Market Overview

The global freighter aircraft market reached approximately USD ~billion based on a recent historical assessment, supported by expanding cross-border trade, rising e-commerce shipment volumes, and continuous modernization of logistics fleets. Airlines and cargo operators are increasingly investing in dedicated freight platforms and passenger-to-freighter conversions to enhance payload efficiency and route flexibility. Technological advancements in aircraft design and growing requirements for rapid cargo transportation continue to reinforce capital deployment across commercial aviation supply chains.

Within this landscape, Asia Pacific has emerged as a strategic growth center due to its manufacturing dominance, export-led economies, and strong digital retail penetration. China, Japan, South Korea, Singapore, and India collectively support high cargo throughput through advanced airport infrastructure and integrated logistics corridors. Major urban hubs including Shanghai, Hong Kong, Singapore, Tokyo, and Seoul facilitate long-haul freight connectivity, while expanding regional trade agreements further accelerate aircraft procurement by cargo carriers seeking operational resilience and faster delivery cycles.

Market Segmentation

By Product Type

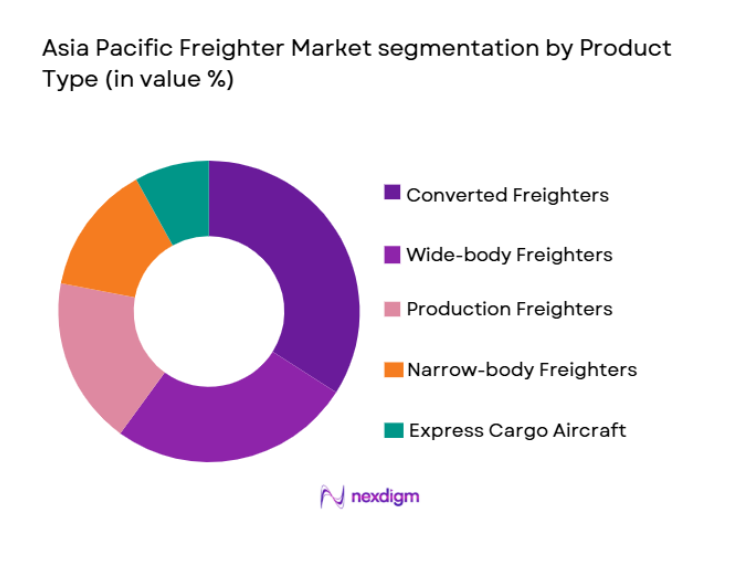

Asia Pacific Freighter Aircraft market is segmented by product type into wide-body freighters, narrow-body freighters, converted freighters, production freighters, and express cargo aircraft. Recently, converted freighters has a dominant market share due to factors such as lower acquisition costs, faster deployment timelines, strong aftermarket ecosystem, and airline preference for asset optimization. Operators increasingly retrofit aging passenger aircraft to address capacity shortages while avoiding long manufacturing lead times. This approach also aligns with financial risk mitigation strategies during demand fluctuations. Additionally, the surge in regional e-commerce distribution favors mid-capacity aircraft capable of high-frequency operations across short to medium distances. Leasing firms actively support conversion programs, improving accessibility for emerging cargo carriers. Maintenance providers across Asia Pacific further strengthen the segment through specialized engineering capabilities, making conversions a pragmatic and scalable solution for fleet expansion.

