Market Overview

The Asia Pacific Non Lethal Weapons Market is valued at USD ~ billion based on a recent historical assessment derived from defense procurement disclosures of regional interior ministries and financial reporting of less-lethal technology manufacturers. Market expansion is driven by rising investments in civil unrest management capabilities, modernization of policing equipment, and military adoption of graduated force systems. Increasing cross-border security operations and emphasis on human-rights-compliant engagement tools further stimulate procurement across law enforcement and defense agencies.

China, India, South Korea, Japan, and Australia dominate the Asia Pacific Non Lethal Weapons Market due to strong internal security budgets, indigenous defense manufacturing ecosystems, and large-scale law enforcement modernization programs. Urban population density and frequent public-order operations in megacities such as Beijing, Shanghai, Delhi, Mumbai, Seoul, and Tokyo drive sustained equipment demand. Regional governments prioritize domestic production and technology transfer partnerships, strengthening supply chains and procurement continuity across national security agencies.

Market Segmentation

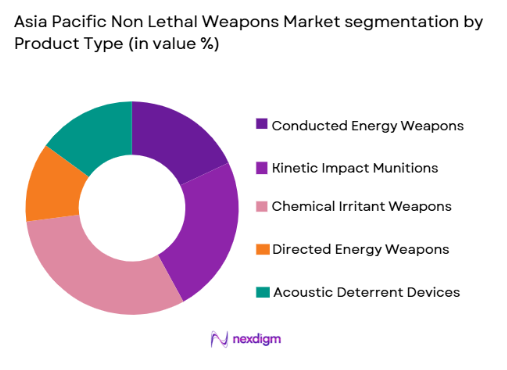

By Product Type:

Asia Pacific Non Lethal Weapons Market is segmented by product type into conducted energy weapons, kinetic impact munitions, chemical irritant weapons, directed energy weapons, and acoustic deterrent devices. Recently, chemical irritant weapons have a dominant market share due to factors such as widespread adoption in crowd control operations, regulatory acceptance across Asia Pacific policing frameworks, low unit cost enabling large-scale deployment, established domestic manufacturing capability in China and India, and operational familiarity among law enforcement agencies. These systems also offer scalable response levels and compatibility with handheld and vehicle-mounted launchers, reinforcing procurement preference across urban police forces and border security units managing mass-gathering scenarios and riot-control missions.

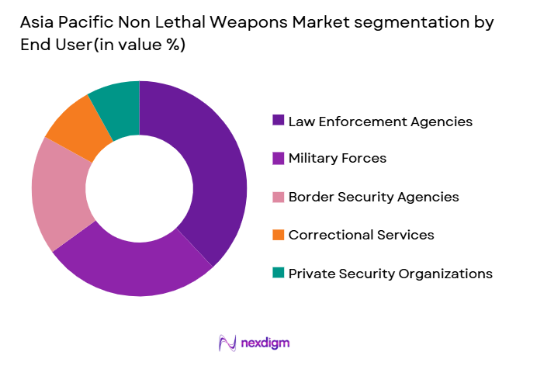

By End User:

Asia Pacific Non Lethal Weapons Market is segmented by end user into law enforcement agencies, military forces, border security agencies, correctional services, and private security organizations. Recently, law enforcement agencies have a dominant market share due to factors such as continuous modernization of police equipment, increasing civil unrest management responsibilities in dense urban environments, regulatory mandates for proportional force application, and recurring procurement cycles for riot control and compliance tools. National police forces across China, India, and Southeast Asia maintain large personnel bases requiring standardized less-lethal equipment, while metropolitan policing units conduct frequent crowd-management operations, driving sustained acquisition of handheld deterrence and area-control systems.

