Market Overview

The Asia Pacific commercial aircraft cabin lighting market reached approximately USD ~ billion based on a recent historical assessment, supported by expanding aircraft deliveries, modernization of airline fleets, and rising emphasis on passenger-centric cabin environments. Airlines increasingly deploy advanced LED lighting to improve energy efficiency, reduce maintenance cycles, and enhance onboard ambiance. Growing retrofit programs across aging aircraft further stimulate procurement, while technological integration with smart cabin systems continues to strengthen long-term demand across regional aviation ecosystems.

China, Japan, Singapore, and India dominate the regional landscape due to strong aviation infrastructure, expanding airline networks, and increasing aircraft assembly activities. China benefits from large-scale fleet induction and domestic manufacturing capabilities, while Japan contributes through precision electronics expertise. Singapore acts as a major aviation maintenance hub supporting retrofit activity, and India’s rapidly expanding passenger base encourages airline investments in modern aircraft interiors, reinforcing consistent demand for advanced lighting systems.

Market Segmentation

By Product Type

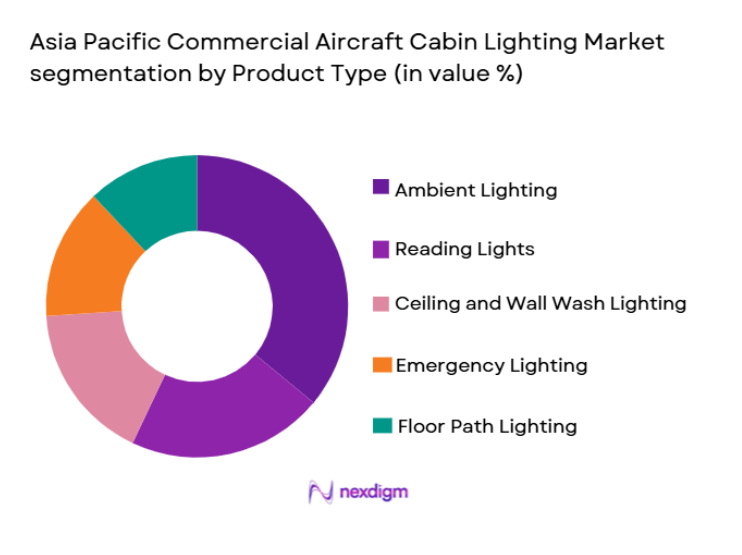

Asia Pacific Commercial Aircraft Cabin Lighting market is segmented by product type into ambient lighting, reading lights, ceiling and wall wash lighting, floor path lighting, and emergency lighting. Recently, ambient lighting has a dominant market share due to its direct influence on passenger comfort and airline brand differentiation. Carriers increasingly deploy customizable mood lighting to reduce travel fatigue and support circadian rhythm alignment on long-haul routes. Technological advancements in LED platforms allow airlines to create dynamic lighting scenarios while lowering power consumption. Integration with digital cabin management systems further strengthens operational flexibility, enabling crew-controlled lighting adjustments during various flight phases. Premium cabin strategies across full-service airlines have accelerated adoption, as differentiated onboard experiences are becoming a competitive necessity. Retrofit initiatives also prioritize ambient lighting upgrades because they deliver immediate perceptible improvements for travelers without requiring structural cabin modifications.

