Market Overview

The Asia Pacific medium and large caliber ammunition market is valued at USD ~ billion based on a recent historical assessment. This growth is primarily driven by the increasing defense spending in the region, particularly in countries with strategic geopolitical importance. Key contributors to market demand include the growing military modernization programs in nations like India, China, and Japan. Additionally, the expanding need for advanced ammunition for defense forces, law enforcement, and security applications bolsters the market. Furthermore, the surge in military conflicts and rising military budgets have propelled the market’s momentum.

The market is largely dominated by countries like India, China, and Japan, which maintain substantial defense budgets and advanced technological capabilities. India has emerged as one of the largest consumers of medium and large caliber ammunition, driven by its military expansion and regional security concerns. China follows closely, with a rapid increase in defense expenditures and a focus on technological advancements in weaponry. Japan’s dominance is attributed to its robust military policies and regional defense initiatives. These countries continue to shape the market due to their large-scale procurement and production of ammunition.

Market Segmentation

By Product Type

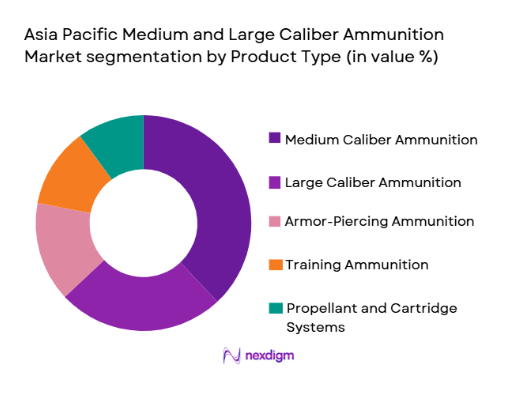

The Asia Pacific medium and large caliber ammunition market is segmented by product type into medium caliber ammunition, large caliber ammunition, armor-piercing ammunition, training ammunition, and propellant and cartridge systems. Recently, medium caliber ammunition has a dominant market share due to factors such as its versatility in various defense platforms, higher demand for tactical operations, and enhanced efficiency in modernized military vehicles. The ongoing demand for medium caliber rounds by land forces, naval units, and airborne platforms is a crucial driver of this dominance.

By Platform Type

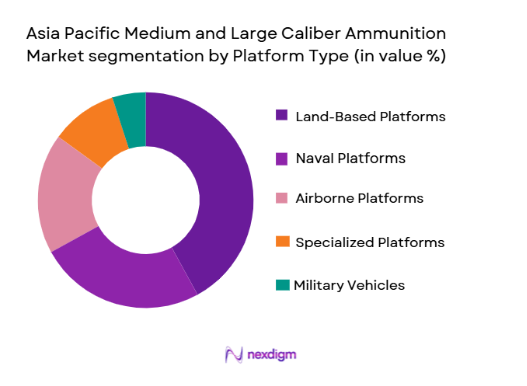

The Asia Pacific medium and large caliber ammunition market is segmented by platform type into land-based platforms, naval platforms, airborne platforms, specialized platforms, and military vehicles. Recently, land-based platforms have a dominant market share, primarily due to the large number of ground forces deployed across the region. The need for artillery and infantry support systems for land-based operations has significantly increased, especially in countries with active military conflicts or border tensions. The growing modernization of land forces and the shift towards precision weaponry contribute to the strong presence of this segment.

Competitive Landscape

The competitive landscape of the Asia Pacific medium and large caliber ammunition market is marked by substantial consolidation, with a few large players controlling a significant share of the market. These major players are expanding their market reach through strategic mergers and acquisitions, enhancing their technological capabilities, and increasing production capacity. The market also witnesses strong competition due to the growing demand for advanced ammunition technologies, with players vying to innovate and offer superior solutions for defense applications.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Medium and Large Caliber Ammunition Market Analysis

Growth Drivers

Increased Military Spending

Increased military spending is a key growth driver in the Asia Pacific region, with countries such as India, China, and Japan ramping up their defense budgets in response to regional security threats. The rising military expenditure in these nations is directly fueling the demand for high-performance medium and large caliber ammunition. With defense budgets reaching new heights, governments are focusing on modernizing their military forces, which includes upgrading their ammunition capabilities. Consequently, this heightened spending is driving demand for specialized ammunition, as nations seek to enhance their operational readiness in both conventional and unconventional warfare scenarios. Increased defense spending also leads to the procurement of more advanced weapon systems that require sophisticated ammunition to complement their operational needs

Military Modernization Programs

Military modernization programs are another critical driver of the market. Several countries in the Asia Pacific region, especially India and China, are undergoing large-scale defense reforms to bolster their military capabilities. These modernization programs focus on enhancing the operational efficiency of their armed forces, including the procurement of modern weaponry, including medium and large caliber ammunition. As these countries update their weapons systems with more advanced technology, the demand for ammunition that matches these new systems has risen. Moreover, the modernization drive is not limited to weapons but also includes ammunition logistics, leading to higher demand for durable and efficient munitions.

Market Challenges

High Manufacturing Costs

One of the key challenges in the Asia Pacific medium and large caliber ammunition market is the high manufacturing costs. The production of high-quality, high-performance ammunition requires significant investment in advanced manufacturing technologies and materials, such as high-strength alloys and precision engineering. These costs are further exacerbated by the need for compliance with international standards, which adds complexity and expense to the production process. Manufacturers also face rising labor and raw material costs, including the price of metals and propellants, which can significantly impact their profit margins. As a result, the high cost of production restricts the ability of certain players to compete effectively, especially in emerging markets where cost considerations are more pressing.

