Market Overview

The Asia Pacific Naval Vessels market is valued at USD ~ billion based on a recent historical assessment derived from regional defense procurement disclosures, naval shipbuilding contracts, and consolidated financial reports of major state-owned and private shipyards across China, South Korea, Japan, India, and Australia. Market expansion is driven by sustained naval modernization programs, fleet recapitalization initiatives, indigenous warship development policies, and rising maritime security requirements across territorial waters and sea lines of communication.

China, South Korea, Japan, and India dominate the Asia Pacific Naval Vessels market due to large-scale domestic naval shipbuilding ecosystems, advanced maritime engineering capabilities, and strong sovereign defense funding frameworks supporting indigenous vessel programs. Major naval construction hubs including Shanghai, Dalian, Busan, Ulsan, Yokohama, and Mumbai concentrate shipyard infrastructure, specialized workforce, and integrated supply chains, enabling high-tonnage vessel production, complex warship integration, and long-term fleet sustainment across regional naval forces.

Market Segmentation

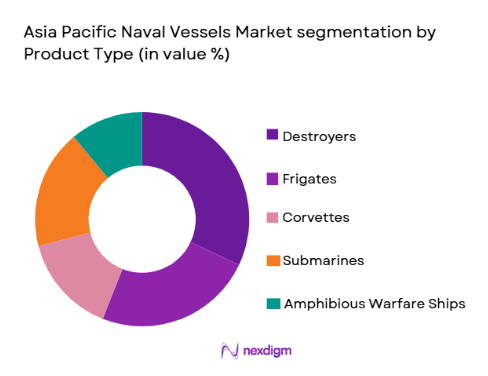

By Product Type:

Asia Pacific Naval Vessels market is segmented by product type into Destroyers, Frigates, Corvettes, Submarines, and Amphibious Warfare Ships. Recently, Destroyers has a dominant market share due to factors such as expanding blue-water naval doctrines, multi-role combat capability requirements, strong indigenous destroyer programs in China, Japan, South Korea, and India, and sustained procurement of air-defense and anti-submarine warfare platforms. Their larger displacement, advanced radar systems, integrated missile capabilities, and fleet command roles drive higher unit procurement values compared to smaller surface combatants or submarines across regional naval modernization programs.

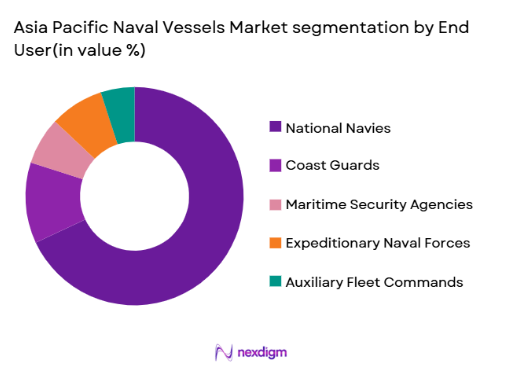

By End User:

Asia Pacific Naval Vessels market is segmented by end user into National Navies, Coast Guards, Maritime Security Agencies, Expeditionary Naval Forces, and Auxiliary Fleet Commands. Recently, National Navies has a dominant market share due to factors such as sovereign fleet expansion priorities, power-projection doctrine adoption, modernization of legacy warships, and increased defense budgets allocated to blue-water capability development. Large procurement contracts for destroyers, frigates, submarines, and amphibious assault ships are primarily issued by national defense ministries, reinforcing naval forces as the principal procurement authority across regional maritime security architectures.

Competitive Landscape

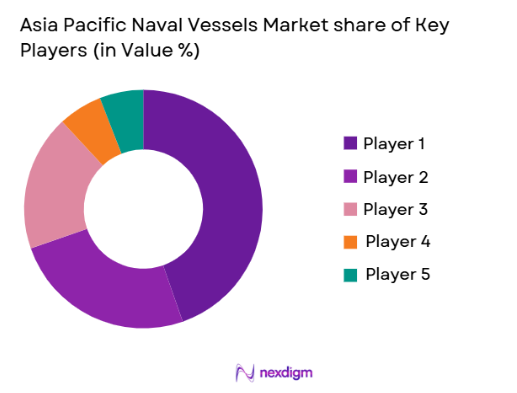

The Asia Pacific Naval Vessels market exhibits high consolidation with dominance of state-owned shipbuilding conglomerates and a limited number of technologically advanced private shipyards capable of constructing large displacement combat vessels. Major players maintain influence through sovereign naval contracts, integrated combat system capabilities, and domestic industrial policy alignment, creating high entry barriers for new participants and reinforcing long-term procurement concentration within national shipbuilding ecosystems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Vessel Class Portfolio |

| China State Shipbuilding Corporation | 2019 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| Hyundai Heavy Industries | 1972 | Ulsan, South Korea | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Heavy Industries | 1884 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Mazagon Dock Shipbuilders | 1934 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| Austal Limited | 1988 | Henderson, Australia | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Naval Vessels Market Analysis