By Aircraft Type

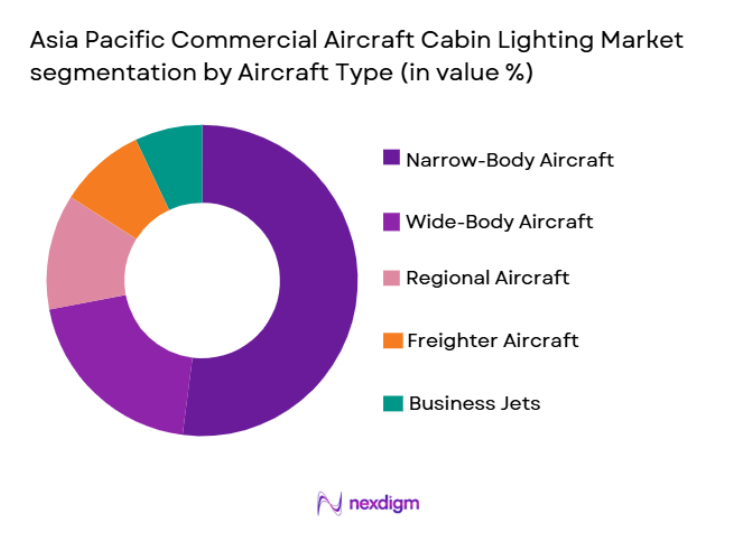

Asia Pacific Commercial Aircraft Cabin Lighting market is segmented by aircraft type into narrow-body aircraft, wide-body aircraft, regional aircraft, freighter aircraft, and business jets. Recently, narrow-body aircraft have a dominant market share due to their extensive utilization across high-density domestic and regional routes. Airlines favor these aircraft for operational efficiency, encouraging consistent interior upgrades that include modern lighting systems. Rapid expansion of low-cost carriers has intensified procurement volumes, as standardized cabin configurations simplify maintenance and reduce downtime. Manufacturers increasingly install energy-efficient lighting during line-fit production to meet airline cost targets. Furthermore, short-haul aircraft often undergo periodic refurbishments to remain competitive, sustaining aftermarket demand. Growing airport connectivity across secondary cities also supports narrow-body fleet expansion, reinforcing the segment’s leadership in lighting installations throughout the regional aviation sector.

Competitive Landscape

The Asia Pacific commercial aircraft cabin lighting market is characterized by moderate consolidation, with a small group of global aerospace electronics manufacturers controlling a substantial portion of supply. Companies compete primarily through technological innovation, reliability, and certification expertise while forming long-term agreements with OEMs and airlines. Strategic partnerships with retrofit providers and maintenance organizations further enhance competitive positioning, enabling firms to capture recurring revenue streams while strengthening regional presence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Lighting Innovation Capability |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Cabin | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ |

| Astronics Corporation | 1968 | United States | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1997 | Singapore | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Commercial Aircraft Cabin Lighting Market Analysis

Growth Drivers

Increasing Airline Focus on Passenger Experience Enhancement

Airlines across Asia Pacific are intensifying efforts to improve onboard environments as passenger expectations continue to evolve toward comfort, personalization, and visual appeal. Cabin lighting plays a central role in shaping traveler perception, prompting carriers to invest in advanced mood lighting capable of simulating natural daylight patterns. Such systems help reduce jet lag and enhance overall travel satisfaction, particularly on long-duration flights. Competitive differentiation has become critical as airlines compete for loyalty within increasingly crowded routes. Lighting technologies now integrate with entertainment platforms and digital controls, allowing dynamic adjustments tailored to service phases. Premium cabins especially rely on immersive lighting to reinforce brand identity and justify higher ticket pricing. Manufacturers are responding with programmable LED architectures that balance brightness, color range, and energy efficiency. Lower maintenance requirements further support adoption by minimizing aircraft downtime. Retrofit demand is also expanding because lighting upgrades deliver high passenger impact with relatively manageable installation complexity. Collectively, the pursuit of superior passenger experience continues to function as a powerful catalyst for sustained market expansion.

Transition Toward Energy-Efficient Solid-State Lighting Technologies

Airlines are steadily replacing legacy fluorescent systems with solid-state lighting solutions that offer superior efficiency, durability, and operational performance. LED technology consumes significantly less power, directly supporting airline objectives to reduce fuel burn and operating expenses. Longer product lifespans decrease maintenance frequency, allowing carriers to optimize fleet utilization. Environmental sustainability initiatives further encourage adoption, as lower energy consumption contributes to reduced carbon emissions. Technological improvements have enabled lighter lighting assemblies that complement broader aircraft weight-reduction strategies. Suppliers are investing in advanced thermal management and optical engineering to enhance reliability under demanding flight conditions. Integration capabilities allow lighting to function seamlessly within centralized cabin management platforms. Regulatory acceptance of LED systems has also accelerated installations during both line-fit and retrofit programs. As production costs gradually decline, adoption barriers continue to weaken across airline categories. This structural shift toward efficient lighting technologies is reshaping procurement strategies throughout the region.

