Market Overview

The Asia Pacific Riot Control System Market reached USD ~ billion based on a recent historical assessment, supported by sustained procurement of non-lethal weapons, protective equipment, and integrated crowd-management platforms by internal security agencies. Market growth is driven by government spending on public-order modernization and replacement cycles of aging riot gear. Expansion of urban populations across major Asian economies has increased demand for scalable deterrence and containment systems, reinforcing procurement budgets and domestic manufacturing programs.

China, India, Japan, South Korea, and Australia remain dominant within the Asia Pacific Riot Control System Market due to large law-enforcement personnel bases and institutionalized public-security modernization programs. Metropolitan centers such as Beijing, Shanghai, Delhi, Tokyo, and Seoul maintain extensive crowd-management infrastructure, specialized riot units, and domestic suppliers. Strong defense-industrial ecosystems, local production of non-lethal munitions, and centralized procurement authorities enable sustained adoption of advanced riot control technologies across these countries.

Market Segmentation

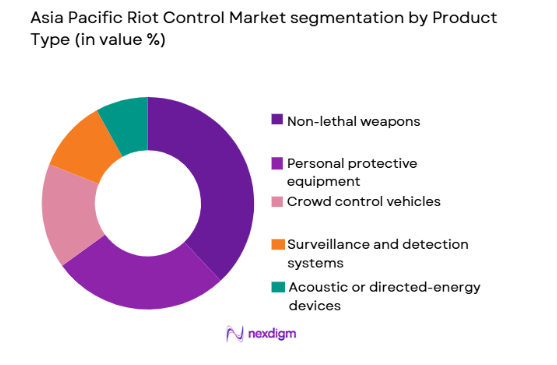

By Product Type:

Asia Pacific Riot Control System Market is segmented by product type into non-lethal weapons, personal protective equipment, crowd control vehicles, surveillance and detection systems, and acoustic or directed-energy devices. Recently, non-lethal weapons has a dominant market share due to factors such as operational flexibility, regulatory preference for graduated force options, and rapid deployment capability during urban disturbances. Law-enforcement agencies prioritize tear-gas launchers, stun grenades, and electroshock devices because they provide effective crowd dispersal while minimizing fatality risks. Domestic production capacity across China and India further supports procurement scale, while frequent replacement cycles sustain volume demand. Non-lethal systems also integrate easily with existing tactical doctrine and training frameworks, reducing adoption barriers. Continuous product upgrades such as multi-shot launchers and safer irritant formulations reinforce procurement continuity across the region.

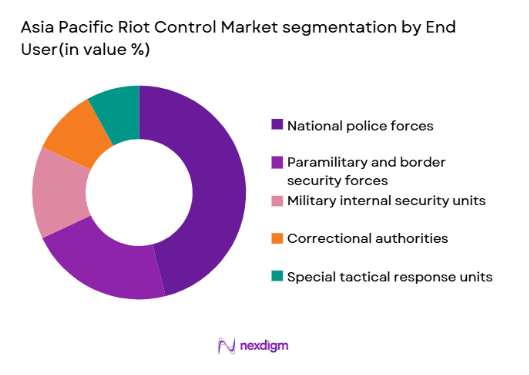

By End User:

Asia Pacific Riot Control System Market is segmented by end user into national police forces, paramilitary and border security forces, military internal security units, correctional authorities, and special tactical response units. Recently, national police forces has a dominant market share due to factors such as large personnel strength, continuous urban deployment, and primary responsibility for civil-order operations. National police agencies conduct routine crowd-management missions, requiring extensive inventories of shields, batons, launchers, and protective gear. Centralized government budgets prioritize police modernization and domestic procurement mandates, supporting large-scale acquisitions. Police forces also maintain dedicated riot units and training academies, ensuring consistent equipment replacement cycles. Expansion of metropolitan policing and public-event security operations across Asia Pacific further reinforces their procurement dominance in riot control systems.

