Market Overview

The Asia Pacific Missiles and Missile Defense Systems market is valued at USD ~ billion based on a recent historical assessment derived from defense budget allocations, procurement disclosures, and financial reporting of leading regional missile manufacturers and defense ministries. Market expansion is driven by accelerated strategic deterrence modernization, large-scale deployment of layered air and missile defense architectures, and sustained acquisition of precision-guided, ballistic, and hypersonic missile systems across land, naval, and air force programs throughout major Asia Pacific military economies.

China, India, Japan, and South Korea dominate the Asia Pacific Missiles and Missile Defense Systems market due to indigenous missile production ecosystems, vertically integrated defense industries, and sustained state-funded military modernization programs. Beijing, Hyderabad, Tokyo, and Seoul function as primary missile design, propulsion, and guidance technology hubs supported by advanced aerospace manufacturing infrastructure, national defense laboratories, and long-term strategic missile development roadmaps enabling comprehensive system design, testing, and deployment capabilities across regional defense forces.

Market Segmentation

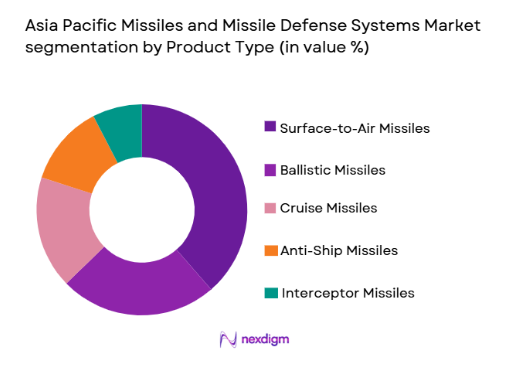

By Product Type:

Asia Pacific Missiles and Missile Defense Systems market is segmented by product type into Surface-to-Air Missiles, Ballistic Missiles, Cruise Missiles, Anti-Ship Missiles, and Interceptor Missiles. Recently, Surface-to-Air Missiles has a dominant market share due to factors such as extensive deployment across national air defense grids, continuous modernization of layered interception capabilities, high procurement frequency for protection of urban and military infrastructure, and integration with radar and command systems across land and naval platforms. Regional militaries prioritize airspace denial against aircraft, drones, and missile threats, resulting in sustained acquisition cycles and upgrades of medium- and long-range surface-to-air missile batteries across Asia Pacific defense forces.

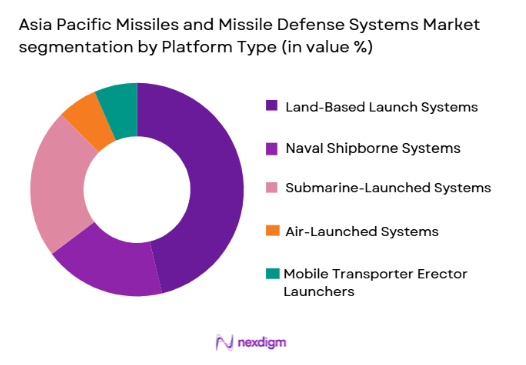

By Platform Type:

Asia Pacific Missiles and Missile Defense Systems market is segmented by platform type into Land-Based Launch Systems, Naval Shipborne Systems, Submarine-Launched Systems, Air-Launched Systems, and Mobile Transporter Erector Launchers. Recently, Land-Based Launch Systems has a dominant market share due to factors such as wide territorial coverage requirements, deployment flexibility across fixed and mobile sites, integration into national missile defense networks, and cost-effective scalability for protecting strategic infrastructure and urban regions. Ground-based missile platforms support layered air and missile defense architectures and long-range strike deterrence missions, leading to continuous procurement of silo-based, mobile, and vertical launch ground systems across regional defense forces.

