Market Overview

The Asia Pacific military satellite market is currently valued at approximately USD ~ billion, with substantial investments and advancements in satellite technology by several countries. Growth in defense spending, particularly in nations such as China, India, and Japan, is a key driver of the market’s expansion. Additionally, geopolitical tensions and the increasing demand for high-tech satellite systems to support military operations have further propelled this sector. The market is expected to continue growing as nations prioritize national security and technological advancements in space-based defense systems.

The dominant countries in the Asia Pacific military satellite market include China, India, Japan, and South Korea, each of which has been ramping up their investments in space and defense technology. These nations have large defense budgets and have prioritized space as a strategic asset for military intelligence, communications, and surveillance. China’s aggressive space program and India’s growing space defense capabilities highlight their dominance. Japan and South Korea continue to strengthen their military satellite infrastructure due to their proximity to potential geopolitical risks, further solidifying their positions in the market.

Market Segmentation

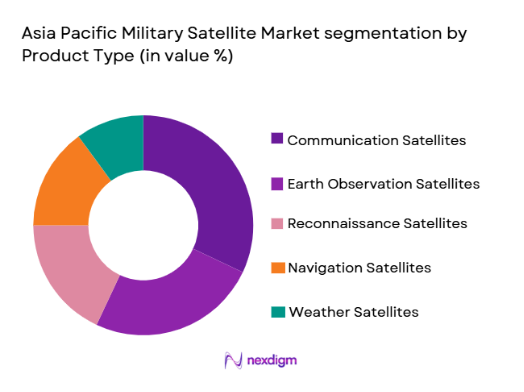

By Product Type:

The Asia Pacific military satellite market is segmented by product type into communication satellites, earth observation satellites, reconnaissance satellites, navigation satellites, and weather satellites. Recently, communication satellites have dominated the market due to their crucial role in providing secure and reliable communication channels for defense operations. The increasing need for real-time intelligence, surveillance, and reconnaissance (ISR) has driven this segment’s growth. Governments and defense agencies heavily invest in satellite systems that ensure strategic advantage, effective communication, and data transmission capabilities. Moreover, the rise of digital warfare and cyber threats has further fueled the demand for secure and robust communication satellite systems for military purposes.

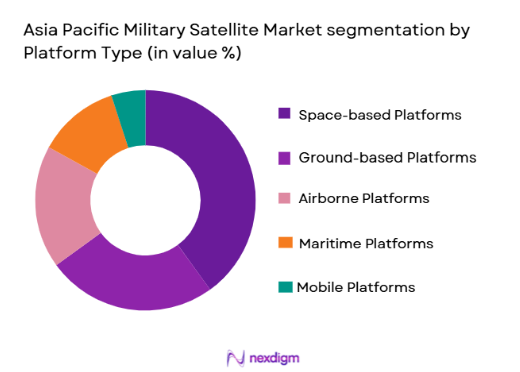

By Platform Type:

The Asia Pacific military satellite market is segmented by platform type into ground-based platforms, airborne platforms, space-based platforms, maritime platforms, and mobile platforms. Space-based platforms have emerged as the dominant sub-segment, primarily due to their ability to provide global coverage and support a wide range of military operations, including surveillance, communication, and navigation. With growing investments in satellite constellations and low Earth orbit (LEO) satellite networks, countries are leveraging these platforms for strategic military purposes. The increasing reliance on space-based assets to ensure national security has further contributed to the dominance of this sub-segment in the Asia Pacific region.