By Range

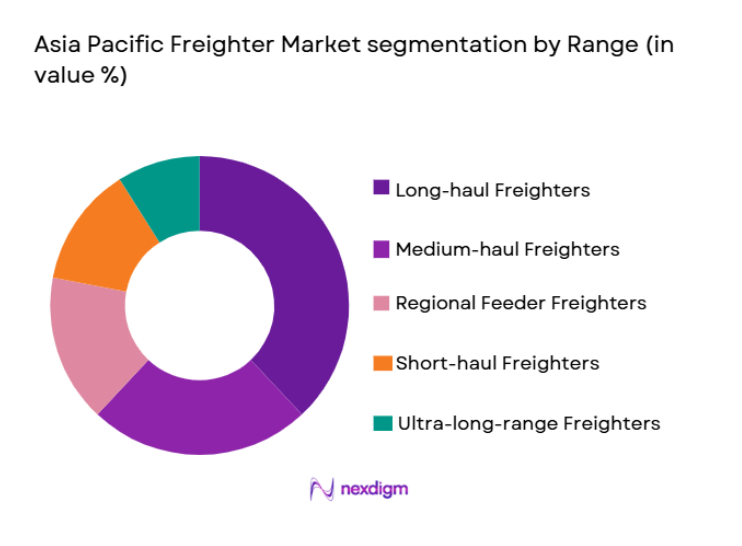

Asia Pacific Freighter Aircraft market is segmented by range into long-haul freighters, medium-haul freighters, short-haul freighters, ultra-long-range freighters, and regional feeder freighters. Recently, long-haul freighters has a dominant market share due to factors such as intercontinental trade expansion, high-value cargo movement, and demand for nonstop logistics routes between manufacturing bases and consumption markets. Export-intensive economies rely on wide coverage networks to maintain supply chain continuity, particularly for electronics, pharmaceuticals, and automotive components. Airlines prioritize aircraft capable of maximizing payload across extended distances to reduce per-unit transportation costs. Hub-and-spoke cargo models further reinforce long-haul demand, as central logistics gateways consolidate shipments before global distribution. Fleet planners increasingly favor aircraft with improved fuel efficiency and extended flight endurance, ensuring profitability despite volatile fuel prices. Consequently, long-haul capabilities remain central to strategic fleet procurement decisions across the region.

Competitive Landscape

The competitive landscape of the Asia Pacific Freighter Aircraft market reflects moderate consolidation, with global aerospace manufacturers and specialized conversion firms shaping supply dynamics. Large incumbents leverage technological expertise, certification capabilities, and long-term airline partnerships to sustain leadership positions, while regional engineering companies compete through cost efficiency and localized maintenance networks. Strategic collaborations between aircraft manufacturers, leasing companies, and logistics operators further intensify competitive positioning, enabling rapid fleet modernization and scalable cargo capacity deployment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Conversion Capability |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1997 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Freighter Aircraft Market Analysis

Growth Drivers

E-commerce Expansion Driving Air Cargo Fleet Modernization

The acceleration of digital commerce across Asia Pacific has fundamentally reshaped logistics networks, compelling cargo operators to expand dedicated aircraft capacity to maintain delivery timelines. Rapid fulfillment expectations are forcing airlines to prioritize speed over traditional shipping modes, particularly for high-value goods and time-sensitive inventory. Retail platforms increasingly rely on overnight and cross-border delivery models, strengthening the business case for freighter acquisition. Airlines are simultaneously transitioning from mixed cargo strategies toward specialized fleets that improve load optimization and scheduling reliability. Government investments in smart logistics corridors are reinforcing this shift by reducing airport bottlenecks and enhancing cargo handling efficiency. Additionally, supply chain diversification among multinational corporations is creating new freight corridors requiring dependable air transport solutions. Financial institutions are supporting aircraft procurement through leasing frameworks that lower capital barriers for carriers. Conversion programs also benefit from this trend, enabling rapid capacity additions without extensive manufacturing delays. As consumer expectations continue to prioritize immediacy, cargo airlines are expected to maintain aggressive fleet modernization strategies to remain competitive.

Supply Chain Resilience and Trade Diversification

Geopolitical volatility and pandemic-era disruptions have encouraged corporations to redesign supply chains with redundancy and geographic flexibility, significantly increasing reliance on air freight assets. Manufacturers across electronics, semiconductors, and medical equipment sectors increasingly utilize aircraft to protect production continuity during maritime disruptions. Regional trade agreements further stimulate cross-border goods movement, reinforcing the necessity for dependable cargo aviation infrastructure. Airlines are responding by integrating predictive analytics into route planning, improving operational resilience while maximizing aircraft utilization rates. Governments are concurrently strengthening aviation infrastructure through cargo terminal expansion and regulatory streamlining to support export competitiveness. Fleet planners are therefore prioritizing aircraft capable of operating across diverse route structures without compromising payload efficiency. Insurance providers and financiers also favor modern freighter fleets due to their stronger lifecycle economics and operational predictability. Strategic stockpiling practices among large manufacturers additionally sustain consistent cargo demand. Collectively, these structural adjustments position freighter aircraft as critical enablers of resilient global trade networks.

