Market Overview

The Asia Pacific Remote Sensing Satellites Market is valued at USD ~ billion based on a recent historical assessment, driven by expanding earth observation programs, defense surveillance investments, and agricultural monitoring initiatives across emerging space economies. Government-led satellite deployments, regional disaster monitoring missions, and growing commercial geospatial data demand are accelerating satellite manufacturing and launch activities. Increasing adoption of small satellite constellations and hyperspectral imaging systems further strengthens procurement across defense, environmental, and commercial observation applications.

China, India, and Japan dominate the Asia Pacific Remote Sensing Satellites Market due to strong sovereign space capabilities, domestic satellite manufacturing ecosystems, and sustained government funding in earth observation infrastructure. China leads through large-scale electro-optical and radar constellations, India through cost-efficient observation satellites and launch services, and Japan through advanced imaging payload technologies. Regional collaboration programs and expanding commercial earth observation firms in South Korea and Southeast Asia further reinforce regional leadership in satellite deployment and geospatial intelligence utilization.

Market Segmentation

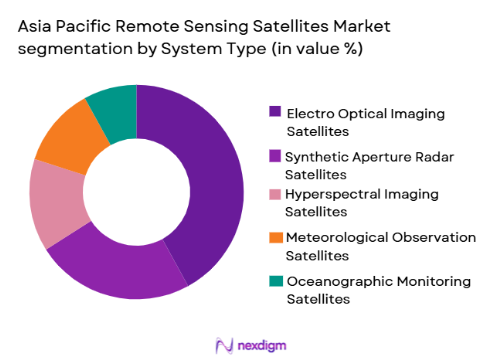

By System Type:

Asia Pacific Remote Sensing Satellites market is segmented by system type into electro optical imaging satellites, synthetic aperture radar satellites, hyperspectral imaging satellites, meteorological observation satellites, and oceanographic monitoring satellites. Recently, electro optical imaging satellites has a dominant market share due to factors such as broad applicability in agriculture monitoring, urban mapping, defense reconnaissance, and infrastructure planning across Asia Pacific economies. Governments prioritize high-resolution optical imaging for civil and military earth observation missions, while commercial geospatial firms depend on optical data for mapping and analytics services. Mature sensor technology, lower processing complexity compared with radar systems, and widespread demand from environmental agencies and smart city programs further sustain optical satellite dominance. Expanding small satellite constellations carrying optical payloads also accelerate deployment frequency and coverage, reinforcing sustained procurement across regional observation programs.

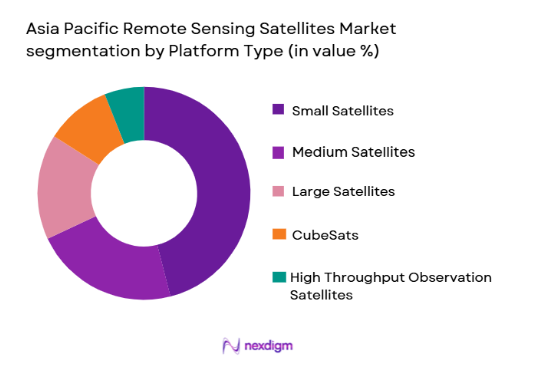

By Platform Type:

Asia Pacific Remote Sensing Satellites market is segmented by platform type into small satellites, medium satellites, large satellites, CubeSats, and high throughput observation satellites. Recently, small satellites has a dominant market share due to factors such as rapid deployment capability, lower manufacturing cost, constellation scalability, and increasing commercial and defense earth observation missions across Asia Pacific. Governments and private operators favor small satellite constellations to achieve high revisit frequency and persistent monitoring across agriculture, maritime, and border surveillance applications. Technological miniaturization of sensors and onboard processing systems enables advanced imaging payloads within compact satellite buses, making small platforms cost-effective for regional observation programs. Emerging private space companies and academic launch collaborations further accelerate small satellite deployment across the region.

