Market Overview

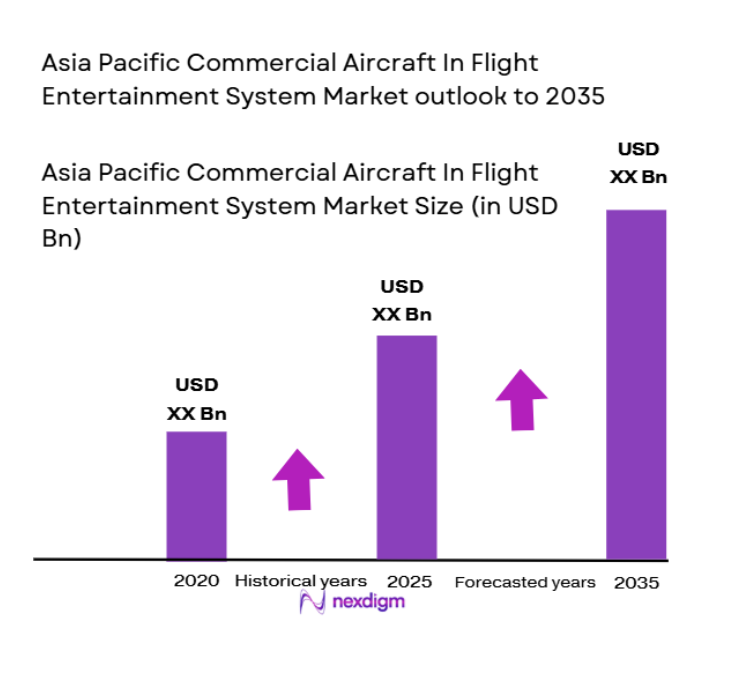

The Asia Pacific commercial aircraft in flight entertainment system market reached approximately USD ~ billion based on a recent historical assessment, supported by accelerating aircraft deliveries, growing passenger expectations for digital connectivity, and airline investments in advanced cabin technologies. Increasing adoption of wireless streaming platforms and high-definition seatback displays is strengthening procurement activity. Airlines are prioritizing integrated connectivity ecosystems that enable real-time content access, e-commerce services, and personalized media, reinforcing long-term demand across both retrofit and line-fit installations.

China, Japan, Singapore, and India dominate the regional landscape due to strong aviation growth, expanding airline fleets, and advanced digital infrastructure. China benefits from large aircraft induction programs, while Japan contributes through electronics innovation and precision manufacturing. Singapore functions as a major aviation technology and maintenance hub supporting system upgrades, and India’s rapidly expanding passenger traffic encourages carriers to modernize cabin offerings, sustaining consistent demand for sophisticated entertainment platforms.

Market Segmentation

By Product Type

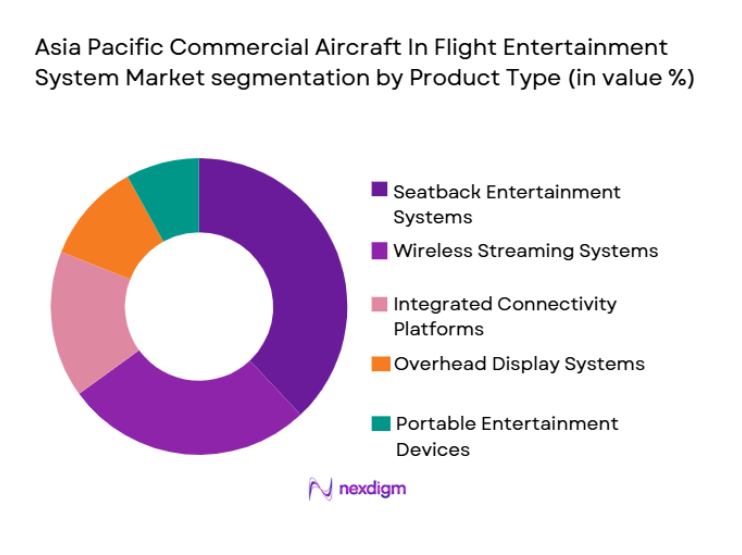

Asia Pacific Commercial Aircraft in Flight Entertainment System market is segmented by product type into seatback entertainment systems, wireless streaming systems, overhead display systems, portable entertainment devices, and integrated connectivity platforms. Recently, seatback entertainment systems have a dominant market share due to their reliability, premium passenger appeal, and ability to deliver consistent content regardless of personal device compatibility. Full-service airlines particularly favor embedded displays to enhance brand perception and support long-haul travel comfort. These systems enable high-definition viewing, gaming, and interactive services that elevate onboard experience. Airlines also generate ancillary revenue through advertising and onboard purchases integrated within seatback interfaces. Continuous improvements in screen resolution and power efficiency further support adoption. Although wireless models are gaining traction, many carriers still prioritize embedded solutions for service differentiation, ensuring steady installation volumes across wide-body and premium narrow-body aircraft fleets.

