Market Overview

The Asia Pacific drones market generated revenue of approximately USD ~ billion based on a recent historical assessment, reflecting strong regional adoption across commercial and defense applications. Growth is primarily driven by precision agriculture deployment, infrastructure inspection, logistics experimentation, and expanding autonomous capabilities supported by favorable regulatory initiatives. Increasing sensor sophistication and GPS-enabled analytics continue improving operational efficiency, while public-sector incentives and enterprise digitization accelerate procurement across multiple industries.

China, India, Japan, and South Korea represent dominant contributors due to strong manufacturing ecosystems, government-backed innovation programs, and rising defense modernization efforts. China leads with extensive domestic production capacity and technological investment, while India benefits from policy platforms supporting drone deployment across rural landscapes. Urban technology hubs such as Shenzhen, Bengaluru, Tokyo, and Seoul foster research partnerships and supply-chain integration, enabling rapid commercialization and reinforcing the region’s strategic leadership in unmanned aerial capabilities.

Market Segmentation

By Product Type

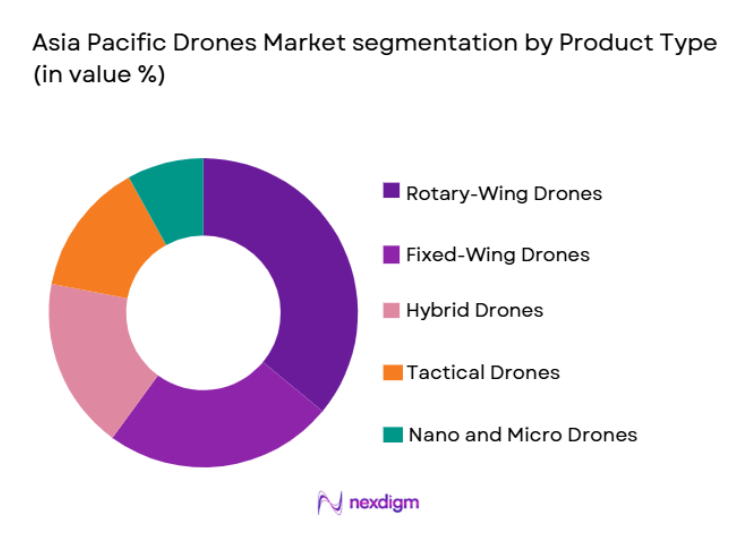

Asia Pacific Drones market is segmented by product type into fixed-wing drones, rotary-wing drones, hybrid drones, nano and micro drones, and tactical drones. Recently, rotary-wing drones have a dominant market share due to operational flexibility, vertical takeoff capability, and suitability for dense urban environments common across major Asia Pacific economies. Their widespread use in surveillance, agriculture, and infrastructure inspection enhances demand, while relatively lower training requirements support adoption among commercial operators. Defense agencies also favor rotary platforms for intelligence missions requiring maneuverability and precision hovering. Growing investments in smart-city surveillance further reinforce deployment across municipal authorities. Additionally, improvements in battery endurance and payload capacity allow rotary drones to perform complex tasks previously limited to fixed-wing systems, strengthening their procurement momentum across both public and private sectors in the region.