Competitive Landscape

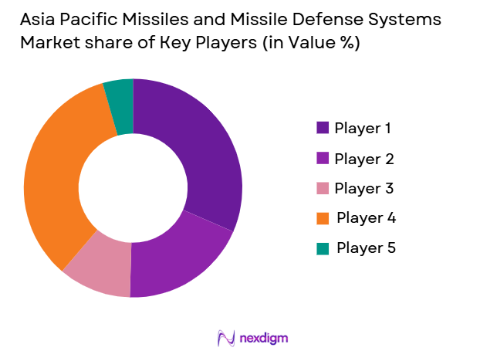

The Asia Pacific Missiles and Missile Defense Systems market is highly consolidated and dominated by state-backed aerospace and defense conglomerates with vertically integrated missile development capabilities spanning propulsion, guidance electronics, launch systems, and interceptor technologies. Regional governments prioritize domestic suppliers through indigenous development and licensed production programs, while select multinational firms participate via joint ventures and technology collaboration. Long-term military contracts, sovereign funding, and strategic deterrence programs reinforce market concentration among a limited group of technologically advanced missile manufacturers across Asia Pacific.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Missile Segment Strength |

| China Aerospace Science and Technology Corporation | 1999 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| China Aerospace Science and Industry Corporation | 2001 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Hanwha Aerospace | 1977 | Seoul, South Korea | ~ | ~ | ~ | ~ | ~ |

| Bharat Dynamics Limited | 1970 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Missiles and Missile Defense Systems Market Analysis

Growth Drivers

Regional Strategic Missile Deterrence Modernization Programs:

Governments across Asia Pacific are rapidly modernizing missile arsenals and defensive interception networks to strengthen strategic deterrence and counter evolving ballistic, cruise, and hypersonic threats from neighboring states and emerging military powers. Countries are investing in long-range ballistic missiles, multi-layered surface-to-air defense systems, and integrated command-and-control architectures that enhance national security posture and retaliatory capability. Persistent territorial disputes and maritime tensions necessitate credible strike and interception readiness across land and naval forces. Defense budgets in major regional economies prioritize missile acquisition due to high strategic impact and force multiplication benefits. Indigenous missile development initiatives expand domestic manufacturing and technological sovereignty while reducing reliance on imports. Military alliances and joint exercises stimulate interoperability and standardized missile system deployment across coalition forces. Integration of missile defense with radar, satellite tracking, and early-warning systems enhances interception reliability. Sustained modernization cycles and procurement continuity significantly accelerate long-term market demand.

Expansion of Integrated Multi-Layered Air and Missile Defense Networks:

Asia Pacific militaries are deploying nationwide layered air and missile defense architectures combining short-, medium-, and long-range interception systems interconnected with advanced radar, sensors, and command platforms to counter multi-domain aerial threats. Rapid proliferation of ballistic missiles, cruise missiles, and unmanned aerial systems has compelled countries to expand defense coverage protecting urban centers, military bases, and critical infrastructure. Network-centric warfare technologies enable seamless coordination among sensors, launchers, and control units for simultaneous engagement across altitude envelopes. Mobile missile launchers improve survivability and geographic reach of defense layers. Naval vessels equipped with vertical launch air defense systems extend maritime protection zones. Continuous upgrades in seeker, propulsion, and guidance technologies improve interception speed and accuracy. Integrated defense networks enhance early detection and response time against emerging threats. These factors collectively drive large-scale procurement and upgrade of missile defense systems across Asia Pacific defense forces.

Market Challenges

Advanced Missile System Development Costs and Engineering Complexity:

Missile and missile defense systems require advanced propulsion technologies, high-temperature materials, precision guidance electronics, and extensive testing infrastructure, making development programs capital-intensive and technologically demanding for manufacturers and governments. Hypersonic weapons and advanced interceptors involve specialized materials and navigation systems that significantly increase research and production costs. Missile testing requires dedicated ranges, telemetry systems, and safety infrastructure, further elevating expenditure and program timelines. Smaller regional defense budgets struggle to sustain indigenous development without international collaboration. Integration of radar, command networks, and launch platforms adds engineering complexity and interoperability challenges. Long qualification cycles delay operational deployment. Export restrictions on critical components constrain technological access. These factors limit participation to technologically capable nations and slow market expansion in emerging defense economies.