Growth Drivers

Indigenous Naval Modernization and Fleet Expansion Programs:

Asia Pacific naval forces are undertaking extensive indigenous fleet modernization initiatives to replace aging vessels and expand maritime combat capability, supported by sustained defense budget allocations and long-term naval acquisition roadmaps across major regional powers. Governments are prioritizing domestic shipbuilding ecosystems to ensure strategic autonomy, industrial employment, and technological self-reliance in warship construction, which directly increases procurement volumes for destroyers, frigates, submarines, and amphibious platforms. National shipyards in China, India, Japan, and South Korea are executing multi-class warship programs simultaneously, enabling continuous production cycles and economies of scale that reinforce domestic procurement preference. Increasing territorial security requirements across contested maritime zones and sea lanes have accelerated fleet expansion mandates, particularly for blue-water capable combatants and carrier escort groups. Naval modernization strategies emphasize multi-role vessels with integrated air defense, anti-submarine warfare, and network-centric combat systems, driving higher vessel complexity and procurement value. Regional naval doctrine evolution toward power projection and expeditionary operations has further increased demand for larger displacement vessels capable of sustained deployments. Industrial policy incentives and local content mandates strengthen domestic procurement commitments and reduce reliance on foreign suppliers. Long-term naval shipbuilding plans extending across multiple decades ensure predictable procurement pipelines that stabilize the regional naval vessels market.

Maritime Security Pressures and Geopolitical Naval Competition:

Intensifying geopolitical competition across the Indo-Pacific maritime domain is driving accelerated naval capability development and fleet reinforcement among regional states seeking deterrence, sea control, and maritime domain awareness superiority. Strategic maritime chokepoints and contested territorial waters require sustained naval presence, prompting procurement of advanced surface combatants, submarines, and patrol vessels capable of high-end combat and persistent surveillance. Regional naval force structures are shifting toward balanced fleets combining air-defense destroyers, anti-submarine frigates, and amphibious assault ships to support expeditionary and joint operations. Defense cooperation frameworks and alliance commitments are encouraging interoperable naval platforms and joint maritime security architectures, further expanding procurement requirements. Rising naval exercises, patrol deployments, and maritime law enforcement missions necessitate fleet expansion and technological upgrades to maintain operational readiness across large oceanic regions. Governments are investing in network-centric naval warfare capabilities, integrated sensors, and advanced propulsion systems to maintain competitive parity with neighboring naval powers. Strategic rivalry in shipbuilding capacity and fleet tonnage among major regional states reinforces continuous naval procurement cycles. These geopolitical drivers collectively sustain long-term demand for advanced naval vessels across the Asia Pacific region.

Market Challenges

Capital Intensive Shipbuilding and Budget Allocation Constraints:

Naval vessel construction requires extremely high capital investment across shipyard infrastructure, specialized materials, combat systems integration, and skilled workforce development, creating substantial financial burden for governments and shipbuilders engaged in warship production programs. Large surface combatants and submarines involve long construction timelines and significant upfront funding commitments that compete with other defense priorities such as aerospace and land systems procurement. Fluctuations in national defense budgets and fiscal pressures can delay or scale down naval acquisition programs, directly affecting order pipelines for shipyards and subsystem suppliers. Complex warship integration processes involving propulsion, sensors, weapons, and electronics increase cost escalation risk and lifecycle expenditure uncertainty. Developing nations within the region face affordability constraints in acquiring high-end naval platforms, limiting fleet modernization pace despite security needs. Shipyard modernization and technology adoption investments further raise capital requirements for domestic naval manufacturing ecosystems. Economic volatility and currency fluctuations influence imported component costs and project financing stability. These financial constraints collectively challenge sustained naval procurement continuity across parts of the Asia Pacific market.

