Market Overview

The Asia Pacific Intelligence Surveillance and Reconnaissance market is projected to reach USD ~ billion based on a recent historical assessment. This market is driven by increasing defense budgets and the growing demand for advanced surveillance technologies to enhance security measures. Additionally, the rise in geopolitical tensions and the need for sophisticated intelligence gathering have contributed to the market’s expansion. The integration of artificial intelligence (AI) and machine learning for real-time data processing is further accelerating the demand for ISR systems across the region.

Countries such as China, India, Japan, and South Korea are leading the market due to their robust defense spending and technological advancements in military capabilities. These nations have prioritized the development of advanced surveillance systems, particularly airborne and satellite-based ISR technologies, to maintain strategic advantages. Their investment in border security, maritime patrol systems, and national defense infrastructure is pushing the demand for ISR solutions, making these countries key players in the Asia Pacific market.

Market Segmentation

By System Type

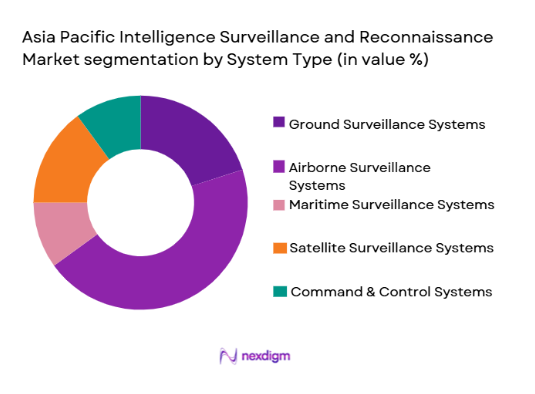

Asia Pacific Intelligence Surveillance and Reconnaissance market is segmented by system type into ground surveillance systems, airborne surveillance systems, maritime surveillance systems, satellite surveillance systems, and command & control systems. Recently, airborne surveillance systems have a dominant market share due to factors such as increasing defense investments in drones, unmanned aerial vehicles (UAVs), and aircraft equipped with ISR capabilities. These systems offer flexibility, rapid deployment, and comprehensive coverage, making them critical to modern defense strategies. Airborne surveillance systems are integral to providing real-time intelligence, especially in dynamic and complex environments such as coastal and border regions. As a result, this segment is growing due to the demand for both manned and unmanned aircraft that can perform surveillance over large areas.

By Platform Type

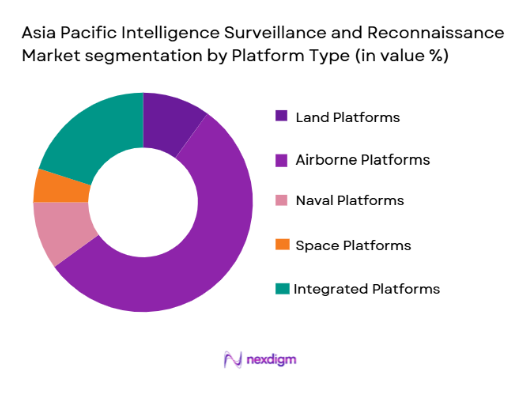

Asia Pacific Intelligence Surveillance and Reconnaissance market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have a dominant market share due to their ability to quickly deploy in diverse environments and provide continuous surveillance. With advancements in unmanned aerial systems (UAS), drones, and advanced aircraft technology, airborne platforms have become more cost-effective and versatile. Their ability to cover vast areas and provide real-time data feeds to command centers makes them indispensable in modern military operations and law enforcement, driving their dominance in the market.

