Market Overview

The Asia Pacific commercial aircraft cabin interior market generated revenue of about USD ~ billion based on a recent historical assessment, supported by rapid urbanization, expanding airline fleets, and rising disposable incomes across emerging economies. Increasing adoption of low-cost carrier models and sustained investments in airport infrastructure have intensified demand for new aircraft equipped with modern interiors. Airlines are prioritizing passenger comfort, connectivity, and lightweight materials, which is accelerating procurement of seating, entertainment systems, and modular cabin components.

China, India, and Japan dominate the regional landscape due to large aviation markets, strong fleet expansion strategies, and government-backed aerospace initiatives. China benefits from domestic manufacturing capabilities and premium travel demand, while India’s aviation growth is driven by expanding middle-class travel and infrastructure development. Japan contributes through advanced engineering and high-quality interior manufacturing. Southeast Asian hubs such as Singapore further strengthen regional leadership by supporting airline modernization programs and retrofit activity.

Market Segmentation

By Product Type

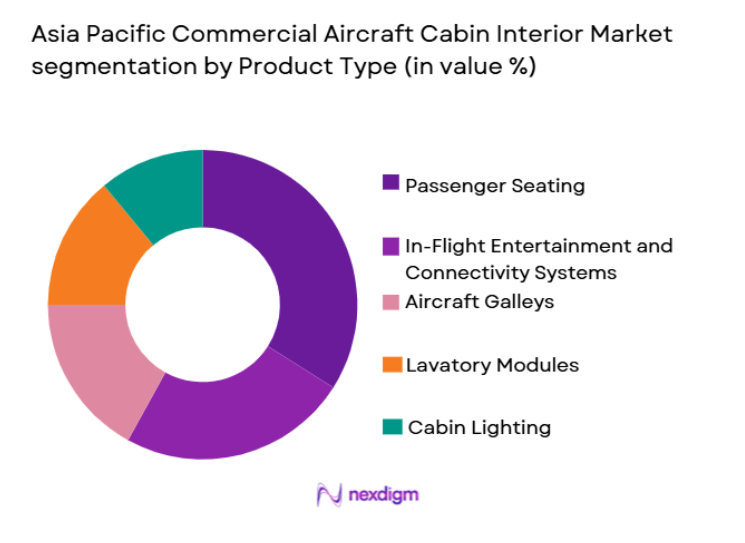

Asia Pacific Commercial Aircraft Cabin Interior market is segmented by product type into passenger seating, in-flight entertainment and connectivity systems, aircraft galleys, lavatory modules, and cabin lighting. Recently, passenger seating has a dominant market share due to its high replacement frequency, customization requirements, and direct impact on passenger experience. Airlines continually invest in ergonomic designs, premium seating layouts, and lightweight structures to optimize fuel efficiency while maintaining comfort. Fleet modernization programs across the region further amplify demand, as seating upgrades often accompany aircraft deliveries and refurbishment initiatives. Additionally, competition among carriers to differentiate onboard experiences encourages adoption of advanced seating technologies such as lie-flat configurations and space-efficient designs. The segment also benefits from regulatory safety standards that require periodic upgrades, ensuring consistent procurement across both new aircraft and retrofit projects.

