Market Overview

Based on a recent historical assessment, the Asia Pacific Satellite Manufacturing and Launch Systems market is expected to reach USD ~ billion. This market is driven by the increasing demand for satellite communication systems, rising investments in space infrastructure, and the growing commercial use of satellites for Earth observation and telecommunication purposes. Technological advancements in satellite miniaturization and the commercialization of space technology further propel market growth. Government investments in space exploration, coupled with the commercialization of satellite launches, are significant growth drivers.

The dominant countries in the Asia Pacific region include China, India, Japan, and South Korea. China’s leadership in satellite manufacturing and launching systems can be attributed to its government-backed space exploration initiatives and substantial investments in space technology. India has established itself as a competitive player in satellite launch services, driven by ISRO’s cost-effective and efficient satellite launches. Japan and South Korea have also maintained a strong foothold through significant technological advancements and collaborations with global aerospace companies.

Market Segmentation

By Product Type

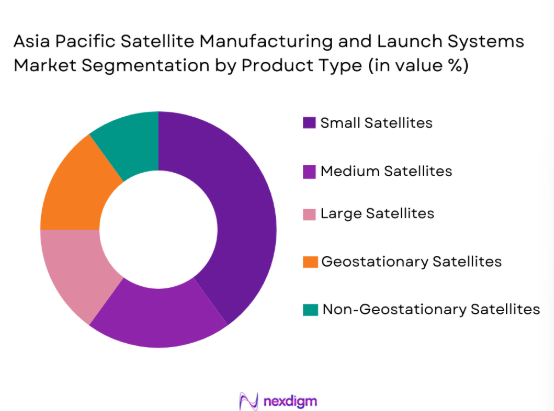

Asia Pacific Satellite Manufacturing and Launch Systems market is segmented by product type into small satellites, medium satellites, large satellites, geostationary satellites, and non-geostationary satellites. Recently, small satellites have gained a dominant market share due to advancements in miniaturization technologies, which reduce production costs and enable quicker deployment. These small-scale satellites, often used for telecommunications and Earth observation, offer affordable alternatives to larger, traditional satellites. The rising demand for low Earth orbit (LEO) satellites, driven by the need for global internet connectivity and remote sensing applications, further contributes to the dominance of small satellites in the market.

By Platform Type

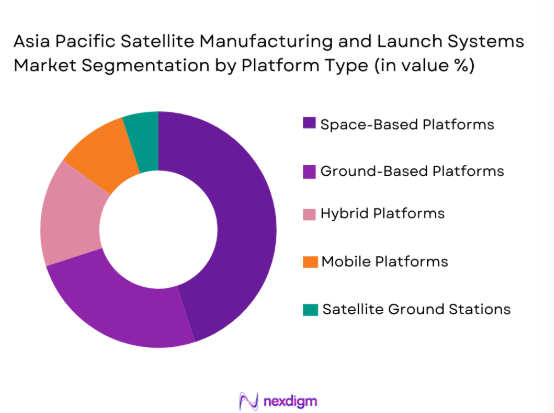

Asia Pacific Satellite Manufacturing and Launch Systems market is segmented by platform type into space-based platforms, ground-based platforms, hybrid platforms, mobile platforms, and satellite ground stations. Space-based platforms dominate the market, driven by the demand for global satellite communication systems and Earth observation missions. Space-based systems are crucial for commercial telecommunication services, scientific research, and defense applications. The increasing demand for space-based internet constellations, combined with advancements in satellite technology, continues to drive the growth of space-based platforms in the region.

Competitive Landscape

The competitive landscape in the Asia Pacific Satellite Manufacturing and Launch Systems market is highly fragmented, with several players ranging from large aerospace manufacturers to small innovative startups. While established companies like SpaceX and Arianespace continue to dominate the market, regional players such as ISRO and China Aerospace Corporation (CASC) are making significant strides with cost-effective launch services and advanced satellite manufacturing capabilities. The market is witnessing consolidation through mergers and partnerships, with key players integrating vertically across satellite production, launch services, and satellite communication.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| SpaceX | 2002 | United States | ~ | ~ | ~ | ~ | ~ |

| Arianespace | 1980 | France | ~ | ~ | ~ | ~ | ~ |

| ISRO | 1969 | India | ~ | ~ | ~ | ~ | ~ |

| China Aerospace Corp. | 1999 | China | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Satellite Manufacturing and Launch Systems Market Analysis

