Market Overview

Based on a recent historical assessment, the Asia Pacific fighter aircraft market was valued at approximately USD ~ billion, driven primarily by expanding defense budgets, rapid fleet modernization, and procurement of next-generation combat aircraft. Governments across the region continue investing in stealth platforms, advanced avionics, and multi-role fighters to strengthen aerial superiority. Collaborative development programs and export partnerships further stimulate industry expansion, while long-term capability enhancement strategies sustain procurement pipelines across emerging and established defense economies.

Dominant countries include China, India, Japan, and South Korea, supported by large defense allocations, indigenous manufacturing programs, and strategic modernization agendas. Industrial hubs such as Chengdu, Bengaluru, Nagoya, and Sacheon benefit from strong aerospace ecosystems and government backing. Regional demand is reinforced by geopolitical tensions and territorial security priorities, encouraging sustained fighter acquisitions and technology upgrades. Cross-border defense collaborations and offset agreements continue strengthening domestic production capacity throughout the Asia Pacific aerospace network.

Market Segmentation

By Product Type

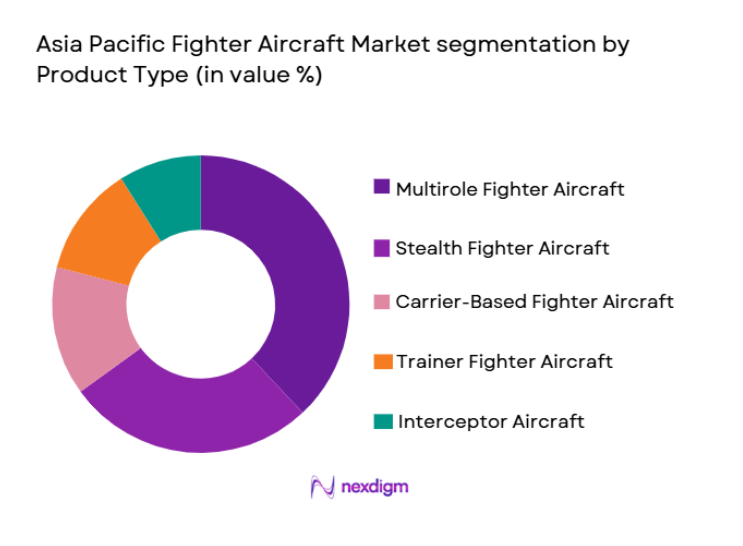

Asia Pacific Fighter Aircraft market is segmented by product type into stealth fighter aircraft, multirole fighter aircraft, interceptor aircraft, carrier-based fighter aircraft, and trainer fighter aircraft. Recently, multirole fighter aircraft has a dominant market share due to operational flexibility, allowing air forces to conduct air superiority, strike, reconnaissance, and electronic warfare missions using a single platform. Defense agencies increasingly prioritize cost efficiency and lifecycle optimization, making multirole jets attractive compared to specialized platforms. Strong procurement pipelines, interoperability with allied forces, and compatibility with modern weapons further strengthen adoption. Additionally, modernization programs across developing defense economies favor adaptable aircraft capable of meeting diverse mission requirements without requiring multiple fleet categories, reinforcing their leadership position in regional acquisitions.

