Market Overview

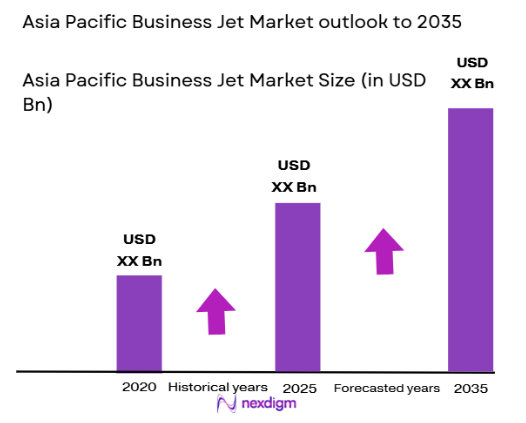

The Asia Pacific business jet market reached USD ~billion based on a recent historical assessment, supported by rising corporate travel requirements, expanding high-net-worth populations, and technological advancements improving aircraft efficiency and range. Increasing multinational activity across financial and manufacturing hubs has strengthened demand for flexible executive mobility. Additionally, enhanced financing structures and growth in charter services have accelerated procurement cycles, while modernization of private aviation infrastructure continues to reinforce fleet expansion across key economies.

China, India, Japan, Singapore, and Australia dominate the regional landscape due to strong economic output, concentration of multinational headquarters, and mature aviation ecosystems. Major cities including Shanghai, Hong Kong, Tokyo, Singapore, and Sydney act as operational centers because of advanced airport facilities and business connectivity. Corporate globalization and cross-border investments further elevate flight demand, while regional wealth creation supports private ownership. Expanding charter networks and aircraft management services also strengthen operational density within these metropolitan corridors.

Market Segmentation

By Product Type

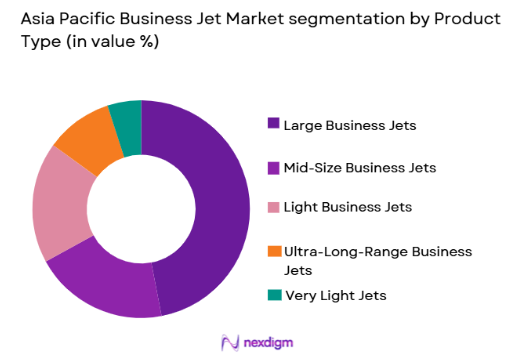

Asia Pacific Business Jet market is segmented by product type into light business jets, mid-size business jets, large business jets, ultra-long-range business jets, and very light jets. Recently, large business jets has a dominant market share due to factors such as superior range capability, higher passenger capacity, and suitability for intercontinental travel connecting major financial centers. Corporations favor these aircraft because they enable nonstop travel between distant markets while maintaining onboard productivity environments. Growing executive mobility requirements and preference for spacious cabins further reinforce adoption. Operators also benefit from stronger resale values and extended lifecycle performance, making large jets financially attractive despite higher acquisition costs. Additionally, charter providers prioritize these aircraft to serve premium clients seeking comfort and reliability, strengthening utilization rates across the region’s busiest routes.

By End User

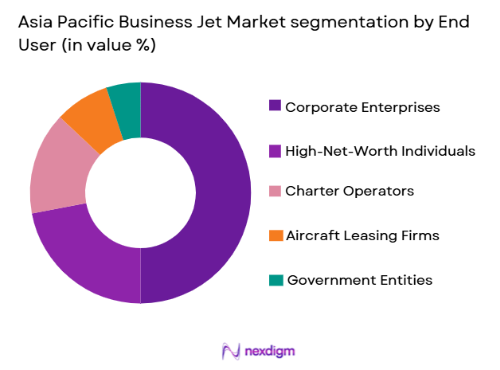

Asia Pacific Business Jet market is segmented by end user into corporate enterprises, high-net-worth individuals, charter operators, government entities, and aircraft leasing firms. Recently, corporate enterprises has a dominant market share due to expanding regional trade networks and increasing need for time-efficient executive transportation. Businesses rely on private aviation to optimize travel schedules, facilitate rapid decision-making, and access secondary cities lacking commercial connectivity. As multinational firms expand operations, executive travel frequency rises, encouraging fleet acquisitions and long-term charter agreements. Corporate users also value confidentiality and operational control, particularly during mergers, strategic negotiations, and site visits. Furthermore, improved financing availability enables organizations to justify ownership through productivity gains, reinforcing corporate aviation as a strategic mobility tool rather than a discretionary expense.

