Market Overview

The Asia Pacific Small UAV market is valued at approximately USD ~ billion in recent historical assessments, with robust demand stemming from military, commercial, and agricultural sectors. This growth is primarily driven by technological advancements, cost reductions, and expanding UAV applications across industries, from surveillance and logistics to agriculture and environmental monitoring. Small UAVs are increasingly deployed due to their compactness, efficiency, and versatility, fueling their adoption in both civilian and military applications. As demand rises, regional governments are fostering market growth through favorable regulations and investment incentives.

Countries like China, India, and Japan are leading the charge in the Asia Pacific Small UAV market, driven by large-scale industrial applications and advanced technological ecosystems. China remains a dominant player due to its robust manufacturing base and governmental support for drone technology. India follows suit, with the agricultural sector rapidly adopting UAVs for precision farming. Japan is also witnessing significant growth in both commercial and surveillance sectors, supported by a strong R&D framework and governmental backing for technological innovation.

Market Segmentation

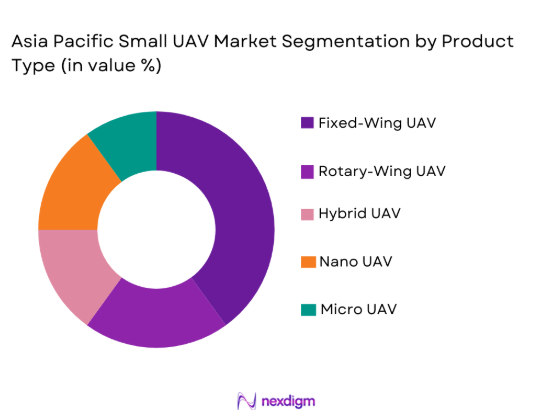

By Product Type

The Asia Pacific Small UAV market is segmented by product type into fixed-wing UAVs, rotary-wing UAVs, hybrid UAVs, nano UAVs, and micro UAVs. Recently, fixed-wing UAVs have captured the largest market share, owing to their extended flight range, higher payload capacities, and better suitability for surveillance and agriculture. The demand for fixed-wing UAVs is particularly high among military and defense sectors, where these UAVs provide long endurance and operational flexibility for surveillance missions and logistics. The efficiency and cost-effectiveness of fixed-wing systems have made them a preferred choice in large-scale commercial applications as well.

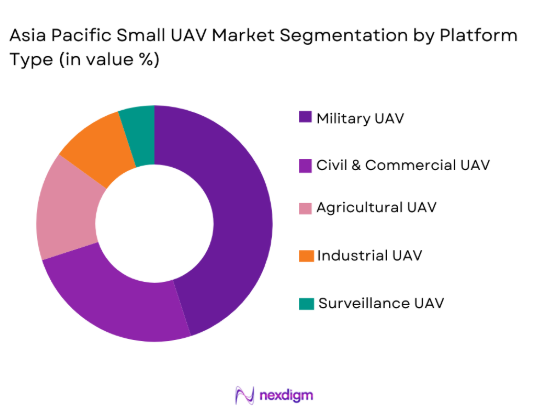

By Platform Type

The Asia Pacific Small UAV market is segmented by platform type into civil & commercial UAVs, military UAVs, agricultural UAVs, industrial UAVs, and surveillance UAVs. Military UAVs dominate the market share due to the growing demand for unmanned aerial vehicles in defense operations, surveillance, and intelligence gathering. The region’s military forces invest heavily in UAV technology, driven by the need for cost-effective, versatile aerial surveillance and reconnaissance solutions. Surveillance UAVs also contribute significantly to market dominance due to their widespread adoption in both military and civil sectors, particularly for border control, infrastructure monitoring, and disaster management.

Competitive Landscape

The Asia Pacific Small UAV market is highly competitive, with significant consolidation and the presence of leading technology providers. Major players in the market are investing in R&D and forming strategic partnerships to develop innovative UAV solutions for a wide range of applications. Competitive dynamics are largely shaped by the ability of firms to integrate advanced technologies, such as AI, machine learning, and autonomous systems, into their UAVs. The competition is expected to intensify as more players enter the market, supported by regulatory shifts and increasing demand from both defense and commercial sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | R&D Investment |

| DJI Innovations | 2006 | China | ~ | ~ | ~ | ~ | ~ |

| Parrot SA | 1994 | France | ~ | ~ | ~ | ~ | ~ |

| AeroVironment Inc. | 1971 | US | ~ | ~ | ~ | ~ | ~ |

| Skydio | 2014 | US | ~ | ~ | ~ | ~ | ~ |

| Autel Robotics | 2014 | China | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Small UAV Market Analysis

