Market Overview

The Asia Pacific Small Satellite market is valued at approximately USD ~ billion, driven primarily by increasing investments in satellite technology and the growing demand for small-scale communication, Earth observation, and scientific missions. The market’s rapid growth is largely supported by technological advancements, reduced launch costs, and increasing interest from both governmental and private players. These factors have led to a steady rise in satellite launches, thereby significantly expanding the market for small satellite systems. Furthermore, the expansion of 5G networks and the increasing demand for global connectivity are propelling the market’s upward trajectory.

In the Asia Pacific region, countries like China, Japan, India, and South Korea are leading the way in small satellite deployment. Their dominance can be attributed to their robust space programs, increasing commercial investments, and strategic partnerships with private companies. These nations have developed advanced space infrastructure, allowing them to conduct regular satellite launches and foster collaboration between government bodies and private enterprises. The strong governmental support and the competitive edge of local firms also play a pivotal role in reinforcing their leadership in the market.

Market Segmentation

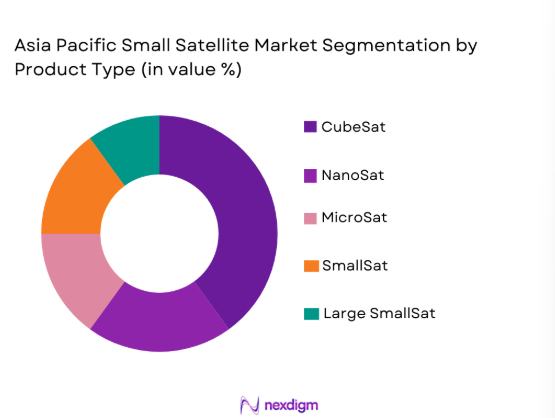

By Product Type

The Asia Pacific Small Satellite market is segmented by product type into CubeSat, NanoSat, MicroSat, SmallSat, and Large SmallSat. Recently, CubeSat has a dominant market share due to its lower production costs, scalability, and the increasing interest in educational and commercial space projects. CubeSat’s popularity has surged, particularly in Earth observation, telecommunications, and scientific research applications. The versatility and compact design of CubeSats have made them an attractive option for both startups and established space agencies in the region. CubeSat’s cost-effectiveness, along with advancements in miniaturized technology, continues to drive its widespread adoption, contributing significantly to the market’s growth.

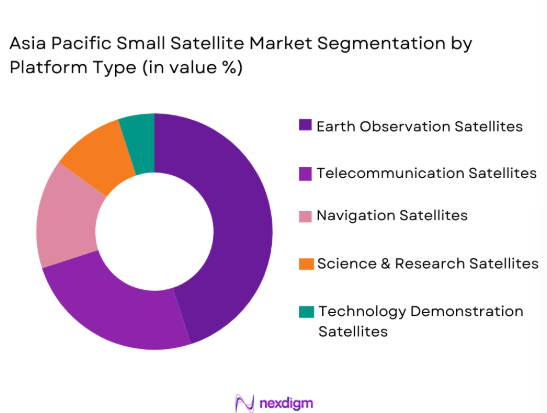

By Platform Type

The Asia Pacific Small Satellite market is segmented by platform type into Earth Observation Satellites, Telecommunication Satellites, Navigation Satellites, Science & Research Satellites, and Technology Demonstration Satellites. Earth Observation Satellites have a dominant market share due to their increasing use in monitoring environmental changes, disaster management, and urban development. The need for high-resolution satellite imagery for various applications such as agriculture, weather forecasting, and urban planning has significantly contributed to the popularity of Earth Observation Satellites. Moreover, the growing demand for real-time data from these satellites further reinforces their market dominance, making them crucial in the region’s space programs.