By Platform

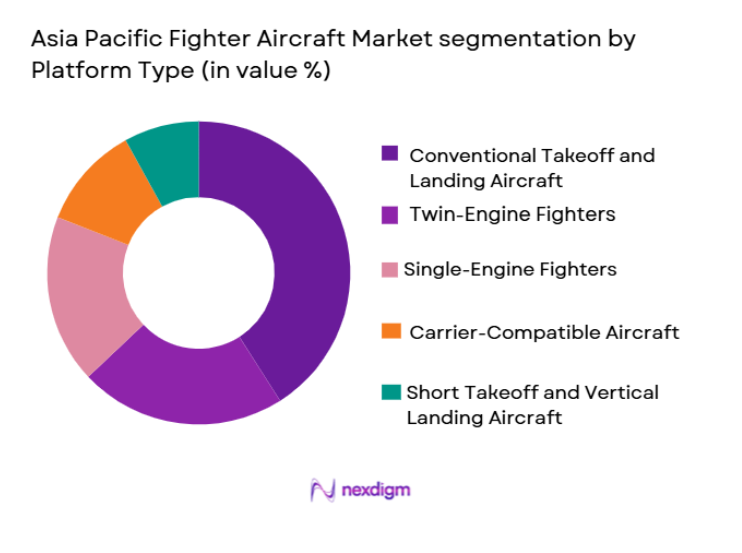

Asia Pacific Fighter Aircraft market is segmented by platform into conventional takeoff and landing aircraft, short takeoff and vertical landing aircraft, carrier-compatible aircraft, twin-engine fighters, and single-engine fighters. Recently, conventional takeoff and landing aircraft has a dominant market share due to widespread infrastructure compatibility and lower operational complexity. Most regional airbases are designed for conventional operations, enabling rapid deployment without costly runway modifications. Procurement strategies also favor proven reliability, easier maintenance frameworks, and established supply chains. Furthermore, conventional platforms support large payload capacities and extended range, aligning with regional defense doctrines focused on deterrence and territorial protection. Their operational maturity reduces training timelines and lifecycle risks, making them the preferred choice for both modernization and fleet expansion initiatives.

Competitive Landscape

The Asia Pacific fighter aircraft market is moderately consolidated, with a limited number of prime contractors controlling major procurement programs. Large aerospace manufacturers benefit from long-term government contracts, technological specialization, and integrated supply chains. Strategic partnerships, licensed production agreements, and domestic manufacturing initiatives are reshaping competition, enabling regional firms to challenge traditional Western suppliers while maintaining collaborative development models for advanced combat platforms.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Indigenous Production Capability |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | United States | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | India | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Fighter Aircraft Market Analysis

Growth Drivers

Accelerating Defense Modernization Across Asia Pacific

Accelerating defense modernization across Asia Pacific is significantly expanding demand for advanced fighter aircraft as governments prioritize air superiority within evolving security frameworks. Regional forces are transitioning from aging fleets toward digitally enabled platforms equipped with integrated sensors, electronic warfare suites, and precision strike capabilities. Strategic doctrines increasingly emphasize network-centric warfare, requiring aircraft capable of real-time data sharing across air, land, and maritime domains. Procurement cycles are therefore shifting toward technologically sophisticated fighters with upgrade potential rather than legacy platforms. Industrial policies promoting domestic aerospace manufacturing further support acquisition programs by reducing import dependence. Technology transfer agreements enable local assembly, maintenance infrastructure development, and workforce specialization, strengthening long-term operational readiness. Rising interoperability requirements with allied nations also influence platform selection, encouraging purchases aligned with multinational defense architectures. Enhanced training ecosystems and simulator investments improve fleet utilization rates while supporting rapid pilot readiness. Additionally, lifecycle sustainment strategies now factor heavily into procurement decisions, prompting adoption of fighters designed for modular upgrades. Collectively, modernization initiatives reinforce stable procurement pipelines and create sustained growth momentum for the regional fighter aircraft ecosystem.

Rising Geopolitical Tensions and Territorial Security Priorities

Rising geopolitical tensions and territorial security priorities continue to shape fighter aircraft procurement strategies across Asia Pacific defense establishments. Maritime disputes, contested airspaces, and shifting alliance structures are motivating governments to strengthen deterrence capabilities through advanced aerial combat assets. Air power increasingly serves as a strategic instrument for rapid response, surveillance, and force projection, reinforcing the need for technologically superior fleets. Defense planners are prioritizing aircraft with longer operational ranges and enhanced situational awareness to address expansive territorial responsibilities. Joint exercises and coalition operations further elevate requirements for interoperable fighter platforms capable of integrating seamlessly into multinational command frameworks. Budget allocations reflect this urgency, often favoring combat aviation programs despite broader fiscal pressures. Indigenous development efforts are simultaneously accelerating to ensure sovereign control over critical defense technologies. Export-oriented production strategies also support economic objectives while expanding geopolitical influence. As threat perceptions evolve, procurement timelines are shortening, encouraging multi-year acquisition agreements that stabilize industry demand. These security dynamics collectively underpin consistent investment flows into fighter aircraft programs across the region.

