Market Overview

The Asia Pacific In-Flight Entertainment and Connectivity market is estimated to reach USD ~ billion in 2024, driven by the growing demand for enhanced passenger experiences. Airlines are increasingly adopting advanced in-flight entertainment systems and connectivity options to meet consumer expectations. The rising need for seamless connectivity, high-speed internet, and improved entertainment content is leading to increased investments in new technologies and system upgrades. Additionally, favorable government regulations and the expanding air travel sector in Asia Pacific are contributing to market growth.

Countries like China, India, Japan, and Australia dominate the market due to their rapidly expanding aviation sectors and high demand for digital entertainment services. These countries are seeing substantial investments in infrastructure, technology, and new aircraft, which are crucial for meeting the growing demand. Factors such as the large number of passengers, rising disposable incomes, and government initiatives to modernize air travel are driving the growth in these regions, making them key players in the market.

Market Segmentation

By System Type

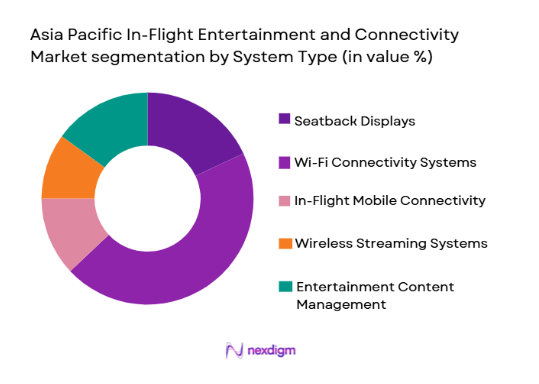

Asia Pacific In-Flight Entertainment and Connectivity market is segmented by system type into seatback displays, Wi-Fi connectivity systems, in-flight mobile connectivity systems, wireless streaming systems, and entertainment content management systems. Recently, the Wi-Fi connectivity systems segment has a dominant market share due to the increasing passenger demand for reliable internet access during flights. Airlines are prioritizing investments in high-speed Wi-Fi and satellite-based systems to enhance customer satisfaction. This growing preference for internet-enabled services is driving substantial growth in the Wi-Fi connectivity systems sub-segment.

By Platform Type

Asia Pacific In-Flight Entertainment and Connectivity market is segmented by platform type into commercial aircraft, private jets, helicopters, regional aircraft, and charter services. Recently, commercial aircraft have a dominant market share due to their large scale of operations and the rising number of passengers choosing air travel. Airlines are investing in providing superior in-flight entertainment and connectivity services on commercial flights to cater to the growing expectations of tech-savvy travelers. This segment’s growth is further supported by the increasing competition among airlines to offer better passenger experiences.

Competitive Landscape

The Asia Pacific In-Flight Entertainment and Connectivity market is highly competitive, with major players focusing on product innovation and expanding their technological capabilities. Consolidation is evident as companies seek partnerships to enhance their market position. Leading players are continuously upgrading their offerings, focusing on developing satellite connectivity and content management solutions. The competition is intensifying due to rising demand for high-speed internet services and entertainment on flights, with major companies striving to meet evolving consumer preferences.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (2024) | Key Partnerships |

| Panasonic Avionics | 1979 | California, USA | ~ | ~ | ~ | ~ | ~ |

| Gogo Inc. | 1991 | Illinois, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Viasat | 1986 | California, USA | ~ | ~ | ~ | ~ | ~ |

Asia Pacific In-Flight Entertainment and Connectivity Market Analysis

Growth Drivers

Rising Demand for Enhanced Passenger Experience

The demand for superior in-flight experiences continues to grow as passengers increasingly expect high-quality entertainment and connectivity options. Airlines are responding by integrating advanced technologies that provide seamless internet access, live streaming, and on-demand entertainment content. Travelers now view these services as essential to their journey, not just a luxury. To meet these demands, airlines are adopting next-generation connectivity solutions, including satellite-based internet services. As a result, market growth is expected to accelerate due to the airline industry’s focus on improving the travel experience. Additionally, advancements in technology such as 5G networks and Wi-Fi 6 are making in-flight connectivity faster and more reliable, further driving demand for these services. These factors are creating a significant revenue-generating opportunity for the in-flight entertainment and connectivity market, with airlines continuing to upgrade their fleets to include the latest systems and technologies. The competitive landscape in Asia Pacific is being shaped by airlines’ commitment to providing high-quality services to retain customer loyalty.