Competitive Landscape

The Asia Pacific Intelligence Surveillance and Reconnaissance market is highly competitive, with major players focusing on technological advancements and strategic partnerships to expand their market presence. The consolidation of smaller players and collaborations between defense contractors and tech companies are prevalent in the market. Market leaders are investing heavily in research and development to enhance system capabilities, especially in AI and satellite-based technologies, which are expected to play a pivotal role in future ISR operations. The competition is intense, and players are striving to deliver more cost-effective, reliable, and secure ISR solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Research & Development Focus |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Intelligence Surveillance and Reconnaissance Market Analysis

Growth Drivers

Increased Government Spending on National Security

Increased government defense budgets, especially in nations like China, India, and Japan, are driving the demand for ISR systems. With rising geopolitical tensions, countries are prioritizing investments in national security and defense capabilities. The growing need for robust border protection, counterterrorism efforts, and maritime security has led to significant expenditures on surveillance systems that provide real-time intelligence. These governments are particularly investing in advanced ISR technologies, such as UAVs, satellites, and command & control systems, to enhance their defense readiness and operational efficiency. The growing recognition of the importance of ISR capabilities in national security strategies is fueling market growth. As countries continue to modernize their military forces, the demand for high-tech surveillance solutions, particularly those that integrate artificial intelligence and machine learning for real-time decision-making, is expected to continue rising. Additionally, the increasing frequency of military operations and surveillance requirements in urban and remote areas will further boost government spending on ISR systems.

Technological Advancements in UAVs and Radar Systems

Technological advancements in unmanned aerial vehicles (UAVs) and radar systems are significantly driving the growth of the ISR market. UAVs, which are increasingly being used for surveillance operations, provide an economical and efficient solution for intelligence gathering. These systems can cover vast areas, perform high-resolution imaging, and transmit real-time data to command centers. Additionally, advancements in radar technology, particularly in synthetic aperture radar (SAR) systems, are enabling more accurate and detailed monitoring, even in adverse weather conditions. The integration of AI and machine learning into UAVs and radar systems allows for enhanced data analysis and faster decision-making. As these technologies become more affordable and accessible, more defense and security agencies are adopting them for border patrol, disaster management, and military operations. The widespread adoption of advanced UAVs and radar systems is expected to continue driving the growth of the ISR market, providing enhanced capabilities in intelligence, surveillance, and reconnaissance missions.

Market Challenges

High Capital Investment in Surveillance Infrastructure

One of the primary challenges facing the ISR market is the high cost associated with the development, installation, and maintenance of advanced surveillance systems. Surveillance infrastructure, especially satellite systems, high-end UAVs, and radar technologies, requires substantial capital investment, which may be difficult for some countries and organizations to afford. While these systems are critical for national security and defense, the upfront and ongoing costs for procurement, integration, and maintenance can be prohibitive. For example, satellites and unmanned aerial vehicles, which are central to modern ISR operations, are costly to manufacture, launch, and operate. Additionally, specialized workforce training, ongoing maintenance, and technology upgrades further add to the financial burden. Smaller defense contractors or nations with limited budgets may find it challenging to keep up with these costs, limiting their access to advanced ISR systems. The high capital requirements present a significant barrier to entry for new players and restrict the growth potential of the market in certain regions.

Cybersecurity Risks and Data Privacy Concerns

As ISR systems become more technologically advanced and interconnected, the risk of cybersecurity threats and data breaches increases. Modern ISR systems rely on satellite communications, UAVs, and cloud-based data management, all of which are vulnerable to cyberattacks and unauthorized access. These systems often handle sensitive and classified data, which, if compromised, could lead to severe consequences, including intelligence leaks, national security risks, and public safety threats. As a result, governments and defense contractors must invest heavily in cybersecurity measures to protect their ISR systems from cyber threats. The need to safeguard the vast amounts of data collected by ISR platforms, including surveillance footage, radar readings, and communications, is becoming increasingly complex. Furthermore, international regulations governing data privacy and the sharing of surveillance information are adding additional layers of complexity. These concerns are becoming a major challenge for the growth of the ISR market, as businesses and governments must ensure that their systems are secure and comply with relevant privacy laws.

Opportunities

Expansion of Autonomous Systems for Surveillance

One of the most significant opportunities in the ISR market is the expansion of autonomous systems for surveillance. Autonomous vehicles, drones, and UAVs are increasingly being used to carry out surveillance missions without the need for human operators. These systems can provide real-time intelligence gathering in remote, dangerous, or otherwise inaccessible locations, reducing the risk to human personnel. As autonomous systems continue to evolve and improve, they offer greater flexibility, efficiency, and scalability compared to traditional manned systems. Additionally, autonomous systems can operate continuously, providing persistent surveillance and improving the speed and accuracy of intelligence gathering. The growing demand for autonomous surveillance systems in defense, border control, and disaster response scenarios presents a significant market opportunity. As these systems become more affordable and reliable, they are expected to see widespread adoption, further fueling growth in the ISR market.

