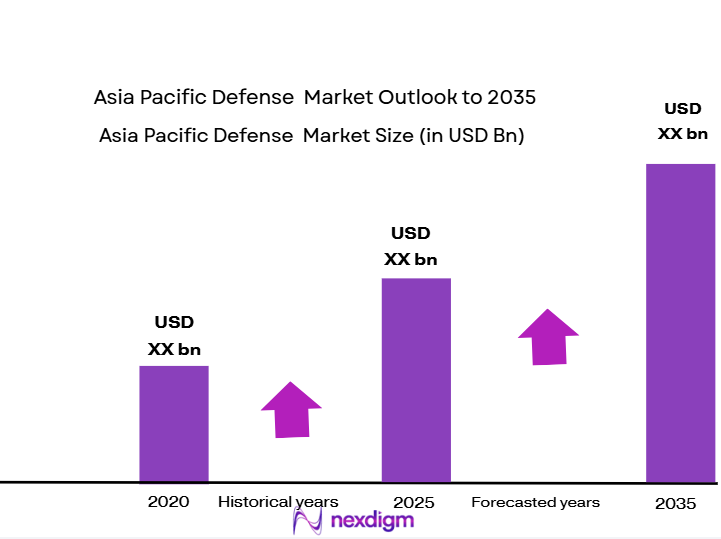

Market Overview

The Asia Pacific defense market reached approximately USD ~ billion based on a recent historical assessment, driven by sustained increases in military expenditure across major economies and expanding investments in advanced combat capabilities. Rising geopolitical tensions, modernization initiatives, and growing emphasis on deterrence strategies continue to shape procurement patterns. Governments are allocating larger budgets toward next-generation technologies including missile defense, cyber warfare, and autonomous systems, reinforcing long-term market expansion and strengthening regional security architectures.

China, India, Japan, and South Korea dominate the regional landscape due to large defense budgets, expanding force structures, and strategic modernization priorities. China accounts for roughly half of regional expenditure, while Japan recorded its largest spending increase in decades to strengthen air defense and strike capabilities. South Korea maintains one of the highest military burdens globally, and India continues investing in capability development, collectively reinforcing the region’s operational readiness and technological advancement.

Market Segmentation

By Product Type:

Asia Pacific Defense market is segmented by product type into land defense systems, naval defense systems, air defense systems, missile defense systems, and cyber defense systems. Recently, air defense systems have a dominant market share due to increasing concerns over aerial threats, missile proliferation, and the necessity for multi-layered protection frameworks. Governments are prioritizing integrated radar, interception, and surveillance networks capable of responding to evolving threat vectors. The rapid advancement of hypersonic weapons and unmanned aerial vehicles has intensified demand for sophisticated detection and neutralization technologies. Defense planners view air defense as essential for protecting critical infrastructure and maintaining territorial integrity. Procurement programs increasingly emphasize interoperability across armed forces, enabling coordinated responses. Additionally, modernization of legacy platforms is accelerating replacement cycles, while domestic manufacturing initiatives support technological self-reliance. These factors collectively position air defense systems as the cornerstone of regional defense investment strategies.

By Platform:

Asia Pacific Defense market is segmented by platform into ground platforms, naval platforms, airborne platforms, space-based platforms, and unmanned platforms. Recently, ground platforms have a dominant market share due to their central role in territorial security and rapid deployment operations. Nations continue investing in armored vehicles, artillery, and mobile command systems to enhance battlefield mobility and resilience. Border tensions and internal security priorities further encourage modernization of land forces. Ground platforms also offer operational flexibility across diverse terrains, making them indispensable for regional defense doctrines. Technological upgrades such as active protection systems and digital battlefield integration are improving survivability and coordination. Moreover, large standing armies across several Asia Pacific nations necessitate sustained equipment procurement. With defense strategies increasingly emphasizing readiness and force projection, ground platforms remain a foundational component of military capability development.

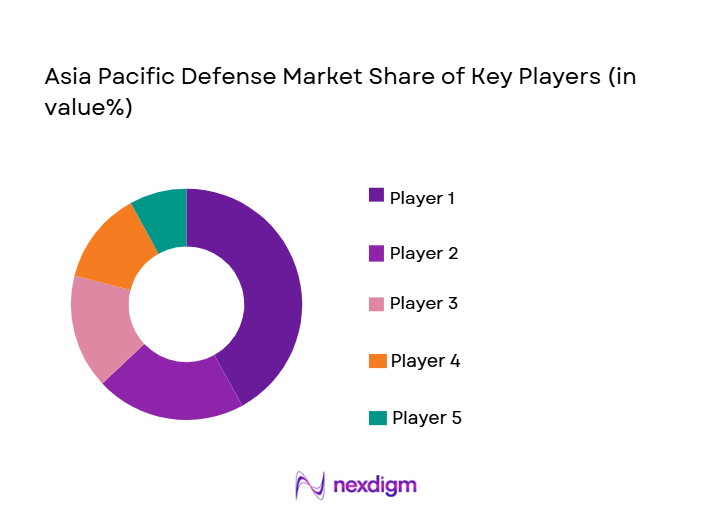

Competitive Landscape

The Asia Pacific defense market is highly competitive yet moderately consolidated, with major global and regional contractors securing multi-year procurement agreements through government tenders. Competitive strength is defined by technological innovation, production scale, and the ability to deliver integrated multi-domain capabilities. Strategic partnerships, indigenous manufacturing initiatives, and long-term modernization programs continue shaping supplier positioning across the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Contract Backlog |

| Lockheed Martin Corporation | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Heavy Industries | 1884 | Japan | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Defense Market Analysis