Technological Complexity and Integration Risks in Advanced Warships:

Modern naval vessels incorporate highly sophisticated combat systems, integrated propulsion architectures, stealth design features, and digital command networks that significantly increase engineering complexity and technical risk during design and construction phases. Integration of multi-domain sensors, missile systems, radar arrays, and electronic warfare suites requires advanced systems engineering capabilities and rigorous testing cycles, extending development timelines and increasing project uncertainty. Indigenous shipbuilding programs attempting technological self-reliance often face challenges in mastering advanced naval technologies traditionally dominated by established maritime powers. Delays in subsystem development or integration can cascade across entire shipbuilding schedules, affecting fleet induction timelines and operational readiness goals. Rapid evolution of naval warfare technologies risks obsolescence of platforms under development, forcing costly redesign or upgrades during construction. Cybersecurity and electronic warfare resilience requirements add additional layers of technical complexity in modern naval vessels. Limited domestic supplier bases for specialized naval components can constrain integration capabilities and increase dependency on foreign technology transfer. These technological challenges elevate risk exposure across regional naval vessel development programs.

Opportunities

Expansion of Indigenous Defense Shipbuilding Ecosystems:

Governments across the Asia Pacific region are actively promoting domestic naval shipbuilding capabilities through industrial policy incentives, local content mandates, and technology transfer frameworks designed to strengthen sovereign defense manufacturing ecosystems. Indigenous warship programs provide long-term industrial opportunities for national shipyards, subsystem manufacturers, and maritime engineering suppliers engaged in vessel construction and lifecycle support. Increasing localization of propulsion systems, combat electronics, hull structures, and materials production enhances domestic value addition and reduces foreign procurement dependence. Regional shipyards are upgrading infrastructure and adopting advanced modular construction techniques to expand warship production capacity and technological sophistication. Collaboration among domestic defense companies and research institutions accelerates innovation in naval architecture and maritime technologies. Indigenous shipbuilding initiatives also create export opportunities for emerging naval manufacturing nations seeking participation in global defense markets. Government backed naval procurement pipelines ensure stable demand for domestic shipbuilders across multiple vessel classes. These structural industrial developments present sustained growth opportunities within the Asia Pacific naval vessels market.

Adoption of Advanced Propulsion and Autonomous Naval Technologies:

The transition toward integrated electric propulsion, hybrid power systems, and autonomous maritime technologies is creating new technological development and procurement opportunities across next-generation naval vessel programs in the Asia Pacific region. Advanced propulsion architectures improve energy efficiency, acoustic stealth, and onboard power availability for sensors and directed energy systems, enhancing operational capability of future warships. Autonomous and optionally manned naval platforms are emerging as force multipliers for surveillance, mine countermeasures, and maritime security missions, expanding naval fleet composition beyond traditional crewed vessels. Integration of artificial intelligence-enabled decision support, predictive maintenance systems, and digital ship management technologies increases vessel performance and lifecycle efficiency. Regional navies are investing in research and prototype development of unmanned surface and underwater vehicles complementing conventional fleets. Shipbuilders adopting modular open architecture design can integrate evolving technologies more rapidly, extending platform relevance. Government funding for maritime innovation and naval technology research accelerates development of next-generation vessels. These technological transitions create substantial opportunity space for advanced naval vessel development across the Asia Pacific market.

Future Outlook

The Asia Pacific Naval Vessels market is expected to maintain sustained expansion driven by long-term naval modernization programs, geopolitical maritime competition, and increasing defense industrial localization. Technological evolution toward integrated electric propulsion, stealth architectures, and autonomous maritime systems will redefine vessel design priorities. Regional governments will continue prioritizing indigenous shipbuilding capacity and domestic procurement frameworks. Expanding maritime security requirements and blue-water naval doctrines will reinforce demand for high-capability surface combatants and submarines across the region.