Competitive Landscape

The Asia Pacific Riot Control System Market shows moderate consolidation with a mix of global non-lethal technology manufacturers and strong regional defense suppliers. Established firms leverage government contracts, local manufacturing partnerships, and compliance certifications to secure long-term procurement programs. Asian producers increasingly compete on cost and localization advantages, while Western companies maintain technological leadership in electroshock, optical, and advanced irritant systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Regional Manufacturing Presence |

| Combined Systems Inc | 1981 | USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Denel Munitions | 2008 | South Africa | ~ | ~ | ~ | ~ | ~ |

| Condor Tecnologias Não Letais | 1985 | Brazil | ~ | ~ | ~ | ~ | ~ |

| MKU Limited | 1985 | India | ~ | ~ | ~ | ~ | ~ |

| Senken Group | 1990 | China | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Riot Control System Market Analysis

Growth Drivers

Urbanization-Driven Expansion of Public Order Infrastructure:

Rapid urbanization across Asia Pacific has created dense metropolitan environments where mass gatherings, demonstrations, and public-event security requirements are significantly more frequent and complex. Governments have responded by expanding riot control infrastructure, equipping police forces with scalable non-lethal systems and protective gear to manage high-population environments effectively. Large cities require layered response capabilities ranging from handheld dispersal devices to vehicle-mounted crowd-control platforms, increasing procurement diversity and volume. National modernization programs emphasize readiness for civil disturbances and disaster-related crowd scenarios, further strengthening demand. Urban transit hubs, stadium districts, and political centers necessitate permanent riot-management deployments, supporting surveillance-integrated deterrence technologies. Police training academies and specialized riot units are expanding concurrently, generating recurring equipment replacement cycles. Domestic manufacturing initiatives in India and China are aligned with urban security investments, improving availability and reducing import dependency. Overall, urbanization directly translates into sustained institutional procurement of riot control systems across Asia Pacific.

Modernization of Non-Lethal Law Enforcement Capabilities:

Law-enforcement agencies across Asia Pacific are transitioning from legacy crowd-control tools toward technologically advanced non-lethal systems designed to balance operational effectiveness with human-rights compliance. Governments are adopting electroshock devices, improved irritant dispersal systems, and modular riot gear that reduce lethality risks while maintaining deterrence capability. Modernization programs include digital inventory management, standardized equipment certification, and interoperability with surveillance platforms, increasing system sophistication. International policing standards and accountability frameworks encourage procurement of safer, regulated technologies, driving replacement of outdated equipment. Technological upgrades such as multi-range launchers, smart munition control, and lightweight composite armor improve operational efficiency and officer safety. Regional defense industries are investing in research and local production to meet modernization mandates and export opportunities. Procurement policies increasingly favor domestically certified non-lethal technologies, strengthening regional supply chains. Consequently, modernization initiatives constitute a central growth engine for riot control system adoption.

Market Challenges

Regulatory Constraints and Human-Rights Compliance Scrutiny:

Riot control systems operate under strict regulatory frameworks governing use of force, chemical irritants, and electroshock technologies, creating compliance complexities for manufacturers and law-enforcement agencies. Governments face increasing public and judicial scrutiny regarding deployment practices, requiring certification, reporting, and accountability measures that slow procurement cycles. International conventions and national legislation restrict certain non-lethal formulations and directed-energy devices, limiting product portfolios in multiple jurisdictions. Manufacturers must invest in testing, documentation, and training support to ensure compliance, increasing costs and extending time-to-market. Negative publicity related to misuse incidents can trigger procurement suspensions or policy reviews, affecting demand continuity. Export controls and licensing requirements also complicate cross-border sales within Asia Pacific. Agencies therefore prioritize proven and certified technologies, constraining innovation adoption speed. Regulatory sensitivity ultimately acts as a structural constraint on market expansion despite underlying demand.

