Market Overview

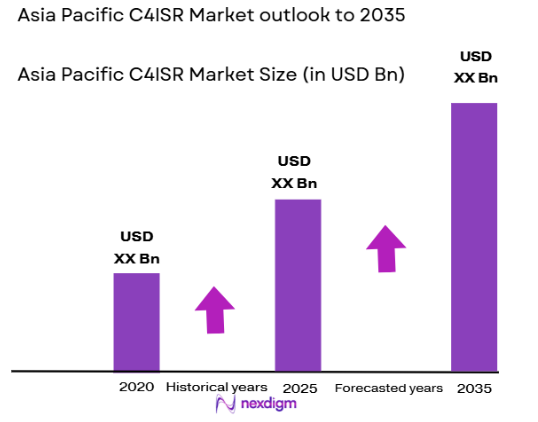

The Asia Pacific C4ISR market generated approximately USD ~ billion based on a recent historical assessment, driven by rising defense digitization, increasing procurement of intelligence and surveillance platforms, and modernization of command infrastructures. Military organizations are prioritizing integrated communication networks, artificial intelligence-enabled analytics, and secure battlefield systems to enhance decision superiority. Expanding geopolitical tensions and demand for multi-domain situational awareness are further accelerating investments, while adoption of advanced sensors and cyber-resilient architectures continues to strengthen operational readiness across defense establishments.

China, India, Japan, South Korea, and Australia dominate regional deployment due to large defense budgets, indigenous technology programs, and strong emphasis on joint-force operations. Strategic military hubs such as Beijing, New Delhi, Tokyo, Seoul, and Canberra lead procurement initiatives because of advanced research ecosystems and established defense manufacturing bases. Investments in satellite reconnaissance, tactical communication networks, and electronic warfare capabilities reinforce leadership, while cross-border security priorities sustain consistent demand for integrated command solutions throughout the region.

Market Segmentation

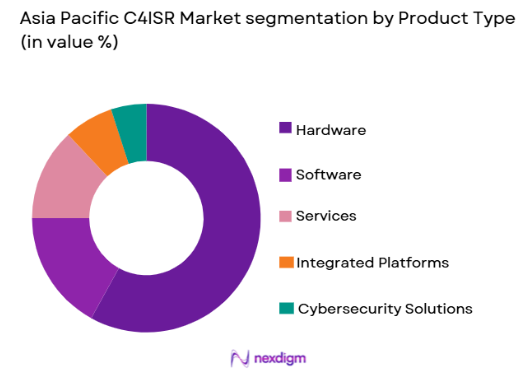

By Product Type

Asia Pacific C4ISR market is segmented by product type into hardware, software, services, integrated platforms, and cybersecurity solutions. Recently, hardware has a dominant market share due to factors such as extensive deployment of sensors, communication equipment, and battlefield computing infrastructure required for real-time intelligence. Defense agencies prioritize hardware investments because they form the backbone of command networks and surveillance ecosystems. Growing acquisition of radars, tactical radios, electro-optical devices, and data processing units supports operational continuity across land, air, and maritime environments. Additionally, modernization programs emphasize replacing legacy infrastructure with interoperable systems capable of supporting network-centric warfare doctrines. Hardware procurement is often bundled within long-term defense contracts, reinforcing spending consistency. The need for resilient infrastructure capable of functioning in contested environments further strengthens demand, ensuring hardware remains the foundational component of integrated defense architectures across Asia Pacific militaries.

