Market Overview

The Asia Pacific satellite manufacturing market has seen significant growth, with a market size valued at USD ~ billion based on a recent historical assessment. This expansion is driven by increasing demand for satellite communications, Earth observation, and navigation systems. Technological advancements in satellite miniaturization, cost reductions in production, and the increasing involvement of private companies have all contributed to the market’s rapid development. The market is poised for further growth as satellite-based services become integral to global communications and surveillance infrastructure.

In terms of dominance, countries like China, India, and Japan are leading in the Asia Pacific satellite manufacturing market, primarily due to government-driven space programs and private sector involvement. China’s significant investments in satellite production and infrastructure have propelled it to the forefront, with India and Japan closely following due to their strong governmental policies and technological expertise in satellite applications. These countries have strategically developed their satellite capabilities to support telecommunication, defense, and global connectivity, making them key players in the regional market.

Market Segmentation

By Product Type

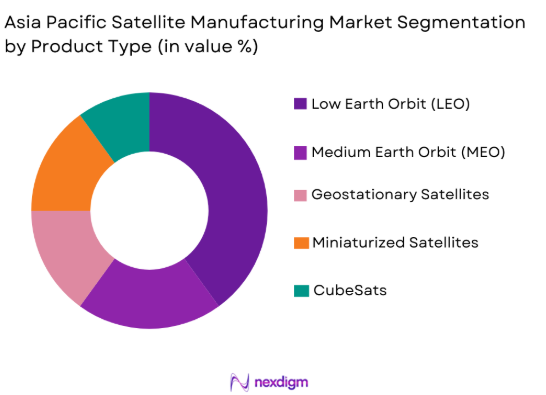

The Asia Pacific satellite manufacturing market is segmented by product type into low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, geostationary satellites, miniaturized satellites, and CubeSats. Recently, the LEO satellite segment has dominated market share, driven by increased demand for broadband internet connectivity, global communications, and the reduced cost of satellite production and launches. LEO satellites offer quicker deployment, lower operational costs, and greater flexibility, making them the preferred choice for commercial and governmental purposes. These satellites are key to expanding global coverage for internet services, environmental monitoring, and defense applications. The growing interest in satellite constellations, such as SpaceX’s Starlink, has further contributed to the dominance of LEO satellites in the region.

By Platform Type

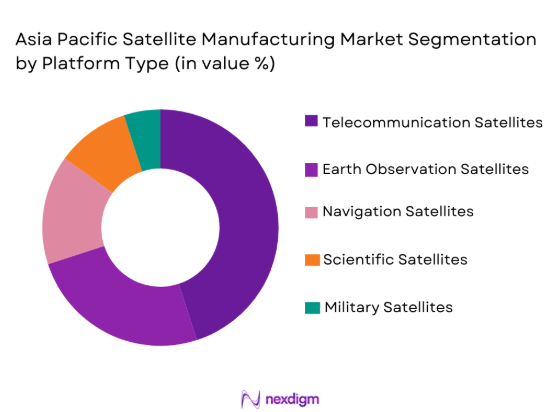

The Asia Pacific satellite manufacturing market is segmented by platform type into telecommunication satellites, Earth observation satellites, navigation satellites, scientific satellites, and military satellites. The telecommunication satellite segment has captured a dominant market share, primarily due to the rapid growth of broadband services, especially in remote and underserved regions. The demand for high-capacity communication networks has surged, and telecommunication satellites offer robust solutions for wide-area coverage. Advances in satellite technology have enabled more efficient use of spectrum and improved data transmission, further supporting the market growth for telecommunication satellites. This demand is particularly evident in countries with large rural populations, where terrestrial communication infrastructure is challenging to implement.