Market Challenges

High Capital Intensity and Lifecycle Costs

Procuring freighter aircraft requires substantial financial commitment, encompassing acquisition, maintenance, fuel consumption, crew training, and regulatory compliance expenditures. Smaller carriers often struggle to access long-term financing, limiting fleet expansion despite favorable demand conditions. Aircraft residual value uncertainty further complicates investment decisions, particularly during cyclical freight downturns. Maintenance intervals for aging converted aircraft can also introduce unpredictable cost burdens, reducing operational margins. Airlines must simultaneously invest in digital fleet management systems to maintain efficiency, increasing upfront technological expenses. Insurance premiums remain elevated due to operational risks associated with cargo transport. Currency volatility across emerging Asia Pacific economies can amplify procurement costs for imported aircraft components. Moreover, sustainability mandates are compelling operators to explore next-generation platforms, potentially accelerating asset obsolescence. These combined financial pressures frequently delay purchase decisions and encourage reliance on leasing structures rather than outright ownership.

Regulatory Complexity and Certification Barriers

Aircraft conversion and deployment involve extensive certification processes governed by multiple aviation authorities, creating procedural complexity for operators expanding across jurisdictions. Differences in safety standards and documentation requirements often prolong approval timelines, delaying revenue generation from newly modified aircraft. Compliance with environmental regulations is becoming increasingly stringent, requiring investments in fuel-efficient engines and emissions monitoring technologies. Operators must also adhere to noise standards when accessing urban airports, constraining route flexibility for older fleets. Workforce qualification requirements add another layer of regulatory oversight, necessitating continuous training programs. Cross-border cargo operations involve customs harmonization challenges that can undermine scheduling predictability. Manufacturers must therefore coordinate closely with regulators during design and modification stages to avoid costly redesigns. Legal liabilities associated with cargo handling further reinforce the need for rigorous compliance frameworks. Collectively, regulatory intricacy remains a structural barrier influencing operational scalability.

Opportunities

Passenger-to-Freighter Conversion Ecosystem Expansion

The growing availability of aging passenger aircraft presents a compelling opportunity for conversion specialists and cargo airlines seeking cost-effective capacity expansion. Conversion timelines are significantly shorter than new aircraft production cycles, allowing operators to respond quickly to demand spikes. Engineering firms across Asia Pacific are investing in advanced modification facilities, strengthening regional self-sufficiency. Financial models supporting conversions typically require lower upfront investment, improving return metrics for carriers. Leasing companies increasingly structure conversion-ready portfolios to attract logistics clients. Technological enhancements are also improving payload configurations and structural durability, extending aircraft service life. Secondary markets for converted freighters continue to mature, enhancing liquidity for investors. Airlines benefit from operational familiarity with converted platforms, reducing training requirements. This ecosystem expansion is expected to remain a pivotal growth avenue as airlines balance cost discipline with capacity requirements.

Integration of Sustainable Aviation Technologies

Environmental pressures are driving industry participants to adopt fuel-efficient engines, lightweight materials, and optimized aerodynamic designs that reduce operating costs while meeting regulatory expectations. Airlines pursuing sustainability targets are evaluating next-generation freighters capable of lowering carbon intensity per ton-kilometer. Governments across Asia Pacific are simultaneously incentivizing green aviation initiatives through infrastructure upgrades and policy support. Manufacturers are investing heavily in research focused on alternative propulsion pathways and advanced composites. Cargo operators increasingly recognize that sustainability improvements can enhance brand perception among corporate clients seeking low-emission logistics partners. Digital optimization tools further support fuel savings by refining flight paths and load planning. Financing institutions are beginning to align lending criteria with environmental performance metrics, potentially lowering borrowing costs for compliant fleets. As sustainability transitions from optional to mandatory, early adopters are positioned to secure long-term competitive advantages.

Future Outlook

The Asia Pacific Freighter Aircraft market is expected to witness sustained expansion as trade volumes increase and logistics networks prioritize speed and reliability. Technological innovation in aircraft efficiency and conversion engineering will likely enhance fleet economics. Regulatory frameworks supporting cargo infrastructure modernization may further stimulate procurement activity. Growing digital commerce and manufacturing output should reinforce long-term demand, positioning freighter aircraft as a cornerstone of regional supply chain architecture.

