Market Overview

The Asia Pacific charter jet service market reached approximately USD ~ billion based on a recent historical assessment, supported by expanding corporate travel, rising high-net-worth populations, and increasing reliance on flexible aviation solutions for cross-border mobility. Industry analysis from Mordor Intelligence identifies the sector as benefiting from point-to-point travel adoption and broader access through membership and fractional models. Growing investment in fixed-base operations and maintenance infrastructure further improves service availability while strengthening operational efficiency across regional charter networks.

Mainland China remains the largest business jet ecosystem in the region with about 249 aircraft in operation, while Australia and India continue expanding fleets for business mobility and medical transport services, according to Asian Sky Group. Singapore functions as a regulatory and maintenance hub that supports charter certifications across multiple jurisdictions. Mature aviation infrastructure, concentration of multinational corporations, and increasing private wealth across major metropolitan centers collectively reinforce regional dominance and sustain strong demand for charter aviation services.

Market Segmentation

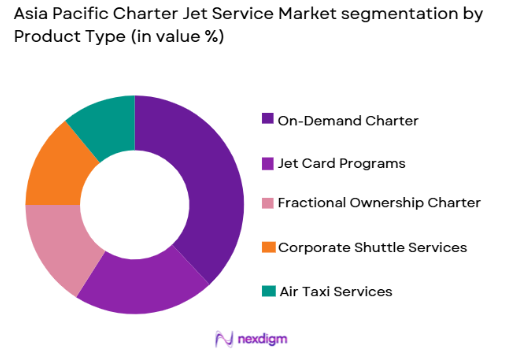

By Product Type

Asia Pacific Charter Jet Service market is segmented by product type into on-demand charter, jet card programs, fractional ownership charter, air taxi services, and corporate shuttle services. Recently, on-demand charter has a dominant market share due to factors such as flexibility in scheduling, cost transparency, and the ability to access aircraft without long-term commitments. Corporate travelers increasingly prefer this model for urgent intercity travel, while leisure clients use it for remote destinations lacking commercial connectivity. Operators also favor the segment because dynamic pricing improves fleet utilization. The rise of digital booking platforms has simplified procurement, enabling customers to compare aircraft availability quickly. Growing numbers of high-net-worth individuals across Asia Pacific further reinforce demand, while post-pandemic travel behavior emphasizes privacy and efficiency. Additionally, infrastructure investments in fixed-base operators have improved turnaround times, strengthening the operational feasibility of on-demand services across key aviation hubs.

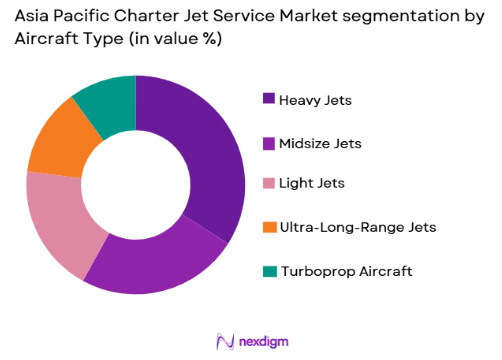

By Aircraft Type

Asia Pacific Charter Jet Service market is segmented by aircraft type into heavy jets, midsize jets, light jets, turboprop aircraft, and ultra-long-range jets. Recently, heavy jets have a dominant market share due to their superior range, cabin capacity, and suitability for intercontinental routes connecting financial centers. Large corporate delegations and government missions frequently rely on heavy jets for nonstop travel, reducing operational complexity. Charter providers prioritize these aircraft because higher hourly billing improves revenue generation despite elevated operating costs. Infrastructure at major airports increasingly accommodates larger business aircraft, reinforcing deployment efficiency. Wealth concentration in global business hubs further supports premium travel demand, while multinational firms require secure transport for executives. The segment also benefits from growing expectations for onboard productivity features such as connectivity and conference layouts. These advantages collectively sustain heavy jets as the preferred platform within premium charter operations.

