Market Overview

The Asia Pacific General Aviation market is experiencing strong growth, with a market size projected to reach USD ~ billion by recent historical assessment. This growth is driven by increasing demand for private and business aviation, the rising affluence in emerging markets, and technological advancements in aircraft design. Additionally, significant investments in aviation infrastructure and government support in countries like China and India contribute to the market’s robust performance.

Countries like China, India, Japan, and Australia dominate the Asia Pacific General Aviation market due to their large-scale economies, expanding infrastructure, and increasing disposable incomes. The demand for private aircraft, charter services, and flight schools is particularly strong in these nations, with urbanization and industrialization boosting the aviation sector. Moreover, favorable government regulations, especially in China and India, are encouraging further growth in the region, making it an attractive destination for investments in general aviation.

Market Segmentation

By Product Type

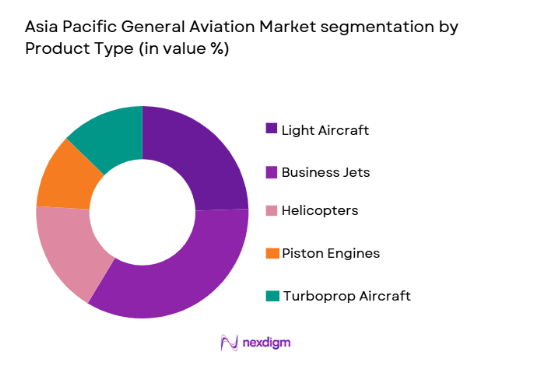

The Asia Pacific General Aviation market is segmented by product type into light aircraft, business jets, helicopters, piston engines, and turboprop aircraft. Recently, business jets have a dominant market share due to their rising demand in corporate and private sectors, offering efficiency and luxury for short to medium-range travel. The increasing need for faster travel, along with expanding business activities, especially in China and India, has contributed to the growth of this sub-segment.

By Platform Type

The market is segmented by platform type into fixed-wing aircraft, rotorcraft, unmanned aerial systems (UAS), amphibious aircraft, and electric aircraft. Fixed-wing aircraft has been dominating the market share as they are widely used for both business and private aviation, offering versatility and performance. The demand for long-range travel and cargo capacity has resulted in fixed-wing aircraft becoming the preferred choice in the region.

Competitive Landscape

The competitive landscape of the Asia Pacific General Aviation market is characterized by strong consolidation among a few key players who dominate the market share. These major players are expanding their presence through strategic partnerships, technological innovations, and market penetration strategies. The influence of established players like Textron Aviation and Bombardier is significant, driving the development of new aircraft models and aviation technologies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Textron Aviation | 1923 | Wichita, Kansas | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | São José dos Campos, Brazil | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Stans, Switzerland | ~ | ~ | ~ | ~ | ~ |

Asia Pacific General Aviation Market Analysis

Growth Drivers

Increasing Demand for Private and Business Aviation

The increasing demand for private and business aviation is a significant driver of growth in the Asia Pacific General Aviation market. As economies in the region continue to expand, individuals and corporations are seeking faster, more efficient means of travel. The rising number of high-net-worth individuals, particularly in China, India, and Japan, is contributing to the increasing demand for private aircraft. Business aviation offers the convenience of direct flights to regional hubs, saving time and enhancing productivity for executives. Furthermore, government policies in emerging markets like India are supporting the expansion of private aviation, further propelling growth. As the general aviation market develops, it will continue to address the need for quick and cost-effective travel options.

Technological Advancements in Aircraft Design

Technological advancements in aircraft design and manufacturing are contributing significantly to the growth of the Asia Pacific General Aviation market. Innovations in avionics, materials, and propulsion systems are making aircraft more efficient, safer, and environmentally friendly. The growing focus on reducing aircraft weight through advanced composite materials and improving fuel efficiency is gaining traction in the region. Additionally, developments in hybrid and electric aircraft technology are expected to revolutionize the aviation industry. These advancements align with the increasing demand for sustainable aviation solutions, positioning the Asia Pacific market as a hub for innovation in general aviation technologies. The region’s proactive approach to adopting new technologies is expected to drive growth in the coming years.

Market Challenges

High Operational and Maintenance Costs

High operational and maintenance costs present a significant challenge to the growth of the Asia Pacific General Aviation market. Despite the increasing demand for private aviation, the cost of maintaining and operating aircraft remains a barrier to entry for many potential buyers. Aircraft require regular maintenance, repairs, and spare parts, which can be costly, particularly for smaller operators. The long-term investment involved in purchasing and maintaining aircraft is often beyond the reach of smaller businesses or individuals, limiting market expansion. This challenge is particularly evident in emerging markets where aviation infrastructure is still developing. As a result, market players must find ways to reduce operational and maintenance costs to make general aviation more accessible to a broader range of customers.

Stringent Regulatory Requirements

Stringent regulatory requirements imposed by governments in the Asia Pacific region are a significant challenge for the growth of the general aviation market. The aviation industry is heavily regulated, with strict safety and environmental standards that must be adhered to by all operators. These regulations often vary from country to country, creating additional complexity for businesses operating across multiple markets. In some countries, these regulatory barriers can delay the approval of new aircraft models or hinder the establishment of new aviation infrastructure. The need for compliance with these regulations increases operational costs and can stifle innovation, as companies must navigate the complex regulatory landscape while trying to remain competitive in the market.