Competitive Landscape

The Asia Pacific business jet market reflects moderate consolidation, with global manufacturers competing alongside specialized charter and fleet management providers. Leading companies maintain influence through technologically advanced aircraft portfolios, strong service networks, and long-term client relationships. Strategic partnerships with regional operators enhance distribution, while aftermarket support capabilities create recurring revenue streams. Competitive differentiation increasingly centers on cabin innovation, connectivity features, and fuel efficiency, positioning major aerospace firms as primary drivers of technological progress across the sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Typical Aircraft Range |

| Gulfstream Aerospace | 1958 | Georgia, United States | ~ | ~ | ~ | ~ | ~ |

| Bombardier Aviation | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Embraer Executive Jets | 1969 | São José dos Campos, Brazil | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 2014 | Kansas, United States | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Business Jet Market Analysis

Growth Drivers

Expansion of High-Net-Worth Population Across Emerging Economies

Rapid wealth creation across Asia Pacific economies has significantly increased the pool of individuals capable of purchasing or chartering private aircraft, directly strengthening business jet demand. Economic diversification in sectors such as technology, finance, pharmaceuticals, and manufacturing has generated substantial personal and corporate fortunes, translating into higher discretionary spending on premium mobility solutions. Affluent travelers increasingly prioritize privacy, flexibility, and health security, reinforcing the appeal of private aviation over commercial alternatives. Cross-border investment activity further compels executives to travel frequently between regional headquarters and international markets. Family offices and wealth managers are also recommending aviation assets as strategic tools for time optimization rather than luxury purchases. Growing interest in aircraft fractional ownership reduces the financial barrier to entry while expanding customer participation. Meanwhile, lifestyle shifts toward personalized travel experiences support recurring charter usage. Governments in several economies are liberalizing aviation frameworks, enabling smoother aircraft registration and operations. As wealth concentration intensifies in metropolitan clusters, demand for point-to-point connectivity is expected to remain structurally resilient.

Rising Corporate Globalization and Executive Mobility Requirements

Multinational corporations expanding throughout Asia Pacific are increasingly adopting business aviation to maintain operational agility in highly competitive markets. Executive teams rely on private aircraft to conduct multiple site visits within compressed timelines, improving strategic responsiveness and governance oversight. Business jets also enable access to secondary cities where commercial airline schedules remain limited, facilitating supply chain supervision and partnership development. Heightened competition encourages firms to prioritize productivity, making airborne workspaces a practical extension of corporate infrastructure. Post-pandemic business continuity planning has further highlighted the importance of controlled travel environments. Leasing arrangements and charter memberships provide scalable alternatives to outright ownership, supporting broader enterprise participation. Companies engaged in mergers, infrastructure projects, and energy development particularly benefit from rapid transportation capabilities. Additionally, enhanced onboard connectivity allows executives to remain operational during flights, reinforcing efficiency gains. As regional trade corridors deepen, corporate aviation is likely to remain integral to executive mobility strategies.

Market Challenges

High Acquisition Costs and Lifecycle Operating Expenses

Business jets require substantial capital outlays that include purchase prices, maintenance programs, crew training, insurance, and hangar infrastructure, collectively limiting the addressable buyer base. Even financially strong corporations must evaluate opportunity costs before committing to ownership. Fluctuating fuel prices and currency movements can further elevate operating budgets, complicating long-term planning. Depreciation dynamics also influence investment decisions because residual values vary depending on aircraft category and technological relevance. Smaller enterprises often conclude that charter solutions offer better financial flexibility. Additionally, regulatory compliance and safety certification expenses increase administrative burdens. Financing conditions may tighten during macroeconomic uncertainty, reducing lending appetite for aviation assets. Supply chain constraints affecting parts availability can extend maintenance cycles and raise downtime risk. These financial and operational pressures encourage cautious procurement behavior across the region.

Infrastructure Limitations and Airport Access Constraints

Despite strong aviation growth, several Asia Pacific economies still lack sufficient dedicated business aviation terminals, restricting operational convenience. Congested metropolitan airports frequently prioritize commercial traffic, resulting in slot limitations that reduce scheduling flexibility for private aircraft. Secondary airports capable of supporting business jets remain unevenly distributed, particularly across emerging markets. Ground handling capabilities and maintenance facilities also vary in quality, affecting service reliability. Regulatory procedures for permits and cross-border operations sometimes introduce delays that undermine the value proposition of time-efficient travel. Furthermore, urban expansion has intensified airspace congestion, complicating flight planning. Investments in fixed-base operators are improving conditions gradually, yet infrastructure gaps continue to constrain fleet expansion potential.

Opportunities

Growth of Fractional Ownership and Jet Membership Models

Innovative ownership structures are transforming access to private aviation by allowing multiple stakeholders to share aircraft usage while distributing costs proportionally. These programs appeal to corporations and affluent individuals seeking predictable availability without assuming full operational responsibilities. Membership-based flight hours provide budgeting clarity and reduce administrative complexity. Operators benefit from higher aircraft utilization rates, improving asset profitability. Digital booking platforms enhance transparency and streamline scheduling, attracting technologically inclined clients. Financial institutions are increasingly supporting these arrangements through tailored lending products. As awareness grows, fractional models are expected to unlock previously underserved demand segments. This democratization of access broadens the customer base while stabilizing revenue streams for service providers.

Integration of Sustainable Aviation Technologies and Fuel Alternatives

Environmental considerations are reshaping procurement strategies as operators explore ways to reduce carbon intensity without compromising performance. Sustainable aviation fuel adoption is gaining traction among corporate clients committed to emission reduction targets. Manufacturers are investing in lighter materials, aerodynamic enhancements, and next-generation propulsion concepts to improve fuel efficiency. Regulatory encouragement for greener aviation further supports experimentation and deployment. Charter providers promoting carbon-offset programs are attracting environmentally conscious travelers. Advances in hybrid-electric research may eventually redefine aircraft economics, presenting long-term transformation potential. Companies that align sustainability with operational efficiency are positioned to capture reputational and competitive advantages across the evolving aviation ecosystem.