Competitive Landscape

The competitive landscape of the Asia Pacific military satellite market is marked by significant consolidation and the presence of both established defense giants and emerging players. Leading firms continue to dominate through technology innovation, extensive research, and strong governmental ties. However, there is a growing emphasis on collaboration and partnerships among nations and private firms to enhance satellite capabilities and space defense infrastructure. These companies are leveraging cutting-edge technology, such as miniaturization, to meet growing demands for compact, cost-effective, and efficient satellite systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | Toulouse, France | ~ | ~ | ~ | ~ |

Asia Pacific Military Satellite Market Analysis

Growth Drivers

Rising Geopolitical Tensions:

Rising geopolitical tensions in the Asia Pacific region have significantly contributed to the demand for military satellites. As countries like China, India, and Japan face regional security threats, the need for advanced satellite systems to support national defense becomes more critical. These tensions have led to increased defense budgets and investments in space technology, particularly in satellite systems that enhance military intelligence, surveillance, and reconnaissance (ISR). The use of military satellites to monitor troop movements, detect threats, and communicate securely is integral to modern defense strategies. Nations are prioritizing space-based technologies for their strategic value, leading to an accelerated pace of satellite development and deployment. As geopolitical risks continue to rise, the demand for military satellites will likely grow, ensuring continued market expansion in the region.

Advancements in Satellite Technology:

Technological advancements in satellite technology have further driven the growth of the military satellite market in Asia Pacific. The emergence of low Earth orbit (LEO) satellites and miniaturized satellite systems has revolutionized the industry by offering more affordable, scalable, and reliable solutions for military applications. These advancements allow for enhanced communication, faster data transfer, and improved imagery capabilities, all of which are essential for defense operations. Additionally, the integration of AI and machine learning in satellite systems has enabled faster processing and analysis of satellite data, aiding in real-time decision-making. As technology continues to evolve, military satellites will become more advanced, leading to an increasing demand for cutting-edge space-based technologies across the Asia Pacific region.

Market Challenges

High Costs of Satellite Deployment:

One of the major challenges hindering the growth of the Asia Pacific military satellite market is the high costs associated with satellite deployment. Developing and launching advanced military satellites involves significant capital investment, which poses a barrier for many countries, particularly those with limited defense budgets. The cost of building and maintaining satellite infrastructure, coupled with the expense of launching and managing space missions, creates financial constraints for nations. While advanced satellites offer critical benefits, including improved surveillance, communication, and data transfer, the prohibitive costs limit the number of satellites that can be deployed. As such, countries need to balance the demand for advanced satellite technology with the high costs involved in their development and maintenance.

Cybersecurity and Space Vulnerabilities:

The increasing reliance on satellites for military communication and intelligence poses significant cybersecurity risks. Military satellites are often prime targets for cyberattacks, which can disrupt operations or result in the theft of sensitive information. Protecting these space assets from cyber threats is a growing challenge, as adversaries continue to develop sophisticated tools to hack or jam satellite systems. Furthermore, the vulnerability of satellite infrastructure to attacks on the ground, including launch facilities and ground stations, exacerbates the risk. Countries in the Asia Pacific region are under pressure to enhance cybersecurity measures for their military satellite networks, creating additional costs and challenges in maintaining secure space-based assets.

Opportunities

Growth in Commercial and Defense Satellite Convergence:

The convergence of commercial and defense satellite markets presents significant opportunities for innovation and growth. As commercial satellite technology advances, military organizations are leveraging these innovations to enhance their defense capabilities. By utilizing off-the-shelf commercial satellite technology, defense agencies can lower costs and accelerate deployment times. This trend is particularly evident in the use of LEO satellite constellations, which are now being deployed for both commercial and military applications. Collaborative efforts between defense contractors and commercial space companies will likely continue to flourish, creating new opportunities for cost-effective and efficient satellite solutions. As these commercial technologies evolve, defense agencies will benefit from greater capabilities and flexibility in their military satellite systems.

Expansion of Low Earth Orbit (LEO) Satellites:

The rapid expansion of LEO satellites represents a significant opportunity for the Asia Pacific military satellite market. LEO satellites offer lower latency and better coverage compared to traditional geostationary satellites, making them particularly suited for military communication, surveillance, and navigation. These satellites are smaller, more affordable, and can be deployed in constellations, providing continuous global coverage. The growing interest in LEO satellite constellations, driven by companies like SpaceX and OneWeb, is expected to continue expanding, providing military organizations with new tools to enhance their operations. With reduced costs and faster deployment times, LEO satellites are poised to become a major driver of growth in the military satellite market.