Technological Advancements in Connectivity Solutions

Another key growth driver is the continuous advancement in connectivity technologies, particularly satellite-based solutions. These technologies allow for uninterrupted and high-speed internet services, even in remote areas. With airlines increasingly investing in new technologies, the demand for satellite and internet-based systems is expected to rise. This trend is particularly evident in the Asia Pacific region, where the rising number of international flights necessitates reliable connectivity solutions. New partnerships between airlines and technology companies are also contributing to the market’s growth by enabling airlines to deliver enhanced in-flight services. Additionally, technological advancements in wireless streaming and content management systems are enabling airlines to offer a broader range of entertainment options, appealing to a wider passenger demographic. Airlines are also investing in systems that allow passengers to connect their own devices to the aircraft’s entertainment system, improving the overall experience. This shift toward integrated technological solutions is set to fuel further growth in the market as airlines continue to focus on enhancing their service offerings.

Market Challenges

High Installation and Maintenance Costs

One of the key challenges facing the Asia Pacific In-Flight Entertainment and Connectivity market is the high cost of installing and maintaining advanced systems. Airlines must invest significant capital in upgrading their fleets to accommodate the latest connectivity and entertainment systems. The installation of satellite-based systems, Wi-Fi solutions, and entertainment displays involves substantial infrastructure and technology costs, which can be a barrier for many airlines, especially smaller operators or those with aging fleets. Furthermore, maintaining and upgrading these systems requires a continuous investment in technology and services, adding to the financial burden. While these systems enhance passenger experience, the costs associated with installation, system upgrades, and ongoing maintenance present a significant hurdle for airlines looking to provide premium in-flight services while keeping operational costs in check. The return on investment for these systems can be slow, as airlines rely on increased passenger satisfaction and loyalty to drive future growth. This financial challenge is one of the primary obstacles to the broader adoption of in-flight entertainment and connectivity solutions in the Asia Pacific region.

Technological Integration and Interoperability Issues

Another challenge is the integration of new technologies with existing aircraft systems. Airlines must ensure that new connectivity and entertainment solutions are compatible with older aircraft and that they meet safety and regulatory standards. This can be a complex and costly process, as airlines must work closely with system manufacturers to ensure seamless integration. Furthermore, the rapidly evolving nature of technology in the aviation industry means that new systems must be constantly updated to stay competitive. The lack of standardization in in-flight entertainment and connectivity solutions also poses a challenge, as different systems may not always be interoperable. This lack of uniformity can lead to compatibility issues between various devices, systems, and platforms, making it difficult for airlines to offer a consistent experience across their fleets. The need to balance innovation with compatibility and regulatory compliance further complicates the market landscape.

Opportunities

Growth in Low-Cost Carriers Investing in Connectivity

An emerging opportunity in the Asia Pacific market is the increasing investment by low-cost carriers (LCCs) in in-flight connectivity. Traditionally, LCCs have been more focused on keeping operational costs low, but as competition intensifies, these carriers are recognizing the need to offer more than just basic services. By introducing in-flight connectivity options, low-cost carriers can enhance passenger satisfaction and potentially increase their revenue from ancillary services. These carriers are increasingly adopting satellite-based Wi-Fi and offering a range of entertainment options to attract tech-savvy passengers. This trend is expected to open up new market opportunities, as low-cost carriers in the Asia Pacific region rapidly expand their fleets and seek innovative ways to differentiate themselves. With the growing importance of connectivity and entertainment for modern travelers, LCCs are likely to accelerate their investments in these areas, driving market growth and creating new avenues for technology providers. The demand for affordable and accessible in-flight entertainment is also growing in the budget travel segment, further supporting the growth of this opportunity.

Emerging Demand for Autonomous Aircraft Systems and Services

The development of autonomous aircraft technology is another opportunity for the in-flight entertainment and connectivity market. As the aviation industry moves toward more automated systems, there is a growing need for advanced connectivity solutions that can support autonomous operations. In the Asia Pacific region, which is at the forefront of adopting cutting-edge technologies, the demand for autonomous aircraft systems is expected to rise significantly. This shift presents an opportunity for connectivity providers to develop specialized solutions that cater to the unique needs of autonomous aircraft. Additionally, as these aircraft are expected to operate with minimal crew, providing high-quality in-flight entertainment and connectivity will be essential to ensure passenger comfort and satisfaction. This opportunity is particularly relevant to the growing market for private jets, which are increasingly incorporating autonomous technologies. As the demand for autonomous aircraft grows, the in-flight entertainment and connectivity market will need to adapt and offer innovative solutions to support this new generation of air travel.

