Market Overview

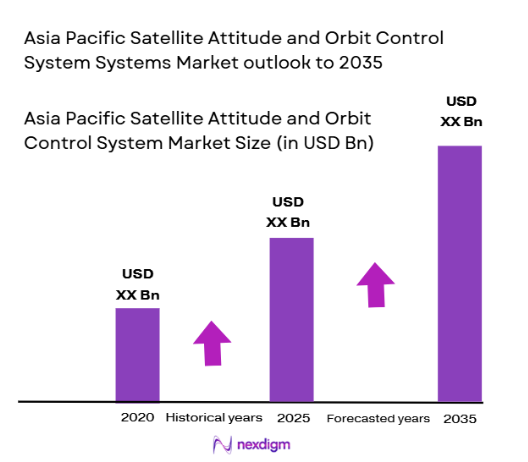

The Asia Pacific Satellite Attitude and Orbit Control System market reached approximately USD ~ billion based on a recent historical assessment, reflecting sustained expansion of satellite manufacturing and deployment across commercial communication, navigation, and earth observation missions. Demand is driven by growth in regional satellite constellations, defense space programs, and increased private investment in small satellite technologies. Rising adoption of integrated AOCS modules and miniaturized control components has further accelerated procurement across both civil and military spacecraft platforms.

China, Japan, and India dominate the Asia Pacific Satellite Attitude and Orbit Control System market due to strong national space programs, vertically integrated satellite manufacturing ecosystems, and expanding commercial launch capabilities. Beijing and Shanghai host major spacecraft production clusters, while Tokyo and Nagoya lead in precision space component manufacturing. Bengaluru and Hyderabad have emerged as key hubs for indigenous satellite avionics and control system development. Government-backed space industrialization initiatives and defense satellite modernization programs reinforce regional leadership.

Market Segmentation

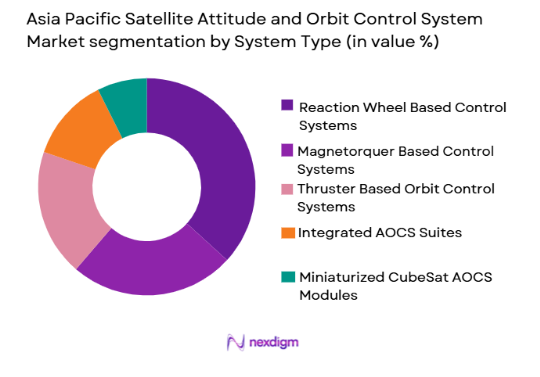

By System Type:

Asia Pacific Satellite Attitude and Orbit Control System market is segmented by system type into Reaction Wheel Based Control Systems, Magnetorquer Based Control Systems, Thruster Based Orbit Control Systems, Integrated AOCS Suites, and Miniaturized CubeSat AOCS Modules. Recently, Reaction Wheel Based Control Systems has a dominant market share due to factors such as high precision pointing capability, extensive heritage across communication and earth observation satellites, strong supplier base in Japan and China, and compatibility with both large and small satellite platforms deployed across the region.

By Platform Type:

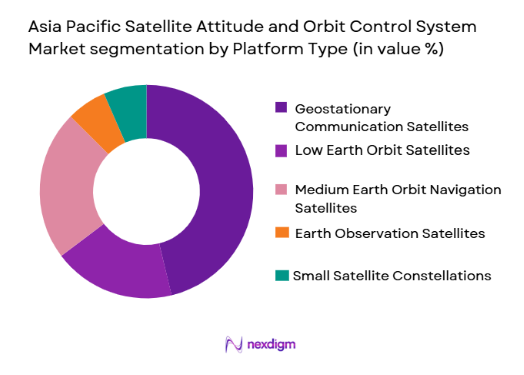

Asia Pacific Satellite Attitude and Orbit Control System market is segmented by platform type into Geostationary Communication Satellites, Low Earth Orbit Satellites, Medium Earth Orbit Navigation Satellites, Earth Observation Satellites, and Small Satellite Constellations. Recently, Low Earth Orbit Satellites has a dominant market share due to accelerated deployment of broadband and earth observation constellations, regional launch cost advantages, rapid small satellite manufacturing cycles, and increased demand for agile attitude control in multi-satellite network architectures across commercial and defense missions.