By Application

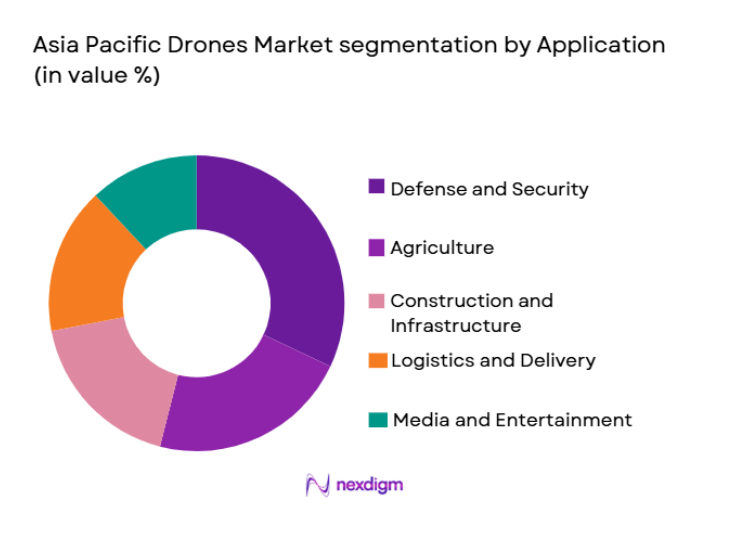

Asia Pacific Drones market is segmented by application into agriculture, defense and security, construction and infrastructure, logistics and delivery, and media and entertainment. Recently, defense and security has a dominant market share due to heightened geopolitical awareness, border monitoring requirements, and sustained procurement programs across several regional militaries. Governments increasingly integrate unmanned platforms for reconnaissance, disaster response, and maritime patrol, reducing operational risk while enhancing situational awareness. Persistent surveillance demand across contested zones further drives acquisition cycles. Additionally, modernization budgets prioritize autonomous technologies capable of force multiplication without proportional manpower expansion. Collaborative defense initiatives and indigenous manufacturing programs also accelerate adoption, ensuring steady long-term demand from national security agencies while influencing technological standards throughout the broader ecosystem.

Competitive Landscape

The Asia Pacific drones market exhibits moderate consolidation, characterized by established aerospace manufacturers, specialized UAV developers, and rapidly scaling regional firms. Leading companies influence pricing structures, technological benchmarks, and supply-chain partnerships through continuous innovation in autonomy, payload integration, and endurance systems. Strategic collaborations with defense agencies and commercial enterprises further reinforce competitive positioning, while domestic manufacturing incentives in major economies encourage localized production, intensifying rivalry yet simultaneously expanding the overall addressable market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| DJI | 2006 | Shenzhen, China | ~ | ~ | ~ | ~ | ~ |

| AeroVironment | 1971 | Virginia, U.S. | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Parrot SA | 1994 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Drones Market Analysis

Growth Drivers

Accelerating Government Investments in Autonomous Defense Systems

Defense modernization programs across Asia Pacific increasingly prioritize unmanned aerial capabilities to strengthen intelligence gathering, border surveillance, and rapid-response operations. Governments recognize drones as cost-efficient force multipliers that reduce human exposure in high-risk environments while expanding operational reach. Procurement cycles are expanding as armed forces adopt layered surveillance strategies integrating UAVs with satellite and radar networks. Domestic production incentives encourage local firms to develop advanced platforms, reducing reliance on imports and enhancing supply-chain resilience. Strategic tensions in maritime corridors further compel governments to deploy persistent aerial monitoring solutions capable of real-time data transmission. Defense agencies also emphasize interoperability, ensuring drones can function within broader digital battlefield architectures. Continued funding for artificial intelligence integration is enabling semi-autonomous mission execution, lowering operator workload and improving accuracy. Public-sector research partnerships with private manufacturers accelerate prototype deployment and technology maturation. These factors collectively establish a durable demand foundation that supports long-term market expansion across both tactical and strategic drone categories.

Expanding Commercial Utilization Across Agriculture and Infrastructure

Throughout the region increasingly deploy drones to enhance productivity, minimize operational costs, and improve data-driven decision-making. Precision agriculture applications enable crop monitoring, irrigation planning, and fertilizer optimization through advanced imaging technologies, transforming traditional farming practices into digitally managed ecosystems. Infrastructure developers rely on UAV mapping tools for terrain analysis, structural inspections, and project monitoring, significantly shortening evaluation timelines. Logistics experimentation is also progressing, particularly in geographically complex markets where aerial transport reduces dependency on ground routes. Smart-city initiatives are incorporating drones into traffic management, environmental monitoring, and emergency response frameworks. Improvements in battery efficiency and sensor miniaturization allow longer missions with higher-resolution outputs, strengthening return on investment for commercial operators. Regulatory reforms gradually supporting beyond-visual-line-of-sight operations further unlock scalable enterprise deployments. As digital transformation accelerates across sectors, drones increasingly function as critical operational assets rather than experimental technologies.