Competitive Landscape

The competitive landscape of the Asia Pacific satellite manufacturing market is characterized by consolidation, with several major players dominating the space. Companies like Lockheed Martin, Airbus Defence and Space, and ISRO have significant influence, driving innovation and shaping market trends. These firms invest heavily in R&D, which accelerates technological advancements in satellite manufacturing. As the market continues to grow, partnerships and collaborations between key players, government agencies, and private firms are becoming more common, further solidifying their positions in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Manufacturing Capacity |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | Cannes, France | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Satellite Manufacturing Market Analysis

Growth Drivers

Technological Advancements

The rapid development in satellite manufacturing technology has significantly contributed to the growth of the Asia Pacific satellite manufacturing market. The miniaturization of satellite components, advancements in propulsion technologies, and improvements in solar panel efficiency have enabled the production of cost-effective, high-performance satellites. These innovations have reduced the overall cost of satellite manufacturing, making satellite deployment more accessible to private companies and governments. The ability to manufacture smaller and more efficient satellites has opened up new possibilities for satellite constellations, offering expanded global coverage for communication, Earth observation, and scientific data collection. Furthermore, the emergence of reusable rockets and streamlined satellite deployment methods has lowered launch costs, providing a more feasible path for satellite manufacturers to cater to the increasing demand for connectivity and data services. The growing number of satellite constellations is expected to further accelerate technological advancements in the industry.

Market Expansion in Emerging Economies

One of the key drivers of the Asia Pacific satellite manufacturing market’s growth is the expanding demand in emerging economies such as India, China, and Southeast Asia. These regions are increasing their investments in space technologies to support economic growth, national security, and social development. Governments in these regions are focusing on improving connectivity, especially in rural and remote areas, through satellite-based services such as broadband internet and remote healthcare services. Additionally, many countries in the region are developing space programs to enhance their global position, further contributing to the growth of the satellite manufacturing market. With the increasing reliance on satellite technology for communications, transportation, and agriculture, emerging economies are positioning themselves as key players in the global satellite manufacturing industry. This trend is expected to create significant growth opportunities in the coming years.

Market Challenges

High Manufacturing and Launch Costs

A significant challenge faced by the Asia Pacific satellite manufacturing market is the high cost associated with satellite production and launches. The complexity of satellite systems, along with the need for specialized materials and precision engineering, contributes to the high production costs. Moreover, the cost of launching satellites into space remains a major barrier for many companies, especially smaller manufacturers. While advancements in satellite miniaturization and reusable launch vehicles are helping to reduce costs, the overall expenses remain high, limiting access to space for emerging players in the industry. This challenge is particularly impactful for small and medium-sized companies, which may struggle to compete with larger, well-established firms that have greater financial resources to support large-scale satellite programs. Reducing production and launch costs remains a key focus area for the industry to increase accessibility to satellite technology.

Regulatory Barriers and Space Debris

Another challenge affecting the growth of the Asia Pacific satellite manufacturing market is the complex regulatory environment surrounding satellite launches and space debris management. Governments around the world are enacting stricter regulations on satellite manufacturing, launch permits, and orbital slots to ensure the safe and sustainable use of outer space. The risk of space debris, which poses a threat to both active satellites and space missions, is increasing with the growing number of satellites being deployed. Manufacturers and operators must comply with these regulatory requirements, which can involve significant costs and delays in the satellite deployment process. Governments are also establishing guidelines for satellite end-of-life disposal and debris mitigation, further complicating the regulatory landscape. Managing regulatory compliance while addressing space debris concerns is essential for ensuring the long-term sustainability of the satellite manufacturing market.

Opportunities

Increased Investment in Space Programs:

One of the most significant opportunities for growth in the Asia Pacific satellite manufacturing market is the increasing investment by governments in space programs. Countries like India, China, and Japan are expanding their space capabilities to enhance national security, economic development, and technological advancement. These governments are allocating substantial budgets to develop indigenous satellite manufacturing capabilities, which presents opportunities for local satellite manufacturers to collaborate with governmental space agencies. Additionally, the growing demand for satellite-based services, including telecommunication, Earth observation, and navigation, provides a sustainable long-term market for satellite manufacturers. This trend is expected to continue as space programs receive additional funding to meet the increasing demand for satellite-based applications.

Private Sector Involvement in Satellite Manufacturing

The rise of private-sector companies investing in satellite manufacturing presents a unique opportunity for market growth in the Asia Pacific region. Private players, such as SpaceX and OneWeb, are leading the charge in satellite constellations and low-cost satellite deployments, making space more accessible to commercial and governmental users. The increase in private-sector involvement not only expands the market for satellite manufacturers but also drives innovation, leading to the development of more cost-effective and efficient satellite technologies. Furthermore, partnerships between private companies and governments are becoming more common, enabling the sharing of resources and expertise in satellite manufacturing. This collaboration is expected to accelerate the pace of satellite deployments, particularly for communication, Earth observation, and remote sensing applications.