By Aircraft Type

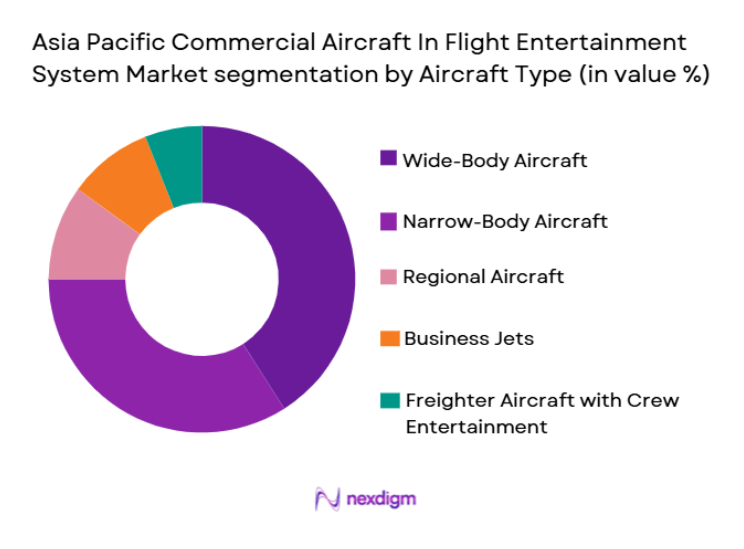

Asia Pacific Commercial Aircraft in Flight Entertainment System market is segmented by aircraft type into narrow-body aircraft, wide-body aircraft, regional aircraft, business jets, and freighter aircraft with crew entertainment. Recently, wide-body aircraft have a dominant market share due to their deployment on long-haul routes where passenger expectations for immersive entertainment are significantly higher. Airlines invest heavily in advanced systems for these aircraft to improve traveler satisfaction during extended flight durations. Premium cabin configurations commonly installed on wide-body fleets require high-performance displays, robust connectivity, and expanded content libraries. Additionally, international competition encourages carriers to differentiate through superior onboard digital experiences. Frequent upgrades aligned with aircraft refurbishments further sustain demand. As global travel corridors continue expanding, wide-body platforms remain central to entertainment system innovation across the regional aviation ecosystem.

Competitive Landscape

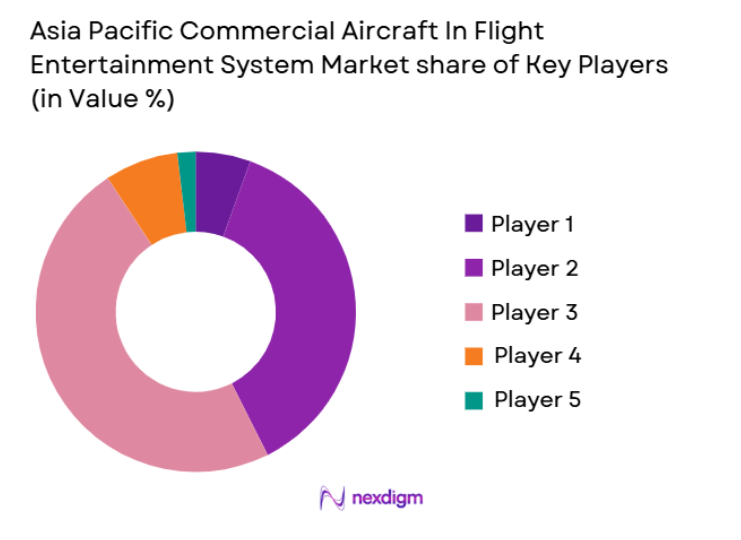

The Asia Pacific commercial aircraft in flight entertainment system market demonstrates moderate consolidation, with leading avionics and connectivity providers securing long-term airline partnerships. Competitive advantage is largely determined by technological innovation, system reliability, and integration capability with satellite networks. Major players are investing heavily in software ecosystems, cybersecurity, and cloud-based content delivery to strengthen differentiation while expanding regional service infrastructure.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Connectivity Integration Capability |

| Panasonic Avionics Corporation | 1979 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Viasat Inc. | 1986 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Passenger Innovations | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Commercial Aircraft in Flight Entertainment System Market Analysis

Growth Drivers

Rising Passenger Demand for Digitally Connected Travel Experiences

Passenger behavior has shifted toward constant connectivity, compelling airlines to deliver onboard environments comparable to ground-based digital ecosystems. Travelers increasingly expect streaming capabilities, messaging access, and interactive entertainment during flights, pushing carriers to upgrade legacy systems. Airlines recognize that superior digital engagement enhances customer satisfaction and loyalty while influencing airline selection. Embedded platforms now support personalized content recommendations, multilingual interfaces, and integrated retail services. The proliferation of smart devices has further accelerated expectations for seamless connectivity across flight durations. Manufacturers are responding with scalable architectures capable of handling higher bandwidth demands without compromising reliability. Enhanced graphical interfaces and responsive touchscreens improve usability, reinforcing adoption. Airlines also benefit from ancillary revenue opportunities generated through advertising and onboard transactions. Retrofit programs are expanding as carriers modernize aging fleets to remain competitive. Collectively, evolving passenger expectations are establishing digital entertainment as a core component of airline value propositions.