By Aircraft Type

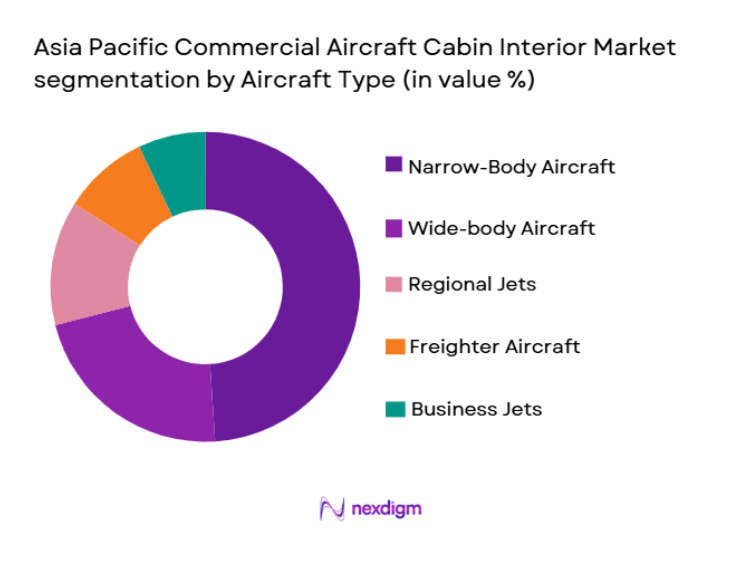

Asia Pacific Commercial Aircraft Cabin Interior market is segmented by aircraft type into narrow-body aircraft, wide-body aircraft, regional aircraft, freighter conversions, and business jets. Recently, narrow-body aircraft has a dominant market share due to their extensive deployment on short- and medium-haul routes across densely populated corridors. Airlines prefer these aircraft because they deliver operational efficiency, faster turnaround times, and lower operating costs, making them ideal for high-frequency travel markets. Rapid passenger traffic growth encourages carriers to expand narrow-body fleets, resulting in consistent demand for standardized cabin interiors. Moreover, low-cost carriers rely heavily on these aircraft to maximize seat density and profitability, reinforcing procurement volumes. Continuous cabin refresh cycles further support the segment, as airlines aim to maintain competitive service quality while accommodating growing traveler expectations.

Competitive Landscape

The Asia Pacific commercial aircraft cabin interior market reflects moderate consolidation, with established global suppliers collaborating closely with regional airlines and OEMs. Major players leverage technological innovation, integrated manufacturing, and long-term supply agreements to sustain competitive advantages. Strategic partnerships and localized production facilities are increasingly common, allowing companies to meet rising demand efficiently while strengthening aftermarket service capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Cabin Interior Specialization |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | United States | ~ | ~ | ~ | ~ | ~ |

| RECARO Aircraft Seating | 1972 | Germany | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Commercial Aircraft Cabin Interior Market Analysis

Growth Drivers

Surging Passenger Traffic Driving Airline Cabin Modernization

The steady increase in air travelers across Asia Pacific has compelled airlines to upgrade cabin environments to remain competitive and improve customer satisfaction. Rising middle-class populations and stronger discretionary spending have encouraged more frequent air travel, prompting carriers to prioritize comfort-focused interiors. Airlines are investing heavily in redesigned seating layouts, enhanced lighting, and digital entertainment platforms that create differentiated onboard experiences. Competitive pressures among regional carriers further intensify modernization cycles, as service quality increasingly influences traveler loyalty. Aircraft manufacturers are aligning production strategies with airline preferences, ensuring that new deliveries feature advanced interior configurations. Retrofit programs have also accelerated as operators seek to extend aircraft lifespans while maintaining contemporary cabin standards. Technological innovation enables lighter materials that simultaneously reduce fuel consumption and operating expenses. Improved connectivity infrastructure allows passengers to remain digitally engaged throughout flights, reinforcing demand for integrated systems. These evolving expectations collectively sustain procurement momentum across interior component suppliers. As travel demand continues to strengthen, modernization remains a structural driver shaping long-term market expansion.

Expansion of Low-Cost Carrier Networks Increasing Standardized Interior Demand

The proliferation of low-cost carriers across Asia Pacific has transformed airline operating models, emphasizing efficiency, rapid fleet utilization, and optimized seating density. These carriers favor standardized cabin layouts that streamline maintenance and reduce turnaround times, generating consistent demand for cost-effective interior solutions. High aircraft utilization rates necessitate durable components capable of withstanding frequent operations without compromising safety. Suppliers are therefore focusing on modular designs that simplify installation and replacement processes. The growth of secondary airports and regional connectivity initiatives further supports fleet additions, reinforcing procurement requirements. Low-cost airlines also adopt slimline seating and lightweight monuments to enhance fuel efficiency while maximizing passenger capacity. Partnerships between carriers and interior manufacturers enable bulk purchasing agreements that stabilize supply chains. Meanwhile, digital booking ecosystems and ancillary revenue strategies encourage incremental upgrades such as onboard connectivity. As budget travel becomes increasingly mainstream, standardized interior configurations continue to underpin supplier revenue stability. This structural shift ensures sustained growth opportunities across the cabin interior ecosystem.