Missile Technology Transfer Restrictions and Export Control Regimes:

Missile technologies are heavily regulated under international non-proliferation agreements and export control frameworks that restrict transfer of propulsion, seeker, and interception technologies across national borders, limiting access for many Asia Pacific countries. Procurement of advanced missile defense systems often faces geopolitical constraints and licensing barriers. Indigenous development programs encounter technological gaps due to restricted access to advanced sensors and electronics. Collaborative projects involve strict intellectual property controls that limit domestic manufacturing autonomy. Restrictions on high-performance semiconductor and navigation components hinder system capability advancement. Approval processes prolong acquisition timelines and increase costs. Dependence on limited foreign suppliers creates supply vulnerabilities. These regulatory constraints complicate technology acquisition and slow modernization across regional missile defense programs.

Opportunities

Hypersonic Missile and Counter-Hypersonic Defense System Development:

Asia Pacific nations are investing extensively in hypersonic strike weapons and counter-hypersonic interception technologies to maintain strategic parity with global military powers and respond to emerging high-speed threat environments. Hypersonic missiles provide rapid penetration capability against advanced air defenses, strengthening deterrence strategies. Simultaneously, demand for counter-hypersonic defense drives research into high-velocity interceptors, advanced tracking sensors, and directed energy concepts. Defense agencies are funding experimental propulsion such as scramjets and boost-glide vehicles. Collaboration between national laboratories and aerospace industries expands regional hypersonic innovation ecosystems. Specialized testing infrastructure for high-Mach flight is being developed across multiple countries. Dual demand for offensive and defensive hypersonic capability ensures long-term procurement pipelines. These technological advancements create significant growth opportunities for regional missile manufacturers and system integrators.

Mobile and Modular Missile Defense Deployment for Urban and Infrastructure Protection:

Rising missile threats to metropolitan regions and strategic infrastructure across Asia Pacific are driving demand for mobile, rapidly deployable missile defense systems capable of protecting population centers, energy facilities, and military installations. Governments are prioritizing adaptable defense architectures using transporter erector launchers and modular interceptor batteries that can be relocated based on threat intelligence. Urban defense strategies require short- and medium-range interception systems integrated with radar and command networks. Modular launch platforms enable scalable deployment across geographic terrains and threat levels. Rapid deployment supports contingency operations and crisis response. Investments in compact sensors and networked command platforms enhance coverage efficiency. Integration with civil defense and disaster protection frameworks expands mission scope. These developments create sustained procurement opportunities for flexible missile defense solutions across Asia Pacific.

Future Outlook

The Asia Pacific Missiles and Missile Defense Systems market is expected to expand steadily over the next five years supported by sustained geopolitical tensions, strategic deterrence modernization, and expansion of layered air and missile defense architectures across major regional economies. Hypersonic weapons development, indigenous production initiatives, and naval missile deployment will shape procurement patterns. Governments are increasing investment in mobile launch platforms and integrated interception networks protecting urban and strategic assets. Advancements in propulsion, guidance, and sensor technologies will further accelerate regional market growth.

Major Players

- China Aerospace Science and Technology Corporation

- China Aerospace Science and Industry Corporation

- Mitsubishi Heavy Industries

- Hanwha Aerospace

- Korea Aerospace Industries

- Bharat Dynamics Limited

- DRDO India

- Larsen and Toubro Defense

- Tata Advanced Systems

- Hindustan Aeronautics Limited

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- MBDA

- Thales

- Kongsberg Defence and Aerospace

Key Target Audience

- Nationaldefenseministries

- Missile procurement agencies

- Air and missile defense commands

- Naval defense acquisition divisions

- Strategic forces modernization offices

- Aerospace and defense manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key analytical variables included missile system categories, platform deployment types, defense spending patterns, procurement cycles, and regional military modernization programs. Data inputs were derived from defense budgets, acquisition plans, and aerospace industry financial disclosures across Asia Pacific countries.