Growth Drivers

Escalating Regional Security Tensions and Strategic Deterrence Requirements:

Heightened geopolitical friction across maritime boundaries and contested territories is compelling governments to expand military capabilities at an accelerated pace. Defense planners increasingly prioritize deterrence frameworks that discourage aggression while maintaining operational readiness. Investments are flowing into advanced surveillance networks, long-range strike assets, and layered defense architectures capable of countering diverse threat scenarios. Strategic competition among major powers is encouraging neighboring states to strengthen force posture and enhance interoperability with allies. Procurement programs now emphasize resilience against hybrid warfare, including cyber and electronic threats. Military doctrines are evolving toward rapid response models supported by precision technologies. Additionally, expanding joint exercises demonstrate a collective focus on preparedness. Governments are also enhancing intelligence capabilities to improve situational awareness. As uncertainty persists across strategic corridors, sustained defense spending is becoming embedded within national security policy. These dynamics collectively reinforce long-term expansion of the regional defense market.

Acceleration of Military Modernization and Technological Transformation:

Armed forces across Asia Pacific are replacing aging equipment with technologically advanced platforms designed for multi-domain operations. Modernization initiatives increasingly integrate artificial intelligence, autonomous systems, and network-centric communication frameworks to improve decision-making speed. Defense ministries are prioritizing capabilities that enhance precision, survivability, and operational efficiency. Indigenous research programs are expanding to reduce dependence on imports while strengthening domestic industrial ecosystems. Governments are also encouraging private-sector participation to accelerate innovation cycles. The adoption of digital battlefield technologies enables seamless coordination across air, land, sea, cyber, and space domains. Lifecycle upgrades are extending the relevance of existing platforms while incorporating advanced sensors and data analytics. Budget allocations increasingly reflect long-term capability planning rather than short-term procurement. Collaborative development agreements are further facilitating technology transfer. As modernization becomes central to defense strategy, demand for integrated systems is expected to remain strong.

Market Challenges

Budgetary Pressures and Competing Fiscal Priorities:

Although defense spending is rising, governments must balance military investment with economic development, healthcare, and infrastructure commitments. Economic volatility can constrain procurement timelines and force reassessment of large-scale programs. Currency fluctuations may increase acquisition costs, particularly for imported technologies. Policymakers often face scrutiny over defense allocations, especially during periods of fiscal tightening. Long development cycles can further strain financial planning. Cost overruns in complex programs occasionally lead to delays or restructuring. Smaller economies may prioritize incremental upgrades instead of comprehensive modernization. Debt considerations also influence long-term expenditure strategies. Defense ministries must therefore optimize procurement efficiency while maintaining readiness. These financial realities continue shaping purchasing behavior across the region.

Complex Procurement Processes and Regulatory Oversight:

Defense acquisitions typically involve extensive evaluation, compliance checks, and multi-stage approvals that can extend contract timelines. Transparency requirements and political oversight add additional layers of scrutiny. International regulations governing arms transfers may limit supplier options and complicate partnerships. Offset obligations often require foreign contractors to invest locally, increasing negotiation complexity. Technology security concerns can restrict knowledge sharing. Bureaucratic procedures sometimes slow deployment of urgently needed capabilities. Vendors must navigate varying regulatory frameworks across countries, raising administrative costs. Changing policy priorities may alter procurement pathways mid-cycle. Despite modernization urgency, institutional processes remain deliberate to mitigate risk. Consequently, regulatory complexity persists as a structural constraint within the defense market.

Opportunities

Expansion of Indigenous Defense Manufacturing Capabilities:

Governments throughout Asia Pacific are promoting domestic production to enhance strategic autonomy and reduce reliance on external suppliers. Industrial policies increasingly incentivize local research, manufacturing, and supply chain development. Defense offsets are fostering technology transfer that strengthens national capabilities. Domestic firms benefit from stable demand generated by long-term procurement plans. Workforce development initiatives are building specialized engineering expertise. Localization also shortens logistics chains, improving operational readiness. Partnerships between public and private entities are accelerating innovation across advanced materials and electronics. Export potential is emerging as indigenous platforms achieve global competitiveness. Political commitment to self-reliance further reinforces investment momentum. As ecosystems mature, domestic manufacturing is expected to become a major growth engine for the regional defense market.