Market Challenges

Regulatory Fragmentation Across National Aviation Authorities

Despite growing adoption, inconsistent aviation frameworks across Asia Pacific create operational complexity for manufacturers and service providers. Each jurisdiction maintains distinct certification procedures, flight restrictions, and licensing requirements, complicating cross-border deployments and delaying commercialization timelines. Companies must often redesign compliance strategies for individual markets, increasing administrative costs and prolonging approval cycles. Airspace integration remains particularly challenging in densely populated urban centers where safety concerns necessitate cautious regulatory progression. Uncertainty surrounding beyond-visual-line-of-sight permissions restricts scalable logistics operations and limits enterprise experimentation. Data privacy considerations further influence drone usage policies, especially in surveillance contexts. Smaller firms face disproportionate burdens when navigating fragmented regulatory environments, potentially slowing innovation. Although harmonization efforts are underway through regional aviation dialogues, implementation timelines vary considerably. Until greater standardization emerges, regulatory divergence will continue shaping investment decisions and influencing market entry strategies.

High Capital Requirements and Technological Complexity

Advanced drone systems demand substantial upfront investment in research, component engineering, software development, and testing infrastructure. Manufacturers must integrate propulsion technologies, navigation systems, sensors, and cybersecurity safeguards into cohesive platforms, requiring multidisciplinary expertise. Rapid technological evolution also shortens product lifecycles, compelling companies to sustain continuous innovation spending to remain competitive. Enterprise buyers frequently hesitate due to high acquisition costs, particularly when scaling fleet deployments. Maintenance requirements, battery replacement cycles, and operator training further increase total ownership expenses. Supply-chain dependencies on specialized semiconductors and imaging equipment expose producers to price volatility and procurement delays. Additionally, cybersecurity risks necessitate investment in encrypted communication channels and secure data storage. These financial and technological pressures can constrain market participation, especially for emerging firms lacking robust capital backing, thereby reinforcing competitive concentration among established players.

Opportunities

Integration of Artificial Intelligence for Fully Autonomous Operations

Artificial intelligence is redefining drone capabilities by enabling predictive navigation, automated obstacle avoidance, and real-time analytics. Autonomous flight systems significantly reduce reliance on manual control, allowing operators to manage multiple platforms simultaneously and improving mission scalability. Machine learning algorithms enhance object recognition accuracy, expanding applications in disaster response, wildlife monitoring, and industrial inspections. Defense organizations increasingly pursue swarm technologies capable of coordinated maneuvers, creating new procurement pathways. Commercial enterprises benefit from automated data interpretation, transforming aerial imagery into actionable insights without extensive human intervention. As computing hardware becomes more energy efficient, onboard processing capabilities continue advancing. Partnerships between software developers and hardware manufacturers accelerate innovation cycles, while venture funding supports experimentation. The convergence of AI and UAV technology positions autonomy as a transformative growth vector across the regional ecosystem.

Emergence of Urban Air Mobility and Drone Logistics Networks

Rapid urbanization throughout Asia Pacific is intensifying demand for alternative transportation models capable of alleviating congestion and improving delivery speed. Drone logistics networks offer compelling advantages in densely populated environments by bypassing ground infrastructure limitations. Retailers and healthcare providers increasingly explore aerial delivery for time-sensitive shipments, including medical supplies. Government pilot programs testing low-altitude corridors signal institutional willingness to support future integration. Infrastructure investment in charging stations and traffic management platforms strengthens ecosystem readiness. Advances in payload capacity allow drones to handle heavier cargo, broadening commercial viability. Environmental considerations also favor electric aerial systems that generate fewer emissions than conventional transport. As regulatory clarity improves, large-scale deployment could redefine last-mile logistics economics and unlock substantial revenue streams across metropolitan regions.

Future Outlook

The Asia Pacific drones market is expected to experience sustained expansion supported by technological maturation, defense modernization, and enterprise digitization. Advancements in autonomy, sensor fusion, and battery chemistry will likely enhance operational reliability while lowering lifecycle costs. Regulatory bodies are gradually refining frameworks that encourage commercial deployment without compromising safety standards. Rising demand from agriculture, logistics, and smart infrastructure projects will reinforce procurement momentum, positioning the region as a central hub for unmanned innovation over the coming years.