Growth Drivers

Technological Advancements in UAV Systems

The development of autonomous and AI-powered UAVs is one of the most significant growth drivers for the Asia Pacific Small UAV market. Advancements in artificial intelligence, machine learning, and sensor technologies have significantly enhanced the capabilities of small UAVs. These technologies enable drones to carry out more complex tasks such as real-time decision-making, autonomous navigation, and advanced imaging. As technology continues to evolve, small UAVs are becoming more efficient, reliable, and versatile, thereby increasing their adoption across multiple industries such as agriculture, military, and surveillance. The adoption of AI-powered systems allows UAVs to operate in complex environments, with minimal human intervention, which is highly desirable in commercial and defense applications. Furthermore, technological innovations are lowering the cost of manufacturing UAVs, thus expanding market opportunities and enabling mass adoption in both developed and emerging economies.

Expanding Military and Defense Applications

The military sector is a key driver of growth for the Asia Pacific Small UAV market. Rising geopolitical tensions and the need for advanced surveillance capabilities are increasing demand for small UAVs in military operations. UAVs provide cost-effective solutions for surveillance, reconnaissance, and intelligence-gathering missions, particularly in areas that are challenging for manned aircraft. They offer real-time data, reduced operational costs, and lower risks to human personnel. The growing defense budgets in countries like India, China, and Japan are contributing to the increased procurement of small UAVs for military use. Moreover, the development of lightweight, durable, and high-performance UAVs tailored for military applications is expanding the market for small UAVs in the defense sector. As the technology continues to mature, military forces are expected to increase their reliance on UAVs for border surveillance, maritime operations, and intelligence support.

Market Challenges

Regulatory Barriers and Airspace Restrictions

Regulatory constraints and airspace management issues pose significant challenges to the growth of the Asia Pacific Small UAV market. Although governments are increasingly supportive of UAV technologies, strict regulations governing UAV operations, particularly in urban environments and near airports, hinder widespread adoption. These regulations are essential for ensuring safety and preventing accidents, but they also limit the operational areas for UAVs, especially in populated regions. For instance, the requirement for UAV operators to obtain special permits, limitations on flight altitude, and no-fly zones reduce the overall operational flexibility for commercial and military users. Furthermore, the lack of standardized regulations across countries in the Asia Pacific region creates confusion and complicates cross-border UAV operations, particularly in defense and surveillance missions. These barriers may slow down market growth, especially in regions where regulatory frameworks are not well-defined or enforced.

High Initial Investment and Maintenance Costs

The significant upfront cost of small UAVs, particularly those designed for military or industrial applications, remains a barrier to widespread adoption in some sectors. Despite technological advancements and reduced manufacturing costs, high-quality drones that meet stringent performance standards require substantial capital investment, which can be prohibitive for small businesses or organizations with limited budgets. In addition to the initial purchase price, ongoing maintenance and operational costs for small UAVs are considerable. These costs include battery replacements, sensor calibration, and software updates, which can add up over time and discourage long-term investments. For military and commercial users, the need for continuous maintenance and the potential costs of damage during operations pose further challenges. As such, while demand for small UAVs is high, the financial barriers remain a significant challenge, particularly in developing economies.

Opportunities

Growth of UAV-based Agricultural Solutions

The agricultural sector is increasingly adopting UAVs for precision farming, which presents a significant growth opportunity for the Asia Pacific Small UAV market. UAVs are being used for crop monitoring, soil analysis, pest control, and irrigation management, enabling farmers to improve yields and reduce costs. The ability of UAVs to capture high-resolution images and analyze data in real-time has revolutionized the way farmers monitor and manage their crops. With the rise of digital farming and precision agriculture, small UAVs are becoming an essential tool for maximizing agricultural productivity. Governments across the region are also supporting this trend by offering subsidies and incentives for the adoption of UAV technology in agriculture. As small UAVs continue to offer more cost-effective solutions for large-scale farming, the agricultural sector’s reliance on these technologies is expected to grow substantially in the coming years.