Step 2: Market Analysis and Construction

Supply-side analysis of missile manufacturers and demand-side assessment of defense procurement were combined to construct market size and segmentation. Regional production capabilities, deployment inventories, and modernization timelines were evaluated to determine market structure and segment dominance.

Step 3: Hypothesis Validation and Expert Consultation

Defense analysts, missile engineers, and former military procurement officials validated assumptions related to system deployment, procurement frequency, and technology adoption trends. Cross-verification ensured alignment with regional defense strategies, industrial capacity, and geopolitical security dynamics.

Step 4: Research Synthesis and Final Output

Validated quantitative data and qualitative defense insights were synthesized into structured market sections including segmentation, competitive landscape, and outlook. Estimates were reconciled with procurement trends and policy frameworks to produce the final regional missile market assessment.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising regional geopolitical tensions and deterrence modernization

Expansion of integrated air and missile defense architectures

Indigenous missile development and localization initiatives

Growing naval missile deployment for maritime security

Advancements in hypersonic and precision guidance technologies - Market Challenges

High development and lifecycle costs of advanced missile systems

Technology transfer restrictions and export control regimes

Complex system integration across multi-domain defense networks

Missile defense interception reliability and testing constraints

Dependence on critical electronic and propulsion components - Market Opportunities

Deployment of layered missile defense shields in urban centers

Co-development programs for hypersonic defense technologies

Expansion of mobile missile systems for rapid response forces - Trends

Shift toward hypersonic strike and counter-hypersonic defense

Integration of AI-enabled target recognition and tracking

Adoption of vertical launch and modular missile architectures

Growth of sea-based missile deterrence platforms

Network-centric missile defense command systems - Government Regulations & Defense Policy

National missile deterrence and strategic forces doctrines

Regional missile proliferation control frameworks

Defense industrial self-reliance and localization policies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ballistic Missile Defense Systems

Surface-to-Air Missile Systems

Cruise Missile Systems

Tactical Ballistic Missiles

Anti-Ship Missile Systems - By Platform Type (In Value%)

Land-Based Missile Systems

Naval Shipborne Missile Systems

Submarine-Launched Missile Systems

Air-Launched Missile Systems

Integrated Mobile Missile Launch Platforms - By Fitment Type (In Value%)

Fixed Silo-Based Systems

Mobile Transporter Erector Launcher Systems

Vertical Launch Systems

Canisterized Missile Systems

Modular Launcher Systems - By EndUser Segment (In Value%)

National Armed Forces

Strategic Rocket Forces

Naval Defense Commands

Air Defense Commands

Joint Integrated Defense Agencies - By Procurement Channel (In Value%)

Direct Government Procurement

Intergovernmental Defense Agreements

Licensed Production Programs

Defense Offset Partnerships

State-Owned Defense Enterprises - By Material / Technology (in Value %)

Solid Propellant Missile Technology

Liquid Propellant Missile Technology

Hypersonic Glide Vehicle Technology

Active Radar Seeker Technology

Infrared Homing Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Missile Range Capability, Guidance Accuracy, Launch Platform Compatibility, Interception Altitude Envelope, Mobility and Deployment Time, Propulsion Technology, Seeker Type, System Integration Level, Lifecycle Cost, Indigenous Content Level)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

China Aerospace Science and Technology Corporation

China Aerospace Science and Industry Corporation

Mitsubishi Heavy Industries

Korea Aerospace Industries

Hanwha Aerospace

DRDO India

Bharat Dynamics Limited

Tata Advanced Systems

Larsen and Toubro Defense

Israel Aerospace Industries

Rafael Advanced Defense Systems

MBDA

Thales

Kongsberg Defence and Aerospace

Hindustan Aeronautics Limited

- Strategic forces prioritizing long-range deterrent missile deployment

- Naval commands expanding shipborne missile defense coverage

- Air defense units adopting layered interception systems

- Joint defense agencies integrating multi-domain missile networks

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035