Competitive Landscape

The Asia Pacific Non Lethal Weapons Market exhibits moderate consolidation with state-owned defense manufacturers in China and South Korea alongside global less-lethal specialists shaping technology development and supply. Regional procurement favors domestic producers for compliance and cost advantages, while multinational firms provide advanced electronic deterrence and specialty munitions. Strategic partnerships, licensed production agreements, and government-backed industrial programs reinforce competitive positioning and long-term supply contracts across national security agencies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User Focus |

| Norinco Group | 1980 | China | ~ | ~ | ~ | ~ | ~ |

| Poly Technologies | 1984 | China | ~ | ~ | ~ | ~ | ~ |

| Poongsan Corporation | 1968 | South Korea | ~ | ~ | ~ | ~ | ~ |

| MKU Limited | 1985 | India | ~ | ~ | ~ | ~ | ~ |

| Axon Enterprise | 1993 | USA | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Non Lethal Weapons Market Analysis

Growth Drivers

Urban Civil Unrest Management Modernization Programs:

Governments across Asia Pacific are expanding procurement of non lethal weapons to equip police and paramilitary forces with scalable response tools for managing protests, riots, and mass gatherings in rapidly urbanizing megacities. Large population concentrations and frequent public-order deployments require standardized crowd-control equipment, driving sustained acquisition of chemical irritant munitions, impact projectiles, and conducted energy weapons. National modernization initiatives emphasize replacing legacy batons and firearms with proportional force options aligned with international policing standards and human-rights guidelines. Interior ministries in China, India, and Southeast Asia allocate dedicated budgets for riot-control gear and personal deterrence systems to enhance operational readiness and officer safety. Urban security planning frameworks incorporate less-lethal technologies into rapid-response units and metropolitan policing commands, reinforcing recurring procurement cycles. Increasing deployment frequency accelerates wear-and-tear replacement demand and consumable munition consumption, further expanding market size. Standardization policies mandate nationwide equipment compatibility, promoting bulk procurement contracts and domestic production incentives. Training academies integrate non lethal weapons into tactical doctrine, institutionalizing their use across law enforcement hierarchies. Regional governments also prioritize crowd-management preparedness for large public events and political demonstrations, sustaining long-term acquisition programs.

Military Internal Security and Border Control Adoption:

Asia Pacific military and border forces increasingly deploy non lethal weapons for internal security, checkpoint enforcement, and maritime interdiction missions where lethal force escalation is restricted. Border disputes, migration control operations, and counter-insurgency environments require compliance tools capable of deterring intrusions without provoking armed confrontation, stimulating procurement of long-range acoustic devices, dazzlers, and irritant dispersal systems. Defense ministries integrate graduated force concepts into operational doctrine, equipping patrol units and naval boarding teams with less-lethal options. Coastal security agencies and paramilitary units conducting gray-zone operations rely on non lethal deterrence to manage encounters with civilian vessels and unauthorized crossings. Equipment standardization across joint security forces drives multi-agency procurement programs and domestic manufacturing expansion. Military modernization budgets allocate funds for specialized non lethal launchers compatible with existing weapon platforms and vehicles. Training programs incorporate escalation-of-force protocols emphasizing controlled deterrence and compliance. Regional defense collaborations and joint exercises also promote interoperability of non lethal systems across allied forces. Growing emphasis on minimizing casualties and political escalation in contested zones reinforces sustained defense adoption of non lethal technologies.

Market Challenges

Regulatory and Export Control Constraints on Less-Lethal Technologies:

The Asia Pacific non lethal weapons market faces complex regulatory oversight governing production, export, and operational use of chemical irritants, electro-muscular devices, and directed energy deterrents. National legislation and international conventions impose licensing requirements, classification controls, and end-user certifications that restrict cross-border trade and technology transfer. Manufacturers must navigate varying compliance frameworks across countries, increasing administrative costs and delaying procurement cycles. Restrictions on certain irritant formulations and energy-based devices limit product standardization and scale economies for regional suppliers. Government approval processes for police and military acquisition often require extensive testing and certification, prolonging deployment timelines. Export limitations reduce opportunities for regional manufacturers to expand beyond domestic markets, constraining revenue growth. Public scrutiny regarding misuse and human-rights concerns prompts tighter operational regulations and oversight mechanisms. Policy variability between jurisdictions complicates multinational contracts and joint production arrangements. Compliance risks and reputational considerations also influence purchasing decisions by security agencies, slowing adoption of advanced non lethal technologies.