Expansion of Satellite Connectivity Infrastructure Across Aviation Networks

Advances in satellite technology are transforming inflight entertainment capabilities by enabling faster and more stable internet connections at cruising altitudes. High-throughput satellites support streaming-quality bandwidth, allowing airlines to deliver content-rich experiences previously constrained by limited connectivity. Partnerships between airlines and communication providers are accelerating deployment across regional fleets. Improved network coverage ensures consistent service even on remote flight paths, strengthening passenger trust in onboard connectivity. Technological competition among satellite operators is gradually reducing service costs, encouraging broader adoption. Integrated connectivity also supports operational efficiencies such as real-time aircraft monitoring and crew communication. Suppliers are designing entertainment ecosystems that merge connectivity with cloud-based content delivery for enhanced flexibility. Regulatory acceptance of airborne broadband has further facilitated installations. As infrastructure continues expanding, airlines are better positioned to standardize connected cabin offerings. This structural evolution is reinforcing long-term demand for advanced entertainment platforms.

Market Challenges

High Installation Costs and Complex Certification Processes

Deploying inflight entertainment systems requires significant capital investment due to hardware expenses, integration engineering, and regulatory approvals. Certification procedures mandate rigorous testing to ensure electromagnetic compatibility and operational safety, often extending deployment timelines. Airlines must carefully evaluate return on investment before committing to large-scale installations. Weight considerations further complicate system design because additional hardware can impact fuel efficiency. Customization requests from airlines add engineering complexity, increasing development costs for suppliers. Smaller carriers may delay adoption due to financial constraints. Continuous software updates also require validation to maintain compliance standards. Coordination between OEMs, connectivity providers, and integrators introduces additional operational layers. These factors collectively slow market penetration despite strong passenger demand. Managing cost structures therefore remains a persistent industry challenge.

Cybersecurity Risks Within Connected Cabin Ecosystems

As entertainment platforms become increasingly connected, protecting passenger data and aircraft networks has emerged as a critical priority. Unauthorized access could compromise sensitive information or disrupt onboard services, making robust security frameworks essential. Suppliers must invest heavily in encryption, intrusion detection, and secure network architectures. Regulatory bodies are strengthening cybersecurity guidelines, increasing compliance requirements for manufacturers. Software vulnerabilities demand continuous monitoring and patch management. Airlines also face reputational risks if data breaches occur, encouraging cautious adoption strategies. Integration with multiple digital services expands potential attack surfaces. Training personnel to manage cybersecurity protocols adds operational complexity. Collaborative industry initiatives are underway to standardize protective measures. Nevertheless, maintaining secure digital ecosystems remains an ongoing challenge for stakeholders.

Opportunities

Adoption of Wireless Streaming Solutions for Narrow-Body Fleets

Airlines are increasingly deploying wireless entertainment platforms that allow passengers to stream content directly to personal devices, reducing reliance on seatback hardware. These systems significantly lower installation weight and maintenance costs, improving operational efficiency. Narrow-body aircraft operating high-frequency routes are particularly well suited for such solutions because turnaround times remain short. Wireless architectures enable rapid software updates and flexible content management without extensive physical modifications. Airlines benefit from scalable deployment strategies aligned with fleet growth. Passenger familiarity with personal devices further accelerates acceptance. Suppliers can differentiate through intuitive interfaces and robust content ecosystems. Partnerships with media providers enhance service appeal while generating ancillary revenue streams. As technology matures, reliability continues improving. This shift toward wireless delivery presents substantial growth potential across regional fleets.

Integration of Data Analytics for Personalized Passenger Engagement

Advanced analytics platforms are enabling airlines to tailor entertainment offerings based on traveler preferences, enhancing engagement and satisfaction. Data-driven insights allow carriers to curate content libraries, recommend services, and optimize advertising strategies. Personalization strengthens brand loyalty while increasing onboard spending opportunities. Suppliers are developing intelligent software capable of processing usage patterns in real time. Integration with loyalty programs further enriches passenger interaction. Airlines can also leverage analytics to refine service models and improve operational planning. Privacy-compliant data management frameworks are gaining importance as personalization expands. Collaborative ecosystems between airlines, technology firms, and content providers accelerate innovation. Predictive capabilities support proactive system maintenance, reducing disruptions. This convergence of analytics and entertainment is expected to reshape the future passenger experience landscape.