Market Challenges

High Acquisition and Lifecycle Sustainment Costs

High acquisition and lifecycle sustainment costs represent a major constraint for the Asia Pacific fighter aircraft market, particularly for emerging defense economies balancing modernization with fiscal discipline. Advanced fighters require substantial upfront capital for procurement, infrastructure upgrades, and training ecosystems. Beyond purchase expenses, long-term maintenance, spare parts provisioning, and software upgrades significantly increase total ownership costs. Budget planners must therefore evaluate tradeoffs between fleet size and technological sophistication, often delaying acquisitions to maintain financial stability. Currency fluctuations and inflation further complicate multi-year defense contracts, potentially escalating program costs. Complex supply chains also contribute to expenditure volatility, especially when components rely on specialized manufacturing processes. Sustainment requirements demand skilled technical personnel and dedicated facilities, increasing operational overhead. Governments are increasingly exploring joint procurement and co-development models to distribute financial risk while enhancing bargaining power. However, such arrangements introduce coordination challenges that may extend deployment timelines. Consequently, cost pressures continue influencing procurement strategies and may slow adoption among smaller defense forces.

Supply Chain Vulnerabilities and Technology Dependencies

Supply chain vulnerabilities and technology dependencies pose significant operational risks within the Asia Pacific fighter aircraft ecosystem as production relies heavily on specialized components and advanced materials. Engine systems, semiconductors, avionics modules, and stealth coatings require precision manufacturing that is often concentrated among limited suppliers. Disruptions caused by geopolitical friction, trade restrictions, or industrial bottlenecks can delay delivery schedules and escalate program costs. Governments increasingly recognize these risks and are investing in domestic manufacturing capabilities to enhance resilience. Nonetheless, achieving technological self-reliance demands long development cycles and substantial capital commitment. Collaborative development programs partially mitigate exposure but introduce dependency on partner nations’ export controls and regulatory approvals. Maintenance operations may also face challenges when spare parts availability fluctuates, affecting fleet readiness. Digital architectures add another layer of complexity, as cybersecurity considerations become integral to supply chain integrity. Strategic stockpiling and supplier diversification are emerging as mitigation strategies, yet implementation remains uneven across the region. These structural dependencies continue shaping procurement decisions and industrial policy priorities.

Opportunities

Expansion of Indigenous Fighter Development Programs

Expansion of indigenous fighter development programs presents a transformative opportunity for the Asia Pacific fighter aircraft market as governments seek technological sovereignty and industrial growth. Domestic programs stimulate high-value manufacturing, research capabilities, and skilled workforce development, strengthening national aerospace ecosystems. Local production reduces reliance on foreign suppliers while enabling customization aligned with operational doctrines. Governments frequently integrate offset requirements into procurement contracts, ensuring technology transfer that accelerates domestic innovation. Indigenous platforms also enhance export potential, allowing countries to participate more actively in the global defense marketplace. Public-private partnerships are increasingly supporting subsystem development, including avionics, propulsion, and mission software. Over time, localized supply chains can improve cost predictability and shorten delivery timelines. National pride and strategic autonomy further reinforce political commitment to such initiatives. As development maturity increases, regional manufacturers may evolve from license producers to original designers, expanding competitive dynamics. This structural shift creates long-term growth pathways not only for aircraft production but also for maintenance, training, and modernization services.

Integration of Artificial Intelligence and Advanced Combat Technologies

Integration of artificial intelligence and advanced combat technologies is reshaping the future trajectory of fighter aircraft capabilities across Asia Pacific defense forces. AI-enabled decision support tools enhance pilot situational awareness by rapidly processing sensor data and identifying threats. Autonomous teaming concepts allow fighters to coordinate with unmanned systems, expanding mission flexibility while reducing operational risk. Advanced analytics also support predictive maintenance, improving aircraft availability and lowering lifecycle costs. Governments are investing heavily in next-generation avionics architectures designed to accommodate continuous software upgrades. Electronic warfare enhancements and adaptive mission systems further strengthen survivability in contested environments. Technology convergence between cyber, space, and airborne domains is driving the evolution of multi-domain operational doctrines. Collaborative research programs accelerate innovation while distributing development expenses. Training methodologies are also evolving through immersive simulation technologies that replicate complex combat scenarios. As these capabilities mature, procurement priorities are expected to increasingly favor digitally native platforms, creating substantial opportunities for manufacturers specializing in advanced aerospace technologies.

Future Outlook

The Asia Pacific fighter aircraft market is expected to witness steady expansion as defense modernization remains a strategic priority. Technological advancements such as AI-enabled combat systems, stealth materials, and networked warfare capabilities will influence procurement decisions. Regulatory support for indigenous manufacturing is likely to strengthen domestic aerospace ecosystems. Rising security concerns and cross-border collaborations should sustain long-term demand. Overall, investment momentum indicates a structurally resilient growth trajectory over the coming five years.