Market Challenges

Stringent Safety Certification and Compliance Requirements

Aircraft cabin lighting must comply with rigorous aviation safety standards covering fire resistance, electromagnetic compatibility, and emergency visibility performance. Achieving certification requires extensive laboratory testing and documentation, significantly increasing product development timelines. Manufacturers must coordinate closely with regulatory authorities to validate each design iteration before commercial deployment. Even minor modifications can trigger recertification procedures, delaying program schedules and elevating engineering costs. Smaller suppliers often face resource constraints that limit their ability to navigate complex compliance frameworks. Airlines demand reliability because lighting failures can compromise safety perception, further intensifying quality expectations. Documentation requirements also extend across the supply chain, necessitating traceability of components and materials. Continuous regulatory updates force manufacturers to adapt production methods regularly. These procedural burdens raise barriers to entry and contribute to market concentration among experienced providers. Ultimately, compliance complexity remains a persistent operational challenge.

Volatility in Electronic Component Supply Chains

Cabin lighting systems depend heavily on semiconductors, control units, and specialized electronic assemblies sourced through global supply networks. Disruptions caused by geopolitical tensions or manufacturing bottlenecks can restrict component availability, forcing suppliers to adjust production schedules. Lead times often extend unexpectedly, complicating airline retrofit planning and OEM delivery commitments. Price fluctuations further strain contractual agreements negotiated under fixed cost assumptions. Companies are increasingly pursuing dual-sourcing strategies, yet qualifying alternative vendors requires strict technical validation. Inventory buffering can mitigate shortages but introduces higher carrying expenses. Rapid technological evolution also risks component obsolescence, requiring ongoing redesign efforts. Coordination across multiple tiers of suppliers adds operational complexity. Persistent uncertainty pressures profit margins and forecasting accuracy for lighting manufacturers. Strengthening supply chain resilience therefore remains a strategic imperative.

Opportunities

Expansion of Premium Cabin Concepts Across Long-Haul Networks

Airlines are expanding premium travel offerings to capture higher-yield passengers, creating strong demand for sophisticated lighting architectures that enhance exclusivity. Mood lighting synchronized with seat functions and entertainment interfaces elevates perceived service quality. As competition intensifies on international routes, differentiated cabin ambiance becomes a valuable branding tool. Lighting suppliers benefit from increased customization requirements that command higher margins than standardized installations. Growth in long-haul connectivity across Asia Pacific supports aircraft acquisitions featuring advanced interiors. Collaborative design partnerships between airlines and manufacturers accelerate innovation cycles tailored to premium travelers. Enhanced lighting also complements privacy-focused seating arrangements, reinforcing luxury positioning. Carriers recognize that visual comfort influences passenger satisfaction metrics and repeat bookings. Technological flexibility enables rapid adaptation of lighting scenarios for different service models. Consequently, premiumization represents a significant avenue for sustained revenue generation.

Integration of Smart Lighting Within Digitally Connected Cabin Ecosystems

The aviation industry is progressively embracing digital transformation, and cabin lighting is becoming an integral component of interconnected aircraft environments. Smart lighting systems can respond automatically to flight phases, passenger activity, or external daylight conditions, improving operational efficiency. Data-driven controls enable predictive maintenance by identifying performance anomalies before failures occur. Connectivity platforms allow centralized management of multiple cabin functions, simplifying crew workflows. Airlines increasingly favor suppliers capable of delivering interoperable solutions compatible with broader cabin networks. Advances in sensor technology further support adaptive illumination strategies that enhance comfort while conserving energy. Investments in satellite connectivity expand the possibilities for real-time system updates. As aircraft evolve into digitally orchestrated spaces, lighting becomes part of an integrated passenger experience architecture. Suppliers positioned at the intersection of electronics and software stand to benefit significantly. This convergence of technologies offers durable long-term growth potential.

Future Outlook

The Asia Pacific commercial aircraft cabin lighting market is expected to grow steadily over the next five years, supported by fleet expansion and airline modernization initiatives. Advancements in smart lighting and energy-efficient technologies are likely to enhance operational performance while reducing lifecycle costs. Regulatory emphasis on safety and sustainability should accelerate adoption of certified solid-state systems. Rising passenger expectations and premium travel trends are anticipated to sustain demand, positioning lighting as a critical element of next-generation aircraft interiors.