Future Outlook

The Asia Pacific commercial aircraft in flight entertainment system market is expected to expand steadily over the next five years, supported by rapid digitalization of airline cabins and growing passenger expectations for seamless connectivity. Technological advancements in satellite communications and cloud-based platforms will enhance service quality while reducing latency. Regulatory support for secure onboard networks is likely to accelerate installations. Continued fleet expansion and retrofit programs are anticipated to sustain procurement momentum across the region.

Major Players

- Panasonic Avionics Corporation

- Thales Group

- Collins Aerospace

- Viasat Inc.

- Safran Passenger Innovations

- Gogo Business Aviation

- Astronics Corporation

- Lufthansa Systems

- Kontron AG

- Honeywell Aerospace

- Bluebox Aviation Systems

- Inmarsat Aviation

- SITAONAIR

- Global Eagle Entertainment

- ST Engineering Aerospace

Key Target Audience

- Commercial aircraft manufacturers

- Airline operators

- Aircraft leasing companies

- Maintenance repair and overhaul providers

- Avionics system suppliers

- Connectivity service providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including fleet growth, connectivity adoption, passenger behavior, and retrofit activity were identified through structured secondary research. Aviation databases and financial disclosures supported baseline demand evaluation.

Step 2: Market Analysis and Construction

Top-down and bottom-up analytical models were applied to estimate market size and segment distribution. Aircraft delivery statistics were cross-validated with supplier installation data to ensure consistency.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with avionics engineers, connectivity specialists, and airline procurement professionals validated assumptions regarding technology adoption and investment priorities, strengthening analytical accuracy.

Step 4: Research Synthesis and Final Output

Validated datasets were consolidated into a cohesive analytical framework emphasizing reliability and strategic relevance. The final report integrates quantitative insights with qualitative interpretation to support informed decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising passenger demand for connected onboard experiences

Expansion of long-haul airline networks

Increasing integration of high-speed satellite connectivity

Airline differentiation through digital cabin services

Growing aircraft retrofit and modernization initiatives - Market Challenges

High installation and certification costs

Bandwidth limitations impacting service quality

Rapid technology obsolescence cycles

Cybersecurity risks within connected cabin ecosystems

Complex integration with legacy aircraft platforms - Market Opportunities

Adoption of cloud-based entertainment ecosystems

Growth in wireless streaming solutions for narrow-body fleets

Partnerships between airlines and connectivity providers - Trends

Shift toward bring-your-own-device entertainment models

Expansion of high-definition interactive displays

Integration of e-commerce platforms within IFE systems

Personalized content delivery using data analytics

Convergence of connectivity and entertainment architectures - Government Regulations & Defense Policy

Aviation cybersecurity compliance frameworks

Passenger data protection regulations

Airworthiness standards for onboard electronic systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seatback Entertainment Systems

Wireless Streaming Entertainment Systems

Overhead Display Systems

Portable Entertainment Devices

Integrated Connectivity and Entertainment Platforms - By Platform Type (In Value%)

Narrow-Body Aircraft

Wide-Body Aircraft

Regional Aircraft

Business Jets

Freighter Aircraft with Crew Entertainment - By Fitment Type (In Value%)

Line Fit Installations

Retrofit Programs

Cabin Modernization Integrations

IFE System Upgrades

Connectivity-Enabled Fitments - By EndUser Segment (In Value%)

Full-Service Airlines

Low-Cost Carriers

Charter Airlines

Corporate Aviation Operators

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct OEM Contracts

Tier-1 Avionics Supplier Agreements

Aftermarket Procurement

Connectivity Service Partnerships

Third-Party Cabin Integrators - By Material / Technology (in Value %)

4K Display Technology

Satellite-Based Connectivity Systems

Wireless Content Streaming Technology

Cloud-Based Content Management Platforms

Touchscreen Interface Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Display Resolution Capability, Connectivity Integration, Content Management Expertise, Airline Partnerships, Geographic Presence, R&D Investment, System Scalability, Cybersecurity Features, Cost Efficiency, Aftermarket Support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Panasonic Avionics Corporation

Thales Group

Collins Aerospace

Safran Passenger Innovations

Viasat Inc.

Gogo Business Aviation

Global Eagle Entertainment

Astronics Corporation

Lufthansa Systems

ST Engineering Aerospace

Kontron AG

Honeywell Aerospace

Bluebox Aviation Systems

Inmarsat Aviation

SITAONAIR

- Full-service airlines investing in immersive entertainment ecosystems

- Low-cost carriers adopting wireless streaming platforms

- Leasing firms prioritizing modular upgrade-ready systems

- Corporate operators demanding premium digital interfaces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035