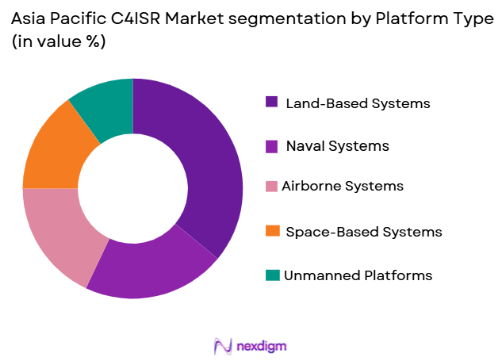

By Platform

Asia Pacific C4ISR market is segmented by platform into land-based systems, naval systems, airborne systems, space-based systems, and unmanned platforms. Recently, land-based systems has a dominant market share due to persistent requirements for battlefield coordination, border monitoring, and tactical communication across large territorial boundaries. Governments are deploying mobile command posts, ground sensors, and communication nodes to maintain operational awareness in high-risk zones. These platforms support troop movement tracking and intelligence fusion while enabling faster response cycles. Investments in smart border initiatives and terrestrial surveillance further elevate deployment rates. Land platforms also benefit from scalability and easier integration compared to space-based alternatives, allowing defense agencies to expand coverage without extensive infrastructure overhaul. Their ability to operate in diverse terrain strengthens adoption across regional militaries prioritizing defensive readiness and internal security operations.

Competitive Landscape

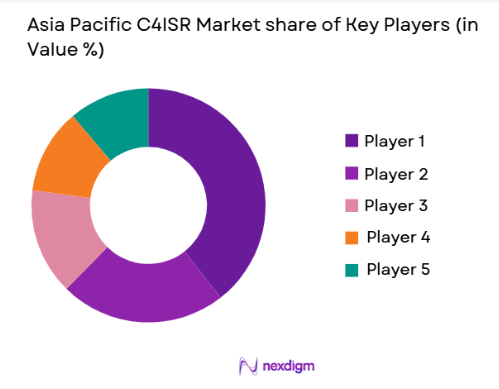

The Asia Pacific C4ISR market reflects a consolidated competitive environment dominated by multinational defense contractors with extensive system integration expertise. Major companies leverage long-term government contracts, advanced research capabilities, and interoperable technology portfolios to sustain influence. Strategic collaborations with domestic manufacturers are common, enabling compliance with localization policies while strengthening supply chains. Innovation in artificial intelligence, sensor fusion, and cyber-secure communications continues to differentiate leading participants operating across multi-domain defense ecosystems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Integrated Defense Capability |

| Lockheed Martin | 1995 | Maryland, United States | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Virginia, United States | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | Florida, United States | ~ | ~ | ~ | ~ | ~ |

Asia Pacific C4ISR Market Analysis

Growth Drivers

Acceleration of Network-Centric Warfare Adoption

Military doctrines across Asia Pacific are increasingly centered on interconnected operational frameworks that allow seamless information exchange between land, air, maritime, cyber, and space forces. This transformation is encouraging defense agencies to invest heavily in integrated command platforms capable of consolidating intelligence from multiple sensors into unified operational pictures. Enhanced data-sharing reduces decision latency and improves battlefield responsiveness, which is critical in modern high-speed conflict environments. Governments are replacing fragmented legacy systems with interoperable architectures to strengthen mission coordination. The proliferation of secure tactical data links further enables collaborative engagements between allied forces. Advanced analytics embedded within command platforms assist commanders in identifying threats with greater precision. Defense planners also view network-centric capabilities as force multipliers that enhance efficiency without proportionally increasing troop levels. Continuous military exercises demonstrate the operational advantages of synchronized intelligence flows. As regional tensions persist, adoption of digitally interconnected warfare ecosystems is expected to remain a primary catalyst for sustained procurement activity.

Rising Defense Modernization Programs Across Major Economies

Large-scale military upgrade initiatives are reshaping procurement strategies throughout Asia Pacific as governments allocate substantial budgets toward next-generation defense capabilities. Programs focused on electronic warfare, satellite reconnaissance, and secure battlefield communication are reinforcing demand for integrated C4ISR frameworks. Countries are pursuing indigenous manufacturing to reduce reliance on imports while strengthening technological sovereignty. Modernization also includes upgrading command centers with high-performance computing infrastructure capable of processing massive intelligence datasets. Cross-border collaborations with advanced defense partners accelerate technology transfer and implementation timelines. Armed forces increasingly prioritize automation to enhance operational readiness while minimizing human error. Investments in resilient architectures support mission continuity even in contested electromagnetic environments. Policymakers consider digital command superiority essential for deterrence, motivating sustained capital flows into advanced systems. As modernization cycles extend over multiple years, suppliers benefit from recurring upgrade contracts that stabilize long-term market expansion.