Competitive Landscape

The Asia Pacific charter jet service market demonstrates moderate consolidation, with established operators leveraging fleet scale, regulatory certifications, and service networks to secure corporate contracts. Leading firms benefit from integrated aircraft management capabilities and partnerships with maintenance providers, while smaller brokers compete through digital marketplaces and niche luxury offerings. Strategic fleet expansion and cross-border operating permissions remain central competitive differentiators, shaping long-term positioning within the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Fleet Size |

| Deer Jet | 1995 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| ExecuJet Aviation Group | 1991 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ |

| VistaJet | 2004 | Malta | ~ | ~ | ~ | ~ | ~ |

| TAG Aviation Asia | 2006 | Hong Kong | ~ | ~ | ~ | ~ | ~ |

| Club One Air | 1997 | New Delhi, India | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Charter Jet Service Market Analysis

Growth Drivers

Rising Concentration of High-Net-Worth Individuals and Corporate Travel Demand

The expansion of private wealth across Asia Pacific has significantly increased the addressable customer base for charter aviation services. Wealth creation in technology, manufacturing, and financial services has produced a growing class of executives requiring time-efficient mobility between regional business centers. Companies increasingly deploy charter flights to minimize productivity losses associated with commercial airline schedules and transit delays. Flexible routing allows organizations to connect secondary cities that lack direct airline coverage, strengthening operational agility. High-net-worth travelers also prioritize privacy and personalized service, reinforcing demand for bespoke aviation experiences. The proliferation of family offices and cross-border investments further elevates travel frequency, particularly for due diligence and asset management activities. Charter operators respond by expanding fleets and introducing membership structures that lower entry barriers. Infrastructure improvements such as fixed-base operators and maintenance hubs enhance reliability, making charter services more attractive to corporate clients. Over time, these structural shifts establish private aviation as a strategic mobility tool rather than a discretionary luxury.

Expansion of Aviation Infrastructure and Digital Booking Ecosystems

Significant investments in aviation support facilities across Asia Pacific are improving the operational feasibility of charter services. New maintenance centers, hangars, and fixed-base operations reduce aircraft downtime while enabling faster dispatch capabilities. Airports increasingly allocate dedicated terminals for business aviation, improving passenger throughput and confidentiality. Digital booking platforms are simultaneously transforming procurement by allowing real-time pricing visibility and aircraft comparisons. This transparency encourages first-time users to transition from commercial premium travel toward charter solutions. Operators leverage predictive analytics to optimize fleet placement, ensuring aircraft availability near demand clusters. Integration of mobile applications simplifies itinerary adjustments, an important feature for executives managing dynamic schedules. Regulatory modernization in several jurisdictions is gradually streamlining permit approvals, reducing administrative friction. Together, infrastructure readiness and technology adoption enhance service reliability and customer confidence. These developments collectively accelerate market maturation while supporting scalable charter operations across geographically dispersed economies.

Market Challenges

High Operating Costs and Capital Intensity of Charter Operations

Charter aviation remains inherently expensive due to aircraft acquisition, maintenance requirements, and specialized crew training. Fuel price volatility directly influences hourly charter rates, complicating pricing strategies for operators attempting to maintain competitiveness. Insurance premiums for high-value aircraft further elevate cost structures, particularly in regions with evolving regulatory frameworks. Maintenance scheduling demands strict compliance, often grounding aircraft temporarily and limiting revenue opportunities. Smaller operators face financing constraints when attempting to modernize fleets, which can result in service inconsistencies. Currency fluctuations across Asia Pacific markets add another layer of financial uncertainty for multinational operators. Airport fees and navigation charges vary widely between jurisdictions, increasing operational complexity. Additionally, sustainability expectations are pushing companies toward costlier fuel alternatives and carbon mitigation initiatives. These financial pressures narrow profit margins despite strong demand fundamentals. Consequently, long-term viability depends on disciplined capacity planning and efficient fleet utilization.