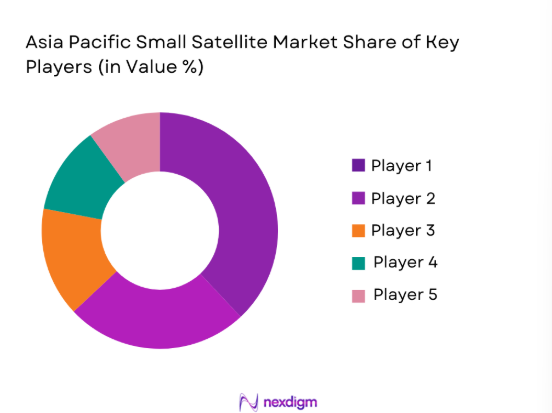

Competitive Landscape

The competitive landscape of the Asia Pacific Small Satellite market is characterized by strong consolidation, with key players focused on technological advancements and strategic collaborations. The market is dominated by a mix of established space agencies, private players, and tech startups, all aiming to provide innovative small satellite solutions. Market leaders are investing heavily in R&D to develop more efficient and cost-effective satellite technologies, which has spurred significant competition. The influence of major players such as SpaceX, OneWeb, and Rocket Lab has shaped the industry, pushing smaller companies to form partnerships and collaborations to remain competitive.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| SpaceX | 2002 | USA | ~ | ~ | ~ | ~ | ~ |

| OneWeb | 2012 | UK | ~ | ~ | ~ | ~ | ~ |

| Rocket Lab | 2006 | USA/NZ | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Planet Labs | 2010 | USA | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Small Satellite Market Analysis

Growth Drivers

Cost Reduction in Satellite Launches

The growing trend of cost-effective small satellite launches is one of the primary drivers of market growth. With advancements in launch vehicle technologies, such as reusable rockets, launch costs have significantly decreased, making space more accessible for a wide range of companies. This affordability has led to a surge in the number of small satellite projects across the Asia Pacific region. These cost savings are crucial for emerging commercial players who previously faced barriers to entry due to high capital expenditure. Moreover, the rise of private companies offering affordable launch services has provided an additional avenue for small satellite deployment. As more companies and governments invest in small satellite technology, the market will continue to expand. The trend of reduced launch costs is expected to foster innovation, which in turn will drive further growth in the small satellite market.

Technological Advancements in Satellite Components

Advances in miniaturization and satellite component technologies have been pivotal in driving market growth. Small satellites have become more capable and efficient, offering advanced payloads, sensors, and propulsion systems that were once limited to larger satellites. As these technological innovations make small satellites more versatile, they are being increasingly adopted for various applications such as Earth observation, communication, and scientific research. The integration of advanced communication systems and high-resolution imaging technology into compact satellite designs has enabled small satellites to deliver comparable performance to their larger counterparts at a fraction of the cost. This makes them attractive to businesses looking for efficient and cost-effective space solutions. The rapid pace of technological progress will continue to drive the market, offering new opportunities for players to capitalize on.

Market Challenges

Regulatory and Spectrum Management Challenges

One of the significant challenges facing the small satellite market is the regulatory landscape, particularly in the Asia Pacific region, where space regulations are still evolving. The lack of clear, standardized regulations for satellite deployment and frequency allocation complicates the process for new entrants. These regulatory hurdles can delay satellite launches, increase costs, and create uncertainties around satellite orbital management. Furthermore, as more satellites are launched, there is an increasing risk of interference and congestion in key frequency bands, requiring careful spectrum management to avoid signal conflicts. Governments and regulatory bodies need to establish clear guidelines to streamline satellite operations and reduce operational risks. Until such regulatory challenges are addressed, they will continue to pose significant barriers to market growth.

Operational Challenges in Satellite Deployment

Another challenge is the technical complexity and cost associated with satellite deployment and maintenance. Small satellites, despite their reduced size and cost, still require significant investment in infrastructure and skilled labor. The process of deploying and maintaining satellites in orbit involves numerous technical challenges, including managing satellite health, ensuring proper orbital positioning, and maintaining communication with the ground stations. For smaller players, this represents a high barrier to entry, as it requires access to advanced space technologies and a high level of operational expertise. Additionally, satellites face risks from space debris, radiation, and other space hazards that can compromise their effectiveness. Overcoming these operational challenges is critical for ensuring the long-term viability of small satellite technology in the market.

Opportunities

Expanding Demand for Earth Observation

Earth observation has become one of the most promising applications for small satellites, particularly as the demand for real-time data increases across various sectors. Governments and commercial entities are increasingly turning to small satellites for applications such as environmental monitoring, agriculture, disaster management, and urban planning. With advancements in imaging technology, small satellites are now capable of providing high-resolution data comparable to larger satellites, making them an attractive option for organizations that need up-to-date and accurate information. The ability to quickly deploy small satellites in constellations further enhances their capabilities, enabling global coverage and constant monitoring. This growing demand for Earth observation data presents significant opportunities for small satellite manufacturers, satellite service providers, and technology developers.