Market Challenges

Complex Integration Requirements Across Multi-Domain Architectures

Implementing C4ISR ecosystems demands seamless interoperability between diverse hardware, software, and communication protocols, presenting a persistent technical challenge for defense agencies. Legacy infrastructure often lacks compatibility with modern digital platforms, requiring extensive customization that increases deployment timelines. Integrating sensors from multiple vendors can introduce latency risks if data standards are not harmonized effectively. Defense organizations must also ensure cybersecurity resilience while expanding connectivity, complicating system design. Training personnel to operate sophisticated interfaces adds further operational strain. Budget overruns frequently arise when integration complexity is underestimated during procurement planning. Testing procedures must simulate real combat conditions, extending validation cycles before full deployment. Agencies therefore prioritize phased implementation to manage risk. Without careful coordination, fragmented intelligence streams could undermine situational awareness, making integration discipline essential for achieving operational superiority.

Escalating Cybersecurity Threat Landscape Targeting Defense Networks

As C4ISR systems become increasingly digitized, they present attractive targets for adversaries seeking to disrupt command structures or extract sensitive intelligence. Sophisticated cyberattacks can compromise communication channels, manipulate data streams, or degrade operational reliability during critical missions. Defense agencies must continuously invest in encryption, intrusion detection, and network monitoring to safeguard infrastructure. However, maintaining cyber resilience requires constant upgrades as threat vectors evolve rapidly. Insider risks and supply chain vulnerabilities further complicate protection strategies. Regulatory frameworks mandate strict compliance standards, increasing administrative overhead. Defense planners are also confronted with balancing accessibility and security to ensure operational agility without exposing systems to exploitation. Continuous red-teaming and vulnerability assessments are necessary but resource intensive. Consequently, cybersecurity remains both a strategic priority and a persistent operational challenge for regional militaries.

Opportunities

Expansion of Space-Based Intelligence and Surveillance Infrastructure

Growing reliance on satellite constellations for reconnaissance and communication presents a substantial opportunity for C4ISR vendors capable of delivering resilient orbital technologies. Space-enabled platforms provide persistent coverage over vast geographic areas, supporting missile detection, maritime tracking, and disaster response coordination. Governments increasingly recognize the strategic advantage of autonomous space capabilities and are allocating budgets accordingly. Advances in low Earth orbit architectures reduce latency while enhancing data throughput. Integration of space intelligence with terrestrial command systems enables comprehensive operational visibility. Collaborative programs between allied nations further expand deployment potential. Private aerospace firms entering defense partnerships accelerate innovation cycles. As geopolitical competition extends into the space domain, demand for secure satellite networks is expected to intensify, positioning this segment as a critical growth frontier.

Adoption of Artificial Intelligence for Real-Time Decision Superiority

Artificial intelligence is redefining how defense organizations process intelligence by enabling rapid interpretation of complex datasets generated from multi-sensor environments. Machine learning algorithms can detect anomalies, predict threat trajectories, and recommend tactical responses faster than traditional analytical methods. This capability significantly enhances decision-making speed, which is decisive in modern conflict scenarios. Governments are funding AI research to embed cognitive capabilities within command platforms. Automation reduces operator workload while improving accuracy in high-pressure conditions. Integration with unmanned systems further amplifies operational reach. Ethical governance frameworks are evolving to guide responsible deployment without limiting innovation. Vendors specializing in AI-enabled analytics are therefore positioned to capture substantial defense contracts. As algorithm maturity improves, intelligent command ecosystems are expected to become standard components of future military architectures.

Future Outlook

The Asia Pacific C4ISR market is expected to advance steadily as defense organizations prioritize digital command superiority and multi-domain integration. Technological progress in artificial intelligence, satellite surveillance, and cyber-secure communication will likely reshape operational frameworks. Regulatory support for indigenous manufacturing and joint-defense collaborations may further stimulate procurement. Rising geopolitical uncertainty and sustained military spending are projected to reinforce long-term demand for advanced intelligence and command platforms across the region.