Opportunities

Introduction of Electric Aircraft

The introduction of electric aircraft presents a significant opportunity for the Asia Pacific General Aviation market. As the world moves toward more sustainable and eco-friendly solutions, electric aircraft are becoming an attractive alternative to traditional fuel-powered aircraft. In Asia Pacific, countries like China and Japan are leading the way in electric aircraft development, supported by government initiatives and incentives aimed at reducing carbon emissions in the aviation sector. The growing focus on reducing the environmental impact of aviation is driving investments in electric aircraft, with several companies already working on prototypes and testing electric propulsion systems. This shift toward electric aircraft offers opportunities for manufacturers, operators, and investors to capitalize on a new and growing segment of the aviation market, making it an exciting prospect for the region’s future growth.

Emerging Demand for Urban Air Mobility

Urban air mobility (UAM) is an emerging opportunity for the Asia Pacific General Aviation market. The rapid urbanization of cities in the region, coupled with increasing traffic congestion, is driving the need for new transportation solutions. UAM, which includes the use of electric vertical take-off and landing (eVTOL) aircraft for urban transport, has the potential to revolutionize transportation in densely populated cities. Several cities in Asia, particularly in China, Japan, and South Korea, are exploring the potential of UAM to alleviate traffic congestion and improve mobility. The development of UAM infrastructure, including air traffic management systems and vertiports, presents a significant growth opportunity for the general aviation market. Companies investing in UAM technologies are positioning themselves to capitalize on this emerging market, which is expected to see rapid growth over the next decade.

Future Outlook

Over the next five years, the Asia Pacific General Aviation market is expected to experience steady growth, driven by technological advancements, regulatory support, and increasing demand for private and business aviation. The introduction of electric aircraft and the expansion of urban air mobility are set to revolutionize the market, providing new opportunities for both aircraft manufacturers and operators. Government policies in key markets such as China, India, and Japan will continue to foster growth, while advancements in aircraft design and efficiency will improve the accessibility and affordability of general aviation. The market will also see increased consolidation among key players as they expand their portfolios to meet evolving demand.

Major Players

- Textron Aviation

- Bombardier

- Embraer

- Dassault Aviation

- Pilatus Aircraft

- Cessna

- Gulfstream Aerospace

- Hawker Beechcraft

- Diamond Aircraft

- Piaggio Aerospace

- Honda Aircraft

- Raytheon Technologies

- Northrop Grumman

- Airbus

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation infrastructure developers

- Aircraft manufacturers

- Private and business jet owners

- General aviation operators

- Aircraft maintenance service providers

- Commercial airlines

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables affecting the Asia Pacific General Aviation market, including market size, growth drivers, and key technologies.

Step 2: Market Analysis and Construction

This step focuses on analyzing the general aviation industry’s structure and identifying sub-segments to better understand market trends and demand.

Step 3: Hypothesis Validation and Expert Consultation

The third step involves validating hypotheses with industry experts, using primary and secondary research to ensure accuracy and comprehensiveness.

Step 4: Research Synthesis and Final Output

Finally, research findings are synthesized into a final report that presents actionable insights, ensuring accuracy and relevance to market stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Private and Business Aviation

Rising Affluence in Emerging Markets

Advancements in Aircraft Technologies

Government Incentives and Support Programs

Expansion of General Aviation Infrastructure - Market Challenges

High Operational and Maintenance Costs

Stringent Regulatory Requirements

Lack of Skilled Workforce

Fuel Price Fluctuations

Environmental Concerns and Emission Regulations - Market Opportunities

Introduction of Electric Aircraft

Increase in Cross-Border Aviation Services

Growth of Urban Air Mobility - Trends

Increase in Demand for Hybrid and Electric Aircraft

Technological Advancements in Aircraft Design

Focus on Reducing Carbon Footprint in Aviation

Increased Adoption of Autonomous Systems

Emerging Aircraft Leasing Models - Government Regulations & Defense Policy

Aviation Safety and Environmental Standards

Airport Infrastructure Development

Governmental Aviation Subsidies and Incentives - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Aircraft

Business Jets

Helicopters

Piston Engines

Turboprop Aircraft - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotorcraft

Unmanned Aerial Systems (UAS)

Amphibious Aircraft

Electric Aircraft - By Fitment Type (In Value%)

New Aircraft

Pre-owned Aircraft

Retrofit Solutions

Upgrade Kits

Aftermarket Services - By EndUser Segment (In Value%)

Private Owners

Corporate and Business Fleets

Government & Defense

Air Charter Services

Flight Schools - By Procurement Channel (In Value%)

Direct Procurement

Authorized Dealers

Online Platforms

Third-Party Distributors

Leasing Companies - By Material / Technology (in Value%)

Advanced Composites

Hybrid Power Systems

Avionics and Navigation Technology

Electric Propulsion Systems

Aerodynamic Enhancements

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Geographic Presence, Pricing Strategy, Aircraft Size, Production Capacity)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Textron Aviation

Bombardier

Embraer

Dassault Aviation

Pilatus Aircraft

Airbus Helicopters

Boeing

Gulfstream Aerospace

Sikorsky Aircraft

Cessna

Hawker Beechcraft

Diamond Aircraft

Piaggio Aerospace

Kawasaki Aerospace

Honda Aircraft

- Growing Interest in Personal Aircraft Ownership

- Rising Corporate Use of Aircraft

- Expansion of General Aviation in Asia-Pacific

- Emergence of New Flight Training Centers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035