Partnerships Between Government and Private Tech Firms

Another key opportunity lies in the collaboration between government agencies and private technology firms. Governments around the world are increasingly turning to private companies to develop and deploy cutting-edge ISR technologies. This collaboration enables governments to access the latest advancements in AI, machine learning, and satellite communications without having to develop all of the technology in-house. Private tech firms, especially those in the defense and aerospace sectors, are well-positioned to capitalize on this opportunity, as they bring specialized knowledge, innovation, and technical expertise to the table. These partnerships help to accelerate the development of next-generation ISR systems and make them more cost-effective for governments and defense contractors. The increasing trend of public-private partnerships in the defense industry is expected to provide substantial growth opportunities for companies involved in ISR technology, leading to faster adoption of advanced solutions in the market.

Future Outlook

The Asia Pacific Intelligence Surveillance and Reconnaissance market is poised for significant growth in the next five years, driven by technological advancements, increasing defense budgets, and rising security concerns. The demand for advanced ISR systems, such as UAVs, satellite-based surveillance, and AI-powered data analytics, will continue to rise as governments and private firms seek to enhance national security and military capabilities. The market is also expected to benefit from regulatory support and increasing investments in autonomous and cloud-based ISR solutions. Demand from emerging economies and the expansion of defense infrastructure in the Asia Pacific region will play a pivotal role in shaping the future growth of the market.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- L3 Technologies

- Leonardo

- Harris Corporation

- Saab Group

- Elbit Systems

- Rheinmetall AG

- Boeing

- Leonardo

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Aerospace and technology firms

- Border security agencies

- Emergency response and law enforcement agencies

- Defense intelligence agencies

- Surveillance technology providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical market variables such as government defense budgets, technological advancements, and geopolitical factors influencing ISR demand.

Step 2: Market Analysis and Construction

In this step, the market size, segmentation, and trends are analyzed using primary and secondary data sources to create a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market growth and demand drivers are tested and validated through expert consultations and interviews with key industry stakeholders.

Step 4: Research Synthesis and Final Output

The final research output is synthesized, consolidating findings from analysis and expert feedback to deliver strategic insights on the market’s future direction.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Spending on National Security

Technological Advancements in UAVs and Radar Systems

Rising Geopolitical Tensions

Growing Demand for Border and Maritime Surveillance

Integration of AI and Machine Learning for Real-time Analysis - Market Challenges

High Capital Investment in Surveillance Infrastructure

Cybersecurity Risks and Data Privacy Concerns

Interoperability Issues Among Different Systems

Regulatory and Compliance Barriers

High Maintenance and Operational Costs - Market Opportunities

Expansion of Autonomous Systems for Surveillance

Partnerships Between Government and Private Tech Firms

Emerging Demand for Border Security and Maritime Patrol Systems - Trends

Integration of Artificial Intelligence and Big Data

Rise of Autonomous Vehicles in Surveillance Operations

Shift Toward Cloud-Based Surveillance Systems

Increase in Remote Sensing Technologies

Adoption of Integrated C4ISR Systems - Government Regulations & Defense Policy

National and International Data Protection Regulations

Export Control and Compliance Policies

Government Funding and Grants for Surveillance Technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground Surveillance Systems

Airborne Surveillance Systems

Maritime Surveillance Systems

Satellite Surveillance Systems

Command & Control Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Satellite Technology

Radar Systems

Unmanned Aerial Vehicles (UAVs)

Electronic Warfare Systems

Data Analytics Solutions

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Regional Reach, Customer Base, Innovation Rate, Profit Margins)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Intelligence Systems

- Government Agencies’ Role in Regulating and

- Procuring Defense Systems

- Defense Contractors’ Shift Toward Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035