Major Players

- Lockheed Martin

- Northrop Grumman

- RTX Corporation

- BAE Systems

- Thales Group

- Leonardo S.p.A.

- Saab AB

- Elbit Systems

- L3Harris Technologies

- General Dynamics

- Hensoldt AG

- Israel Aerospace Industries

- Bharat Electronics Limited

- Hanwha Systems

- Fujitsu

Key Target Audience

- Defense ministries

- Military command authorities

- Homeland security agencies

- Intelligence organizations

- Defense procurement departments

- Aerospace system integrators

- Government and regulatory bodies

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Critical variables such as defense expenditure trends, procurement programs, technology adoption, and system deployment intensity were identified. These factors established the analytical baseline for assessing demand across integrated command ecosystems.

Step 2: Market Analysis and Construction

Market size was constructed using validated defense industry databases, financial disclosures, and procurement records. Data triangulation ensured consistency between revenue estimates, deployment patterns, and modernization initiatives.

Step 3: Hypothesis Validation and Expert Consultation

Defense analysts, system integrators, and technology specialists were consulted to validate assumptions regarding operational requirements and procurement timelines. Expert insights strengthened accuracy across qualitative and quantitative findings.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured framework emphasizing analytical rigor and methodological transparency. Final validation ensured coherence across datasets, delivering a reliable representation of evolving market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense modernization initiatives across regional militaries

Increasing adoption of network centric warfare doctrines

Growing need for real time battlefield situational awareness

Expansion of joint and coalition military operations

Rapid integration of artificial intelligence into defense systems - Market Challenges

High lifecycle costs of integrated defense architectures

Complex interoperability requirements across legacy systems

Cybersecurity vulnerabilities within connected command networks

Procurement delays due to regulatory approvals

Shortage of skilled personnel for advanced system operations - Market Opportunities

Deployment of space enabled surveillance capabilities

Expansion of indigenous defense manufacturing ecosystems

Integration of autonomous platforms with command networks - Trends

Shift toward multi domain command frameworks

Adoption of cloud enabled tactical data processing

Rising investment in cyber defense capabilities

Miniaturization of ISR sensors

Growth of software defined communication systems - Government Regulations & Defense Policy

Strengthening national defense cybersecurity mandates

Policies promoting domestic defense technology production

Increased multi nation intelligence sharing agreements

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Communications Systems

Computers and Data Processing Systems

Intelligence Surveillance and Reconnaissance Systems

Electronic Warfare Integration Systems - By Platform Type (In Value%)

Land Based C4ISR Platforms

Naval C4ISR Platforms

Airborne C4ISR Platforms

Space Based C4ISR Platforms

Unmanned Systems Integrated Platforms - By Fitment Type (In Value%)

Line Fit Installations

Retrofit Programs

Modular Deployable Units

Mobile Tactical Systems

Fixed Command Centers - By End User Segment (In Value%)

Military Defense Forces

Homeland Security Agencies

Border Security Organizations

Intelligence Agencies

Coalition Task Forces - By Procurement Channel (In Value%)

Direct Defense Contracts

Government Tender Programs

Strategic Defense Partnerships

Foreign Military Sales

System Integrator Procurement - By Material / Technology (in Value %)

Artificial Intelligence Enabled Analytics

Secure Tactical Data Links

Advanced Battlefield Networking

Cyber Resilient Communication Infrastructure

Satellite Based Reconnaissance Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Breadth, System Integration Capability, Defense Contract Value, Regional Presence, Cybersecurity Strength, AI Capability, Platform Compatibility, R&D Investment, Lifecycle Support, Strategic Partnerships)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Northrop Grumman

RTX Corporation

BAE Systems

Thales Group

Leonardo S.p.A.

Saab AB

Elbit Systems

L3Harris Technologies

General Dynamics Mission Systems

Hensoldt AG

Israel Aerospace Industries

Bharat Electronics Limited

Hanwha Systems

Fujitsu Defense

- Defense forces prioritizing integrated command visibility across domains

- Intelligence agencies investing in advanced data fusion tools

- Border security units adopting real time surveillance coordination

- Naval forces enhancing maritime domain awareness capabilities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035