Stringent Regulatory Environment

Another market challenge is the stringent regulatory environment governing the production, storage, and distribution of ammunition in the Asia Pacific region. Many countries in this region have strict regulations on the types of ammunition that can be manufactured, sold, and exported, which can create barriers to entry for new players. Compliance with these regulations requires significant investment in certifications, environmental standards, and safety protocols, increasing operational costs for ammunition manufacturers. Furthermore, changes in defense policies, especially in countries with rapidly evolving security needs, can result in shifts in regulatory frameworks, forcing companies to adapt quickly. This dynamic regulatory landscape creates uncertainty, making it difficult for companies to forecast long-term demand.

Opportunities

Adoption of Smart Ammunition

The adoption of smart ammunition presents a significant opportunity for growth in the Asia Pacific medium and large caliber ammunition market. As military forces increasingly demand more precision and accuracy in combat, the integration of smart ammunition systems is expected to become more prevalent. Smart ammunition, which includes features such as advanced guidance systems, electronic fuses, and target identification capabilities, provides improved effectiveness in complex military operations. As countries modernize their defense technologies, there is a growing interest in adopting ammunition that enhances operational efficiency. This shift towards smart ammunition creates opportunities for manufacturers to invest in research and development of next-generation munitions.

Expansion in Emerging Markets

The expansion of defense capabilities in emerging markets in Asia Pacific presents an opportunity for ammunition manufacturers. Countries such as Vietnam, Indonesia, and the Philippines are rapidly increasing their defense spending and enhancing their military infrastructure, which in turn drives the demand for high-quality ammunition. These emerging markets present a growth opportunity for global ammunition manufacturers seeking to establish a presence in regions that are investing heavily in their defense sectors. As these countries develop their military capacities, they are increasingly relying on advanced ammunition to support modern military operations, creating significant demand for medium and large caliber rounds.

Future Outlook

The medium and large caliber ammunition market in Asia Pacific is poised for significant growth over the next five years, driven by the continued expansion of military budgets, modernization programs, and advancements in ammunition technology. Technological innovations, such as the development of smart munitions and precision-guided systems, are expected to shape the future trajectory of the market. Additionally, regulatory support in key regions will further bolster the demand for high-quality ammunition as countries enhance their defense capabilities. Furthermore, evolving geopolitical factors and defense policies will continue to influence demand-side factors, particularly in nations with heightened security concerns.

Major Players

- BAE Systems

- Lockheed Martin

- Rheinmetall

- Thales Group

- General Dynamics

- Northrop Grumman

- Leonardo

- Raytheon Technologies

- Saab

- Elbit Systems

- Maxam

- Olin Corporation

- Denel SOC

- Nexter Systems

- Munitions India Limited

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military procurement agencies

- Defense contractors

- Ammunition manufacturers

- Private security firms

- Law enforcement agencies

- Defense technology companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key factors that influence the medium and large caliber ammunition market, such as technological trends, demand drivers, and economic conditions.

Step 2: Market Analysis and Construction

In this step, a comprehensive market analysis is conducted using both primary and secondary data sources to understand the size, scope, and dynamics of the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through expert consultations and insights from industry leaders, manufacturers, and regulatory bodies to refine market understanding.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the collected data, drawing conclusions, and preparing a detailed market report based on the research findings.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Military Spending

Rising Geopolitical Tensions

Advancements in Ammunition Technology

Growing Demand for Defense Modernization

Increased Military Training Programs - Market Challenges

High Manufacturing Costs

Regulatory Compliance Issues

Limited Availability of Raw Materials

Environmental Concerns and Sustainability

Counterfeit Ammunition Concerns - Market Opportunities

Expansion of Military Modernization Programs

Adoption of Smart Ammunition Systems

Growth in Export Markets - Trends

Development of Smart Ammunition

Integration of AI and Robotics in Ammunition Systems

Shift Towards Lightweight Ammunition

Advancements in Ammunition Testing

Emerging Markets for Ammunition - Government Regulations & Defense Policy

Tighter Export Regulations

Sustainability Mandates for Ammunition

National Security Policies on Defense Procurement - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Medium Caliber Ammunition

Large Caliber Ammunition

Armor-Piercing Ammunition

Training Ammunition

Propellant and Cartridge Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Airborne Platforms

Specialized Platforms

Military Vehicles - By Fitment Type (In Value%)

Integrated Systems

Standalone Systems

Aftermarket Systems

OEM Systems

Modular Systems - By EndUser Segment (In Value%)

Defense Forces

Law Enforcement Agencies

Private Security

Civilian Contractors

Ammunition Manufacturers - By Procurement Channel (In Value%)

Government Procurement

Private Contracts

Direct Sales

Distributors and Dealers

Online Platforms - By Material / Technology (in Value%)

High-Strength Steel

Composite Materials

Lightweight Polymers

Advanced Propellant Systems

Electronic Fuze Technology

- Market share snapshot of major players

- Cross Comparison Parameters (Market Share, Revenue Growth, Product Innovation, Geographic Reach, Pricing Strategy, Production Capacity, Distribution Network, Customer Base, Product Portfolio, Technological Advancements)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Northrop Grumman

BAE Systems

General Dynamics

Lockheed Martin

Rheinmetall

Leonardo

Thales Group

L3 Technologies

Saab

Elbit Systems

Olin Corporation

Maxam

Munitions India Limited

Denel SOC

Nexter Systems

- Military Demand for Advanced Ammunition

- Growth of Defense Contractors in Emerging Markets

- Private Sector’s Role in Ammunition Supply

- Technological Adoption Among Defense Forces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035