Growth Drivers

Technological Advancements in Satellite Miniaturization

The growing trend of miniaturization in satellite technology has significantly fueled the market’s expansion. Smaller satellites are more cost-effective to manufacture, launch, and maintain, thus attracting both government and private sector investments. These miniaturized satellites are used across various sectors, including telecommunications, Earth observation, and space science, offering advantages like reduced launch costs and faster deployment times. Furthermore, the growing demand for low Earth orbit (LEO) satellites, capable of providing global internet connectivity, drives further innovation in miniaturization technologies. This shift in the manufacturing process and the lowering of barriers to entry for satellite deployment have been key growth drivers, enabling rapid scalability and efficiency within the market. This trend is supported by both governmental and private sector investments, helping to accelerate the development of next-generation satellite systems that cater to new market needs.

Increasing Demand for Satellite Connectivity

The increasing demand for satellite-based communication and broadband services is another prominent driver in the Asia Pacific satellite market. As more countries seek to improve connectivity, particularly in remote and underserved regions, satellite networks offer an effective solution. This is particularly evident in the demand for global internet coverage, where satellite constellations are being developed to provide seamless connectivity. Moreover, commercial ventures such as SpaceX’s Starlink and OneWeb have made satellite broadband more accessible, helping bridge the digital divide. The expanding global satellite internet services market, coupled with the rising adoption of connected devices, drives a consistent need for advanced satellite systems capable of delivering high-speed internet globally. These developments position satellite communication systems as vital infrastructure in the growing digital economy, particularly as the global demand for connectivity continues to rise.

Market Challenges

High Initial Capital Investment

The high cost of satellite manufacturing and launch systems presents a significant barrier to entry, particularly for smaller companies. Satellite manufacturers and launch service providers need substantial capital investments for research, development, and infrastructure setup. Despite technological advancements and cost-reduction strategies, the upfront cost of satellite production and launch remains a significant challenge, especially for emerging players in the market. This financial constraint is often overcome by partnerships between governments, private companies, and international space agencies. However, the continued reliance on substantial investment to support satellite infrastructure and space launch operations can create market volatility, especially during economic downturns. The financial risk involved in large-scale satellite launches also affects pricing strategies and makes it difficult for smaller players to compete with industry giants in providing affordable solutions.

Regulatory Hurdles and Licensing Constraints

The regulatory framework governing satellite manufacturing and launches is complex, particularly in the Asia Pacific region. Different countries have varying regulations regarding satellite launches, frequency allocation, space traffic management, and orbital debris management. Navigating these regulations can delay satellite projects and increase operational costs for companies. Additionally, international agreements and national security considerations can further complicate the regulatory environment, creating challenges for companies seeking to expand their reach. Despite the development of regional regulatory bodies and frameworks, the fragmented regulatory landscape remains a key challenge, as companies must comply with multiple sets of rules to launch satellites in different jurisdictions. These legal complexities can delay the commercialization of satellite technologies and limit the ability of companies to enter certain markets, especially in competitive regions with stringent regulatory environments.

Opportunities

Collaboration between Government and Private Sector

The growing trend of collaboration between governments and private companies presents a major opportunity for the satellite manufacturing and launch systems market. Governments in the Asia Pacific region are increasing their support for space exploration and satellite projects, while private companies are pushing for more cost-effective satellite manufacturing and launching solutions. These collaborations enable more efficient use of resources and technology, leading to reduced costs and accelerated satellite deployments. By joining forces, both sectors can leverage each other’s strengths to foster innovation in satellite technology. This trend is expected to continue in the coming years, driving further market growth and enabling new satellite applications to emerge across sectors such as telecommunications, defense, and Earth observation.

Rise in Space Exploration Missions

The increasing interest in space exploration missions presents a significant opportunity for the satellite manufacturing market. Space exploration efforts, driven by both governmental agencies like ISRO and private players such as SpaceX, are increasing the demand for advanced satellite systems. These missions require highly specialized and sophisticated satellite technologies for communication, navigation, and data collection. As space exploration activities grow, the demand for more robust, durable, and efficient satellite systems will increase, opening new avenues for manufacturers. Additionally, space tourism and resource exploration in space are expected to drive further demand for satellite systems, particularly for Earth observation and communications, contributing to the market’s long-term growth prospects.

