immigration Enforcement Agencies - By Procurement Channel (In Value%)

Direct Government Contracts

Defense Procurement Agencies

Public Private Partnerships

System Integrator Agreements

Multinational Security Programs - By Material / Technology (in Value %)

Artificial Intelligence Enabled Analytics

Electro Optical and Infrared Sensors

Radar Based Detection Technologies

Satellite Surveillance Technology

Secure Communication Networks

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Portfolio, Regional Presence, Contract Value, System Integration Capability, Innovation Pipeline, Government Partnerships, Deployment Scale, Cybersecurity Features, Lifecycle Support, Pricing Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Airbus Defence and Space

Leonardo S.p.A.

Elbit Systems

Saab AB

L3Harris Technologies

Indra Sistemas

Hensoldt AG

Israel Aerospace Industries

NEC Corporation

Fujitsu Limited

Hanwha Systems

Bharat Electronics Limited

ST Engineering

Rheinmetall AG

- Defense forces prioritizing real time situational awareness tools

- Border agencies investing in automated identity verification

- Coast guards adopting long range maritime detection systems

- Immigration authorities implementing digital processing platforms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035