Budgetary Prioritization and Procurement Delays in Public Security Spending:

Riot control systems depend almost entirely on government procurement, making the market sensitive to fiscal prioritization and administrative approval processes. Public-security budgets compete with defense modernization, disaster management, and social infrastructure funding, leading to periodic allocation shifts. Large procurement programs often require multi-level approvals, tendering procedures, and compliance verification, causing delays in contract execution. Economic fluctuations and currency pressures in emerging Asia Pacific economies can postpone equipment replacement cycles or reduce order volumes. Domestic manufacturing mandates may necessitate technology transfer arrangements that extend procurement timelines. Small and medium police agencies often rely on centralized procurement pools, further lengthening acquisition processes. Inconsistent funding cycles hinder long-term supplier planning and capacity utilization. Consequently, bureaucratic procurement structures and fiscal constraints represent persistent operational challenges for riot control system vendors.

Opportunities

Localization of Riot Control Manufacturing Across Asia Pacific:

Governments in Asia Pacific increasingly emphasize domestic production of security equipment to enhance supply resilience and industrial capability, creating substantial opportunities for localized riot control manufacturing. National procurement policies favor indigenous suppliers or joint-venture production, enabling technology transfer partnerships between global non-lethal specialists and regional defense firms. Localization reduces import costs, accelerates delivery timelines, and supports certification alignment with national standards. Countries such as India and China are expanding police-equipment industrial bases, including irritant munitions, protective armor, and launch platforms. Domestic manufacturing incentives and defense-industrial corridors attract investment into riot-control technologies. Regional suppliers gain competitive advantage through cost efficiency and proximity to government buyers. Export potential to neighboring developing markets further strengthens localization economics. Overall, localization policies are transforming Asia Pacific into a major production hub for riot control systems.

Integration of Smart Surveillance with Non-Lethal Response Platforms:

Emerging integration between surveillance technologies and riot control systems presents significant opportunity for advanced crowd-management solutions in Asia Pacific. Governments are investing in smart-city infrastructure, facial recognition monitoring, and real-time analytics for public-order management. Linking surveillance networks with non-lethal response platforms enables predictive deployment, targeted dispersal, and coordinated tactical operations. Vehicle-mounted riot systems increasingly incorporate cameras, communication modules, and command-and-control interfaces. Smart launchers and acoustic devices can be remotely directed based on situational awareness data, improving operational precision and accountability. Technology providers capable of integrating sensors, analytics, and non-lethal hardware gain differentiation in procurement programs. Urban security modernization initiatives across major Asian cities support adoption of integrated riot-control architectures. This convergence of surveillance and deterrence technologies represents a major innovation pathway and revenue opportunity within the regional market.

Future Outlook

The Asia Pacific Riot Control System Market is expected to experience steady institutional growth over the next five years, supported by continued urbanization and expansion of public-security infrastructure. Governments are likely to increase investment in modern non-lethal technologies and integrated crowd-management platforms aligned with human-rights compliance standards. Regional manufacturing localization and smart-surveillance integration will accelerate technology adoption. Rising metropolitan security requirements and modernization programs across major Asia Pacific economies will sustain long-term procurement demand.

Major Players

- Combined Systems Inc

- Rheinmetall Denel Munitions

- Condor Tecnologias Não Letais

- MKU Limited

- Senken Group

- Jiangsu Anhua Police Equipment

- Shenzhen Kexin Police Equipment

- Safariland Group

- PepperBall Technologies

- Lamperd Less Lethal

- Paulson Manufacturing

- China North Industries Group

- NonLethal Technologies Inc

- MARS Armor

- Taser International Asia Pacific

Key Target Audience

- Law enforcement modernization agencies

- Paramilitary and border security forces

- National police headquarters

- Defense procurement authorities

- Public safety equipment distributors

- Riot control training academies

- Internal security ministries

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key demand indicators such as police personnel strength, urban population density, and public-security spending were identified. Technology categories including non-lethal weapons, protective equipment, and integrated riot platforms were defined. Regional regulatory frameworks and procurement structures were mapped to understand adoption patterns.