Operational Effectiveness Limitations in Diverse Environmental Conditions:

Non lethal weapons deployed across Asia Pacific must perform reliably in extreme climates ranging from tropical humidity to desert heat and maritime salinity, creating technical and operational challenges for consistent effectiveness. Chemical irritants and electro-muscular devices exhibit variable performance under high humidity, wind dispersion, or heavy rainfall, reducing predictable crowd-control outcomes. Directed energy and acoustic systems may suffer attenuation or interference in dense urban infrastructure or mountainous terrain. Security agencies operating across varied geographies require adaptable equipment configurations, increasing design complexity and cost. Maintenance requirements escalate in corrosive coastal environments or dusty desert regions, affecting lifecycle durability and readiness. Training programs must account for environmental performance variability, complicating standardized tactical procedures. Procurement authorities demand extensive field testing across climates before approval, prolonging evaluation phases. Manufacturers face engineering challenges in balancing portability, power output, and environmental resilience within operational constraints. Performance inconsistencies in real-world conditions can reduce user confidence and slow replacement of conventional deterrence methods.

Opportunities

Localization and Indigenous Production Expansion Programs:

Asia Pacific governments increasingly promote domestic manufacturing of non lethal weapons to reduce dependence on foreign suppliers and strengthen national defense industries, creating significant growth opportunities for regional companies and joint ventures. Industrial policies in China, India, South Korea, and Southeast Asia provide incentives such as procurement preferences, technology transfer agreements, and research funding for local production facilities. Indigenous manufacturing enables customization to regional operational requirements and environmental conditions, enhancing product relevance for domestic security forces. Localization also reduces procurement costs and supply-chain risks associated with imports and export restrictions. Public-sector enterprises and private defense firms collaborate to develop irritant munitions, conducted energy devices, and launch platforms tailored to national standards. Governments integrate non lethal technologies into broader defense indigenization initiatives, ensuring long-term domestic demand. Local production ecosystems stimulate component supply chains including electronics, polymers, and propellant materials. Export potential within Asia Pacific and allied markets expands as regional manufacturers achieve certification and cost competitiveness. Strategic autonomy objectives further reinforce sustained investment in indigenous non lethal weapons capabilities.

Integration of Smart Control and Precision Targeting Technologies:

Advances in electronics, sensors, and digital control systems enable next-generation non lethal weapons with improved accuracy, controllability, and accountability, opening opportunities for premium product segments in Asia Pacific security markets. Smart conducted energy devices with biometric activation, data logging, and programmable output enhance operational safety and compliance with use-of-force regulations. Precision irritant delivery launchers and guided impact munitions reduce collateral exposure and improve crowd-control effectiveness in dense urban settings. Integration with body-worn cameras and command systems allows real-time monitoring and after-action review, supporting transparency and accountability mandates. Governments seeking to modernize policing standards show growing interest in technologically advanced deterrence tools. Defense research institutions and electronics manufacturers in Japan, South Korea, and India are developing sensor-enabled non lethal systems suited to regional operational doctrines. Digitalization also facilitates training simulation and performance analytics, strengthening institutional adoption. Premium smart deterrence devices command higher procurement value and lifecycle service contracts. Technological differentiation provides competitive advantage for suppliers offering integrated, compliant, and precision-controlled non lethal solutions.

Future Outlook

The Asia Pacific Non Lethal Weapons Market is expected to expand steadily as governments continue prioritizing internal security modernization and proportional force capabilities across law enforcement and defense forces. Technological advancements in smart deterrence devices, precision irritant delivery, and integrated control systems will enhance operational effectiveness and accountability. Regulatory support for human-rights-compliant engagement tools and domestic manufacturing initiatives will strengthen regional supply chains. Urbanization, border security demands, and military internal security operations will sustain procurement momentum and long-term market growth.

Major Players

- NorincoGroup

- Poly Technologies

- Poongsan Corporation

- MKU Limited

- Axon Enterprise

- Combined Systems Inc

- NonLethal Technologies Inc

- Lamperd Less Lethal Inc

- Safariland Group

- PepperBall Technologies

- Rheinmetall Denel Munitions

- Premier Explosives Limited

- Tata Advanced Systems Limited

- Daekwang Chemical

- Sage Control Ordnance

Key Target Audience

- Law enforcement agencies

- Military and paramilitary forces

- Border security agencies

- Correctional services departments

- Private security organizations

- Defense procurement authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key market variables including product categories, end-user sectors, procurement channels, and regional production capabilities were identified through analysis of defense procurement records, manufacturer portfolios, and regulatory frameworks across Asia Pacific security agencies.