Future Outlook

The Asia Pacific In-Flight Entertainment and Connectivity market is expected to experience significant growth over the next five years, driven by technological advancements and increasing passenger expectations. Key factors influencing this growth include the rise of low-cost carriers offering in-flight connectivity, the integration of 5G networks for faster internet services, and a greater focus on passenger comfort and satisfaction. As airlines continue to modernize their fleets, there will be increased demand for state-of-the-art connectivity solutions and entertainment systems. Government regulations supporting digital technologies and satellite-based connectivity are expected to further boost market growth. Moreover, developments in autonomous aircraft systems will provide new opportunities for the in-flight connectivity sector, paving the way for a more integrated and connected air travel experience.

Major Players

- Panasonic Avionics

- Gogo Inc.

- Thales Group

- Inmarsat

- Viasat

- Global Eagle Entertainment

- Rockwell Collins

- SITA

- Latécoère

- Vistara

- AeroMobile Communications

- Zodiac Aerospace

- Skytrac Systems

- Bluebox Aviation Systems

- Lufthansa Technik

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and aviation operators

- In-flight entertainment technology providers

- Aircraft manufacturers

- Satellite communication service providers

- Aerospace engineering firms

- Airlines’ procurement and technology departments

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key market drivers, challenges, and variables that will influence the market, including customer preferences, technological trends, and regulatory impacts.

Step 2: Market Analysis and Construction

In this step, market segmentation, trends, and overall market size are analyzed based on reliable industry reports, data sources, and consultations with key stakeholders.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market behavior are tested and validated by consulting industry experts, technical professionals, and stakeholders to ensure the research accuracy and market dynamics.

Step 4: Research Synthesis and Final Output

The final research is synthesized, incorporating findings from the market analysis and expert consultations. The output is structured to provide insights into future market trends and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Enhanced Passenger Experience

Advancements in In-Flight Wi-Fi Connectivity

Increase in Airline Fleet Modernization

Government Initiatives for Air Connectivity

Integration of 5G Networks in Aviation - Market Challenges

High Installation and Maintenance Costs

Technological Limitations in Remote Areas

Cybersecurity Concerns with In-Flight Systems

Regulatory Compliance Challenges

Compatibility Issues Across Aircraft Types - Market Opportunities

Growth in Low-Cost Carriers Investing in Connectivity

Increased Adoption of Autonomous Aircraft Systems

Collaborations Between Airlines and Technology Providers - Trends

Increase in Streaming Services for Passengers

Shift Toward Wireless In-Flight Entertainment

Partnerships Between Airlines and OTT Platforms

Increased Integration of Artificial Intelligence

Enhanced Focus on Data Analytics for Passenger Insights - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Airline Certification for Connectivity Systems

National Policies on Satellite Connectivity - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seatback Displays

Wi-Fi Connectivity Systems

In-Flight Mobile Connectivity Systems

Wireless Streaming Systems

Entertainment Content Management Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Helicopters

Regional Aircraft

Charter Services - By Fitment Type (In Value%)

Linefit

Retrofit

Modular Installations

Portable Systems

Hybrid Installations - By EndUser Segment (In Value%)

Airlines

Charter Operators

Private Jet Owners

Government Agencies

Military Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Supplier Network

Third-Party Integrators

Online Bidding Platforms

Private Sector Procurement - By Material / Technology (in Value%)

Satellite Connectivity Technology

In-Flight Entertainment Hardware

Cabin Management Technology

Wi-Fi Systems

AVOD Systems

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Regional Reach, Customer Base, Innovation Rate, Profit Margins)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Panasonic Avionics

Gogo Inc.

Thales Group

Inmarsat

Honeywell International

Viasat

Global Eagle Entertainment

Rockwell Collins

SITA

Latécoère

Vistara

AeroMobile Communications

Zodiac Aerospace

Skytrac Systems

Bluebox Aviation Systems

- Airlines’ Investment in Enhanced Passenger Services

- Charter Operators’ Growing Need for Connectivity

- Private Jet Owners’ Demand for Luxury Entertainment Systems

- Government and Military Use of Secure Communication Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035