Major Players

- Boeing

- Airbus

- Embraer

- ST Engineering

- Israel Aerospace Industries

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- COMAC

- Elbe Flugzeugwerke

- Textron Aviation

- Lockheed Martin

- Antonov Company

- Korean Aerospace Industries

- Hindustan Aeronautics Limited

- Singapore Technologies Aerospace

Key Target Audience

- Commercial cargo airlines

- Aircraft leasing companies

- Defense procurement agencies

- Logistics and express delivery companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft conversion service providers

- Airport cargo infrastructure operators

Research Methodology

Step 1: Identification of Key Variables

Primary variables including fleet size, cargo demand, aircraft procurement trends, and logistics investment patterns were identified through structured industry analysis. Macro indicators such as trade activity and aviation infrastructure were evaluated to establish baseline market dynamics.

Step 2: Market Analysis and Construction

Quantitative and qualitative datasets were synthesized to construct market estimates, incorporating manufacturer activity, airline fleet strategies, and supply chain developments. Segmentation frameworks were validated against operational deployment patterns across Asia Pacific aviation ecosystems.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were reviewed through consultation with aviation analysts, engineering professionals, and cargo operations specialists. Feedback loops ensured alignment between modeled projections and real-world procurement behavior.

Step 4: Research Synthesis and Final Output

All validated insights were integrated into a structured research framework emphasizing clarity, reliability, and decision-making relevance. Analytical consistency checks were performed before finalizing the market narrative and strategic interpretations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rapid Expansion of E-Commerce Logistics Networks

Rising Air Cargo Demand Across Emerging Economies

Increasing Passenger-to-Freighter Conversion Programs

Airport Infrastructure Modernization Supporting Cargo Capacity

Strategic Fleet Renewal by Regional Cargo Operators - Market Challenges

High Capital Investment Requirements for Freighter Acquisition

Volatility in Global Trade Flows

Limited Availability of Conversion Slots

Regulatory Compliance and Airworthiness Constraints

Fuel Cost Sensitivity Affecting Cargo Profitability - Market Opportunities

Growth in Cross-Border Digital Commerce

Technological Advancements in Fuel-Efficient Cargo Aircraft

Expansion of Regional Air Freight Corridors - Trends

Acceleration of Passenger Aircraft Conversions

Adoption of Digitized Cargo Tracking Platforms

Increasing Demand for Widebody Freighters

Integration of Sustainable Aviation Technologies

Emergence of Dedicated E-Commerce Air Fleets - Government Regulations & Defense Policy

Civil Aviation Safety Regulations Governing Cargo Aircraft

Emissions Standards Influencing Fleet Modernization

National Logistics Policies Supporting Air Freight Expansion - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Narrowbody Freighter Aircraft

Widebody Freighter Aircraft

Very Large Freighter Aircraft

Converted Passenger-to-Freighter Aircraft

Express Parcel Freighter Aircraft - By Platform Type (In Value%)

Long-Haul Cargo Aircraft

Medium-Haul Cargo Aircraft

Short-Haul Cargo Aircraft

Intercontinental Freighters

Regional Distribution Freighters - By Fitment Type (In Value%)

Factory-Built Freighters

Passenger-to-Freighter Conversions

Combi Aircraft Configurations

Quick-Change Aircraft

High-Density Cargo Fitments - By EndUser Segment (In Value%)

Cargo Airlines

Integrated Logistics Providers

E-Commerce Distribution Networks

National Postal Operators

Defense and Humanitarian Airlift Agencies - By Procurement Channel (In Value%)

Direct Aircraft Purchases

Operating Lease Agreements

Finance Lease Contracts

Fleet Replacement Programs

Sale-Leaseback Arrangements - By Material / Technology (in Value %)

Advanced Composite Structures

Fuel-Efficient Turbofan Engines

Digital Cargo Handling Systems

Lightweight Aluminum Alloys

Automated Loadmaster Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Payload Capacity, Range Performance, Fuel Efficiency, Conversion Cost, Turnaround Time, Maintenance Interval, Cargo Volume, Fleet Compatibility, Operating Economics, Loading System Efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing

Airbus

Embraer

ATR

Textron Aviation

Lockheed Martin

Leonardo

COMAC

De Havilland Aircraft of Canada

Ilyushin

Tupolev

Kawasaki Heavy Industries

Mitsubishi Heavy Industries

Precision Aircraft Solutions

Israel Aerospace Industries

- Cargo carriers prioritizing fuel-efficient aircraft to improve margins

- Logistics firms expanding dedicated fleets for time-sensitive shipments

- Postal operators strengthening overnight delivery capabilities

- Government agencies leveraging cargo aircraft for disaster response

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035