Integration of Artificial Intelligence and Autonomous Warfare Systems:

Defense organizations are rapidly adopting AI-driven technologies to enhance battlefield awareness, predictive analytics, and mission planning. Autonomous platforms reduce operational risk while improving efficiency across surveillance and reconnaissance missions. Machine learning algorithms enable faster threat detection and response coordination. Suppliers are developing intelligent command systems capable of processing large data volumes in real time. AI also supports maintenance forecasting, minimizing downtime. Governments view these capabilities as force multipliers within constrained manpower environments. Ethical frameworks and regulatory guidance are evolving to support responsible deployment. Collaborative innovation between defense agencies and technology firms is accelerating progress. Investment in robotics and unmanned systems continues rising. This technological convergence is poised to reshape defense operations and unlock significant market potential.

Future Outlook

The Asia Pacific defense market is expected to expand steadily over the next five years, supported by sustained military expenditure and rapid technological innovation. Advancements in autonomous systems, cyber defense, and integrated command networks are likely to redefine operational capabilities. Regulatory support for domestic manufacturing will strengthen industrial resilience, while geopolitical uncertainties continue reinforcing procurement momentum. As modernization priorities intensify, the region is positioned to remain a central driver of global defense investment.

Major Players

• Raytheon Technologies Corporation

• Northrop Grumman Corporation

• BAE Systems

• Thales Group

• General Dynamics Corporation

• L3Harris Technologies

• Leonardo S.p.A.

• Mitsubishi Heavy Industries

• Hanwha Aerospace

• Hindustan Aeronautics Limited

• Bharat Electronics Limited

• Korea Aerospace Industries

• China Aerospace Science and Technology Corporation

• Israel Aerospace Industries

Key Target Audience

• Armed forces procurement agencies

• Aerospace and defense manufacturers

• Naval command authorities

• Air force modernization divisions

• Homeland security agencies

• Investments and venture capitalist firms

• Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Critical variables such as military expenditure, modernization programs, procurement pipelines, and technological adoption were identified through structured secondary research. Defense databases and official budget disclosures supported baseline evaluation.

Step 2: Market Analysis and Construction

Top-down and bottom-up approaches were applied to estimate market size and segment distribution. Spending data was cross-validated with contractor activity to ensure analytical consistency.

Step 3: Hypothesis Validation and Expert Consultation

Insights from defense analysts, aerospace engineers, and procurement specialists validated assumptions regarding capability development and investment priorities, strengthening the analytical framework.

Step 4: Research Synthesis and Final Output

Validated datasets were consolidated into a cohesive structure emphasizing reliability and strategic relevance. Quantitative findings were integrated with qualitative interpretation to support informed defense planning.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions strengthening defense preparedness

Expanding military modernization programs

Growth in indigenous defense manufacturing

Acceleration of multi-domain warfare capabilities

Increasing investments in advanced surveillance technologies - Market Challenges

Budget allocation pressures across emerging economies

Complex defense procurement procedures

Technology integration across legacy platforms

Export restrictions affecting collaboration

Supply chain dependencies for critical components - Market Opportunities

Expansion of regional defense alliances

Adoption of AI-driven battlefield systems

Growth in autonomous and unmanned defense platforms - Trends

Shift toward network-centric warfare strategies

Rapid adoption of unmanned systems

Integration of cyber and electronic warfare capabilities

Development of hypersonic weapon technologies

Emphasis on space-based defense infrastructure - Government Regulations & Defense Policy

National defense industrialization policies

Strategic procurement and offset regulations

Cross-border defense cooperation frameworks - SWOT Analysis

Stakeholder and Ecosystem Analysis - Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Land Defense Systems

Naval Defense Systems

Air Defense Systems

Missile Defense Systems

Cyber Defense Systems - By Platform Type (In Value%)

Ground Platforms

Surface Naval Platforms

Subsurface Platforms

Airborne Platforms

Space-Based Platforms - By Fitment Type (In Value%)

New Procurement Programs

Mid-Life Upgrade Systems

Retrofit Defense Solutions

Modular Deployment Systems

Integrated Defense Architectures - By EndUser Segment (In Value%)

Army Forces

Naval Forces

Air Forces

Joint Command Units

Homeland Security Agencies - By Procurement Channel (In Value%)

Direct Government Contracts

Foreign Military Sales

Joint Development Agreements

Public-Private Partnerships

Defense Offsets Programs - By Material / Technology (in Value %)

Artificial Intelligence Enabled Systems

Advanced Composite Armor

Directed Energy Technologies

Autonomous Defense Platforms

Next-Generation Radar Systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Technological Capability, Manufacturing Scale, Defense Portfolio Breadth, Strategic Partnerships, R&D Investment, Contract Backlog Strength, Export Capability, Systems Integration Expertise, Lifecycle Support Services, Cost Competitiveness) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin Corporation

Raytheon Technologies Corporation

Northrop Grumman Corporation

BAE Systems

Thales Group

General Dynamics Corporation

L3Harris Technologies

Leonardo S.p.A.

Mitsubishi Heavy Industries

Hanwha Aerospace

Hindustan Aeronautics Limited

Bharat Electronics Limited

Korea Aerospace Industries

China Aerospace Science and Technology Corporation

Israel Aerospace Industries

- Army forces prioritizing modernization of armored and artillery capabilities

- Naval forces expanding blue-water operational capacity

- Air forces investing in next-generation combat aircraft

- Homeland agencies strengthening border and cyber security frameworks

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035