Market Overview

The Asia Pacific Military Aircraft Modernization and Retrofit market is valued at approximately USD ~ billion in 2024, driven by rising defense spending in the region. The demand is particularly bolstered by increased investments in military aircraft upgrades and the shift towards modernizing older fleets to incorporate advanced technologies. Many nations in Asia Pacific are investing heavily in military modernization, especially to enhance their aerial capabilities and remain competitive on the global stage. The market is primarily driven by the need to upgrade legacy aircraft systems with new radar, avionics, and mission systems that align with contemporary combat requirements.

Countries like China, India, Japan, and South Korea are at the forefront of military aircraft modernization in the Asia Pacific region due to their growing military budgets and geopolitical considerations. These nations are consistently enhancing their defense capabilities to protect borders, safeguard maritime routes, and counter regional threats. The dominance of these countries in the market is driven by substantial defense expenditure, high demand for advanced aircraft systems, and a strategic focus on improving military readiness in the face of evolving security challenges.

Market Segmentation

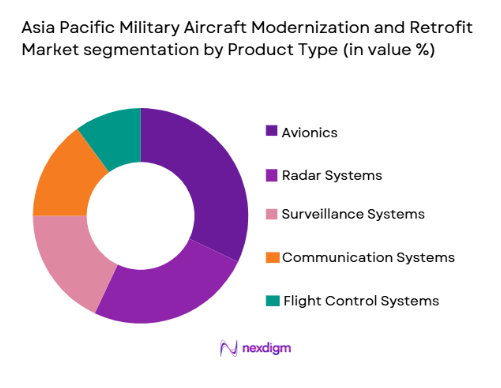

By Product Type:

The Asia Pacific Military Aircraft Modernization and Retrofit market is segmented by product type into systems such as avionics, communication, surveillance, and radar. Recently, the avionics sub-segment has a dominant market share due to technological advancements in cockpit systems and navigation capabilities. Avionics upgrades provide critical enhancements in flight safety, mission success, and operational flexibility, aligning with modernization programs that demand cutting-edge functionality. Countries in the region, especially those with large air forces, are increasingly relying on avionics systems to ensure mission effectiveness in complex combat environments.

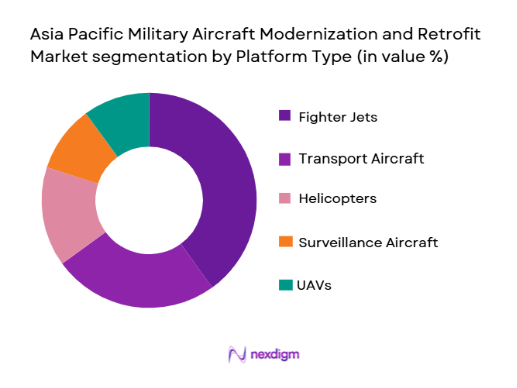

By Platform Type:

The market is segmented by platform type into fighter jets, transport aircraft, helicopters, surveillance aircraft, and unmanned aerial vehicles (UAVs). The fighter jets sub-segment is dominating the market due to the ongoing emphasis on upgrading combat fleets with advanced radar, weapons control systems, and enhanced survivability features. Fighter jets are critical to national defense strategies in Asia Pacific, and the need to modernize aging fleets with superior offensive and defensive capabilities is driving the adoption of retrofit solutions for these platforms.

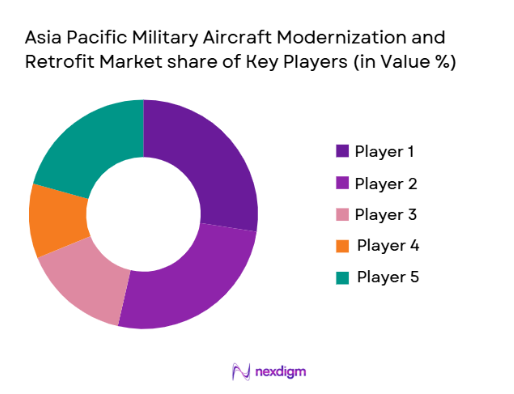

Competitive Landscape

The Asia Pacific Military Aircraft Modernization and Retrofit market is highly competitive, with major defense contractors and regional players driving the consolidation of the market. As governments seek to modernize their fleets, they often partner with industry giants offering comprehensive retrofit solutions, leading to increased competition and technological advancements. The dominance of a few large players who have strong global and regional footprints influences procurement decisions, with a growing emphasis on integrating advanced technologies into military aircraft.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD billion) |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, IL, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