Growth in Commercial Space Ventures

The rise of private space ventures in Asia Pacific presents significant growth opportunities for the small satellite market. The increasing number of private companies entering the space industry, particularly those focused on satellite manufacturing, launch services, and satellite-based applications, is helping to drive the adoption of small satellites. Many of these companies aim to provide innovative services such as low-cost internet connectivity, IoT solutions, and remote sensing data. These companies, supported by investments from venture capitalists and tech firms, are accelerating the development of small satellite technologies and driving market expansion. As space becomes increasingly commercialized, new business models and partnerships will continue to emerge, opening up new revenue streams for market players.

Future Outlook

The Asia Pacific Small Satellite market is expected to continue its strong growth trajectory in the next five years, with technological advancements and cost reductions further boosting adoption. The continued demand for Earth observation data and the proliferation of private space ventures will play significant roles in this growth. Additionally, increasing governmental support, combined with advancements in satellite miniaturization and propulsion systems, will further fuel market expansion. Market players will focus on enhancing satellite capabilities, with more emphasis on satellite constellations, improved data transmission, and real-time analytics to meet evolving consumer demands. Regulatory frameworks are also anticipated to evolve, providing a more stable environment for market participants.

Major Players

- SpaceX

- OneWeb

- Rocket Lab

- Thales Alenia Space

- Planet Labs

- Arianespace

- Maxar Technologies

- Boeing

- Northrop Grumman

- Lockheed Martin

- Airbus

- Blue Origin

- SSL (Space Systems Loral)

- Relativity Space

- Sierra Nevada Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite operators

- Satellite manufacturers

- Commercial satellite service providers

- Space infrastructure developers

- Aerospace and defense contractors

- Telecommunication companies

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the market, such as technological advancements, regulatory policies, and customer demand, were identified through extensive literature reviews and expert interviews.

Step 2: Market Analysis and Construction

In-depth analysis of historical data, industry reports, and current market trends was conducted to understand market size, growth trends, and competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultation was carried out with industry professionals, academics, and key stakeholders to validate hypotheses and refine market models.

Step 4: Research Synthesis and Final Output

All collected data and insights were synthesized to produce the final report, ensuring the conclusions were supported by credible, up-to-date information.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for communication bandwidth

Lower launch costs

Technological advancements in small satellite payloads

Growing interest in remote sensing

Expanding commercial applications - Market Challenges

Regulatory hurdles

Orbital debris management

Reliability concerns

Limited spectrum availability

Competition from traditional satellite manufacturers - Market Opportunities

Collaborations between private players and government agencies

Growth in satellite constellations for global coverage

Technological advancements in propulsion and power systems - Trends

Miniaturization of satellite systems

Rise of small satellite constellations

Increased use of small satellites for Earth observation

Advances in propulsion systems for small satellites

Increased private investment in small satellite technology - Government Regulations & Defense Policy

Stricter international regulations for satellite launches

Development of space traffic management frameworks

Increasing government spending on space-based applications - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

CubeSat

NanoSat

MicroSat

SmallSat

Large SmallSat - By Platform Type (In Value%)

Earth Observation Satellites

Telecommunication Satellites

Navigation Satellites

Science & Research Satellites

Technology Demonstration Satellites - By Fitment Type (In Value%)

Geostationary Orbit (GEO)

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Polar Orbit

Sub-Orbit - By End User Segment (In Value%)

Government & Defense

Commercial Enterprises

Scientific Research Institutions

Telecom Operators

Agriculture & Environmental Monitoring - By Procurement Channel (In Value%)

Direct Purchase

Public Tenders

Private Contracts

Leasing

Secondary Market - By Material / Technology (In Value%)

Composites

Aluminum Alloys

Solar Panels

Antenna & Payloads

Propulsion Systems

- Market share snapshot of major players

- Cross Comparison Parameters (Market Share, Innovation, Pricing Strategy, Product Range, Technology Adoption, Distribution Channels, Strategic Alliances, Customer Base, Geographic Presence, Brand Recognition)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

OneWeb

SpaceX

Planet Labs

Blue Origin

Lockheed Martin

Northrop Grumman

Rocket Lab

Boeing

Thales Alenia Space

Airbus Defence and Space

Sierra Nevada Corporation

Maxar Technologies

SSL (Space Systems Loral)

Momentus

Relativity Space

- Increased adoption in telecom and communication sectors

- Rising demand in agricultural monitoring

- Growing interest in remote sensing for environmental management

- Rising government investments in defense and security

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035