Regulatory Fragmentation Across Multi-Jurisdictional Airspaces

The Asia Pacific aviation landscape encompasses diverse regulatory authorities, each imposing distinct certification, safety, and operational requirements. Charter providers must navigate complex approval processes for cross-border flights, often requiring multiple permits within tight timelines. Differences in customs procedures and passenger documentation standards can delay departures, undermining the value proposition of time efficiency. Cabotage restrictions in certain countries limit domestic charter operations by foreign carriers, constraining network flexibility. Compliance costs rise as operators adapt to varying maintenance and reporting standards. Rapid regulatory changes occasionally create uncertainty regarding allowable charter structures and ownership models. Smaller firms frequently lack the administrative resources necessary to manage these complexities effectively. Divergent taxation regimes also influence aircraft registration decisions, shaping competitive dynamics across jurisdictions. Despite gradual harmonization efforts, regulatory fragmentation continues to hinder seamless regional connectivity. Addressing these barriers remains essential for unlocking the market’s full growth potential.

Opportunities

Adoption of Sustainable Aviation Fuel and Low-Emission Technologies

Environmental accountability is emerging as a decisive factor in private aviation procurement decisions. Corporate clients increasingly incorporate sustainability metrics into travel policies, encouraging operators to explore alternative fuel solutions. Sustainable aviation fuel offers measurable emission reductions without requiring complete fleet replacement, making it an immediately actionable pathway. Governments across Asia Pacific are introducing incentives to accelerate adoption, strengthening the commercial rationale for investment. Operators that integrate carbon offset programs enhance brand perception among environmentally conscious travelers. Advances in engine efficiency further support lower operating footprints while maintaining performance standards. Partnerships between fuel producers and aviation firms are gradually improving supply chain stability. Early adopters can differentiate services through sustainability credentials, attracting multinational corporations with stringent reporting requirements. Over time, regulatory pressure is likely to reinforce these transitions. This opportunity positions sustainability not only as a compliance necessity but also as a competitive advantage.

Emergence of Secondary Cities as Business Aviation Corridors

Economic decentralization across Asia Pacific is generating new travel flows beyond traditional metropolitan hubs. Manufacturing clusters, technology parks, and special economic zones increasingly require rapid executive connectivity. Commercial airline networks often underserve these destinations, creating a natural role for charter aviation. Infrastructure upgrades at regional airports are improving runway capacity and ground handling capabilities. Operators can deploy midsize aircraft to serve these routes efficiently, balancing range with cost considerations. Local governments frequently support airport modernization to attract investment, indirectly benefiting charter services. Growing domestic wealth in emerging urban centers further contributes to passenger demand. Charter flights also enable same-day return itineraries, enhancing productivity for corporate travelers. As supply chains diversify geographically, intercity travel frequency is expected to rise. This structural shift opens a substantial expansion pathway for operators willing to establish early presence in developing corridors.

Future Outlook

The Asia Pacific charter jet service market is expected to advance steadily over the next five years as wealth creation, corporate globalization, and infrastructure investment reinforce demand for private mobility solutions. Technological developments such as digital booking ecosystems and predictive fleet analytics are likely to enhance operational efficiency. Regulatory modernization across several aviation authorities may improve cross-border accessibility. Sustainability initiatives and alternative fuels are anticipated to influence procurement strategies, while expanding secondary airports should broaden regional connectivity.

Major Players

- Vista Jet

- ExecuJet Aviation Group

- TAG Aviation Asia

- Deer Jet

- Club One Air

- Air Charter Service

- Global Jet International

- Phenix Jet

- Metrojet Limited

- Sino Jet

- MJets Air

- Hongkong Jet

- Revesco Aviation

- Karnavati Aviation

- Jet Aviation

Key Target Audience

- Charter jet operators

- Corporate travel departments

- Aircraft management companies

- Luxury travel providers

- High-net-worth investment offices

- Aviation leasing firms

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Core variables including charter demand, fleet availability, pricing structures, infrastructure readiness, and regulatory frameworks were identified. Secondary datasets from aviation intelligence platforms and operator disclosures were reviewed to establish baseline indicators influencing regional market behavior.

