Market Overview

The Asia Pacific Military Helicopters market is valued at approximately USD ~ billion based on a recent historical assessment. This market is driven by increasing defense budgets across countries in the region, with significant investments in upgrading military aircraft fleets, particularly helicopters. The demand for advanced helicopters equipped with modern avionics, communication systems, and multi-role capabilities is growing as governments focus on strengthening their defense capabilities in response to regional security challenges.

Countries like China, India, Japan, and South Korea are dominant players in the Asia Pacific Military Helicopters market due to their large military budgets and focus on enhancing aerial capabilities. These nations are investing in both new helicopter procurement and the modernization of existing fleets. This dominance is fueled by the need for helicopters to perform a wide range of roles, including combat, transport, reconnaissance, and search-and-rescue operations. Increasing geopolitical tensions and the need for strategic military readiness further contribute to their dominance in the market.

Market Segmentation

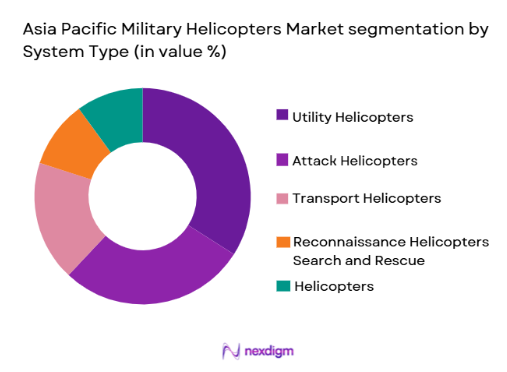

By System Type:

The Asia Pacific Military Helicopters market is segmented by system type into utility helicopters, attack helicopters, transport helicopters, reconnaissance helicopters, and search and rescue helicopters. Recently, the utility helicopters sub-segment has a dominant market share due to their versatility in both military and civilian operations. These helicopters are extensively used for troop transport, logistics, and medical evacuations. Their multi-functional nature, combined with high demand in military modernization programs, has made them a key component of defense forces across the region.

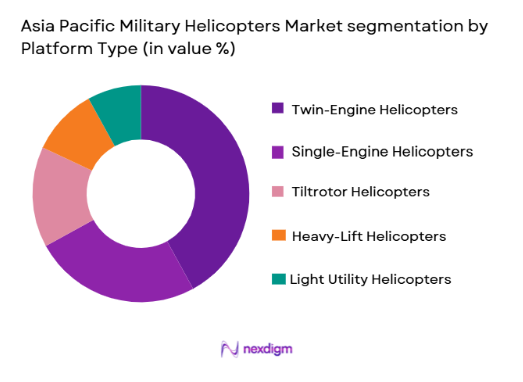

By Platform Type:

The market is segmented by platform type into single-engine helicopters, twin-engine helicopters, tiltrotor helicopters, heavy-lift helicopters, and light utility helicopters. The twin-engine helicopters sub-segment is dominating the market share due to their superior performance, reliability, and safety, particularly for military operations in hostile environments. These helicopters provide enhanced power, endurance, and safety features, making them ideal for combat, reconnaissance, and heavy-lift operations, which are crucial for modern military forces.

Competitive Landscape

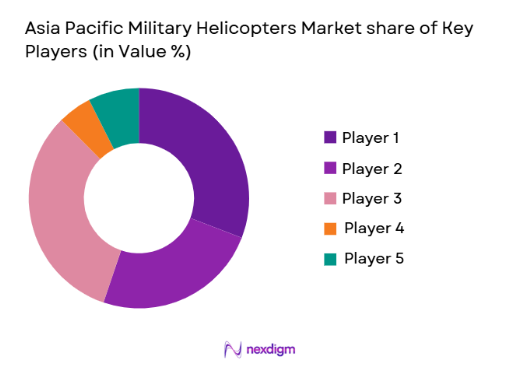

The Asia Pacific Military Helicopters market is highly competitive, with both global and regional players shaping its growth. Consolidation in the market is evident as large multinational aerospace companies collaborate with governments and defense contractors to provide advanced helicopter solutions. The influence of major players is significant, as they drive technological innovations in rotorcraft design, avionics systems, and overall helicopter performance. These players offer both new helicopters and retrofitting solutions to meet the diverse needs of military forces in the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD billion) |

| Boeing | 1916 | Chicago, IL, USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, MD, USA | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, TX, USA | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ |

Asia Pacific Military Helicopters Market Analysis

Growth Drivers

Increasing Military Expenditure:

Increasing military expenditure across the Asia Pacific region is a significant growth driver for the military helicopters market. Several countries in the region, such as China, India, and Japan, are rapidly expanding their defense budgets to modernize their armed forces. This includes enhancing their aviation capabilities, specifically in helicopter fleets, which are crucial for both combat and non-combat operations. The rising defense spending is attributed to geopolitical tensions, evolving security threats, and the desire to maintain a technological edge in military aviation. As nations invest more in advanced military technologies, helicopters, being essential for a variety of operational roles, are prioritized for procurement and upgrades. This increased funding allows for the modernization of existing fleets with advanced systems, ensuring that helicopters remain an integral part of military strategies, further driving the growth of the market.

Technological Advancements in Helicopter Systems:

Technological advancements in military helicopter systems are another key driver of market growth. Innovations in areas such as avionics, engine efficiency, and helicopter durability have significantly enhanced the performance and capabilities of military helicopters. These advancements allow for longer flight ranges, higher payload capacities, and greater operational effectiveness in hostile environments. The integration of advanced radar systems, night vision technologies, and unmanned aerial vehicle (UAV) capabilities in helicopters has revolutionized military operations. Additionally, improvements in rotorcraft design, such as tiltrotor technology, allow helicopters to perform more versatile functions, including vertical take-off and landing (VTOL). These technological advancements, in combination with growing demand for versatile platforms, ensure that military helicopters are well-suited for diverse operations, contributing to the continued growth of the market.

Market Challenges

High Procurement and Maintenance Costs:

High procurement and maintenance costs are major challenges facing the Asia Pacific Military Helicopters market. While the demand for military helicopters is growing, the cost of acquiring and maintaining advanced helicopters remains a significant barrier for some nations. Military helicopters, especially those with cutting-edge technology, come with high upfront costs for procurement, while ongoing maintenance and operational expenses can further strain budgets. Additionally, the complexity of modern helicopters, with their advanced avionics and systems, requires specialized maintenance and support, which adds to the overall operational costs. For countries with limited defense budgets, the high cost of helicopter procurement and maintenance can be a major obstacle, limiting the adoption of new helicopters or the modernization of existing fleets. These financial constraints pose a challenge to achieving the desired growth in the market, especially in developing nations within the Asia Pacific region.

Technological Integration and Compatibility:

Another challenge in the Asia Pacific Military Helicopters market is the integration and compatibility of new technologies with existing helicopter platforms. As military forces seek to upgrade their fleets with advanced avionics, weapons systems, and propulsion technologies, the process of integrating these new systems into older helicopter models can be complex and time-consuming. Compatibility issues can arise, particularly when retrofitting legacy helicopters with modern systems, leading to delays in deployment and additional costs. Furthermore, ensuring that the upgraded systems work seamlessly with existing military infrastructure, including command and control centers and communication networks, requires careful planning and coordination. These integration challenges can slow down the pace of helicopter modernization programs and increase the risk of operational inefficiencies, which may hinder the overall growth of the market.

Opportunities

Growth in Search and Rescue Operations:

The increasing demand for search and rescue (SAR) operations presents a significant opportunity for the Asia Pacific Military Helicopters market. As natural disasters, such as earthquakes, floods, and typhoons, become more frequent in the region, the need for SAR helicopters has grown. These helicopters play a crucial role in rescuing individuals stranded in remote or dangerous areas, delivering aid, and providing emergency medical services. As the region faces the challenges posed by climate change and environmental disasters, the demand for versatile and reliable SAR helicopters continues to rise. This presents an opportunity for helicopter manufacturers to design and produce specialized SAR platforms equipped with advanced navigation systems, medical facilities, and large payload capacities. The growing focus on humanitarian aid and disaster response ensures that SAR helicopters will remain a key area of investment for both military and civilian authorities, driving market growth.

