Market Overview

Based on a recent historical assessment, the Asia Pacific smart airport market size is estimated to reach approximately USD ~ billion in the current year. The market is driven by increasing air traffic, the growing need for automation and passenger experience enhancements, and significant government investments in airport infrastructure upgrades. Technological advancements in IoT, AI, and big data analytics further accelerate the market’s growth. The demand for digital transformation and the adoption of smart systems across airports are expected to continue driving the market forward in the coming years.

Several cities in the Asia Pacific region, including Singapore, Tokyo, and Dubai, have emerged as leaders in the smart airport revolution. These cities dominate due to factors such as highly developed airport infrastructure, government support, and strategic geographic positioning as major travel hubs. Singapore’s Changi Airport, for instance, is recognized for its advanced smart solutions like automated check-ins, baggage handling systems, and integrated passenger services. These airports serve as models for other regional players looking to modernize their facilities and integrate smart technologies to enhance operational efficiency and customer satisfaction.

Market Segmentation

By Product Type

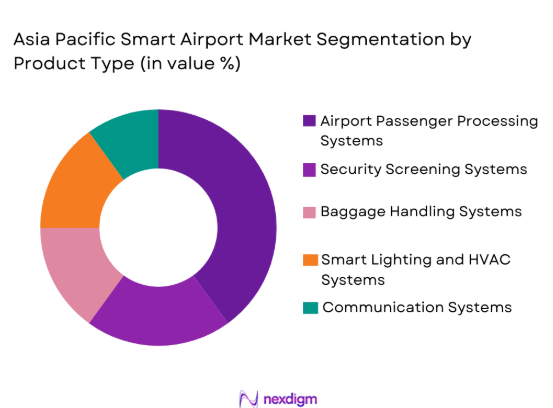

The Asia Pacific smart airport market is segmented by product type into airport passenger processing systems, security screening systems, baggage handling systems, smart lighting and HVAC systems, and communication systems. Recently, airport passenger processing systems have a dominant market share due to factors such as the need to enhance passenger experience, reduce wait times, and improve security. With the growing number of international travelers and the need for streamlined operations, these systems are being increasingly adopted by airports to automate processes such as check-ins, border control, and immigration.

By Platform Type

The Asia Pacific smart airport market is segmented by platform type into cloud-based platforms, on-premise platforms, hybrid platforms, mobile-based platforms, and edge computing platforms. Recently, cloud-based platforms have a dominant market share due to their scalability, flexibility, and cost-effectiveness. Cloud technologies allow airports to centralize data management, streamline operations, and enable seamless communication between different systems across multiple locations. Furthermore, the ease of integration with other technologies, as well as the ability to enhance data analytics and decision-making, has made cloud-based platforms increasingly preferred by airports in the region.

Competitive Landscape

The Asia Pacific smart airport market is highly competitive, with several global players dominating the landscape. The market is witnessing increasing consolidation as companies acquire smaller firms to expand their technology portfolios. Major players are focusing on enhancing their product offerings and providing customized solutions to meet the growing demand for advanced smart systems at airports. These companies are leveraging strategic partnerships, joint ventures, and technological advancements to improve their market positions. Additionally, the increasing focus on sustainability and energy efficiency has also influenced the competitive dynamics in this market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-Specific Parameter |

| Siemens AG | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Honeywell International Inc. | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1973 | USA | ~ | ~ | ~ | ~ | ~ |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ |

Asia Pacific Smart Airport Market Analysis

Growth Drivers

Increasing Air Traffic

The rapid growth of the aviation industry in Asia Pacific, driven by rising disposable incomes, has led to a significant increase in air traffic. As more people travel by air, airports face increasing pressure to enhance operational efficiency and accommodate larger passenger volumes. Smart technologies are becoming critical to address challenges such as congestion, long wait times, and security concerns. Airports are implementing automated systems to streamline check-in processes, baggage handling, and security screening, which helps reduce operational costs while improving the passenger experience. Additionally, the development of new airports and expansion of existing facilities is pushing demand for smart solutions, driving the market’s growth. The adoption of smart technologies also helps to improve safety, reduce operational costs, and enhance sustainability in the face of growing environmental concerns.

Government Investments in Smart Infrastructure

Governments across the Asia Pacific region are heavily investing in smart infrastructure to modernize their airports. This investment is being driven by the need to improve operational efficiency, reduce environmental impact, and enhance security in the face of increasing passenger numbers. Countries like Singapore, Japan, and South Korea are leading the way in creating smart airports that incorporate automation, big data analytics, and IoT technology. These investments also help airports to adapt to the increasing demands of passengers, improve passenger flow, and increase the overall experience. With governments emphasizing digital transformation, the market for smart airport technologies is experiencing rapid growth. Moreover, regulatory frameworks supporting smart infrastructure adoption and sustainability are further boosting the market demand for these advanced systems.

Market Challenges

High Initial Investment Costs

One of the major challenges facing the adoption of smart airport technologies in Asia Pacific is the high initial investment required for infrastructure upgrades. The cost of implementing automated systems, such as self-check-in kiosks, automated baggage handling, and advanced security systems, can be prohibitively expensive for some airports, particularly smaller or regional ones. While these systems promise long-term benefits in terms of operational efficiency and passenger experience, the high upfront costs can delay or deter investment, particularly in developing markets. Additionally, the integration of new technologies with existing legacy systems poses additional challenges and costs. Airports must balance the need for innovation with the financial constraints imposed by these high initial costs, which can affect the pace of smart airport adoption in the region.