Major Players

- Collins Aerospace

- Safran Cabin

- Diehl Aviation

- Astronics Corporation

- ST Engineering

- Honeywell Aerospace

- Cobham Aerospace Communications

- Luminator Aerospace

- Bruce Aerospace

- Heads Up Technologies

- Oxley Group

- Aveo Engineering Group

- Precise Flight

- Soderberg Manufacturing Company

- Devore Aviation Corporation

Key Target Audience

- Commercial aircraft manufacturers

- Airline operators

- Aircraft leasing companies

- Maintenance repair and overhaul providers

- Cabin interior system suppliers

- Aerospace component distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Critical variables such as fleet expansion, retrofit frequency, technology adoption, and airline procurement behavior were identified through structured secondary research. Industry financials and aviation databases were evaluated to establish demand indicators.

Step 2: Market Analysis and Construction

Top-down and bottom-up models were applied to quantify revenue distribution and segment dynamics. Aircraft production metrics were cross-validated with supplier activity to ensure analytical consistency.

Step 3: Hypothesis Validation and Expert Consultation

Aerospace engineers, procurement specialists, and cabin integration professionals were consulted to validate assumptions regarding lighting adoption and innovation pathways. Their insights refined competitive positioning analysis.

Step 4: Research Synthesis and Final Output

Validated datasets were consolidated into a comprehensive framework emphasizing accuracy and strategic relevance. The final report integrates quantitative evaluation with qualitative interpretation to support informed business decisions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for enhanced passenger experience through mood lighting

Fleet expansion across Asia Pacific airlines

Shift toward energy-efficient LED cabin systems

Increasing aircraft retrofit cycles

Integration of smart cabin technologies - Market Challenges

Stringent aviation safety certification requirements

High replacement and installation costs

Complex integration with aircraft electrical systems

Supply chain constraints for electronic components

Limited standardization across aircraft platforms - Market Opportunities

Expansion of premium cabin lighting concepts

Technological innovation in adaptive lighting solutions

Growing demand for lightweight energy-efficient systems - Trends

Adoption of customizable mood lighting environments

Transition from fluorescent to LED systems

Increased focus on circadian rhythm lighting

Integration of lighting with digital cabin controls

Growth in touchless and sensor-based lighting - Government Regulations & Defense Policy

Civil aviation lighting safety compliance standards

Regional mandates on emergency illumination systems

Energy efficiency regulations influencing aircraft components - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ambient Lighting Systems

Reading Lights

Ceiling and Wall Wash Lighting

Floor Path Lighting

Emergency Lighting Systems - By Platform Type (In Value%)

Narrow-Body Aircraft

Wide-Body Aircraft

Regional Aircraft

Business Jets

Freighter Aircraft - By Fitment Type (In Value%)

Line Fit Installations

Retrofit Programs

Cabin Refurbishment Lighting

LED Upgrade Programs

IFE-Integrated Lighting - By EndUser Segment (In Value%)

Full-Service Airlines

Low-Cost Carriers

Charter Airlines

Corporate Aviation Operators

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct OEM Contracts

Tier-1 Supplier Agreements

Aftermarket Procurement

Third-Party Cabin Integrators

Leasing Company Procurement - By Material / Technology (in Value %)

LED Lighting Technology

OLED Lighting Panels

Smart Mood Lighting Systems

Energy-Efficient Solid-State Lighting

Wireless Controlled Lighting

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Lighting Technology Innovation, Product Reliability, Energy Efficiency, Airline Partnerships, Manufacturing Scale, Geographic Presence, Retrofit Capability, R&D Investment, Cost Competitiveness, Delivery Timelines)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Safran Cabin

Collins Aerospace

Diehl Aviation

ST Engineering Aerospace

Astronics Corporation

Cobham Aerospace Communications

Honeywell Aerospace

Luminator Aerospace

Heads Up Technologies

Bruce Aerospace

Precise Flight

Aveo Engineering Group

Oxley Group

Soderberg Manufacturing Company

Devore Aviation Corporation

- Full-service airlines investing in differentiated cabin ambiance

- Low-cost carriers adopting cost-efficient LED lighting

- Leasing firms prioritizing standardized lighting configurations

- Corporate operators demanding customizable lighting solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035