Market Overview

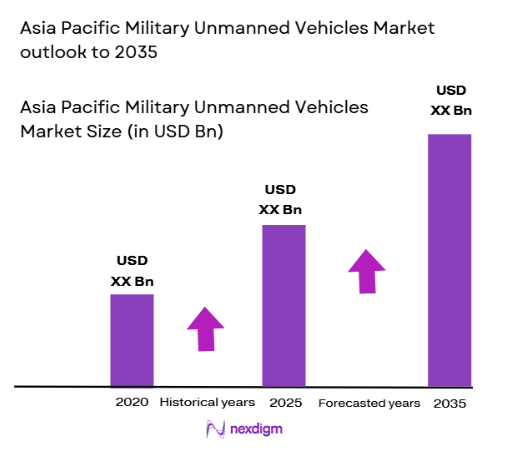

The Asia Pacific Military Unmanned Vehicles market is valued at USD ~ billion based on a recent historical assessment derived from regional defense budget disclosures, procurement contracts, and manufacturer financial reporting across major Asia Pacific defense agencies. Market expansion is driven by accelerated unmanned capability integration across land, air, and maritime forces, increasing ISR mission requirements, and modernization programs emphasizing autonomous systems deployment. Growing investment in indigenous unmanned platforms and advanced payload technologies further sustains procurement volumes and lifecycle upgrades.

China, India, South Korea, Japan, and Australia dominate the Asia Pacific Military Unmanned Vehicles market due to large defense modernization budgets, established aerospace manufacturing ecosystems, and active deployment across multi-domain military operations. Coastal operational environments and territorial surveillance requirements encourage naval unmanned adoption, while border security challenges drive land and aerial systems deployment. Regional industrial policies supporting domestic unmanned vehicle production and export capabilities reinforce technological leadership and sustained procurement activity.

Market Segmentation

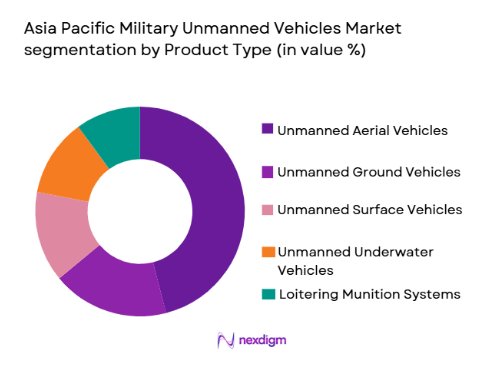

By Product Type:

Asia Pacific Military Unmanned Vehicles market is segmented by product type into Unmanned Aerial Vehicles, Unmanned Ground Vehicles, Unmanned Surface Vehicles, Unmanned Underwater Vehicles, and Loitering Munition Systems. Recently, Unmanned Aerial Vehicles has a dominant market share due to factors such as extensive ISR mission deployment, mature regional manufacturing capability, lower operational costs compared to manned aircraft, broad mission versatility across surveillance and strike roles, and continuous procurement by multiple armed forces. Expanding tactical and MALE-class UAV fleets across Asia Pacific militaries further reinforces aerial platform dominance within operational unmanned system investments.

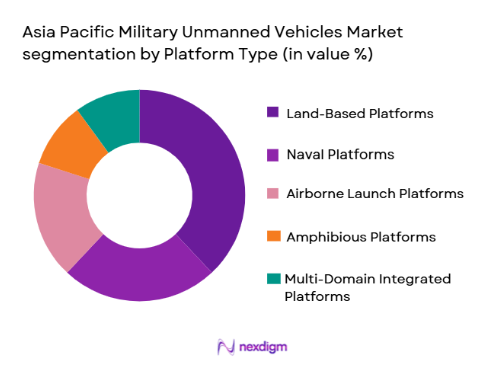

By Platform Type:

Asia Pacific Military Unmanned Vehicles market is segmented by platform type into Land-Based Platforms, Naval Platforms, Airborne Launch Platforms, Amphibious Platforms, and Multi-Domain Integrated Platforms. Recently, Land-Based Platforms has a dominant market share due to factors such as extensive border surveillance deployments, ground combat reconnaissance requirements, high adoption by army modernization programs, and operational suitability across diverse terrains. Persistent land border monitoring and tactical convoy support missions across Asia Pacific militaries continue to drive large-scale procurement and deployment of unmanned ground and land-launch systems.

Competitive Landscape

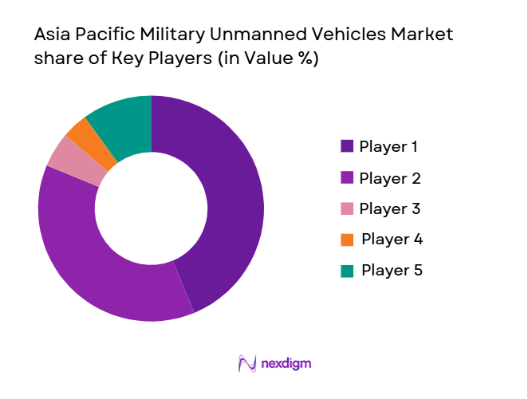

The Asia Pacific Military Unmanned Vehicles market demonstrates moderate consolidation with strong influence from state-supported aerospace and defense conglomerates alongside specialized unmanned system manufacturers. Major players maintain competitive positioning through indigenous production, export partnerships, and integrated autonomy technologies. Regional defense procurement policies favor domestic manufacturers, strengthening local champions while international firms participate through joint ventures and technology transfer programs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary Domain |

| Aviation Industry Corporation of China | 2008 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| China Aerospace Science and Technology Corporation | 1999 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Korea Aerospace Industries | 1999 | Sacheon, South Korea | ~ | ~ | ~ | ~ | ~ |

| ST Engineering | 1967 | Singapore | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Military Unmanned Vehicles Market Analysis