Future Outlook

The Asia Pacific military satellite market is expected to experience steady growth over the next five years, driven by increasing defense budgets and technological advancements in satellite technology. Governments in the region are likely to continue prioritizing investments in space defense capabilities, particularly in response to growing geopolitical risks. Advancements in satellite miniaturization, AI integration, and LEO satellite constellations will fuel demand for next-generation military satellites, making them more affordable and efficient. Additionally, strategic partnerships between defense agencies and commercial satellite providers will contribute to the development of innovative solutions, ensuring the continued expansion of the market.

Major Players

- Lockheed Martin

- Boeing

- Northrop Grumman

- Thales Group

- Airbus Defence and Space

- Raytheon Technologies

- L3 Technologies

- General Dynamics

- BAE Systems

- SpaceX

- China Aerospace Corporation

- ISRO

- Mitsubishi Electric

- SES S.A.

- Arianespace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries and agencies

- Satellite communication providers

- Military contractors

- Aerospace manufacturers

- Private defense companies

- Space research organizations

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying key factors influencing the market, such as technological trends, government spending, and defense needs across the Asia Pacific region.

Step 2: Market Analysis and Construction

In this step, data is gathered from reliable sources, including government reports, defense agency publications, and satellite manufacturers, to construct the market size and segment it effectively.

Step 3: Hypothesis Validation and Expert Consultation

Experts in the field of aerospace and defense are consulted to validate market trends and hypothesize future developments in the military satellite sector.

Step 4: Research Synthesis and Final Output

The final step synthesizes all the collected data and expert opinions into a comprehensive report, ensuring that market forecasts and trends are accurately represented for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Geopolitical Tensions

Rising Military Modernization Programs

Government Investments in National Security

Technological Advancements in Satellite Communication

Integration of Commercial Technologies into Military Satellites - Market Challenges

High Capital Expenditure for Satellite Development

Technological Interoperability and Integration Issues

Cybersecurity Vulnerabilities in Satellite Systems

Regulatory Barriers and Compliance Challenges

Limited Availability of Skilled Personnel - Market Opportunities

Expansion in Earth Observation and Imaging Satellites

Strategic Partnerships with Private Tech Firms

Growth in Autonomous Satellite Technologies - Trends

Adoption of AI and Machine Learning in Satellite Operations

Increased Use of Low Earth Orbit (LEO) Satellites

Focus on Miniaturization of Military Satellites

Emerging Demand for Dual-Use Satellites

Investments in Secure Satellite Communication Networks - Government Regulations & Defense Policy

Regulations on Satellite Launch and Operation

Export Control Regulations for Satellite Technologies

Government Funding and Grants for Satellite Development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Reconnaissance Satellites

Weather Satellites - By Platform Type (In Value%)

Ground-based Platforms

Airborne Platforms

Space-based Platforms

Maritime Platforms

Mobile Platforms - By Fitment Type (In Value%)

Integrated Solutions

On-premise Solutions

Hybrid Solutions

Cloud-based Solutions

Modular Solutions - By EndUser Segment (In Value%)

Military Forces

Government Agencies

Private Sector

Defense Contractors

International Alliances - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Composite Materials

Electronics & Photonics

Optical Materials

Advanced Propulsion Technologies

Solar Power Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material / Technology, Market Value, Installed Units, Average System Price, System Complexity Tier)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Thales Group

BAE Systems

Raytheon Technologies

SpaceX

Harris Corporation

Airbus Defence and Space

L3 Technologies

General Dynamics

Sierra Nevada Corporation

Rocket Lab

China Aerospace Corporation

India Space Research Organisation

Arianespace

- Military Forces’ Increasing Demand for Advanced Satellite Systems

- Government Agencies’ Role in Satellite Procurement and Operations

- Private Sector’s Increasing Investment in Satellite Technologies

- Collaboration Between International Defense Alliances for Shared Satellite Resources

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035