Future Outlook

The Asia Pacific business jet market is positioned for steady expansion as wealth creation, corporate globalization, and infrastructure investments continue to reinforce demand. Technological innovation in fuel efficiency, connectivity, and cabin design is expected to elevate aircraft capabilities while improving operating economics. Regulatory frameworks supporting private aviation and sustainable fuel adoption may further encourage procurement. Additionally, expanding charter ecosystems and alternative ownership models are likely to broaden accessibility, strengthening long-term market resilience.

Major Players

- Gulfstream Aerospace

- Bombardier Aviation

- Dassault Aviation

- Embraer Executive Jets

- Textron Aviation

- Honda Aircraft Company

- Airbus Corporate Jets

- Boeing Business Jets

- Pilatus Aircraft

- Leonardo S.p.A.

- Jet Aviation

- VistaJet

- NetJets

- Flexjet

- TAG Aviation

Key Target Audience

- Corporate aviation departments

- Aircraft charter service providers

- Private jet fleet operators

- Aircraft leasing companies

- Airport fixed-base operators

- Aerospace component suppliers

- High-net-worth investment offices

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Core variables including aircraft deliveries, ownership patterns, financing availability, infrastructure readiness, and executive travel demand were identified. These indicators established the analytical foundation for evaluating revenue formation across the regional business aviation ecosystem.

Step 2: Market Analysis and Construction

Market sizing was developed through evaluation of verified aviation databases, fleet intelligence reports, manufacturer disclosures, and financial records. Triangulation methods ensured alignment between aircraft values, transaction volumes, and operator activity.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists, aviation strategists, and fleet managers were consulted to validate assumptions regarding procurement behavior, utilization rates, and technological adoption. Their insights refined demand projections and competitive positioning analysis.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative findings were consolidated into a structured framework emphasizing consistency and analytical rigor. Final outputs were reviewed to ensure methodological reliability and an accurate representation of evolving market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising population of high net worth individuals across emerging economies

Expansion of corporate aviation for time efficient travel

Growth of charter aviation services in major economic hubs

Increasing investment in airport infrastructure supporting private aviation

Technological advancements improving fuel efficiency and cabin comfort - Market Challenges

High acquisition and operating costs limiting new buyers

Regulatory constraints on private aviation operations

Limited availability of dedicated business aviation airports

Supply chain disruptions affecting aircraft deliveries

Environmental scrutiny related to carbon emissions - Market Opportunities

Expansion of fractional ownership programs

Adoption of sustainable aviation fuel in private aviation

Growing demand for long range jets connecting secondary cities - Trends

Shift toward ultra long range aircraft

Integration of high bandwidth inflight connectivity

Cabin customization emphasizing productivity and comfort

Digitalization of fleet management

Rising preference for newer generation fuel efficient jets - Government Regulations & Defense Policy

Strengthening of civil aviation safety frameworks

Airspace modernization initiatives

Incentives supporting sustainable aviation adoption

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Business Jets

Mid Size Business Jets

Super Mid Size Business Jets

Large Cabin Business Jets

Ultra Long Range Business Jets - By Platform Type (In Value%)

Private Ownership Aircraft

Corporate Fleet Aircraft

Charter Service Aircraft

Fractional Ownership Aircraft

Government and Special Mission Aircraft - By Fitment Type (In Value%)

Factory Built Aircraft

Aftermarket Cabin Upgrades

Retrofit Avionics Packages

Connectivity Enhancement Installations

Interior Reconfiguration Programs - By End User Segment (In Value%)

High Net Worth Individuals

Corporate Enterprises

Charter Operators

Government and Defense Agencies

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Manufacturer Sales

Authorized Dealership Networks

Broker Facilitated Transactions

Leasing and Financing Agreements

Pre Owned Aircraft Marketplaces - By Material / Technology (in Value %)

Advanced Composite Airframes

Next Generation Fuel Efficient Engines

High Speed Satellite Connectivity

Digital Flight Deck Systems

Predictive Maintenance Platforms

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Aircraft Range, Cabin Size, Purchase Cost, Operating Efficiency, Delivery Timeline, Connectivity Features, Brand Strength, Service Network, Residual Value, Customization Capability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Gulfstream Aerospace

Bombardier Aviation

Dassault Aviation

Embraer Executive Jets

Textron Aviation

Honda Aircraft Company

Airbus Corporate Jets

Boeing Business Jets

Pilatus Aircraft

Leonardo S.p.A.

Comlux Aviation

Jet Aviation

VistaJet

NetJets

Flexjet

- Corporations prioritizing flexible travel to enhance executive productivity

- Charter providers expanding fleets to address on demand mobility

- High net worth individuals seeking privacy and schedule control

- Government agencies utilizing business jets for strategic transport

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035