Market Overview

The Asia Pacific Military Aircraft Market is valued at approximately USD ~ billion in 2024, with growth primarily driven by rising defense budgets across the region. Nations are investing heavily in military modernization programs, focusing on strengthening their air power capabilities, leading to increased demand for military aircraft. These advancements are supported by strategic government initiatives, technological advancements, and rising geopolitical tensions, which push the military aircraft market to expand. Additionally, the shift towards high-performance, multirole aircraft and the increasing procurement of unmanned aerial vehicles (UAVs) contribute significantly to the market’s growth.

The dominance of countries such as China, India, Japan, and South Korea in the Asia Pacific Military Aircraft Market is attributed to their substantial defense budgets and military modernization plans. China, with its focus on advanced fighter jets and UAVs, continues to be a major player, while India’s expanding fleet and growing focus on indigenous aircraft development strengthen its market position. Japan and South Korea have strong defense ties with global powers, boosting demand for next-generation military aircraft, contributing to their dominance in the market.

Market Segmentation

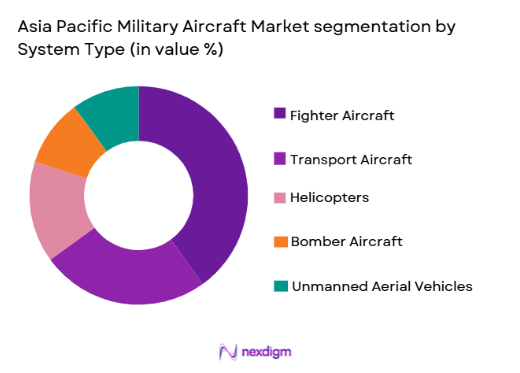

By System Type:

Asia Pacific Military Aircraft Market is segmented by system type into fighter aircraft, transport aircraft, helicopters, bomber aircraft, and unmanned aerial vehicles (UAVs). Recently, fighter aircraft have dominated the market share due to increasing demand for advanced, multirole fighters capable of both air superiority and strike missions. Countries like China and India are increasing their procurement of such aircraft to enhance their strategic defense capabilities. Fighter aircraft’s ability to integrate with modern technologies, such as artificial intelligence, radar systems, and stealth features, has made them indispensable for military forces, further pushing their dominance in the market.

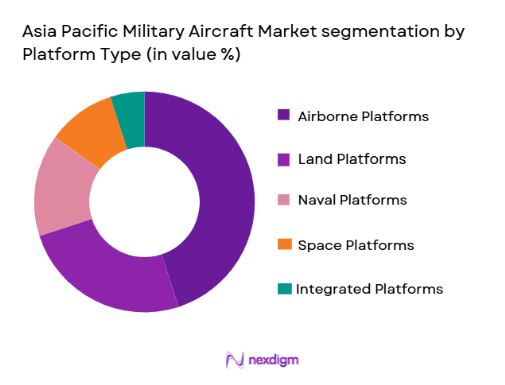

By Platform Type:

Asia Pacific Military Aircraft Market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have held a dominant market share due to the region’s emphasis on strengthening aerial defense capabilities. The demand for versatile airborne platforms, including fighter jets, surveillance aircraft, and aerial refueling tankers, is rising as nations enhance their military capabilities in response to security threats. Airborne platforms are increasingly being integrated with cutting-edge technologies like sensors, communication systems, and precision weapons to provide greater operational flexibility.