Major Players

- China State Shipbuilding Corporation

- Hyundai Heavy Industries

- Mitsubishi Heavy Industries

- Japan Marine United

- Hanwha Ocean

- Mazagon Dock Shipbuilders Limited

- Garden Reach Shipbuilders and Engineers

- Austal Limited

- ST Engineering Marine

- PT PAL Indonesia

- Hanjin Heavy Industries and Construction

- Kawasaki Heavy Industries

- Damen Schelde Naval Shipbuilding

- HD Hyundai Samho

- Cochin Shipyard Limited

Key Target Audience

- Navaldefenseministries

- National shipbuilding corporations

- Maritime security agencies

- Coast guard authorities

- Defense procurement organizations

- Investments and venture capitalist firms

- Government and regulatory bodies

- Naval combat system integrators

Research Methodology

Step 1: Identification of Key Variables

Key naval procurement variables including vessel classes, displacement ranges, propulsion technologies, shipyard capacities, and regional defense spending allocations were identified to structure the Asia Pacific naval vessels market framework and segmentation baseline.

Step 2: Market Analysis and Construction

Regional naval acquisition programs, shipbuilding contracts, fleet modernization plans, and shipyard production capabilities were analyzed to construct market sizing, segmentation, and competitive structure across major Asia Pacific naval manufacturing nations.

Step 3: Hypothesis Validation and Expert Consultation

Defense industry specialists, maritime engineers, naval procurement analysts, and shipbuilding experts were consulted to validate vessel class demand trends, procurement drivers, and technological adoption patterns influencing the regional naval vessels market.

Step 4: Research Synthesis and Final Output

Validated qualitative and quantitative insights were synthesized into structured market analysis, segmentation tables, competitive assessment, and future outlook reflecting procurement pipelines and naval modernization trajectories across the Asia Pacific region.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Maritime Territorial Disputes and Naval Modernization

Expansion of Blue Water Naval Capabilities

Increasing Defense Budgets Across Asia Pacific

Growth of Indigenous Shipbuilding Programs

Demand for Multi Role Naval Platforms - Market Challenges

High Capital Intensity of Naval Shipbuilding

Long Development and Procurement Cycles

Technology Transfer Restrictions

Shipyard Capacity Constraints

Maintenance and Lifecycle Cost Burden - Market Opportunities

Regional Collaboration in Naval Programs

Adoption of Autonomous and Unmanned Naval Systems

Export Potential of Indigenous Naval Platforms - Trends

Shift Toward Stealth and Low Observable Vessel Design

Integration of Network Centric Warfare Systems

Electrification of Naval Propulsion Systems

Modular Mission Configuration Architectures

Increased Submarine Fleet Expansion - Government Regulations & Defense Policy

Naval Modernization and Maritime Security Policies

Local Content and Indigenous Manufacturing Mandates

Defense Export Promotion Frameworks - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aircraft Carriers

Destroyers

Frigates

Corvettes

Amphibious Assault Ships - By Platform Type (In Value%)

Surface Combatants

Submarines

Amphibious Warfare Platforms

Patrol Vessels

Support and Auxiliary Ships - By Fitment Type (In Value%)

New Build Vessels

Midlife Upgrades

Retrofit Programs

Modular Mission Packages

Technology Insertions - By EndUser Segment (In Value%)

National Navies

Coast Guards

Maritime Security Agencies

Expeditionary Forces

Naval Reserve Forces - By Procurement Channel (In Value%)

Government Defense Shipyards

State Owned Naval Contractors

Private Shipbuilding Firms

International Defense Partnerships

Licensed Production Programs - By Material / Technology (in Value %)

Steel Hull Structures

Composite Superstructures

Stealth Coatings and Materials

Integrated Electric Propulsion

Advanced Radar Absorbent Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Vessel Type Portfolio, Indigenous Manufacturing Capability, Stealth Technology Integration, Propulsion Systems, Displacement Range, Combat System Integration, Export Presence, Modular Design Capability, Lifecycle Support Services, Shipyard Capacity)

SWOT Analysis of Key Players

Pricing & Procurement Analysis - Key Players

China State Shipbuilding Corporation

China Shipbuilding Industry Corporation

Hyundai Heavy Industries

Hanwha Ocean

Mitsubishi Heavy Industries

Japan Marine United

Mazagon Dock Shipbuilders Limited

Garden Reach Shipbuilders and Engineers

Hanjin Heavy Industries and Construction

Austal Limited

ST Engineering Marine

PT PAL Indonesia

Damen Schelde Naval Shipbuilding

HD Hyundai Samho

Bharat Dynamics Limited

- Expansion of Regional Naval Fleets for Maritime Security

- Shift Toward Indigenous Vessel Procurement

- Growing Demand for Multi Mission Combat Ships

- Increased Lifecycle Support and Upgrade Programs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035