Competitive Landscape

The Asia Pacific Remote Sensing Satellites Market exhibits moderate consolidation, dominated by government-backed aerospace manufacturers and national space agencies alongside emerging commercial satellite firms. Large integrated aerospace companies maintain technological leadership in high-resolution imaging payloads and constellation architecture, while regional private players expand small satellite manufacturing and geospatial data services. Strategic partnerships, technology transfer agreements, and sovereign satellite programs strongly influence procurement patterns and competitive positioning across the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Satellite Segment Focus |

| China Aerospace Science and Technology Corporation | 1999 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Electric Corporation | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Indian Space Research Organisation | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Satrec Initiative | 1999 | Daejeon, South Korea | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Remote Sensing Satellites Market Analysis

Growth Drivers

Expansion of sovereign earth observation and geospatial intelligence programs:

Governments across Asia Pacific are accelerating indigenous satellite development programs to strengthen national security, environmental monitoring, and resource management capabilities. Rising geopolitical tensions and border surveillance requirements are encouraging defense agencies to deploy persistent reconnaissance satellites with high revisit frequency and all-weather imaging capability. Civil agencies are simultaneously expanding observation missions for agriculture productivity mapping, climate monitoring, and disaster management preparedness across large geographic territories. Regional space policies increasingly emphasize domestic satellite manufacturing ecosystems and sovereign data ownership, boosting local procurement and technology development. Countries such as China, India, Japan, and South Korea are investing heavily in multi-satellite constellations to ensure continuous earth observation coverage and reduce dependence on foreign geospatial data providers. Public funding for space infrastructure, launch capability, and satellite research institutions is strengthening the industrial base and supply chain resilience. Expanding dual-use satellite architectures enabling both defense and civilian observation further amplify demand across ministries and agencies. Growing regional cooperation programs for environmental monitoring and disaster surveillance are also creating multi-nation satellite initiatives that increase production volumes. These sovereign observation strategies collectively drive sustained manufacturing, launch, and data services demand across the Asia Pacific Remote Sensing Satellites Market.

Rapid commercialization of geospatial data and analytics services:

The Asia Pacific region is experiencing significant growth in commercial geospatial intelligence markets serving agriculture, urban planning, maritime monitoring, and infrastructure development sectors. Private earth observation firms are deploying small satellite constellations to provide high-resolution imagery and analytics platforms to governments, enterprises, and insurance industries. Demand for precision agriculture mapping, crop health monitoring, and land-use analytics is expanding satellite data consumption across emerging economies. Infrastructure development projects including smart cities, transportation corridors, and energy networks require continuous spatial monitoring, stimulating commercial observation services demand. Maritime surveillance, fisheries monitoring, and illegal activity detection across vast coastal zones are also driving satellite analytics adoption by regional authorities. Advances in cloud processing and artificial intelligence are enabling automated image interpretation and large-scale geospatial analytics delivery to commercial clients. Venture capital investment in Asia Pacific space startups is accelerating private satellite manufacturing and downstream analytics platforms. Partnerships between national space agencies and commercial data firms further expand satellite utilization across sectors. This commercialization trend strengthens recurring data revenue streams and supports continuous deployment of observation satellites across the region.

Market Challenges

High capital intensity and technological complexity of satellite development:

Remote sensing satellite programs require substantial investment in spacecraft engineering, imaging payload development, launch services, and ground infrastructure, creating financial barriers for emerging Asia Pacific space economies. Advanced electro-optical and radar sensors demand precision manufacturing, radiation-hardened electronics, and sophisticated calibration systems, increasing development costs and project timelines. Many regional countries rely on imported components such as detectors, onboard processors, and propulsion systems, exposing programs to supply chain vulnerabilities and export controls. Limited domestic testing facilities and space qualification capabilities further constrain independent satellite development in developing markets. Government budget cycles and competing national priorities can delay funding continuity for long-term constellation programs. Launch service availability and scheduling constraints add further uncertainty to deployment timelines and mission planning. Workforce shortages in aerospace engineering and satellite systems integration also affect project execution capacity. Technology obsolescence risk remains high due to rapid sensor advancement and evolving observation requirements. These structural cost and capability challenges restrict market entry and slow indigenous satellite ecosystem development across parts of Asia Pacific.