Expansion of UAV-Based Delivery Services

The increasing demand for fast, efficient, and cost-effective delivery solutions has led to the rise of UAV-based logistics services, creating new market opportunities. Companies are exploring drone delivery for everything from consumer goods to medical supplies, particularly in remote or underserved areas. The ability of small UAVs to deliver goods quickly and at lower costs than traditional delivery methods is driving the growth of this market segment. In the Asia Pacific region, countries like China, India, and Japan are already experimenting with UAVs for parcel delivery, and more companies are expected to follow suit. Regulatory authorities are also providing favorable conditions for the growth of drone delivery services, with new regulations being introduced to support their integration into commercial logistics operations. As consumer demand for quick delivery continues to rise, small UAVs are set to play an increasingly significant role in the logistics and supply chain industries.

Future Outlook

The future of the Asia Pacific Small UAV market is promising, with robust growth expected over the next five years. Continued technological advancements in autonomous flight and battery efficiency will drive market expansion, particularly in commercial and agricultural applications. Regulatory support and government initiatives to promote UAV technology are also expected to fuel growth, while increased demand for surveillance and defense applications will support the market in military sectors. As UAV technologies continue to evolve, the market will likely see the introduction of more advanced and specialized UAV systems, further boosting their adoption across various industries.

Major Players

- DJI Innovations

- Parrot SA

- AeroVironment Inc.

- Skydio

- Autel Robotics

- 3D Robotics

- Teledyne FLIR

- Quantum Systems GmbH

- Insitu Inc.

- Yuneec International

- Delair

- Leptron

- Zero Zero Robotics

- Hubsan

- EHang

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- UAV manufacturers

- Defense contractors

- Logistics companies

- Agricultural enterprises

- Surveillance companies

- Environmental agencies

Research Methodology

Step 1: Identification of Key Variables

We identified critical factors influencing the market, including technological advancements, regulatory policies, consumer trends, and economic conditions.

Step 2: Market Analysis and Construction

Data was collected from primary and secondary sources to construct a detailed market model based on historical data and trends.

Step 3: Hypothesis Validation and Expert Consultation

We validated our hypotheses by consulting industry experts and conducting surveys with key stakeholders in the UAV market.

Step 4: Research Synthesis and Final Output

We synthesized the data and insights into a comprehensive market report, providing actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in UAV technology

Increasing demand for surveillance & monitoring

Integration of AI & automation in UAV systems

Growing applications in agriculture

Government defense investments - Market Challenges

Regulatory restrictions and airspace management

High initial investment costs

Limited battery life and payload capacity

Technological complexity and system reliability

Environmental and weather limitations - Market Opportunities

Expansion of UAV applications in new industries

Technological advancements reducing costs

Rising demand for drone deliveries - Trends

Miniaturization of UAV systems

Increased focus on autonomous flight

Development of hybrid propulsion systems

Growth in UAV-based geospatial data services

Enhanced communication networks for UAV control - Government Regulations & Defense Policy

UAV airspace regulations

Export control regulations for military UAVs

National security initiatives supporting UAV R&D - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-Wing UAV

Rotary-Wing UAV

Hybrid UAV

Nano UAV

Micro UAV - By Platform Type (In Value%)

Civil & Commercial UAV

Military UAV

Agricultural UAV

Industrial UAV

Surveillance UAV - By Fitment Type (In Value%)

OEM

Aftermarket

Conversion Kits

Modification Kits

Spare Parts - By EndUser Segment (In Value%)

Agriculture

Military & Defense

Commercial

Surveillance & Security

Research & Development - By Procurement Channel (In Value%)

Direct Sales

Distributors & Dealers

Online Sales

Government Contracts

OEMs - By Material / Technology (in Value%)

Carbon Fiber

Aluminum Alloy

Lithium Polymer Batteries

Electric Motors

AI & Autonomous Technology

- Market structure and competitive positioning

- Cross Comparison Parameters (Performance, Price, Battery Life, Payload Capacity, Regulation Compliance, Technology Integration, Reliability, Market Reach, Innovation Rate)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

DJI Innovations

Parrot SA

AeroVironment Inc.

Insitu Inc.

Delair

3D Robotics

Teledyne FLIR

Quantum Systems GmbH

Skydio

Yuneec International

Leptron

Zero Zero Robotics

Autel Robotics

Hubsan

EHang

- Commercial sectors adopting UAVs for delivery and services

- Military defense sectors expanding UAV-based surveillance

- Agricultural industries enhancing crop monitoring

- Research institutions exploring new UAV applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035