Competitive Landscape

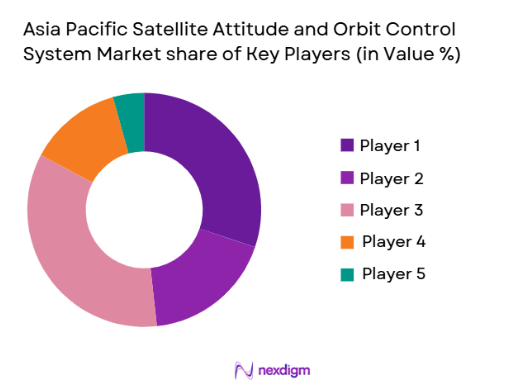

The Asia Pacific Satellite Attitude and Orbit Control System market exhibits moderate consolidation, with a combination of established aerospace conglomerates and emerging NewSpace subsystem suppliers shaping competition. Major regional players benefit from government contracts, vertically integrated satellite production, and heritage in precision space components, while startups compete through miniaturized and cost-optimized AOCS modules for small satellites. Strategic partnerships between satellite manufacturers and propulsion or sensor specialists are common, reinforcing technological differentiation and regional supply chain resilience.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Satellite Class Focus |

| Mitsubishi Electric | 1921 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| NEC Space Technologies | 2001 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| China Aerospace Science and Technology Corporation | 1999 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| Beijing Aerospace Control Devices Institute | 1958 | Beijing, China | ~ | ~ | ~ | ~ | ~ |

| Satrec Initiative | 1999 | Daejeon, South Korea | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Satellite Attitude and Orbit Control System Market Analysis

Growth Drivers

Expansion of regional low earth orbit satellite constellations:

Expansion of regional low earth orbit satellite constellations is accelerating procurement of compact and scalable attitude and orbit control systems across Asia Pacific space programs and commercial ventures. Governments and private operators are deploying broadband, earth observation, and surveillance constellations requiring precise pointing and orbit maintenance capabilities across hundreds of spacecraft. Such constellations demand standardized and miniaturized AOCS architectures capable of mass production and autonomous operation. Manufacturers are therefore increasing production of reaction wheels, star trackers, and integrated control electronics tailored for small satellite buses. Launch cost reductions and reusable launch vehicle availability in the region have further encouraged constellation deployments requiring distributed control subsystems. Satellite manufacturers are also shifting toward modular spacecraft architectures in which AOCS units can be rapidly integrated across multiple missions. Defense agencies increasingly rely on proliferated LEO constellations for resilient communication and surveillance, further strengthening demand. The proliferation of mega-constellations planned by Asian operators ensures sustained long-term procurement of AOCS subsystems across commercial and military segments. Supply chain localization initiatives across China, India, Japan, and South Korea further reinforce domestic production and adoption of regional AOCS technologies.

Indigenous space capability development and defense modernization:

Indigenous space capability development and defense modernization across Asia Pacific nations is significantly increasing investment in domestically produced satellite attitude and orbit control technologies. Governments are prioritizing sovereign control of space assets for communication security, navigation independence, and reconnaissance capabilities, necessitating reliable high-precision AOCS subsystems. National space agencies and defense organizations are funding local manufacturers to develop reaction wheels, gyroscopes, star trackers, and control electronics with radiation-hardened performance. Export control restrictions on advanced space components from foreign suppliers have further accelerated domestic AOCS research and production initiatives. Indigenous satellite programs for navigation, earth observation, and defense reconnaissance require continuous procurement of attitude and orbit control hardware across multiple spacecraft generations. Defense satellite constellations for early warning and secure communication also demand highly resilient control systems capable of operating in contested environments. Regional aerospace conglomerates are integrating AOCS capabilities within vertically integrated satellite production ecosystems. Such investments strengthen technological autonomy and expand industrial capacity for high-precision space control subsystems. As defense and civil space programs expand simultaneously, domestic AOCS suppliers benefit from stable long-term procurement pipelines across Asia Pacific.

Market Challenges

High precision manufacturing and qualification requirements for space-grade AOCS components:

High precision manufacturing and qualification requirements for space-grade AOCS components impose significant technical and financial barriers for suppliers operating in the Asia Pacific satellite ecosystem. Reaction wheels, gyroscopes, and star trackers must meet stringent accuracy, reliability, and lifetime performance criteria under extreme thermal and radiation conditions encountered in orbit. Achieving such precision demands advanced materials, micro-fabrication processes, and highly specialized testing infrastructure, which remain concentrated among limited manufacturers. Qualification cycles for spaceflight hardware involve extensive vibration, thermal vacuum, and radiation testing that can extend development timelines considerably. Certification processes required by space agencies and defense customers further increase development costs and entry barriers for new firms. Even minor performance deviations in AOCS components can compromise spacecraft pointing accuracy or mission lifespan, creating zero-tolerance quality expectations. Smaller suppliers in emerging Asia Pacific space economies often lack facilities for full qualification and must rely on partnerships or foreign testing services. This dependence can delay programs and raise costs for satellite manufacturers. Consequently, the high technical threshold restricts supplier diversity and slows rapid scaling of regional AOCS production capacity.