Regulatory restrictions and geospatial data security policies:

Remote sensing satellite operations are governed by stringent national and international regulations concerning imaging resolution, data distribution, and surveillance capability, particularly in geopolitically sensitive regions. Many Asia Pacific countries impose licensing controls on high-resolution imagery dissemination to protect national security interests, limiting commercial data market expansion. Cross-border data sharing restrictions complicate regional disaster monitoring and environmental observation collaboration initiatives. Export control regulations on advanced sensors, radar technologies, and satellite components constrain technology transfer and manufacturing partnerships. Spectrum allocation and orbital slot coordination processes introduce additional regulatory complexity for constellation deployment. Data privacy and sovereignty concerns also affect geospatial analytics adoption by government agencies and enterprises. Compliance requirements increase operational costs for satellite operators and data providers. International treaties and space governance frameworks impose liability and debris mitigation obligations that influence mission design and lifecycle management. These regulatory and security constraints shape procurement patterns and restrict full commercialization potential within the Asia Pacific Remote Sensing Satellites Market.

Opportunities

Deployment of regional small satellite constellations for high revisit monitoring:

Asia Pacific countries are increasingly pursuing multi-satellite constellations composed of small observation platforms to achieve persistent monitoring capability across large territories. High revisit frequency is essential for agriculture forecasting, maritime surveillance, disaster response, and infrastructure monitoring, creating strong demand for constellation architectures. Small satellite manufacturing advances allow rapid production cycles and scalable deployment strategies suited to regional observation needs. Governments and private operators can collaboratively launch constellation clusters to share data and reduce mission cost burdens. Southeast Asian nations with limited space infrastructure can access shared observation capacity through regional satellite programs. Continuous monitoring capability also supports climate change assessment, deforestation tracking, and coastal management initiatives. Integration of onboard processing and inter-satellite communication enhances constellation data efficiency and responsiveness. Commercial analytics firms can leverage constellation data streams to deliver near-real-time geospatial intelligence services. Venture investment and public funding support emerging constellation developers across Asia Pacific. These constellation deployments represent a major structural growth opportunity for satellite manufacturing and data services markets.

Integration of artificial intelligence and onboard processing in observation satellites:

Advances in artificial intelligence and edge computing technologies are enabling onboard image processing, automated target detection, and real-time data filtering directly within remote sensing satellites. This capability reduces data latency, bandwidth requirements, and ground processing costs, improving operational efficiency for observation missions. Defense agencies benefit from rapid intelligence extraction and event detection without reliance on ground analysis infrastructure. Civil applications including disaster monitoring and maritime surveillance also gain faster response capability through onboard analytics. Asia Pacific satellite developers are increasingly incorporating AI-enabled payload processors and adaptive imaging systems into new spacecraft designs. Integration of machine learning models enhances object recognition, change detection, and predictive environmental analysis from space-borne imagery. Domestic semiconductor and electronics industries in countries such as Japan, South Korea, and China support onboard processing hardware development. Commercial geospatial firms can deliver automated analytics products based on processed satellite data streams. AI-enabled satellites thus create a transformative technological opportunity across the Asia Pacific Remote Sensing Satellites Market.

Future Outlook

The Asia Pacific Remote Sensing Satellites Market is expected to experience sustained expansion driven by sovereign satellite programs, regional constellation deployment, and commercialization of geospatial intelligence services. Technological miniaturization, onboard AI processing, and reusable launch systems will improve satellite economics and deployment frequency. Governments are likely to strengthen regulatory frameworks supporting domestic satellite manufacturing and data sovereignty. Expanding climate monitoring, agriculture analytics, and maritime surveillance demand will further accelerate observation satellite utilization across Asia Pacific economies.

Major Players

- China Aerospace Science and Technology Corporation

- China Academy of Space Technology

- Mitsubishi Electric Corporation

- NEC Corporation

- Indian Space Research Organisation

- Antrix Corporation

- Satrec Initiative

- Korea Aerospace Research Institute

- Hanwha Systems

- Thales Alenia Space Asia Pacific

- Airbus Defence and Space Asia Pacific

- GomSpace Asia Pacific

- Azur Space Asia Pacific

- JAXA Engineering

- Dhruva Space

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries and space agencies

- Commercial earth observation operators

- Geospatial analytics companies

- Agriculture and environmental monitoring agencies

- Disaster management authorities

- Maritime surveillance organizations

Research Methodology

Step 1: Identification of Key Variables

Key market variables including satellite type, platform size, imaging technology, and end-user applications were identified through secondary research and space industry databases. Regional policy frameworks and procurement programs were also mapped to determine demand drivers.