Future Outlook

The future outlook for the Asia Pacific Satellite Manufacturing and Launch Systems market is positive, with strong growth expected in the next five years. Technological advancements, especially in satellite miniaturization and the development of reusable launch systems, are expected to reduce costs and increase the pace of satellite deployments. As regulatory environments become more conducive to commercial satellite ventures, private companies are likely to invest heavily in new satellite constellations, particularly for global internet coverage. The growing need for communication and Earth observation satellites in emerging markets further drives demand. Governments and private players are expected to collaborate more in space exploration and satellite deployment, leading to innovative solutions and market expansion.

Major Players

- SpaceX

- Arianespace

- ISRO

- China Aerospace Corporation

- Lockheed Martin

- Northrop Grumman

- Boeing Space and Launch

- Thales Alenia Space

- Airbus Defence and Space

- SES

- Blue Origin

- Rocket Lab

- Mitsubishi Heavy Industries

- SSL (Space Systems/Loral)

- Geo-Impulse

- OneWeb

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers

- Aerospace & defense companies

- Commercial space operators

- Telecom companies

- Aerospace technology developers

- Space infrastructure service providers

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the Asia Pacific Satellite Manufacturing and Launch Systems market, such as technological trends, demand patterns, and regional regulatory factors, are identified through market analysis and expert consultation.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted, utilizing both primary and secondary data sources. This includes assessing historical market performance and forecasting future trends to construct an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry professionals validate the assumptions and hypotheses formed during the market analysis. Feedback from stakeholders helps refine the market projections and enhance the accuracy of predictions.

Step 4: Research Synthesis and Final Output

The final output is synthesized based on all collected data, findings from expert consultations, and validated market projections, providing a comprehensive report that addresses market size, growth opportunities, and competitive dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for communication and broadband services

Advancements in satellite miniaturization and launch technologies

Government funding and support for space programs

Increased private sector involvement in satellite manufacturing

Growing demand for earth observation satellites - Market Challenges

High initial capital investment for satellite manufacturing

Complex regulatory frameworks in different countries

Technological challenges in launching and maintaining satellites

Limited launch vehicle availability and infrastructure

Environmental and sustainability concerns - Market Opportunities

Increasing satellite constellations for global internet coverage

Collaboration between public and private sectors in space exploration

Technological advancements in reusable launch systems - Trends

Growing adoption of satellite constellations

Increasing investment in space infrastructure

Emergence of new satellite manufacturing players

Technological advancements in satellite propulsion systems

Expansion of commercial space ventures - Government Regulations & Defense Policy

Regulatory guidelines for satellite launches and operations

National space policies and their impact on satellite manufacturing

International space treaties and agreements - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Small Satellites

Medium Satellites

Large Satellites

Geostationary Satellites

Non-Geostationary Satellites - By Platform Type (In Value%)

Space-Based Platforms

Ground-Based Platforms

Hybrid Platforms

Mobile Platforms

Satellite Ground Stations - By Fitment Type (In Value%)

Commercial Applications

Military Applications

Government Applications

Telecommunications

Earth Observation - By EndUser Segment (In Value%)

Aerospace Companies

Government Agencies

Telecommunication Companies

Private Enterprises

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

OEM Channels

Distributors

Government Contracts - By Material / Technology (In Value%)

Composite Materials

Aluminum Alloys

Thermal Protection Systems

Solar Power Systems

Ion Propulsion Systems

- Market share snapshot of major players

- Cross Comparison Parameters (Market Share, Innovation, Pricing Strategy, Product Range, Technology Adoption, Distribution Channels, Strategic Alliances, Customer Base, Geographic Presence, Brand Recognition)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SpaceX

OneWeb

Arianespace

Sierra Nevada Corporation

Rocket Lab

Northrop Grumman Innovation Systems

Blue Origin

Lockheed Martin

Thales Alenia Space

Airbus Defence and Space

SES S.A.

China Aerospace Corporation

ISRO

Raytheon Technologies

Boeing Space and Launch

- Increased demand for satellite communication services

- Rising adoption of satellite-based geospatial technologies

- Government and defense sectors driving satellite development

- Private sector focusing on new satellite applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035