Integration Complexity

The complexity of integrating smart technologies with existing airport systems is another major challenge. Airports often operate multiple, fragmented systems across different departments, and ensuring seamless integration across these systems can be a daunting task. Furthermore, smart airport solutions typically require collaboration between various stakeholders, including airport operators, technology providers, and government authorities. The lack of interoperability among different systems can create challenges in data exchange, communication, and system coordination. Additionally, the need for robust cybersecurity measures to protect against data breaches and cyberattacks further complicates the integration process. Overcoming these integration challenges is critical to ensuring the successful implementation of smart technologies in airports across the region.

Opportunities

Contactless Technology Adoption

The demand for contactless technologies, driven by the ongoing global pandemic, presents a significant opportunity for the Asia Pacific smart airport market. Airports are increasingly adopting biometric systems, facial recognition, and mobile-based solutions to ensure the safety and convenience of passengers. These technologies allow for a seamless, touch-free experience, from check-in to boarding, which is particularly appealing in the context of health and safety concerns. The rise in passenger preference for contactless interactions is prompting airports to invest heavily in these technologies. As the demand for faster and safer airport processes continues to grow, smart airports offering contactless solutions are poised to see significant growth in the coming years.

Smart Sustainability Solutions

With the growing focus on sustainability in the aviation industry, there is a rising demand for smart solutions that reduce energy consumption and minimize environmental impact. Airports are increasingly investing in energy-efficient systems, such as smart lighting, HVAC systems, and renewable energy sources, to lower their carbon footprint. The shift towards sustainable airport operations provides a significant opportunity for companies offering green technologies. Governments and regulatory bodies are also incentivizing the adoption of such solutions, further driving demand for sustainable infrastructure. By integrating eco-friendly technologies into their operations, airports can not only enhance their sustainability credentials but also benefit from cost savings in the long term.

Future Outlook

The future outlook for the Asia Pacific smart airport market over the next five years is promising, with continued growth driven by technological advancements and strong government support. Technological developments, particularly in AI, IoT, and biometrics, will enable further automation and efficiency improvements in airport operations. Additionally, the rising demand for enhanced passenger experiences and sustainability will foster the adoption of smart systems. Regulatory policies that support digital transformation and sustainability will play a key role in driving the market forward, ensuring that airports in the region continue to modernize and meet the growing demands of passengers.

Major Players

- Siemens AG

- Honeywell International Inc.

- Thales Group

- Rockwell Collins

- SITA

- Indra Sistemas

- Beumer Group

- Amadeus IT Group

- UTC Aerospace Systems

- Mitie Group

- TAV Technologies

- MORPHO (Safran)

- Vanderlande Industries

- Cisco Systems

- Schneider Electric

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators

- Airlines

- Technology providers

- Infrastructure developers

- Aviation security agencies

- IT service providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the core factors that drive the market dynamics, including technology adoption, government regulations, and economic trends that influence the smart airport market.

Step 2: Market Analysis and Construction

In this step, a comprehensive analysis of the market is conducted to understand the current trends, competitive landscape, and future growth prospects.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions are sought to validate the assumptions made during market analysis and to ensure that the findings align with industry realities and expert insights.

Step 4: Research Synthesis and Final Output

The final output is synthesized from the research findings and expert inputs, which is then structured into a comprehensive report, offering valuable insights into the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Passenger Traffic

Rising Focus on Security and Safety

Technological Advancements in IoT

Government Investments in Smart Infrastructure

Sustainability Initiatives - Market Challenges

High Initial Investment Costs

Integration Complexity

Cybersecurity Threats

Regulatory and Compliance Issues

Technological Adaptation Barriers - Market Opportunities

Emerging Demand for Contactless Technology

Growth in Eco-friendly Airports

Rise in Smart City Projects - Trends

Automation in Baggage Handling

Use of AI for Airport Operations

Smart Security Solutions

Energy-efficient Airport Systems

Increasing Adoption of Cloud Solutions - Government Regulations & Defense Policy

Aviation Security Regulations

Government Funding for Smart Infrastructure

Environmental and Sustainability Regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airport Passenger Processing Systems

Security Screening Systems

Baggage Handling Systems

Smart Lighting and HVAC Systems

Communication Systems - By Platform Type (In Value%)

Cloud-based Platforms

On-premise Platforms

Hybrid Platforms

Mobile-based Platforms

Edge Computing Platforms - By Fitment Type (In Value%)

New Installations

Retrofits/Upgrades

System Integration

Software-as-a-Service

Managed Services - By EndUser Segment (In Value%)

Airlines

Airport Operators

Government Bodies

Security and Surveillance Agencies

IT Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

OEM Procurement

Online Procurement

Distributor Procurement - By Material / Technology (In Value%)

IoT Technology

Artificial Intelligence (AI)

Machine Learning

Blockchain Technology

Big Data Analytics

- Market structure and competitive positioning

- Cross Comparison Parameters (Revenue, Product Portfolio, Geographic Reach, Technology Integration, Customer Base, R&D Investment, Partnerships, Product Differentiation, Market Strategy)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Siemens AG

Honeywell International Inc.

Thales Group

Schneider Electric

Rockwell Collins

Vanderlande Industries

SITA

Indra Sistemas

Cisco Systems

Beumer Group

Amadeus IT Group

UTC Aerospace Systems

Mitie Group

TAV Technologies

MORPHO

- Airlines focusing on operational efficiency

- Airport operators’ investment in passenger experience

- Government initiatives for infrastructure development

- IT service providers driving digital transformation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035