Competitive Landscape

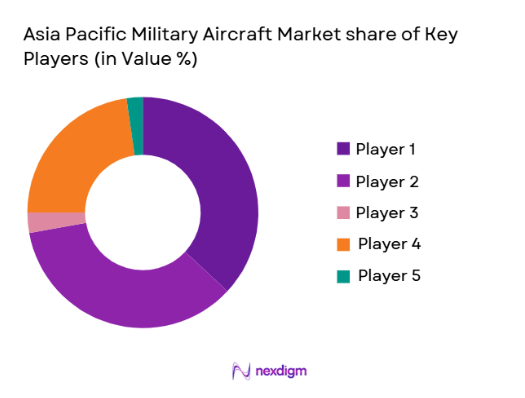

The competitive landscape of the Asia Pacific Military Aircraft Market is marked by consolidation, with major global players exerting significant influence. Companies such as Lockheed Martin, Boeing, and Saab continue to lead the market due to their technological advancements, expansive market reach, and long-standing relationships with defense agencies. However, regional players like China’s AVIC and India’s HAL are also emerging as formidable competitors by focusing on developing advanced aircraft and indigenous production capabilities. The market is characterized by technological innovation, government procurement contracts, and an increasing number of joint ventures between nations and aircraft manufacturers to enhance defense capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ |

| Saab | 1937 | Sweden | ~ | ~ | ~ | ~ |

| AVIC | 1951 | China | ~ | ~ | ~ | ~ |

| HAL | 1940 | India | ~ | ~ | ~ | ~ |

Asia Pacific Military Aircraft Market Analysis

Growth Drivers

Increased Military Budgets:

Many nations in the Asia Pacific region are substantially increasing their military budgets in response to rising security threats and geopolitical tensions. The need to modernize defense systems and keep pace with global powers has driven governments to prioritize military aircraft procurement. Increased spending is evident in countries like India, China, and Japan, which are consistently investing in new aircraft models, advanced technology, and upgrading existing fleets to enhance air power capabilities. The shift towards multirole aircraft and the development of cutting-edge UAVs further accelerates this growth. With the demand for technological innovation, especially in radar systems, stealth capabilities, and electronic warfare, countries in the region are investing heavily in next-generation aircraft to safeguard their airspace.

Technological Advancements in Military Aircraft:

The constant development of new aircraft technologies has emerged as a major growth driver in the Asia Pacific Military Aircraft Market. The integration of artificial intelligence (AI), stealth features, advanced avionics, and unmanned aerial systems (UAS) has created a competitive advantage for defense forces, providing them with superior strategic capabilities. Nations like China and India are advancing their indigenous aircraft production capabilities, particularly in the development of stealth fighters and drones, ensuring their air forces remain at the forefront of technological advancements. This ongoing innovation in aircraft design, materials, propulsion systems, and avionics drives the market’s growth by fulfilling the military’s evolving requirements for versatility, speed, and combat readiness.

Market Challenges

High Development and Maintenance Costs:

One of the primary challenges facing the Asia Pacific Military Aircraft Market is the high cost of aircraft development and maintenance. The complexity of modern aircraft systems, particularly stealth and advanced avionics, requires significant investment in research, development, and testing. This increases not only the initial procurement cost but also long-term maintenance expenses, which many nations find challenging to sustain, particularly in emerging economies. Furthermore, the maintenance of aging fleets and the need to modernize existing aircraft fleets add to the burden. These financial constraints limit the ability of some countries to upgrade their defense systems promptly, hampering market growth.

Regulatory and Compliance Barriers:

Regulatory hurdles and compliance with international defense procurement standards pose significant challenges for the Asia Pacific Military Aircraft Market. Each country must adhere to strict defense regulations that govern the procurement and export of military technology. These regulations can delay aircraft delivery schedules and increase compliance costs. Additionally, international arms control agreements and export restrictions may limit the ability of countries to access advanced military aircraft or technology. The lack of standardization across the region and the differing requirements from country to country further complicate the market dynamics, hindering the efficiency of aircraft procurement processes.

Opportunities

Expansion of Indigenous Aircraft Manufacturing Capabilities:

One of the most significant opportunities in the Asia Pacific Military Aircraft Market lies in the expansion of indigenous aircraft manufacturing capabilities. Countries like India, China, and Japan are heavily investing in local aircraft production to reduce dependency on foreign suppliers. The focus is on building advanced fighter aircraft, drones, and helicopters, which will not only strengthen defense capabilities but also provide economic benefits through the creation of local jobs and technology transfer. As these nations progress in self-sufficiency, they will be better equipped to meet their defense needs and participate more actively in global defense markets.