Growth Drivers

Rising Regional Defense Modernization and Autonomous Capability Programs:

Asia Pacific governments are significantly expanding defense modernization initiatives that prioritize autonomous and unmanned operational capabilities across all military domains. Strategic security reminders, maritime disputes, and border tensions are encouraging procurement of persistent surveillance and combat-support unmanned vehicles. Armed forces are integrating UAVs, UGVs, and unmanned maritime platforms into ISR, reconnaissance, logistics, and strike missions. Regional defense budgets increasingly allocate funding toward robotics, AI-enabled autonomy, and network-centric warfare capabilities. Indigenous development programs in China, India, South Korea, and Japan are accelerating domestic unmanned vehicle manufacturing ecosystems. Military doctrine across Asia Pacific is shifting toward human-machine teaming and distributed operations. This transition drives continuous platform acquisition and upgrades. Growing export ambitions among regional manufacturers further reinforce production scale and technological advancement.

Expanding Multi-Domain ISR and Persistent Surveillance Requirements:

Asia Pacific militaries require continuous intelligence, surveillance, and reconnaissance coverage across vast maritime zones, contested borders, and island territories. Unmanned vehicles enable persistent monitoring without human risk, making them critical for modern situational awareness architectures. UAVs provide long-endurance aerial surveillance while UGVs and unmanned surface vessels support ground and coastal monitoring missions. Integration of electro-optical, infrared, radar, and signals intelligence payloads enhances operational capability across varied environments. Military command networks increasingly depend on real-time unmanned sensor data for decision superiority. Rapid technological advances in autonomy, communications, and miniaturized sensors improve mission effectiveness and endurance. Rising regional security tensions sustain demand for continuous monitoring capability. These operational requirements ensure sustained procurement of diverse unmanned vehicle platforms.

Market Challenges

Export Controls and Technology Transfer Restrictions on Advanced Unmanned Systems:

Advanced autonomy software, secure communication modules, and high-performance sensors used in military unmanned vehicles are subject to strict export controls and international defense trade regulations. Asia Pacific manufacturers often depend on imported components such as imaging sensors, propulsion subsystems, and satellite communication equipment. Restrictions from technology-origin countries limit access to critical subsystems and delay indigenous development timelines. Joint ventures and co-development programs face regulatory approval complexity. These constraints increase program costs and extend development cycles for domestic unmanned platforms. Military procurement agencies must balance strategic autonomy with technology access constraints. Export compliance frameworks also limit regional export opportunities. Such regulatory barriers reduce scalability and interoperability of Asia Pacific unmanned vehicle programs.

Interoperability and Integration Complexity Across Multi-Domain Military Networks:

Asia Pacific armed forces operate diverse unmanned platforms across land, air, and maritime environments with varying communication protocols and control architectures. Integrating these platforms into unified command and control networks requires standardized data links, secure communication, and interoperable mission systems. Legacy military infrastructure often lacks compatibility with advanced autonomous platforms. Integration across joint forces and allied operations increases complexity. Cybersecurity risks further complicate network integration of unmanned vehicles. Diverse terrain and electromagnetic environments across the region require platform-specific customization. High integration and testing costs burden defense procurement programs. Training and doctrine adaptation also require extensive resources. These factors slow deployment of fully networked unmanned ecosystems.

Opportunities

Indigenous Development and Export Expansion of Regional Unmanned Vehicle Platforms:

Asia Pacific governments are prioritizing domestic defense manufacturing to reduce reliance on foreign suppliers and strengthen strategic autonomy in unmanned technologies. Indigenous UAV, UGV, and unmanned maritime system programs are expanding across China, India, South Korea, and Southeast Asia. Localized production enables cost-effective manufacturing and customization for regional operational requirements. Export markets in developing defense nations create growth potential for Asia Pacific unmanned vehicle manufacturers. Regional defense cooperation agreements support technology sharing and joint production initiatives. Domestic supply chains for sensors, propulsion, and autonomy software are maturing rapidly. Government incentives and defense innovation funding accelerate research and commercialization. This environment creates strong opportunity for regional players to scale production and global market presence.