Major Players

- DJI

- AeroVironment

- Israel Aerospace Industries

- Elbit Systems

- Parrot SA

- Northrop Grumman

- Boeing

- Lockheed Martin

- Teledyne FLIR

- Yuneec International

- Autel Robotics

- General Atomics

- Saab AB

- Textron Systems

- Thales Group

Key Target Audience

- Defense ministries

- Commercial agriculture enterprises

- Infrastructure development companies

- Logistics and delivery operators

- Aerospace manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Homeland security agencies

Research Methodology

Step 1: Identification of Key Variables

Primary variables including procurement volumes, component adoption, application demand, and regulatory developments were identified. Secondary indicators such as defense expenditure patterns and enterprise digitization trends were also evaluated to contextualize market dynamics.

Step 2: Market Analysis and Construction

Historical datasets were synthesized with industry publications and financial disclosures to construct baseline estimates. Segmentation models were applied to map revenue distribution across product categories and operational use cases.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were cross-verified through consultations with industry professionals, technology specialists, and supply-chain participants. Divergent assumptions were recalibrated to ensure analytical consistency.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into a structured framework emphasizing demand drivers, constraints, and competitive positioning. Quantitative and qualitative analyses were integrated to produce a coherent market outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing adoption of unmanned systems in military operations

Rising demand for aerial surveillance and intelligence

Expansion of commercial drone applications

Advancements in autonomous flight technologies

Government support for domestic drone manufacturing - Market Challenges

Airspace management and regulatory constraints

Cybersecurity vulnerabilities in unmanned platforms

High development costs for advanced drones

Limited battery endurance affecting mission range

Integration complexity with existing defense systems - Market Opportunities

Growth in drone swarm technologies

Expansion of drone logistics networks

Integration of AI-enabled analytics in drone operations - Trends

Shift toward fully autonomous drone missions

Miniaturization of sensors and payload systems

Increasing use of drones in disaster response

Adoption of hybrid propulsion technologies

Emergence of counter-drone defense solutions - Government Regulations & Defense Policy

National unmanned aircraft regulatory frameworks

Defense procurement policies for autonomous systems

Export control measures governing drone technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-Wing Drones

Rotary-Wing Drones

Hybrid VTOL Drones

Nano and Micro Drones

Tactical Unmanned Aerial Systems - By Platform Type (In Value%)

Airborne ISR Platforms

Combat and Strike Platforms

Logistics and Cargo Platforms

Surveillance Platforms

Mapping and Survey Platforms - By Fitment Type (In Value%)

Line-Fit Drone Systems

Modular Payload Integration

Retrofit Sensor Installations

Swarm-Enabled Configurations

Autonomous Navigation Packages - By EndUser Segment (In Value%)

Military Forces

Homeland Security Agencies

Commercial Enterprises

Agriculture Operators

Infrastructure and Utility Companies - By Procurement Channel (In Value%)

Direct Government Contracts

Defense Procurement Programs

Commercial Vendor Procurement

Leasing and Service-Based Models

Public-Private Partnerships - By Material / Technology (in Value %)

Composite Airframe Structures

AI-Based Flight Control Systems

Electro-Optical and Infrared Sensors

Satellite Navigation Modules

Edge Computing Payloads

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Flight Endurance, Payload Capacity, Autonomous Capability, Sensor Integration, Manufacturing Scale, Cost Efficiency, Operational Range, AI Capability, Export Reach, Aftermarket Support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SZ DJI Technology Co., Ltd.

AeroVironment, Inc.

Northrop Grumman Corporation

Lockheed Martin Corporation

Israel Aerospace Industries

Elbit Systems Ltd.

Parrot SA

Teledyne FLIR LLC

General Atomics Aeronautical Systems

Bharat Electronics Limited

Hindustan Aeronautics Limited

Korea Aerospace Industries

Yuneec International

BAE Systems

Thales Group

- Military forces emphasizing ISR and tactical deployment capabilities

- Commercial sectors leveraging drones for operational efficiency

- Homeland agencies expanding border and urban surveillance

- Infrastructure operators adopting drones for asset inspection

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035