Major Players

- Lockheed Martin

- BoeingDefense

- Dassault Aviation

- Saab AB

- Hindustan Aeronautics Limited

- Chengdu Aircraft Corporation

- Shenyang Aircraft Corporation

- Korea Aerospace Industries

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- BAE Systems

- Airbus Defence and Space

- Leonardo S.p.A.

- Rostec

- Turkish Aerospace Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries

- Air force procurement departments

- Aerospace component manufacturers

- Defense technology integrators

- Military maintenance providers

- Strategic weapons system suppliers

Research Methodology

Step 1: Identification of Key Variables

Critical variables including defense expenditure patterns, procurement pipelines, modernization programs, and fleet replacement cycles were identified. Regional geopolitical factors and industrial capabilities were also evaluated to establish foundational market parameters.

Step 2: Market Analysis and Construction

Comprehensive secondary research was combined with defense procurement data and aerospace production trends to construct the market framework. Segmentation models were developed to reflect platform demand, technology adoption, and operational requirements.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultations with defense analysts, aerospace specialists, and procurement stakeholders. Scenario testing ensured realistic assumptions aligned with strategic military developments across Asia Pacific.

Step 4: Research Synthesis and Final Output

All validated insights were synthesized into a structured analytical format. Quantitative indicators were integrated with qualitative assessments to produce a balanced, decision-ready market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Defense Budgets and Air Power Modernization

Growing Demand for Fifth-Generation Aircraft

Expansion of Indigenous Fighter Development Programs

Increasing Focus on Network-Centric Warfare

Strategic Military Alliances Driving Fleet Expansion - Market Challenges

Extremely High Acquisition and Lifecycle Costs

Lengthy Procurement and Approval Cycles

Technological Dependence on Foreign Suppliers

Complex Maintenance and Sustainment Requirements

Export Restrictions and Geopolitical Constraints - Market Opportunities

Next-Generation Fighter Programs and Collaborative Development

Integration of Artificial Intelligence in Combat Aircraft

Expansion of Upgrade and Retrofit Markets - Trends

Adoption of Stealth and Low-Observable Technologies

Shift Toward Multirole Combat Platforms

Increasing Use of Advanced Simulation Training

Growth in Electronic Warfare Capabilities

Digital Engineering in Aircraft Design - Government Regulations & Defense Policy

Defense Offset Policies Encouraging Local Manufacturing

Export Control Regulations Governing Fighter Technologies

Strategic Defense Modernization Frameworks - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Multirole Fighter Aircraft

Air Superiority Fighter Aircraft

Stealth Fighter Aircraft

Interceptor Aircraft

Light Combat Aircraft - By Platform Type (In Value%)

Land-Based Fighter Aircraft

Carrier-Based Fighter Aircraft

Short Takeoff and Vertical Landing Aircraft

Expeditionary Fighter Platforms

Joint Force Integrated Platforms - By Fitment Type (In Value%)

Line-Fit Aircraft

Retrofit Upgraded Aircraft

Mid-Life Upgrade Platforms

Avionics Modernization Fitments

Weapon System Integration Fitments - By EndUser Segment (In Value%)

National Air Forces

Naval Aviation Units

Joint Defense Commands

Training and Conversion Units

Allied Expeditionary Forces - By Procurement Channel (In Value%)

Government-to-Government Agreements

Direct Commercial Sales

Licensed Production Contracts

Strategic Defense Partnerships

Consortium-Based Procurement - By Material / Technology (in Value %)

Composite Airframe Structures

Radar-Absorbent Materials

Advanced AESA Radar Systems

Fly-by-Wire Control Technology

Integrated Electronic Warfare Suites

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Stealth Capability, Combat Radius, Payload Capacity, Radar Technology, Sortie Generation Rate, Upgrade Potential, Lifecycle Cost, Engine Performance, Avionics Integration, Mission Versatility)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Northrop Grumman

Dassault Aviation

Saab AB

BAE Systems

Mitsubishi Heavy Industries

Korea Aerospace Industries

Hindustan Aeronautics Limited

Chengdu Aircraft Corporation

Shenyang Aircraft Corporation

Aviation Industry Corporation of China

Sukhoi Company

Irkut Corporation

Leonardo

- Air forces prioritizing multirole fleets for operational flexibility

- Naval aviation expanding carrier-compatible fighter capabilities

- Defense agencies investing in pilot training and conversion platforms

- Joint commands emphasizing interoperable aircraft for coalition missions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035