Asia Pacific Military Aircraft Modernization and Retrofit Market Analysis

Growth Drivers

Increasing Defense Budgets:

Rising defense budgets in the Asia Pacific region are one of the primary growth drivers for the military aircraft modernization and retrofit market. Governments in countries like India, Japan, South Korea, and China are allocating significant portions of their national budgets to strengthen military capabilities. This includes enhancing aerial fleets to keep pace with technological advancements and geopolitical shifts. As these nations modernize their forces, the demand for upgraded systems, avionics, and radar technologies increases. The focus on improving aircraft performance, longevity, and survivability ensures that legacy fleets are retrofitted with modern equipment, driving the growth of the aircraft retrofit market. Furthermore, rising tensions in the region, particularly in areas like the South China Sea and the Korean Peninsula, fuel the need for enhanced air combat capabilities. This ongoing investment trend is expected to bolster the retrofit market as nations prepare their forces for more complex, high-intensity operations.

Technological Advancements in Aircraft Systems:

The rapid pace of technological advancements in avionics, radar systems, and communications technologies is another key driver for the military aircraft modernization and retrofit market. Innovations in areas such as artificial intelligence, machine learning, and radar signal processing have enhanced the effectiveness of military aircraft. These advancements allow for more efficient aircraft operation, improved mission success rates, and increased safety in hostile environments. As defense forces in Asia Pacific invest in the latest technologies, retrofitting older aircraft becomes an effective means of ensuring that the fleet remains combat-ready. Moreover, the continuous improvement of modular systems that can be easily integrated into existing platforms has made aircraft modernization more affordable and efficient, expanding the adoption of retrofit solutions across the region.

Market Challenges

High Retrofit Costs:

One of the main challenges in the Asia Pacific military aircraft modernization and retrofit market is the high cost of retrofitting existing aircraft. While retrofitting is often more affordable than procuring new aircraft, it still involves substantial investments in advanced systems, such as radar, avionics, and weapon control systems. For many countries, especially those with limited defense budgets, the cost of retrofitting existing fleets can strain financial resources. Additionally, the complexity of modernizing older aircraft, particularly in terms of system integration and compatibility, increases the overall cost of the retrofit process. This challenge can discourage smaller nations or those with constrained budgets from investing in the necessary upgrades, limiting the growth potential of the market.

Regulatory and Certification Barriers:

Another significant challenge in the market is the regulatory and certification hurdles associated with retrofitting military aircraft. Each country has stringent regulations and certification processes in place to ensure that modernized aircraft meet operational safety and reliability standards. These regulations can delay the approval of retrofit projects, impacting the pace at which aircraft modernization programs are executed. Moreover, the need for frequent testing, validation, and certification of newly integrated systems makes the retrofit process time-consuming. The complexity of navigating these regulatory requirements can deter defense contractors and military agencies from pursuing aircraft retrofitting as aggressively as they might otherwise.

Opportunities

Expansion of UAV Integration:

A significant opportunity in the Asia Pacific Military Aircraft Modernization and Retrofit market lies in the expansion of unmanned aerial vehicle (UAV) integration. UAVs have become an integral part of modern military operations, offering strategic advantages in surveillance, reconnaissance, and combat. As countries in the region seek to modernize their fleets, there is growing interest in retrofitting manned aircraft with UAV control capabilities, allowing for seamless operations between manned and unmanned platforms. This integration enhances the operational flexibility of existing fleets and provides significant cost advantages by extending the operational lifespan of aircraft while incorporating cutting-edge UAV technologies. As the demand for UAVs continues to rise, retrofitting legacy aircraft with these capabilities presents a major opportunity for growth in the market.

Increased Investment in Hybrid and Electric Aircraft Technologies:

The growing focus on sustainable aviation solutions presents an opportunity for military aircraft modernization in the Asia Pacific region. The development of hybrid and electric aircraft technologies is gaining momentum, driven by environmental concerns and the rising costs of traditional aviation fuels. As defense forces seek to reduce their carbon footprints and improve operational efficiency, retrofitting existing fleets with hybrid or electric propulsion systems offers a viable solution. These systems promise to reduce maintenance costs and enhance fuel efficiency, making them increasingly attractive for military operators. The adoption of green technologies in retrofitting programs could revolutionize the way military fleets are modernized, creating new growth opportunities in the aircraft retrofit market.