Market Challenges

Stringent Certification Requirements Extending Product Development Cycles

Aircraft cabin components must comply with rigorous safety and airworthiness regulations before deployment, creating lengthy approval timelines that delay commercialization. Manufacturers must conduct extensive testing related to fire resistance, crashworthiness, and material durability, which significantly increases research expenditures. Any modification to design specifications can trigger additional validation procedures, extending project schedules. Smaller suppliers often struggle to navigate complex regulatory frameworks due to limited technical resources. Certification costs also raise barriers to entry, consolidating market power among established companies. Airlines frequently demand customization, yet tailored solutions must still meet standardized compliance thresholds. Documentation and traceability requirements add further operational complexity for manufacturers. Delays in certification can disrupt aircraft delivery timelines, affecting supplier revenue predictability. Continuous regulatory updates require ongoing adaptation in engineering processes. These factors collectively elevate development risks and constrain innovation speed within the market.

Supply Chain Disruptions Affecting Availability of Specialized Cabin Components

Cabin interiors rely on a global network of suppliers providing electronics, composite materials, and precision hardware, making production vulnerable to logistical interruptions. Transportation bottlenecks and geopolitical tensions can delay shipments, forcing manufacturers to adjust production schedules. Limited availability of aerospace-grade materials intensifies competition among suppliers seeking reliable procurement channels. Price volatility further complicates budgeting, particularly for long-term airline contracts negotiated under fixed pricing structures. Companies increasingly diversify sourcing strategies, yet qualifying new vendors requires strict testing and compliance verification. Inventory buffers help mitigate risk but raise carrying costs. Electronic systems such as in-flight connectivity modules are especially sensitive to semiconductor shortages. Coordination challenges across multinational supply chains may also hinder timely installations. These operational uncertainties pressure profit margins and strain customer relationships. Sustained resilience therefore remains a critical strategic priority for industry participants.

Opportunities

Rising Demand for Premium Cabin Configurations Across Long-Haul Routes

Airlines across Asia Pacific are progressively investing in premium travel offerings to capture higher-yield passengers and strengthen brand positioning. Business-class suites, premium economy seating, and customized lighting schemes are becoming essential differentiators on competitive international routes. Higher disposable incomes and corporate travel recovery further stimulate demand for upgraded cabins. Manufacturers benefit from increased orders for technologically sophisticated seating and integrated entertainment platforms. Premium configurations often require bespoke engineering, enabling suppliers to command stronger margins compared with standardized products. The expansion of hub airports supports long-haul connectivity, reinforcing the need for comfort-oriented interiors. Carriers are also leveraging premium cabins to enhance ancillary revenue streams. Collaborative design initiatives between airlines and suppliers accelerate innovation cycles. Passenger expectations for privacy and personalization continue to evolve, encouraging further upgrades. This transition toward premiumization creates substantial opportunities for specialized interior providers.

Adoption of Smart Cabin Technologies Enabling Connected Passenger Experiences

Airlines are increasingly integrating digital ecosystems within cabins to enhance operational efficiency and passenger engagement. High-speed connectivity, real-time data analytics, and app-based service platforms are reshaping onboard interactions. Smart sensors allow crew members to monitor equipment performance proactively, reducing maintenance disruptions. Personalized entertainment interfaces provide travelers with tailored content, strengthening customer satisfaction metrics. These technologies also support dynamic lighting and climate controls that adapt to flight conditions. Suppliers capable of delivering integrated hardware and software solutions gain strategic relevance in airline procurement decisions. Investments in satellite communication infrastructure further expand connectivity capabilities. Automation within cabin systems streamlines service workflows, improving overall efficiency. As digital transformation accelerates across aviation, connected interiors are expected to become standard rather than optional. This technological shift offers sustained growth potential for innovation-driven manufacturers.

Future Outlook

The Asia Pacific commercial aircraft cabin interior market is expected to expand steadily over the next five years, supported by fleet growth and continuous airline modernization initiatives. Technological advancements in smart cabins and lightweight materials are likely to improve operational efficiency while enhancing passenger comfort. Regulatory emphasis on safety and sustainability should encourage adoption of advanced materials and certified systems. Rising travel demand and premium service strategies are anticipated to sustain procurement momentum across the region.