Integration of Artificial Intelligence, Swarm Autonomy, and Advanced Mission Systems:

Emerging technologies such as AI-driven autonomy, swarm coordination, and adaptive mission software are transforming military unmanned vehicle capabilities. Asia Pacific defense agencies are investing in autonomous navigation, collaborative robotics, and distributed sensing networks. Swarm UAV operations enable scalable surveillance and strike missions with lower operational risk. AI-based target recognition and mission planning enhance operational effectiveness across complex environments. Autonomous maritime patrol and unmanned logistics vehicles expand mission applications beyond ISR roles. Regional research institutions and defense firms are advancing machine learning and robotics integration. Such technological innovation creates opportunities for next-generation unmanned vehicle platforms and system upgrades. Adoption of advanced autonomy also enhances export competitiveness of regional manufacturers.

Future Outlook

The Asia Pacific Military Unmanned Vehicles market is expected to expand steadily over the next five years driven by sustained defense modernization, growing autonomous warfare doctrines, and maritime surveillance priorities. Technological advancement in artificial intelligence, swarm operations, and long-endurance propulsion will accelerate platform capability evolution. Regional governments are strengthening domestic unmanned manufacturing and export programs, while multi-domain integration across armed forces will increase deployment scale. Demand will remain strong across aerial, land, and maritime unmanned vehicle systems.

Major Players

- China Aerospace Science and Technology Corporation

- China North Industries Group Corporation

- Hindustan Aeronautics Limited

- Bharat Electronics Limited

- Korea Aerospace Industries

- Hanwha Aerospace

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- ST Engineering

- PT Dirgantara Indonesia

- DefTech Malaysia

- Elbit Systems Asia

- Israel Aerospace Industries Asia Pacific

- AeroVironment Asia

Key Target Audience

- Armed forces procurement agencies

- Aerospace and defense manufacturers

- Unmanned vehicle system integrators

- Border and maritime security agencies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense technology suppliers

Research Methodology

Step 1: Identification of Key Variables

Core market variables including unmanned platform types, defense procurement budgets, deployment domains, and technology adoption levels were identified across Asia Pacific military programs. Operational roles and platform categories were mapped to establish segmentation structure and demand indicators.

Step 2: Market Analysis and Construction

Regional defense spending, procurement contracts, and manufacturer production capacities were analyzed to construct market size and segmentation. Platform deployment data across land, air, and maritime forces supported share allocation and structural modeling of the Asia Pacific unmanned vehicles ecosystem.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through comparison with defense modernization plans, military robotics adoption patterns, and expert assessments from defense analysts and industry specialists. Technology readiness and procurement cycles were cross-checked against regional defense programs.

Step 4: Research Synthesis and Final Output

Validated data and qualitative insights were synthesized into a structured market framework covering segmentation, competition, and future outlook. Analytical modeling ensured internal consistency across market size, shares, and regional deployment trends for the Asia Pacific Military Unmanned Vehicles market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising regional defense modernization programs

Expansion of autonomous surveillance missions

Growing demand for force protection systems

- Market Challenges

Export controls on advanced subsystems

Interoperability across multi domain forces

High lifecycle maintenance requirements

- Market Opportunities

Indigenous unmanned system development initiatives

Integration of AI enabled mission autonomy

Expansion of maritime unmanned patrol fleets

- Trends

Swarm enabled unmanned operations

Increased endurance hybrid propulsion

Cross domain command integration

Miniaturized ISR payload deployment

Rapid field deployable unmanned units - Government Regulations & Defense Policy

Local content mandates in defense procurement

Cross border defense technology agreements

Operational certification frameworks for autonomy - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Unmanned Aerial Vehicles

Unmanned Ground Vehicles

Unmanned Surface Vehicles

Unmanned Underwater Vehicles

Loitering Munition Systems - By Platform Type (In Value%)

Land-Based Tactical Platforms

Naval Combat Platforms

Airborne Launch Platforms

Amphibious Platforms

Multi-Domain Integrated Platforms - By Fitment Type (In Value%)

Fixed Wing Configurations

Rotary Wing Configurations

Hybrid VTOL Configurations

Tracked Mobility Systems

Wheeled Mobility Systems - By EndUser Segment (In Value%)

Army Forces

Naval Forces

Air Forces

Special Operations Units

Border and Maritime Security Agencies - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Public Sector Contracts

Strategic Military Partnerships

Licensed Local Production

Foreign Military Sales Programs - By Material / Technology (in Value %)

Composite Airframe Structures

Autonomous Navigation Software

Electro Optical and Infrared Sensors

Satellite Communication Systems

Swarm Coordination Algorithms

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Autonomy Level, Endurance, Payload Capacity, Mobility Type, Launch Method, Communication Range, Survivability Features, Mission Type, Platform Compatibility, Lifecycle Cost)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

AeroVironment Asia

China Aerospace Science and Technology Corporation

Aviation Industry Corporation of China

China North Industries Group Corporation

Hindustan Aeronautics Limited

Bharat Electronics Limited

Israel Aerospace Industries Asia Pacific

Elbit Systems Asia

Korea Aerospace Industries

Hanwha Aerospace

Mitsubishi Heavy Industries

Kawasaki Heavy Industries

ST Engineering

PT Dirgantara Indonesia

DefTech Malaysia

- Army demand for tactical reconnaissance robots

- Naval adoption of unmanned maritime patrol craft

- Air force integration of ISR UAV squadrons

- Border forces deployment of persistent surveillance drones

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035