Future Outlook

The Asia Pacific Military Aircraft Modernization and Retrofit market is expected to experience robust growth over the next five years, driven by an increasing focus on military readiness and technological advancements. As defense budgets continue to rise and nations seek to maintain or enhance their aerial capabilities, the demand for retrofit solutions will accelerate. The integration of advanced technologies such as AI, UAVs, and electric propulsion systems will further fuel market growth, while ongoing geopolitical tensions in the region will increase the need for modernized, high-performance military aircraft. Governments are also likely to implement supportive regulations and policies to facilitate the adoption of these technologies, ensuring a positive long-term outlook for the market.

Major Players

- Lockheed Martin

- Boeing

- Northrop Grumman

- BAE Systems

- Airbus

- Saab Group

- Thales Group

- L3Harris Technologies

- General Dynamics

- Leonardo

- Elbit Systems

- Raytheon Technologies

- Harris Corporation

- United Technologies Corporation

- Mitsubishi Heavy Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military procurement agencies

- Aerospace and defense contractors

- Private defense companies

- Defense technology startups

- International defense organizations

- Aviation research institutions

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and understanding the key market drivers, constraints, and opportunities that are central to the Asia Pacific Military Aircraft Modernization and Retrofit market. These variables are essential for building the research framework.

Step 2: Market Analysis and Construction

During this phase, market data is collected and analyzed using both primary and secondary research sources. This helps in constructing a comprehensive market overview and accurately segmenting the market based on various parameters.

Step 3: Hypothesis Validation and Expert Consultation

At this stage, the research hypothesis is tested and validated through consultations with industry experts, defense professionals, and government officials. Their feedback is used to refine market insights and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all research data and findings into a coherent and structured report. The research output is compiled to provide a detailed analysis and forecast of the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets

Rising Military Modernization Efforts

Advancements in Aircraft Retrofit Technologies

Growing Security Concerns in Asia Pacific

Government Initiatives for Aircraft Upgrades - Market Challenges

High Costs of Modernization Programs

Complex Integration with Existing Aircraft

Technological Compatibility Issues

Regulatory and Certification Barriers

Geopolitical Tensions Affecting Procurement - Market Opportunities

Expanding Investment in Defense Technology

Partnerships for Advanced Aircraft Systems

Demand for Autonomous and UAV Technologies - Trends

Shift Toward Digitalization in Military Aircraft

Increased Focus on AI and Autonomous Capabilities

Growth of Public-Private Partnerships in Defense

Advanced Manufacturing Techniques for Retrofit

Use of Hybrid Technologies in Modernization Programs - Government Regulations & Defense Policy

Aircraft Safety and Certification Regulations

Defense Export Control Policies

National Security Policies Impacting Aircraft Procurement - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Electronic Warfare Systems

Radar and Communication Systems

Navigation and Flight Control Systems

Avionics Systems - By Platform Type (In Value%)

Fighter Jets

Transport Aircraft

Helicopters

Surveillance Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

Retrofit for Legacy Aircraft

Upgrades for New Aircraft

Modular System Installation

Full-Scale System Overhaul

Custom Systems Installation - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Security Firms

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Defense Contracts

Tender Submissions

Partnerships with Private Firms

International Cooperation and Alliances - By Material / Technology (in Value%)

Composite Materials

Advanced Radar Technologies

Integrated Sensors

Lightweight Structures

AI-Driven Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Regional Reach, Contract Values, Product Innovation, Partnerships)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Northrop Grumman

Raytheon Technologies

BAE Systems

Airbus

Saab Group

L3Harris Technologies

General Dynamics

Leonardo

Rheinmetall AG

Elbit Systems

Harris Corporation

Thales Group

Sikorsky Aircraft

- Growing Demand from Air Forces and Armies for Modern Aircraft

- Government Agencies Driving Research and Development

- Private Sector’s Role in Advanced Retrofit Solutions

- Rise in Cross-border Defense Collaborations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035