Limited availability of radiation-hardened sensors and control electronics supply chains:

Limited availability of radiation-hardened sensors and control electronics supply chains represents a structural constraint affecting the Asia Pacific Satellite Attitude and Orbit Control System market. Space environments expose AOCS electronics to ionizing radiation that can degrade sensor accuracy or disrupt control processing, requiring specialized hardened components. Production of such electronics involves niche semiconductor processes and design expertise held by relatively few global suppliers. Export restrictions on radiation-tolerant microelectronics and inertial sensors have historically constrained regional procurement options. Asia Pacific manufacturers are investing in domestic fabrication and design capabilities, but industrial maturity remains uneven across countries. Supply disruptions or technology gaps in hardened electronics directly impact the reliability and certification of AOCS subsystems. Satellite primes therefore face procurement risks and extended integration timelines when sourcing critical sensors or processors. Small satellite developers particularly encounter challenges balancing cost constraints with hardened component requirements. These supply chain limitations increase system costs and can delay deployment schedules across commercial and defense satellite programs in the region.

Opportunities

Growth of small satellite manufacturing ecosystems across Asia Pacific:

Growth of small satellite manufacturing ecosystems across Asia Pacific is creating substantial opportunities for suppliers of compact and modular attitude and orbit control systems tailored for mass production spacecraft. Emerging commercial space companies in India, South Korea, Japan, and Southeast Asia are scaling production of small satellites for communication, earth observation, and technology demonstration missions. Such spacecraft rely on miniaturized AOCS modules integrating sensors, actuators, and control electronics within standardized packages. Demand for plug-and-play control subsystems capable of rapid integration is therefore increasing significantly. Governments are supporting small satellite innovation through funding programs and domestic procurement incentives, expanding local AOCS markets. Commercial constellation operators also seek cost-efficient suppliers capable of delivering hundreds of control units annually. Advances in MEMS gyroscopes, compact star trackers, and micro-propulsion compatibility are enabling high-performance miniaturized AOCS solutions. Regional manufacturing clusters are emerging around space industrial hubs such as Bengaluru, Tokyo, and Daejeon. As small satellite production scales across Asia Pacific, suppliers of standardized AOCS modules can achieve economies of scale and export competitiveness. This ecosystem expansion supports sustained growth and technological specialization within the regional AOCS market.

Integration of electric propulsion compatible attitude and orbit control architectures:

Integration of electric propulsion compatible attitude and orbit control architectures represents a major technological opportunity shaping next-generation satellite control systems across Asia Pacific space programs. Electric propulsion systems require coordinated thrust vector control, precise attitude stabilization, and efficient power management integration with AOCS subsystems. As communication and earth observation satellites adopt electric propulsion for orbit raising and station-keeping, demand for advanced control electronics and algorithms increases substantially. Asia Pacific manufacturers are developing AOCS architectures optimized for continuous low-thrust propulsion operations and autonomous navigation. Such integration reduces propellant consumption and extends spacecraft operational lifespan, improving mission economics. Electric propulsion compatible AOCS units also support high-precision pointing required for advanced imaging and communication payloads. Regional satellite primes seek suppliers capable of delivering integrated propulsion-control solutions rather than discrete components. This drives collaboration between propulsion developers and AOCS electronics manufacturers within Asia Pacific. As electric propulsion adoption expands across both large and small satellites, integrated control architectures offer suppliers opportunities for technological leadership and higher value subsystem contracts.

Future Outlook

The Asia Pacific Satellite Attitude and Orbit Control System market is expected to expand steadily as regional satellite deployment accelerates across communication, earth observation, and defense missions. Miniaturized and integrated AOCS architectures will dominate new spacecraft designs, supported by domestic manufacturing initiatives. Increasing adoption of electric propulsion and proliferated LEO constellations will sustain subsystem demand. Government space industrialization programs and private NewSpace investment will reinforce long-term market growth across the region.