Step 2: Market Analysis and Construction

Market size and segmentation were constructed using triangulation of company financial disclosures, government acquisition data, and unit deployment estimates across law enforcement and defense organizations, ensuring alignment with regional procurement structures.

Step 3: Hypothesis Validation and Expert Consultation

Findings and assumptions were validated through consultation with defense industry analysts, former security procurement officials, and less-lethal technology specialists to confirm demand patterns, technology adoption trends, and operational drivers.

Step 4: Research Synthesis and Final Output

Validated datasets and qualitative insights were synthesized into structured market analysis, segmentation, and forecasting frameworks, producing a comprehensive assessment of the Asia Pacific Non Lethal Weapons Market dynamics and outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising civil unrest management requirements in urban Asia Pacific regions

Expansion of non lethal force doctrines in regional military modernization

Increasing border control enforcement across Asia Pacific land and maritime boundaries

Growing adoption of less lethal compliance tools by law enforcement agencies

Regulatory push toward proportional force and human rights compliant weaponry - Market Challenges

Export controls and cross border compliance restrictions on non lethal technologies

Operational reliability concerns in extreme climatic environments

Limited domestic manufacturing capability in several Asia Pacific countries

Public scrutiny and misuse allegations affecting procurement cycles

Interoperability issues with legacy security equipment platforms

Market Opportunities

Localization of non lethal weapons production in emerging Asia Pacific economies

Integration of smart targeting and biometric activation technologies

Expansion of correctional and private security sector demand - Trends

Shift toward smart electronically controlled deterrence devices

Adoption of modular multi effect non lethal weapon platforms

Increased procurement of vehicle mounted crowd control systems

Development of long range precision irritant delivery systems

Integration of AI assisted escalation of force management tools - Government Regulations & Defense Policy

Human rights based use of force regulations in Asia Pacific policing frameworks

National defense indigenization policies encouraging local production

Import licensing and classification standards for less lethal munitions - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Conducted Energy Weapons

Kinetic Impact Projectiles

Chemical Irritant Delivery Systems

Directed Energy Deterrence Systems

Acoustic and Flash Distraction Devices - By Platform Type (In Value%)

Handheld Individual Systems

Vehicle Mounted Systems

Fixed Installation Perimeter Systems

Naval Boarding Systems

Aerial Dispersal Systems - By Fitment Type (In Value%)

Standalone Devices

Integrated Weapon Platforms

Modular Attachments

Wearable Deterrence Units

Remote Operated Systems - By EndUser Segment (In Value%)

Law Enforcement Agencies

Military and Paramilitary Forces

Border Security Units

Correctional Facilities

Private Security Organizations - By Procurement Channel (In Value%)

Government Direct Procurement

Ministry of Defense Contracts

Interior Ministry Tenders

State Police Acquisition Programs

Authorized Defense Distributors - By Material / Technology (in Value %)

Electro Muscular Disruption Technology

Oleoresin Capsicum Formulations

Rubber and Polymer Impact Materials

Laser Dazzler Emitters

Long Range Acoustic Devices

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Technology Type, Effective Range, Energy Output, Payload Type, Platform Integration, Compliance Certification, Procurement Cost, Lifecycle Durability, Operational Environment, Supplier Localization)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Norinco Group

Poly Technologies

Poongsan Corporation

Daekwang Chemical

MKU Limited

Tata Advanced Systems Limited

Premier Explosives Limited

Rheinmetall Denel Munitions

Axon Enterprise

Combined Systems Inc

NonLethal Technologies Inc

Lamperd Less Lethal Inc

Safariland Group

PepperBall Technologies

Sage Control Ordnance

- Law enforcement modernization programs increasing adoption of electronic deterrence systems

- Military internal security operations driving demand for scalable crowd control weapons

- Border security agencies requiring long range and area denial non lethal tools

- Private security sector expansion across commercial and infrastructure facilities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035