Step 2: Market Analysis and Construction

Historical revenue data and fleet statistics were synthesized to construct the market baseline. Segmentation modeling was applied to aircraft categories and service formats to estimate distribution patterns and validate structural dynamics shaping the competitive environment.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were cross-verified through expert commentary, operator briefings, and industry publications. Contradictory signals were stress-tested against macroeconomic indicators to ensure analytical consistency and realistic representation of demand drivers.

Step 4: Research Synthesis and Final Output

All validated insights were consolidated into a structured framework emphasizing measurable trends and operational factors. The final output integrates quantitative benchmarks with qualitative interpretation to deliver a comprehensive view of the Asia Pacific charter jet service market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising concentration of high-net-worth individuals across major Asia Pacific economies

Expansion of regional business travel corridors

Increasing preference for time-efficient and flexible travel solutions

Growth of luxury tourism across island and remote destinations

Corporate adoption of private aviation for executive mobility - Market Challenges

High operational costs linked to fuel and maintenance

Regulatory fragmentation across multiple aviation authorities

Limited airport infrastructure for private jets in emerging economies

Pilot shortages affecting service scalability

Environmental scrutiny on private aviation emissions - Market Opportunities

Expansion of air taxi networks in densely populated metropolitan regions

Adoption of sustainable aviation fuel to attract environmentally conscious clients

Partnerships between charter operators and luxury travel providers - Trends

Digital booking platforms transforming customer acquisition

Growing popularity of jet card subscription models

Integration of real-time pricing algorithms

Increasing demand for ultra-long-range aircraft for intercontinental travel

Shift toward carbon offset programs among operators - Government Regulations & Defense Policy

Strengthening civil aviation safety frameworks across Asia Pacific

Liberalization of air charter policies in select economies

Incentives supporting sustainable aviation initiatives

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

On-demand Charter Services

Private Jet Membership Programs

Air Taxi Services

Corporate Shuttle Charter

Cargo Jet Charter - By Platform Type (In Value%)

Light Jets

Midsize Jets

Heavy Jets

Ultra-long-range Jets

Turboprop Aircraft - By Fitment Type (In Value%)

Fully Managed Charter Programs

Broker-based Charter Services

Fractional Ownership Integration

Jet Card Access Models

Lease-backed Charter Fleets - By End User Segment (In Value%)

High-net-worth Individuals

Corporate Enterprises

Government and Diplomatic Travelers

Medical Evacuation Clients

Sports and Entertainment Professionals - By Procurement Channel (In Value%)

Direct Operator Booking

Digital Charter Marketplaces

Aviation Brokers

Corporate Travel Management Firms

Membership-based Platforms - By Material / Technology (in Value %)

AI-driven Fleet Optimization Systems

Advanced Flight Scheduling Software

Sustainable Aviation Fuel Integration

Next-generation Cabin Connectivity

Predictive Maintenance Platforms

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Fleet Size, Geographic Coverage, Aircraft Mix, Service Pricing Model, Membership Options, Operational Reliability, Cabin Customization, Digital Booking Capability, Sustainability Initiatives, Partnership Network)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Force

- Key Players

Vista Jet

ExecuJet Aviation Group

Jet Aviation

Deer Jet

TAG Aviation Asia

Metrojet Limited

Sino Jet

Air Charter Service

Zetta Jet

Asia Jet

MJets Air

Hongkong Jet

Jet Edge International

Luxaviation Group

Falcon Luxe

- Corporate clients prioritizing productivity-driven travel options

- Wealth-driven leisure travelers demanding personalized flight experiences

- Government usage supporting secure and rapid transportation needs

- Medical institutions relying on charter jets for emergency logis

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035