Major Players

- Safran

- Collins Aerospace

- Panasonic Avionics Corporation

- RECARO Aircraft Seating

- Diehl Aviation

- Thales Group

- Jamco Corporation

- Geven S.p.A.

- Astronics Corporation

- ST Engineering Aerospace

- HAECO Group

- Lantal Textiles

- Acro Aircraft Seating

- FACC AG

- Boeing EnCore Interiors

Key Target Audience

- Commercial aircraft manufacturers

- Airline operators

- Aircraft leasing companies

- Maintenance repair and overhaul providers

- Cabin interior component suppliers

- Aerospace distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Critical variables including fleet expansion, airline procurement behavior, retrofit cycles, and technological adoption were identified through structured secondary research. Industry databases and financial disclosures were examined to establish baseline demand indicators.

Step 2: Market Analysis and Construction

Both top-down and bottom-up analytical models were applied to quantify revenue distribution and segment performance. Cross-referencing aircraft delivery data with supplier activity ensured consistent market construction.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with aerospace professionals, supply chain specialists, and cabin engineering experts. Their insights refined assumptions related to purchasing patterns and innovation trajectories.

Step 4: Research Synthesis and Final Output

Validated data sets were consolidated into a cohesive analytical framework emphasizing reliability and strategic relevance. The final output integrates quantitative metrics with qualitative interpretation to support informed decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising passenger expectations for enhanced onboard experience

Fleet expansion across low-cost and full-service carriers

Technological integration in connected cabin environments

Increasing aircraft retrofit and refurbishment cycles

Demand for lightweight interior components improving fuel efficiency - Market Challenges

High certification requirements for cabin equipment

Volatility in airline capital expenditure cycles

Supply chain constraints for electronic cabin systems

Complex integration of connectivity technologies

Rising costs of advanced interior materials - Market Opportunities

Expansion of premium economy and business-class cabins

Adoption of smart and digitally connected cabin ecosystems

Growth in aftermarket interior upgrades across aging fleets - Trends

Shift toward personalized in-flight entertainment platforms

Increased adoption of mood lighting for passenger comfort

Growing preference for modular cabin architecture

Integration of high-speed satellite connectivity

Focus on antimicrobial and hygienic cabin materials - Government Regulations & Defense Policy

Civil aviation cabin safety compliance standards

Regional mandates on fire-resistant interior materials

Accessibility regulations shaping cabin design - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger Seating Systems

In-Flight Entertainment and Connectivity Systems

Cabin Lighting Systems

Aircraft Galleys

Lavatory Modules - By Platform Type (In Value%)

Narrow-Body Aircraft

Wide-Body Aircraft

Regional Aircraft

Business Jets

Freighter Conversions - By Fitment Type (In Value%)

Line Fit Installations

Retrofit Programs

Cabin Refurbishment

Premium Cabin Upgrades

IFE Modernization Fitments - By EndUser Segment (In Value%)

Full-Service Airlines

Low-Cost Carriers

Charter Operators

Corporate Fleet Operators

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct OEM Procurement

Supplier Long-Term Agreements

Aftermarket Procurement

Third-Party Integrators

Leasing Company Sourcing - By Material / Technology (in Value %)

Lightweight Composite Panels

Smart Cabin Electronics

LED Ambient Lighting

Fire-Resistant Thermoplastics

Touchless Cabin Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Product Innovation, Cabin Customization Capability, Manufacturing Scale, Airline Partnerships, Geographic Presence, Retrofit Expertise, R&D Investment, Delivery Timelines, Cost Efficiency, Aftermarket Support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Safran Cabin

Collins Aerospace

Panasonic Avionics Corporation

Thales Avionics

RECARO Aircraft Seating

Zodiac Aerospace

Diehl Aviation

Jamco Corporation

Geven S.p.A.

ST Engineering Aerospace

HAECO Group

Astronics Corporation

Lantal Textiles

B/E Aerospace

Acro Aircraft Seating

- Full-service airlines investing in differentiated passenger experiences

- Low-cost carriers prioritizing high-density seating layouts

- Leasing companies favoring standardized modular interiors

- Charter operators adopting premium configurable cabin solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035