Step 2: Market Analysis and Construction

Market size and segmentation were constructed using satellite deployment data, manufacturing contracts, and government space budgets across Asia Pacific countries. Historical satellite launches and constellation programs were analyzed to estimate market distribution.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from satellite manufacturing firms, space agencies, and geospatial analytics companies validated assumptions regarding technology adoption, procurement cycles, and platform demand. Feedback ensured realistic representation of regional market dynamics.

Step 4: Research Synthesis and Final Output

Validated datasets and qualitative insights were synthesized to generate market segmentation, competitive landscape, and strategic analysis. Findings were cross-checked against regional space policy documents and satellite deployment records to ensure accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising regional investment in earth observation and geospatial intelligence programs

Expansion of climate monitoring and environmental surveillance missions

Growing defense demand for persistent reconnaissance from space assets

Increasing agricultural monitoring and resource mapping applications

Rapid deployment of small satellite constellations across Asia Pacific - Market Challenges

High launch and satellite development costs in emerging space economies

Regulatory restrictions on high resolution geospatial data sharing

Dependence on foreign launch services and critical components

Space debris risk in dense low earth orbit observation constellations

Limited domestic manufacturing ecosystems in developing countries - Market Opportunities

Expansion of commercial geospatial analytics and data services markets

Regional collaboration on disaster monitoring satellite constellations

Integration of AI enabled onboard image processing technologies - Trends

Shift toward high revisit small satellite constellations

Adoption of synthetic aperture radar for all weather imaging

Miniaturization of hyperspectral sensing payloads

Growth of dual use civil and defense observation missions

Emergence of private earth observation satellite operators - Government Regulations & Defense Policy

National geospatial data security and imaging resolution policies

Regional earth observation cooperation frameworks

Defense space and surveillance satellite development programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electro Optical Imaging Satellites

Synthetic Aperture Radar Satellites

Hyperspectral Imaging Satellites

Meteorological Observation Satellites

Oceanographic Monitoring Satellites - By Platform Type (In Value%)

Small Satellites

Medium Satellites

Large Satellites

CubeSats

High Throughput Observation Satellites - By Fitment Type (In Value%)

Dedicated Remote Sensing Payloads

Hosted Payload Satellites

Constellation Based Systems

Modular Satellite Buses

Integrated Multi Sensor Platforms - By EndUser Segment (In Value%)

Defense and Intelligence Agencies

Environmental and Climate Monitoring Agencies

Agriculture and Forestry Authorities

Disaster Management Agencies

Commercial Geospatial Data Providers - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Space Programs

Public Private Partnerships

Commercial Satellite Operators

International Space Collaboration Programs - By Material / Technology (in Value %)

Silicon Based Imaging Sensors

Compound Semiconductor Detectors

Deployable Antenna Systems

Lightweight Composite Structures

Onboard AI Processing Units

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Satellite Mass Class, Imaging Resolution, Sensor Type, Orbit Type, Revisit Frequency, Data Latency, Constellation Size, Mission Lifetime, Onboard Processing Capability, Launch Integration)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

China Aerospace Science and Technology Corporation

China Academy of Space Technology

Mitsubishi Electric Corporation

NEC Corporation

Japan Aerospace Exploration Agency

Indian Space Research Organisation

Antrix Corporation

Satrec Initiative

Korea Aerospace Research Institute

Hanwha Systems

DLR GfR Asia Pacific

Thales Alenia Space Asia Pacific

Airbus Defence and Space Asia Pacific

Azur Space Asia Pacific

GomSpace Asia Pacific

- Defense agencies prioritizing sovereign earth observation capabilities

- Environmental agencies expanding climate and resource monitoring satellites

- Commercial firms scaling geospatial data and analytics platforms

- Agriculture and disaster authorities adopting satellite based monitoring

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035