Major Players

- Mitsubishi Electric

- NEC Space Technologies

- China Aerospace Science and Technology Corporation

- Beijing Aerospace Control Devices Institute

- Satrec Initiative

- Hanwha Systems

- Korea Aerospace Industries

- Dhruva Space

- Azista BST Aerospace

- Bellatrix Aerospace

- Inovor Technologies

- Shanghai AOS Systems

- ISRO Inertial Systems Unit

- Skyroot Aerospace Avionics

- Astroscale Japan

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers

- Space agencies

- Defense space program offices

- Commercial satellite operators

- Aerospace component suppliers

- Space propulsion developers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as satellite production volume, constellation deployment trends, subsystem pricing, propulsion integration rates, and regional procurement policies were identified. These variables define demand drivers and supply capabilities across the Asia Pacific AOCS ecosystem. Market boundaries were established across commercial, civil, and defense satellite platforms.

Step 2: Market Analysis and Construction

Supply chain mapping and subsystem adoption analysis were conducted across major Asia Pacific satellite manufacturers and programs. AOCS component penetration by satellite class and orbit regime was evaluated to construct market segmentation. Pricing and procurement patterns were analyzed to derive regional market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts including spacecraft engineers, subsystem suppliers, and procurement specialists were consulted to validate adoption rates and technology trends. Technical feasibility and procurement cycles were assessed across satellite classes. Feedback ensured accuracy of segmentation and competitive landscape assumptions.

Step 4: Research Synthesis and Final Output

Validated quantitative and qualitative findings were synthesized into structured market insights covering segmentation, competition, and growth dynamics. Regional policy and industrial developments were integrated to refine outlook assumptions. Final outputs were prepared to support strategic decision-making across the Asia Pacific AOCS sector.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of regional satellite communication constellations

Rising defense space situational awareness programs

Growth in Earth observation missions for climate monitoring

Miniaturization of satellite subsystems enabling smallsat deployment

Increasing private investment in Asia Pacific NewSpace ecosystem - Market Challenges

High precision manufacturing requirements for AOCS components

Limited regional suppliers for advanced space grade sensors

Radiation hardening and reliability certification complexity

Integration challenges across multi vendor satellite subsystems

Long qualification cycles for spaceflight hardware - Market Opportunities

Indigenous AOCS development initiatives across Asia Pacific

Demand for scalable AOCS in mega constellation deployments

Export potential for cost competitive smallsat AOCS modules - Trends

Shift toward fully integrated compact AOCS units

Adoption of AI assisted attitude determination algorithms

Growth of electric propulsion compatible control systems

Increased use of star trackers in small satellites

Regionalization of space supply chains - Government Regulations & Defense Policy

National space industrialization policies in Asia Pacific

Defense space capability development programs

Export control and satellite technology transfer regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Reaction Wheel Based Control Systems

Magnetorquer Based Control Systems

Thruster Based Orbit Control Systems

Integrated AOCS Suites

Miniaturized CubeSat AOCS Modules - By Platform Type (In Value%)

Geostationary Communication Satellites

Low Earth Orbit Satellites

Medium Earth Orbit Navigation Satellites

Earth Observation Satellites

Small Satellite Constellations - By Fitment Type (In Value%)

Line Fit OEM Integration

Modular Payload Integration

Retrofit and Upgrade Systems

Hosted Payload Integration

Plug and Play SmallSat Units - By EndUser Segment (In Value%)

Commercial Satellite Operators

Government Space Agencies

Defense and Military Space Programs

NewSpace Startups

Research and Academic Institutions - By Procurement Channel (In Value%)

Direct OEM Procurement

Government Space Contracts

Prime Contractor Integration

Consortium Based Procurement

Commercial Off The Shelf Acquisition - By Material / Technology (in Value %)

MEMS Based Sensors

Fiber Optic Gyroscopes

Star Tracker Optical Systems

Cold Gas Micro Propulsion

Electric Propulsion Control Electronics

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Precision, Satellite Class Compatibility, Propulsion Integration, Sensor Suite Type, Miniaturization Level, Radiation Hardening, Power Consumption, Cost Tier, Production Scalability, Regional Presence)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Mitsubishi Electric

NEC Space Technologies

ISRO Inertial Systems Unit

Antrix Space Systems

China Aerospace Science and Technology Corporation

Beijing Aerospace Control Devices Institute

Shanghai AOS Systems

Korea Aerospace Industries

Hanwha Systems Space Division

Australia Inovor Technologies

Satrec Initiative

Azista BST Aerospace

Dhruva Space

Bellatrix Aerospace

Skyroot Aerospace Avionics

- Commercial operators prioritizing constellation scalability and autonomy

- Defense agencies demanding high precision and resilient AOCS

- Space agencies focusing on indigenous technology capability

- NewSpace firms emphasizing modular low cost AOCS integration

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035