Future Outlook

The Asia Pacific satellite manufacturing market is expected to experience robust growth in the next five years, driven by technological advancements, increased government investments, and rising demand for satellite services. The development of small satellite constellations, including those for global internet coverage, will likely be a key growth driver, supported by regulatory initiatives aimed at expanding satellite capabilities. As new technologies emerge, such as reusable launch vehicles and AI integration for satellite operations, the market will see reduced costs and improved efficiencies. Additionally, the expansion of satellite-based services for communication, agriculture, and environmental monitoring will drive further demand across the region.

Major Players

- Lockheed Martin

- Airbus Defence and Space

- ISRO

- Northrop Grumman

- Thales Alenia Space

- Boeing

- China Aerospace Corporation

- Mitsubishi Electric Corporation

- SpaceX

- Planet Labs

- SES S.A.

- OneWeb

- Arianespace

- Surrey Satellite Technology

- Rocket Lab

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers

- Aerospace and defense companies

- Satellite service providers

- Telecommunications companies

- Research and development firms

- Commercial enterprises

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key market variables, including market size, growth drivers, segmentation factors, and key industry trends. These variables guide the research process and help define the scope of the study.

Step 2: Market Analysis and Construction

Data is collected and analyzed through both primary and secondary research methods, followed by constructing the market model using statistical tools and forecasting methodologies. The market analysis provides insights into current trends and future growth projections.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed during the initial analysis are validated through consultations with industry experts, stakeholders, and market participants. This step ensures the accuracy and reliability of the findings.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report, which includes an analysis of market trends, competitive landscape, segmentation, and key growth opportunities. The final output is then prepared for distribution to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Demand for Global Connectivity

Technological Advancements in Satellite Miniaturization

Government Investments in Space Programs

Rise in Demand for Earth Observation Data

Emergence of Private Sector Participation in Space Exploration - Market Challenges

High Capital Investment Requirements

Regulatory and Certification Hurdles

Technical Challenges in Satellite Design and Integration

Dependence on Space Launch Availability

Increasing Space Debris Concerns - Market Opportunities

Growing Commercial Satellite Applications

Expansion of Small Satellite Markets

Development of New Low-Cost Manufacturing Technologies - Trends

Rise in Constellations of Small Satellites

Advancements in Satellite Propulsion Technologies

Increased Private Sector Involvement in Satellite Manufacturing

Shift Toward Reusable Satellite Technologies

Integration of AI and Automation in Satellite Operations - Government Regulations & Defense Policy

Regulations on Space Debris Management

Export Control Laws for Satellite Technologies

National Space Policies Supporting Innovation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Geostationary Satellites

Miniaturized Satellites

CubeSats - By Platform Type (In Value%)

Telecommunication Satellites

Earth Observation Satellites

Navigation Satellites

Scientific Satellites

Military Satellites - By Fitment Type (In Value%)

Commercial Fitment

Government Fitment

Military Fitment

Research and Development Fitment

Private Sector Fitment - By EndUser Segment (In Value%)

Government & Defense

Commercial Enterprises

Telecommunications Providers

Space Agencies

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement via Distributors

Procurement via Third-Party Integrators

Government Procured Systems

OEM Direct Sales - By Material / Technology (In Value%)

Solar Panels

Communication Payloads

Propulsion Systems

Onboard Control Systems

Structural Components

- Market share snapshot of major players

- Cross Comparison Parameters (R&D Investment, Production Capacity, Technological Innovation, Market Share, Geographic Reach, Product Portfolio, Strategic Partnerships, Financial Strength, Manufacturing Cost, Customer Base)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Airbus Defence and Space

Thales Alenia Space

SpaceX

OneWeb

Planet Labs

Blue Origin

Boeing

China Aerospace Corporation

ISRO

SpaceX

Sierra Nevada Corporation

Orbital ATK

Mitsubishi Electric Corporation

- Increasing Government Investments in Space Programs

- Expansion of Commercial Space Industry

- Emerging Applications for Earth Observation Satellites

- Growing Demand for Satellite Communications in Remote Areas

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035