Helicopter Fleet Modernization Programs:

Another opportunity lies in the continued modernization of military helicopter fleets across the Asia Pacific region. As defense forces seek to extend the operational life of their aging fleets, retrofitting and upgrading existing helicopters with the latest technologies presents a cost-effective solution. This modernization approach allows military forces to improve the performance, reliability, and safety of their helicopters without the high costs associated with procuring new aircraft. Additionally, many countries are focusing on modular systems that can be easily integrated into older platforms, making it easier to upgrade avionics, weapons systems, and engines. These modernization programs create a significant opportunity for companies offering retrofitting services, spare parts, and upgraded components. As more countries in the region invest in these programs, the demand for military helicopters and associated services is expected to increase, further contributing to market growth.

Future Outlook

The Asia Pacific Military Helicopters market is set to experience significant growth over the next five years, driven by technological advancements and rising defense budgets. As countries in the region continue to modernize their military forces, the demand for advanced helicopters capable of performing a wide range of roles, including combat, transport, and search-and-rescue operations, is expected to grow. Technological developments, such as the integration of UAV capabilities and hybrid propulsion systems, will enhance helicopter performance and versatility. Furthermore, supportive government policies and increasing collaboration between defense contractors and military forces will help drive market expansion. The need for modernized helicopter fleets, especially in response to regional security challenges, ensures a positive outlook for the market.

Major Players

- Boeing

- Airbus

- Lockheed Martin

- Bell Helicopter

- Leonardo

- Sikorsky Aircraft

- MD Helicopters

- AgustaWestland

- Kawasaki Heavy Industries

- Turbomeca

- GE Aviation

- Russian Helicopters

- China Aviation Industry Corporation

- Indian Helicopters Limited

- Hyundai Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military procurement agencies

- Aerospace and defense contractors

- Private defense companies

- Defense technology startups

- International defense organizations

- Aviation research institutions

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and understanding the key market drivers, constraints, and opportunities that are central to the Asia Pacific Military Helicopters market. These variables are essential for building the research framework.

Step 2: Market Analysis and Construction

During this phase, market data is collected and analyzed using both primary and secondary research sources. This helps in constructing a comprehensive market overview and accurately segmenting the market based on various parameters.

Step 3: Hypothesis Validation and Expert Consultation

At this stage, the research hypothesis is tested and validated through consultations with industry experts, defense professionals, and government officials. Their feedback is used to refine market insights and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all research data and findings into a coherent and structured report. The research output is compiled to provide a detailed analysis and forecast of the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Expenditure

Technological Advancements in Helicopter Systems

Rising Demand for Versatile Aerial Platforms - Market Challenges

High Procurement and Maintenance Costs

Technological Integration Complexities

Regulatory and Certification Barriers - Market Opportunities

Expansion of Helicopter Fleet Modernization

Demand for Multi-Role Helicopters

Growth in Search and Rescue Operations - Trends

Integration of AI in Helicopter Operations

Increase in Hybrid-Electric Helicopters

Adoption of Autonomous Flight Systems - Government Regulations & Defense Policy

Certification and Safety Regulations

Export Control and Compliance Policies

National Defense Funding Initiatives - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Utility Helicopters

Attack Helicopters

Transport Helicopters

Reconnaissance Helicopters

Search and Rescue Helicopters - By Platform Type (In Value%)

Single-Engine Helicopters

Twin-Engine Helicopters

Tiltrotor Helicopters

Heavy-Lift Helicopters

Light Utility Helicopters - By Fitment Type (In Value%)

New Aircraft Fitment

Retrofit and Upgrades

Modular Systems

Custom Installations

Full-Scale Overhaul - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Private Sector Procurement

Online Bidding Platforms

Third-Party Distributors - By Material / Technology (in Value%)

Advanced Composites

Lightweight Metals

Carbon Fiber Materials

Hybrid Technologies

Fuel-Efficient Engines

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Regional Reach, Product Innovation, Government Contracts, Price Performance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Northrop Grumman

Bell Helicopter

Airbus Helicopters

Leonardo

Sikorsky Aircraft

Kawasaki Heavy Industries

Russian Helicopters

MD Helicopters

AgustaWestland

Turbomeca

GE Aviation

China Aviation Industry Corporation

Indian Helicopters Limited

- Increased Demand from Air Forces and Armies

- Government Agencies Investing in Modernization

- Private Sector Seeking Utility Helicopters

- Increased Focus on Multi-Role Platforms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035