Collaborations in Defense Technology Development:

Another opportunity for growth in the Asia Pacific Military Aircraft Market is the increasing number of joint ventures and collaborations between regional governments and global aerospace companies. These collaborations facilitate the exchange of advanced technology and expertise, which benefits both parties by improving aircraft capabilities and reducing costs. Countries like India and Japan are entering into agreements with companies such as Lockheed Martin and Boeing to co-develop aircraft and expand their technological capabilities. These collaborations also allow for better integration of aircraft into existing defense systems, improving overall operational effectiveness.

Future Outlook

The future outlook of the Asia Pacific Military Aircraft Market over the next five years is positive, with robust growth driven by increasing defense budgets and technological advancements. The region is expected to see continuous innovation in aircraft systems, particularly in the areas of AI integration, stealth capabilities, and UAVs. Growing geopolitical tensions and the rising need for modernized defense forces will drive the demand for next-generation aircraft. Governments will continue to invest in their air forces, with an emphasis on multirole fighters, advanced drones, and aircraft equipped with cutting-edge technologies. Regulatory support, along with collaborations between defense contractors and governments, will further bolster the region’s military aircraft sector.

Major Players

- Lockheed Martin

- Boeing

- Saab

- AVIC

- HAL

- Northrop Grumman

- Mitsubishi Heavy Industries

- General Dynamics

- Leonardo

- Thales Group

- Raytheon Technologies

- L3 Technologies

- BAE Systems

- Embraer

- Dassault Aviation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace manufacturers

- Military forces

- Aircraft manufacturers

- Private defense organizations

- Military research and development agencies

Research Methodology

Step 1: Identification of Key Variables

We begin by identifying the critical variables affecting the Asia Pacific Military Aircraft Market, including market size, growth rates, and key factors influencing demand and supply.

Step 2: Market Analysis and Construction

Data is collected from primary and secondary sources to construct a detailed market model, ensuring all relevant factors like regional demand, technological advancements, and market trends are included.

Step 3: Hypothesis Validation and Expert Consultation

The preliminary model is validated through consultations with industry experts, including military officers, defense analysts, and aerospace engineers, to ensure accuracy.

Step 4: Research Synthesis and Final Output

The final research report synthesizes data and expert insights, providing actionable recommendations and in-depth analysis of market trends, growth drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Defense Budgets in Asia Pacific

Technological Advancements in Aircraft Systems

Rising Geopolitical Tensions in the Region

Military Modernization Programs

Integration of AI and Autonomous Systems - Market Challenges

High Development and Maintenance Costs

Regulatory and Compliance Barriers

Technological Integration and Interoperability Issues

Political and Social Resistance to Military Expansion

Cybersecurity Threats and Vulnerabilities - Market Opportunities

Growing Demand for UAVs and Drones

Collaborations between Military and Civil Aviation Sectors

Emerging Demand for Advanced Electronic Warfare Systems - Trends

Increased Focus on Stealth and Hypersonic Aircraft

Shift Towards Hybrid and Electric Propulsion Systems

Rising Investment in Advanced Avionics and Sensors

Surge in Demand for Multirole Fighter Aircraft

Integration of Artificial Intelligence in Military Aircraft - Government Regulations & Defense Policy

Export Control and Compliance Policies

Increased Government Funding for Defense Technologies

Data Protection and Privacy Regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fighter Aircraft

Transport Aircraft

Helicopters

Bomber Aircraft

Unmanned Aerial Vehicles - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Composite Materials

Titanium Alloys

Carbon Fiber

Steel Alloys

Advanced Avionics

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technology, Material, Market Value, Installed Units, System Complexity)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Northrop Grumman

Saab

Dassault Aviation

Airbus

General Dynamics

BAE Systems

Leonardo

L3 Technologies

Harris Corporation

Thales Group

Raytheon Technologies

Embraer

Leonardo DRS

- Military Forces’ Increasing Demand for Modern Aircraft

- Government Agencies’ Role in Regulating and Procuring Aircraft

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Aerospace Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035