Step 2: Market Analysis and Construction

Country-level procurement data, manufacturer shipments, and police modernization budgets were aggregated to construct the regional market size. Segmentation by product type and end user was modeled using institutional demand distribution. Competitive positioning and supply-chain localization trends were analyzed.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with law-enforcement equipment suppliers, regional distributors, and public-security procurement specialists. Regulatory compliance requirements and technology adoption barriers were cross-checked. Assumptions on procurement cycles and replacement rates were refined.

Step 4: Research Synthesis and Final Output

Validated datasets and qualitative insights were synthesized into structured market estimates and segment shares. Competitive landscape and growth dynamics were finalized. The Asia Pacific Riot Control System Market assessment was compiled with standardized methodology to ensure analytical consistency.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising civil unrest and urban crowd management requirements

Government investment in non lethal law enforcement modernization

Expansion of paramilitary forces across Asia Pacific

Increased focus on human rights compliant force options

Adoption of advanced directed energy deterrence technologies - Market Challenges

Regulatory restrictions on non lethal weapon deployment

Public scrutiny and accountability pressures on police forces

High cost of advanced riot control platforms

Interoperability issues across legacy equipment

Procurement delays in government security budgets - Market Opportunities

Smart integrated crowd control systems with AI surveillance

Localization of riot gear manufacturing in Asia Pacific

Export potential to developing internal security markets - Trends

Shift toward non lethal and scalable response systems

Integration of surveillance with deterrence platforms

Lightweight composite protective gear adoption

Vehicle mounted multi threat crowd control units

Acoustic and optical directed energy deployment growth - Government Regulations & Defense Policy

Standardization of non lethal weapon use protocols

Regional police modernization funding programs

Human rights compliance frameworks for crowd control - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Non-Lethal Weapons Systems

Crowd Control Vehicles

Personal Protective Equipment

Acoustic and Directed Energy Devices

Surveillance and Detection Systems - By Platform Type (In Value%)

Handheld Portable Systems

Vehicle Mounted Systems

Fixed Perimeter Installations

Aerial Deployed Systems

Naval Boarding Control Systems - By Fitment Type (In Value%)

Integrated Factory Installed

Retrofit Kits

Modular Add On Systems

Wearable Configurations

Shield Mounted Assemblies - By EndUser Segment (In Value%)

National Police Forces

Paramilitary and Border Security

Military Internal Security Units

Correctional and Prison Authorities

Special Tactical Response Teams - By Procurement Channel (In Value%)

Government Direct Procurement

Defense and Security Tenders

Intergovernmental Agreements

Local Distributor Contracts

Public Safety Modernization Programs - By Material / Technology (in Value %)

Composite Ballistic Materials

Electroshock and Conductive Technologies

Chemical Irritant Dispersal Systems

Acoustic Wave Emitters

Optical Dazzler and Laser Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type Coverage, Non Lethal Technology Portfolio, Platform Integration Capability, Protection Level Standards, Vehicle Integration Expertise, Regional Manufacturing Presence, Government Contract Experience, R&D Investment Intensity, Product Certification Compliance, Aftermarket Support Network)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

NonLethal Technologies Inc

Combined Systems Inc

Rheinmetall Denel Munitions

Condor Tecnologias Não Letais

PepperBall Technologies

Lamperd Less Lethal

Taser International Asia Pacific

Safariland Group

Jiangsu Anhua Police Equipment

Shenzhen Kexin Police Equipment

Senken Group

Paulson Manufacturing

MARS Armor

MKU Limited

China North Industries Group

- Urban police forces prioritizing scalable crowd management tools

- Paramilitary units adopting military grade non lethal systems

- Prison authorities increasing anti riot infrastructure investments

- Special forces demanding modular tactical riot equipment

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035